Ulster Bank Ireland Fined for Breaching Obligations to Mortgage Customers

March 25 2021 - 12:11PM

Dow Jones News

By Adriano Marchese

Ulster Bank Ireland DAC has been fined 37.8 million euros ($44.7

million) by the Central Bank of Ireland for breaching obligations

to tracker customers with mortgage accounts.

The Central Bank of Ireland said Thursday that an investigation

found serious failings in the treatment of Ulster Bank Ireland's

tracker customers holding 5,940 mortgage accounts between August

2004 and April 2020.

A tracker mortgage is a type of variable-rate mortgage that

tracks another rate--in most cases, a country's central bank's

rate.

Ulster Bank of Ireland, which is a part of NatWest Group PLC,

has been found to deny customers lower tracker rates, which they

were entitled to, despite receiving complaints. The investigation

found that only customers who complained received the lower

rate.

The original fine was for EUR54 million, but was reduced to

EUR37.8 million in a settlement.

"This fine reflects the gravity with which the Central Bank

views UBID's failings. UBID caused unacceptable and avoidable harm

to its impacted tracker customers; from extended periods of

significant overcharging to the loss of 43 properties, 29 of which

were family homes," the central bank said.

Prior to this fine, Ulster Bank Ireland had already been

required to pay EUR128 million to affected customers as part of the

Central Bank's Tracker Mortgage Examination, which was established

in 2015 to ensure lenders were providing tracker customers with

their entitlements.

Write to Adriano Marchese at adriano.marchese@wsj.com

(END) Dow Jones Newswires

March 25, 2021 11:56 ET (15:56 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

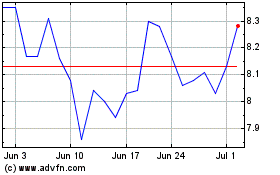

NatWest (NYSE:NWG)

Historical Stock Chart

From Apr 2024 to May 2024

NatWest (NYSE:NWG)

Historical Stock Chart

From May 2023 to May 2024