U.S. index futures show remarkable stability in Monday’s

pre-market trading, anticipating a shortened week due to the

Thanksgiving holiday. This scenario comes after a three-week

recovery streak. Investors are closely watching the nuances of the

American interest rate curve, eagerly awaiting tomorrow’s release

of the minutes from the last Federal Open Market Committee (FOMC)

meeting.

As of 05:50 AM, the Dow Jones futures (DOWI:DJI) rose 7 points,

or 0.02%. The S&P 500 futures rose 0.02% and the Nasdaq-100

futures rose 0.09%. The yield on 10-year Treasury notes was at

4.465%.

In the commodities market, West Texas Intermediate crude oil for

December rose 0.87%, to $76.55 per barrel. Brent crude oil for

January rose 0.88% near $81.32 per barrel. Iron ore with a

concentration of 62%, traded on the Dalian exchange, rose 1.98%, to

$131.05 per ton.

On the economic agenda this Monday, the only highlight is a

government auction with a 20-year maturity. Investors are also

considering the possibility of speeches by Federal Reserve members

throughout the day.

The European financial markets are showing mixed behavior,

reflecting investors’ uncertainty about potential interest rate

cuts. Recent data indicate a significant drop in inflation, where

in the UK, the inflation rate decreased to 4.6% in October,

compared to 6.7% in September. In the eurozone, the confirmed

inflation was 2.9%, a reduction from the previous month’s 4.3%.

Asian markets closed higher after previous losses, reacting to

the maintenance of China’s interest rates. The People’s Bank of

China set its one-year lending rate at 3.45% and the five-year rate

at 4.2%. The indices varied, while the Shanghai SE rose 0.46%, the

Nikkei fell 0.59%. Japan’s Nikkei 225 briefly surpassed its June

intraday peak to reach the highest level since 1990, extending its

gains this year to about 28%.

At Friday’s close, U.S. stocks remained steady, with the Dow

Jones ending with a weekly gain of 1.9%. Nasdaq reached its best

closing level in three months, while S&P 500 achieved its best

in two months. Optimism regarding interest rates and inflation data

contributed to the rise. Some economists suggested that the Fed

will maintain a hawkish tone. Residential construction surprised

with an increase in October, with energy and airline sectors

standing out.

For Monday’s corporate earnings front, investors will be

watching reports from Niu (NASDAQ:NIU),

Legend Biotech (NASDAQ:LEGN),

BiolineRX (NASDAQ:BLRX), ReNew

Power (NASDAQ:RNW), before market open. After the close,

reports from Zoom Video Communications

(NASDAQ:ZM), Agilent Technologies (NYSE:A),

Symbotic (NASDAQ:SYM), Trip.com

(NASDAQ:TCOM), Fidelis (NYSE:FIHL), Enanta

Pharmaceuticals (NASDAQ:ENTA), among others, will be

observed.

Wall Street Corporate Highlights for Today

Microsoft (NASDAQ:MSFT) – Microsoft Corp.

appointed Sam Altman, former co-founder of OpenAI, to lead its new

internal artificial intelligence team, following his departure from

the startup. Greg Brockman, also former OpenAI, joins Altman at

Microsoft. CEO Satya Nadella announced the change as part of

efforts to strengthen Microsoft’s AI plans and reassure investors.

Altman’s appointment comes after Nadella’s failed attempts to

restore him and Brockman at OpenAI, which now has Emmett Shear as

CEO. Nadella reaffirms Microsoft’s commitment to OpenAI and ongoing

innovation in AI.

Meta Platforms (NASDAQ:META) – Meta Platforms

is redistributing its Responsible AI team across different areas of

the company, maintaining focus on AI harm prevention. The change

aims to more closely integrate the team with product development

and core technologies. Additionally, Don Box, head of Meta’s

augmented reality software, is leaving the company, raising

questions about the progress of the operating system for the

planned AR glasses. His departure, for personal reasons, may impact

the project, scheduled for release in 2027.

IBM (NYSE:IBM) – IBM is changing its retirement

plan, replacing 401(k) matching with pension credits, saving half a

billion dollars annually. This reduces the maximum contribution by

employees and deprives them of investing in the stock market,

benefiting the company’s cash flow.

SoFi Technologies (NASDAQ:SOFI) – SoFi

Technologies released a quarterly report reigniting discussions

about the valuation of its loans. Known for its digital financial

services, the company is cutting costs by replacing 401(k)

contributions with non-monetary credits in a pension plan,

impacting employees. This change raises questions about SoFi’s

growth sustainability and accounting practices, affecting both

revenue and book value, and may not reflect the final value

obtained from loans. SoFi’s approach benefits its cash flow and the

company’s stock.

Zoom Video Communications (NASDAQ:ZM) –

Analysts expect Zoom to announce earnings of $1.08 per share and

revenue of $1.12 billion for the third quarter. Although the

company has sought to expand beyond its web meetings, it likely

faces its sixth consecutive quarter of single-digit revenue

growth.

Amazon.com (NASDAQ:AMZN) – Amazon announced

staff reductions in its Alexa unit, focusing more on generative

artificial intelligence. The layoffs, affecting hundreds of

employees, reflect a strategic realignment to align with business

priorities and maximize resources in generative AI. Additionally,

Amazon plans to export Indian goods worth $20 billion by 2025,

expanding its e-commerce platform with thousands of small sellers.

According to Bhupen Wakankar, director of global trade at the

company, growth is driven by strong demand for “Made in India”

products.

Alibaba (NYSE:BABA) – The cancellation of the

spin-off of Alibaba’s cloud division and concerns over U.S. chip

restrictions rattled investors, leading to drops in Chinese tech

stocks. Slow economic recovery, internal growth limits, and

persisting uncertainties, despite seemingly cheap stock prices.

Adidas (TG:ADS), Walmart

(NYSE:WMT) – Waste from brands like Adidas and Walmart is being

burned in brick factories in Cambodia, causing health issues among

workers, reveals a report by LICADHO. Some brands are

investigating, while others claim to follow waste management

norms.

Lions Gate (NYSE:LGF.A),

Disney (NYSE:DIS) – Lions Gate Entertainment and

Disney are the latest companies to suspend advertisements on Elon

Musk’s X.

General Motors (NYSE:GM) – Kyle Vogt, CEO of

General Motors’ robotaxi unit, Cruise, resigned a day after

apologizing to employees during a safety review of the fleet.

Vogt’s departure comes after weeks of turmoil at Cruise, including

the withdrawal of vehicles for safety review following an accident

in October. GM has increased scrutiny over Cruise’s leadership,

with changes on the board and new leadership appointments.

Nikola (NASDAQ:NKLA) – Nikola, an electric

truck manufacturer, announced the departure of CFO Anastasiya

Pasterick, less than a year after taking the position. The company,

which named its fourth CEO in four years, faces financial and

operational challenges, including truck recalls for safety

issues.

Embraer (NYSE:ERJ) – Embraer CEO Francisco

Gomes Neto forecasts about a 20% increase in the company’s revenue

in 2024. He stated that official projections will be released next

year, expecting deliveries of approximately 80 commercial jets and

140 executive jets. Embraer focuses on increasing revenues and

consolidating orders following the launch of new models since

2017.

BP (NYSE:BP) – BP is seeking partnerships for

offshore wind projects in Japan and considering investing in

hydrogen technology. Despite challenges like inflation and

equipment bottlenecks, the company plans to expand into renewable

and low-carbon energies to adapt to the global energy

transition.

BHP Group (NYSE:BHP) – About 400 iron ore train

drivers of BHP in Western Australia will start industrial action

this week, rejecting a company offer that did not meet work

schedule expectations. The train drivers will no longer use a BHP

app for shift changes, demanding individual contact for schedule

changes. The action is a moderate response that avoids complete

stoppages but may present logistical challenges for BHP.

ArcelorMittal (NYSE:MT) – ArcelorMittal

temporarily suspended operations at its steel plant in Bosnia and

supplier mines due to decreased demand in the European steel

market. The company, which produces 700,000 tons of liquid steel

annually and employs about 2,200 workers, cited the war in Ukraine,

high energy and production costs, and inflation as reasons for the

drop in demand.

Northrop Grumman (NYSE:NOC) – Northrop Grumman,

a U.S. defense company, withdrew from the competition to provide

narrowband military satellite communications for the British armed

forces, as reported by the Financial Times. The company had formed

a partnership with Airbus (USOTC:EADSY) to compete for Britain’s

SKYNET program.

AstraZeneca (NASDAQ:AZN) – AstraZeneca created

the Evinova unit to integrate health technology, including AI, into

clinical trials, aiming to cut costs and time. The partnership with

Parexel and Fortrea seeks to streamline lengthy clinical trials, as

the digital health market grows rapidly.

Eli Lilly (NYSE:LLY) – Eli Lilly extended the

deadline for Point Biopharma shareholders to sell their shares

until December 1st, due to low initial uptake. In October, Lilly

agreed to buy Point for $1.4 billion, targeting experimental cancer

therapies. The offered price per share remains $12.50, although

Point’s shares closed at $13.33. So far, only 26.45% of the shares

have been agreed for sale.

Citigroup (NYSE:C) – Citigroup expects to

announce layoffs and changes in senior management today, Monday, as

part of its largest restructuring in decades. Thousands of jobs may

be affected, with management changes to be communicated by email.

The overhaul includes reducing management layers from 13 to eight,

particularly affecting areas like compliance, risk management, and

technology.

Barclays (NYSE:BCS) – Barclays is evaluating

the acquisition of Tesco Bank (LSE:TSCO), with Tesco asking for

non-binding offers by the end of the week as part of its downsizing

of financial services. Barclays showed particular interest in Tesco

Bank’s credit card and savings products. Other bidders are

expected, but there is no certainty about the deal’s

completion.

Blackstone (NYSE:BX) – Blackstone is close to

acquiring a $17 billion portfolio of commercial real estate loans

from Signature Bank, sold by the U.S. FDIC, according to Bloomberg.

Other firms, including Starwood Capital Group and Brookfield

(NYSE:BAM), also participated in the bid.

Moody’s (NYSE:MCO) – Moody’s has maintained

Italy’s sovereign debt rating at Baa3, one level above “junk,” but

upgraded the outlook from negative to stable, positively surprising

Prime Minister Giorgia Meloni’s government. This change reflects a

stabilization in economic prospects and the health of the Italian

banking sector. This decision contrasts with the expectations of

most analysts and follows unchanged assessments by other agencies.

Furthermore, Moody’s has also changed the outlook of SoftBank Group

Corp. (TG:SFT) from negative to stable due to the listing of Arm

Holdings Plc (NASDAQ:ARM), which has brought greater transparency

to the technology portfolio.

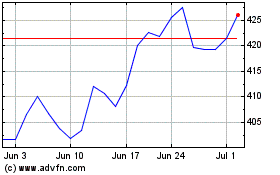

Moodys (NYSE:MCO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Moodys (NYSE:MCO)

Historical Stock Chart

From Nov 2023 to Nov 2024