UPDATE: Northeast Utilities To Buy NStar For $4.3 Billion In Stock

October 18 2010 - 11:42AM

Dow Jones News

Northeast Utilities (NU) has agreed to buy fellow New England

utility company NStar (NST) for $4.3 billion in stock, creating a

dominant utility for the region.

The deal is a merger of equals not meant to provide a premium

for shareholders. NStar holders will get 1.312 shares of Northeast

Utilities for each share of NStar, valuing it at $40.28 each.

That's based on a 20 day average and provides a 1.9% premium to

Friday's closing price.

Northeast Utilities shares were recently up 11 cents, or 0.4%,

at $30.81. NStar's stock, which has been trading just off of its

all-time high, rose 75 cents, or 1.9% to $40.28.

Deal activity in the power sector has picked up in the last year

in the face of weak electricity demand as some utilities look to

bolster balance sheets to pursue major infrastructure projects. Yet

winning state approval continues to be a challenge to

consolidation.

The combined company to be called Northeast Utilities would

operate six regulated electric and gas utilities in three states,

serving nearly 3.5 million electric and gas customers. The combined

company would have generated $8.5 billion in revenues in 2009. The

companies expect the deal to add to earnings in its first full

year.

Northeast Utilities would increase its financial strength

through the deal and deliver a higher dividend to shareholders. The

merger eliminates the need for the Hartford-based company to sell

equity in 2012. Northeast Utilities will raise its dividend by 20%

to match NStar's payout level.

As for NStar, executives for the Boston-based utility said the

deal adds growth opportunities and diversifies the company beyond

Massachusetts. Northeast Utilities has a pipeline of high-voltage

transmission projects it is building in New England, including

lines to move electricity generated by wind from rural areas.

Earnings for the combined companies are expected to grow at 6%-9% a

year, executives said.

"Normally a merger of equals is not a good move," but the

circumstances of cash-strapped Northeast Utilities and cash-flush

NStar makes it an attractive move, said Gabelli & CO. utility

analyst Tim Winter.

The deal will need approval from state regulators in

Massachusetts. During a conference call Monday, Northeast Utilities

Chairman and Chief Executive Charles Shivery said he doesn't

anticipate trouble getting the deal approved in Massachusetts

because "this is a no premium transaction" and a rate freeze over

the next couple years means that customers will not be

affected.

Utility deals have traditionally stumbled at the state level,

yet after a drought in major transactions more companies are trying

mergers.

FirstEnergy Corp. (FE) is in the midst of trying to acquire

Allegheny Energy Inc. (AYE), while PPL Corp. (PPL) is buying the

Kentucky utility operations of German utility giant E.ON AG (EONGY,

EOAN.XE).

The cost savings the two companies plan from the deal remains

unclear. Executives declined to give details during a conference

call. They did say they see "significant ways" to improve

productivity in information technology and various processes, and

they gave a "rule of thumb" that every $10 million in pre-tax

benefits from the deal adds about 2 cents a share to pro forma

earnings.

Northeast Utilities and NStar have worked together in the past,

collaborating to develop $1.1 billion of electric transmission line

that would link eastern Canada and the Northeastern U.S.

As part of the deal, Shivery would become the non-executive

chairman of the company for 18 months, while NStar Chairman and

Chief Executive Thomas May would become president and chief

executive. He would become chairman as well after Shivery's

tenure.

Nstar's May said that the company is canceling a $75 million

stock buyback program because of the merger. A $125 million buyback

has been completed.

-By Naureen S. Malik and Nathan Becker, Dow Jones Newswires;

212-416-4210; naureen.malik@dowjones.com

(Nathan Becker contributed to this article.)

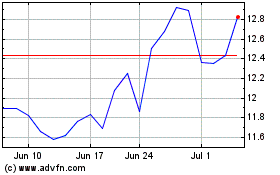

Nu (NYSE:NU)

Historical Stock Chart

From Sep 2024 to Oct 2024

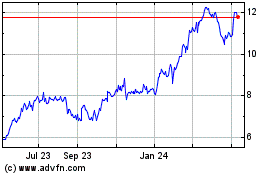

Nu (NYSE:NU)

Historical Stock Chart

From Oct 2023 to Oct 2024