Northeast Utilities (NYSE: NU) today reported first quarter 2010

earnings of $86.2 million, or $0.49 per share, compared with

earnings of $97.7 million, or $0.60 per share, in the first quarter

of 2009.

Charles W. Shivery, NU chairman, president and chief executive

officer, attributed the lower results primarily to lower electric

and natural gas sales, reduced earnings at NU’s competitive

businesses due to the absence of mark-to-market gains, and higher

employee benefit costs, due in part to the enactment of national

health care legislation. NU recorded $3 million in after-tax

charges in the first quarter of 2010 associated with the health

care legislation. In addition, earnings per share were impacted by

the sale of nearly 19 million NU shares in March 2009.

Distribution segment earnings of NU’s four utilities totaled

$47.9 million in the first quarter of 2010, compared with $59.2

million in the first quarter of 2009. “Our electric operating

companies provide critical infrastructure for nearly 2 million

customers, and we continue to invest heavily to maintain reliable

systems, but economic conditions continue to weigh on the returns

of their distribution businesses,” Shivery said.

In the first three months of 2010, NU’s capital expenditures

totaled $182.7 million, including $84 million on its electric and

natural gas distribution systems.

2010 earnings guidance

NU today affirmed its 2010 consolidated earnings guidance of

between $1.80 per share and $2.00 per share. NU continues to

project earnings from its regulated electric and natural gas

distribution and electric generation segment of between $0.95 per

share and $1.05 per share1 and between $0.90 per share and $0.95

per share1 for its transmission segment. It projects earnings of

between $0.00 and $0.05 per share1 at its competitive businesses

and net expenses of approximately $0.05 per share1 at NU parent and

other companies.

Regulated company

results

NU’s transmission earnings were $40.1 million, or $0.23 per

share1, in the first quarter of 2010, compared with $35.4 million,

or $0.22 per share1, in the first quarter of 2009. Shivery said the

improved results primarily reflected a higher level of transmission

investment.

The Connecticut Light and Power Company’s (CL&P)

distribution earnings were $14.3 million in the first quarter of

2010, compared with $21.6 million in the first quarter of 2009. The

lower results were due to a 4.9 percent decline in retail sales

owing to much warmer weather and a continued economic slowdown in

Connecticut, as well as higher pension and other operating

costs.

Public Service Company of New Hampshire’s (PSNH) distribution

and generation earnings were $11.1 million in the first quarter of

2010, compared with $13.5 million in the first quarter of 2009.

PSNH benefited from a temporary rate increase that took effect

August 1, 2009, but that revenue was more than offset by a 5.3

percent decline in retail sales and $1 million of charges related

to the new health care legislation.

Western Massachusetts Electric Company’s (WMECO) distribution

earnings were $2.9 million in the first quarter of 2010, compared

with $4.8 million in the first quarter of 2009. Lower results in

2010 were primarily due to a 4.4 percent decline in retail sales in

the first quarter of 2010, compared with the first quarter of

2009.

Overall, NU’s retail electric sales were down 4.9 percent in the

first quarter of 2010 compared with the first quarter of 2009. They

were down 2.5 percent on a weather-adjusted basis.

Shivery said the first-quarter sales decline reflects a number

of factors, including a much milder New England winter in 2010.

“Our electric sales results also reflect the very significant

ongoing investment in energy conservation measures our customers

continue to make, the region’s slow recovery from the economic

downturn, and our Connecticut customers’ installation of

distributed generation,” Shivery said.

Yankee Gas Services Company earned $19.6 million in the first

quarter of 2010, compared with $19.3 million in the first quarter

of 2009. Lower interest expense was partially offset by a 3.5

percent decline in firm natural gas sales, driven by a 13.5 percent

reduction in year-over-year heating degree days in Connecticut.

Firm natural gas sales rose 6.4 percent on a weather-adjusted

basis.

Competitive businesses

NU’s remaining competitive energy businesses earned $2.3 million

in the first quarter of 2010, compared with $5.8 million in the

first quarter of 2009. The decline was primarily due to reduced

benefits from marking to market the remaining wholesale obligations

of NU Enterprises, Inc. (NUEI). NUEI recorded after-tax

mark-to-market losses of $0.4 million in the first quarter of 2010,

compared with after-tax gains of $3.2 million in the first quarter

of 2009. NU’s wholesale marketing business continues to wind down,

with the last contracts ending in 2013.

Parent and other

affiliates

NU parent and other companies recorded net expenses of $4.1

million in the first quarter of 2010, compared with net expenses of

$2.7 million in the first quarter of 2009. First quarter 2010

results included a charge of $0.6 million related to the new health

care legislation.

The following table reconciles 2010 and 2009 first-quarter

results:

First Quarter

2009 Reported EPS

$0.60 Higher transmission earnings in 2010

$0.02 Lower regulated distribution and

generation earnings in 2010

($0.06)

Lower competitive business earnings in 2010

($0.03)

Dilutive impact of 2009 share issuance ($0.04)

2010 Reported EPS $0.49

Financial results for the first quarters of 2010 and 2009 for

NU’s regulated and competitive segments and parent and other

companies are noted below:

Three months ended:

(in millions, except EPS)

March 31, 2010

March 31, 2009

Increase

(Decrease)

2010 EPS1

CL&P Distribution $14.3 $21.6 ($7.3)

$0.08 PSNH Distribution/Generation $11.1 $13.5

($2.4) $0.06 WMECO Distribution $2.9

$4.8 ($1.9) $0.02 Yankee Gas $19.6

$19.3 $0.3 $0.11

Total--Distribution/Generation $47.9

$59.2 ($11.3) $0.27 CL&P

Transmission $32.7 $30.1 $2.6 $0.19

PSNH Transmission $4.7 $4.0 $0.7 $0.03

WMECO Transmission $2.7 $1.3 $1.4 $0.01

Total—Transmission $40.1 $35.4

$4.7 $0.23 Total—Competitive

$2.3 $5.8 ($3.5) $0.01 NU Parent and

Other Companies ($4.1) ($2.7) ($1.4)

($0.02)

Reported Earnings $86.2

$97.7 ($11.5) $0.49

Retail sales data:

Gwh for three months ended March 31, 2010

March 31, 2009 % Change

Actual

% Change

Weather Norm.

CL&P 5,591 5,880 -4.9% -2.3% PSNH

1,932 2,040 -5.3% -3.0% WMECO

930 972 -4.4% -2.3%

Total NU

8,448 8,888 -4.9%

-2.5% Yankee Gas firm volumes in mmcf for three months

ended

16,443

17,034

-3.5%

6.4%

NU has approximately 176 million common shares outstanding. It

operates New England’s largest energy delivery system, serving more

than 2 million customers in Connecticut, New Hampshire and

Massachusetts.

This news release includes statements concerning NU’s

expectations, beliefs, plans, objectives, goals, strategies,

assumptions of future events, future financial performance or

growth and other statements that are not historical facts. These

statements are “forward-looking statements” within the meaning of

the Private Securities Litigation Reform Act of 1995. In some

cases, readers can identify these forward-looking statements

through the use of words or phrases such as “estimate”, “expect”,

“anticipate”, “intend”, “plan”, “project,” “believe”, “forecast”,

“should”, “could”, and other similar expressions. Forward-looking

statements involve risks and uncertainties that may cause actual

results or outcomes to differ materially from those included in the

forward-looking statements. Factors that may cause actual results

to differ materially from those included in the forward-looking

statements include, but are not limited to, actions or inaction of

local, state and federal regulatory and taxing bodies; changes in

business and economic conditions, including their impact on

interest rates, bad debt expense and demand for NU’s products and

services; changes in weather patterns; changes in laws, regulations

or regulatory policy; changes in levels or timing of capital

expenditures; disruptions in the capital markets or other events

that make NU’s access to necessary capital more difficult or

costly; developments in legal or public policy doctrines;

technological developments; changes in accounting standards and

financial reporting regulations; fluctuations in the value of

NUEI’s remaining competitive electricity positions; actions of

rating agencies; and other presently unknown or unforeseen factors.

Other risk factors are detailed from time to time in NU’s reports

filed with the Securities and Exchange Commission. Any

forward-looking statement speaks only as of the date on which such

statement is made, and NU undertakes no obligation to update the

information contained in any forward-looking statements to reflect

developments or circumstances occurring after the statement is made

or to reflect the occurrence of unanticipated events.

1 All per share amounts in this news release are reported on a

fully diluted basis. The only common equity securities that are

publicly traded are common shares of NU parent. The earnings and

EPS of each business do not represent a direct legal interest in

the assets and liabilities allocated to such business, but rather

represent a direct interest in NU's assets and liabilities as a

whole. EPS by business is a non-GAAP (not determined using

generally accepted accounting principles) measure that is

calculated by dividing the net income or loss attributable to

controlling interests of each business by the weighted average

fully diluted NU parent common shares outstanding for the period.

Management uses this non-GAAP financial measure to evaluate

earnings results and to provide details of earnings results and

guidance by business. Management believes that this measurement is

useful to investors to evaluate the actual and projected financial

performance and contribution of NU’s businesses. Non-GAAP financial

measures should not be considered as alternatives to NU

consolidated net income attributable to controlling interests or

EPS determined in accordance with GAAP as indicators of NU’s

operating performance.

Note: NU will webcast a discussion concerning its first

quarter 2010 results tomorrow, May 6, 2010, at 1 p.m. Eastern

Daylight Time. The webcast can be accessed through NU’s website

at www.nu.com.

NORTHEAST UTILITIES AND SUBSIDIARIES CONDENSED

CONSOLIDATED BALANCE SHEETS (Unaudited)

March 31, December 31, (Thousands of Dollars) 2010

2009

ASSETS

Current Assets: Cash and Cash Equivalents $ 30,012 $ 26,952

Receivables, Net 570,870 512,770 Unbilled Revenues 161,872 229,326

Fuel, Materials and Supplies 229,837 277,085 Marketable Securities

81,960 66,236 Derivative Assets 17,379 31,785 Prepayments and Other

Current Assets 151,641 123,700 Total Current Assets

1,243,571 1,267,854 Property, Plant and

Equipment, Net 8,957,713 8,839,965 Deferred

Debits and Other Assets: Regulatory Assets 3,207,971 3,244,931

Goodwill 287,591 287,591 Marketable Securities 41,763 54,905

Derivative Assets 153,651 189,751 Other Long-Term Assets

213,186 172,682 Total Deferred Debits and Other Assets

3,904,162 3,949,860 Total Assets

$ 14,105,446 $ 14,057,679

The data contained in this report

is preliminary and is unaudited. This report is being submitted for

the sole purpose of providing information to present shareholders

about Northeast Utilities and Subsidiaries and is not a

representation, prospectus, or intended for use in connection with

any purchase or sale of securities.

NORTHEAST UTILITIES AND SUBSIDIARIES CONDENSED

CONSOLIDATED BALANCE SHEETS (Unaudited)

March 31, December 31, (Thousands of Dollars) 2010

2009

LIABILITIES & CAPITALIZATION

Current Liabilities: Notes Payable to Banks $ 100,313 $

100,313 Long-Term Debt - Current Portion 66,286 66,286 Accounts

Payable 385,181 457,582 Accrued Taxes 64,236 50,246 Accrued

Interest 92,879 83,763 Derivative Liabilities 44,208 37,617 Other

Current Liabilities 166,138 183,605

Total Current Liabilities 919,241 979,412

Rate Reduction Bonds 375,866

442,436 Deferred Credits and Other Liabilities:

Accumulated Deferred Income Taxes 1,450,931 1,380,143 Accumulated

Deferred Investment Tax Credits 21,466 22,145 Regulatory

Liabilities 426,687 485,706 Derivative Liabilities 972,041 955,646

Accrued Pension 786,195 781,431 Other Long-Term Liabilities

822,759 823,723 Total Deferred Credits and

Other Liabilities 4,480,079 4,448,794

Capitalization: Long-Term Debt 4,588,862

4,492,935 Noncontrolling Interest in

Consolidated Subsidiary: Preferred Stock Not Subject to Mandatory

Redemption 116,200 116,200

Common Shareholders' Equity: Common Shares 978,381 977,276 Capital

Surplus, Paid In 1,763,894 1,762,097 Deferred Contribution Plan (67

) (2,944 ) Retained Earnings 1,287,271 1,246,543 Accumulated Other

Comprehensive Loss (42,740 ) (43,467 ) Treasury Stock

(361,541 ) (361,603 ) Common Shareholders' Equity

3,625,198 3,577,902 Total Capitalization

8,330,260 8,187,037

Total Liabilities and Capitalization $ 14,105,446 $

14,057,679

The data contained in this report

is preliminary and is unaudited. This report is being submitted for

the sole purpose of providing information to present shareholders

about Northeast Utilities and Subsidiaries and is not a

representation, prospectus, or intended for use in connection with

any purchase or sale of securities.

NORTHEAST UTILITIES AND SUBSIDIARIES CONDENSED

CONSOLIDATED STATEMENTS OF INCOME (Unaudited) March

Year to Date Three Months Ended March 31,

(Thousands of Dollars, Except Share Information)

2010

2009 Operating Revenues $ 1,339,420 $

1,593,483 Operating Expenses: Fuel, Purchased and Net

Interchange Power 603,349 838,920 Other Operating Expenses 248,273

247,445 Maintenance 45,637 48,836 Depreciation 78,656 76,983

Amortization of Regulatory (Liabilities)/Assets, Net (8,327 )

21,691 Amortization of Rate Reduction Bonds 59,570 55,897 Taxes

Other than Income Taxes 85,599 86,429 Total

Operating Expenses 1,112,757 1,376,201

Operating Income 226,663 217,282 Interest Expense: Interest

on Long-Term Debt 57,270 55,684 Interest on Rate Reduction Bonds

6,690 10,625 Other Interest 3,302 4,668

Interest Expense 67,262 70,977 Other Income, Net 8,057

4,182 Income Before Income Tax Expense 167,458

150,487 Income Tax Expense 79,857 51,423 Net

Income 87,601 99,064 Net Income Attributable to Noncontrolling

Interests: Preferred Dividends of Subsidiary 1,390

1,390 Net Income Attributable to Controlling Interests $

86,211 $ 97,674 Basic and Fully Diluted Earnings Per

Common Share $ 0.49 $ 0.60 Dividends Declared per

Common Share $ 0.26 $ 0.24 Weighted Average Common

Shares Outstanding: Basic 176,349,762

162,340,475 Fully Diluted 176,537,472

162,925,167

The data contained in this report

is preliminary and is unaudited. This report is being submitted for

the sole purpose of providing information to present shareholders

about Northeast Utilities and Subsidiaries and is not a

representation, prospectus, or intended for use in connection with

any purchase or sale of securities.

NORTHEAST UTILITIES AND SUBSIDIARIES CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

Three Months Ended March 31, (Thousands of Dollars)

2010 2009 Operating Activities:

Net Income $ 87,601 $ 99,064 Adjustments to Reconcile Net Income to

Net Cash Flows Provided by Operating Activities: Bad Debt Expense

9,556 9,507 Depreciation 78,656 76,983 Deferred Income Taxes 33,248

17,178 Pension and PBOP Expense, Net of Capitalized Portion and

PBOP Contributions 23,331 6,703 Regulatory

Overrecoveries/(Underrecoveries), Net 6,066 (14,694 ) Amortization

of Regulatory (Liabilities)/Assets, Net (8,327 ) 21,691

Amortization of Rate Reduction Bonds 59,570 55,897 Deferred

Contractual Obligations (6,274 ) (8,666 ) Derivative Assets and

Liabilities (2,594 ) (14,769 ) Other (35,160 ) (3,450 ) Changes in

Current Assets and Liabilities: Receivables and Unbilled Revenues,

Net (7,258 ) 10,483 Fuel, Materials and Supplies 48,431 51,171

Taxes Receivable/Accrued 4,639 43,270 Other Current Assets (279 )

(1,541 ) Accounts Payable (46,188 ) (174,497 ) Counterparty

Deposits and Margin Special Deposits (12,946 ) (10,582 ) Other

Current Liabilities (6,369 ) (23,795 ) Net Cash Flows

Provided by Operating Activities 225,703

139,953 Investing Activities: Investments in Property

and Plant (202,487 ) (208,896 ) Proceeds from Sales of Marketable

Securities 21,331 52,933 Purchases of Marketable Securities (21,825

) (54,557 ) Rate Reduction Bond Escrow and Other Deposits (322 )

(1,480 ) Other Investing Activities (156 ) 2,853

Net Cash Flows Used in Investing Activities (203,459

) (209,147 ) Financing Activities: Issuance of Common

Shares - 387,350 Cash Dividends on Common Shares (45,088 ) (37,207

) Cash Dividends on Preferred Stock (1,390 ) (1,390 ) Decrease in

Short-Term Debt - (124,909 ) Issuance of Long-Term Debt 95,000

250,000 Retirements of Rate Reduction Bonds (66,569 ) (62,451 )

Financing Fees (1,124 ) (15,205 ) Other Financing Activities

(13 ) 18 Net Cash Flows (Used in)/Provided by

Financing Activities (19,184 ) 396,206 Net

Increase in Cash and Cash Equivalents 3,060 327,012 Cash and Cash

Equivalents - Beginning of Period 26,952

89,816 Cash and Cash Equivalents - End of Period $ 30,012

$ 416,828

The data contained in this report

is preliminary and is unaudited. This report is being submitted for

the sole purpose of providing information to present shareholders

about Northeast Utilities and Subsidiaries and is not a

representation, prospectus, or intended for use in connection with

any purchase or sale of securities.

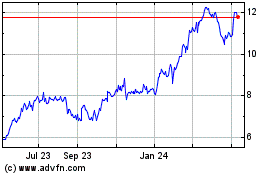

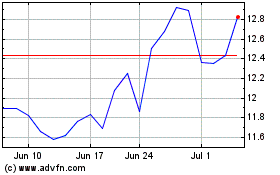

Nu (NYSE:NU)

Historical Stock Chart

From Sep 2024 to Oct 2024

Nu (NYSE:NU)

Historical Stock Chart

From Oct 2023 to Oct 2024