Highlights of the Second Quarter

2018*

Mistras Group, Inc. (NYSE:MG), a leading "one source" global

provider of technology-enabled asset protection solutions, reported

financial results for its second quarter ended June 30, 2018.

Consolidated revenues for the second quarter of 2018 were $191.8

million, 13% higher than the prior year period of $170.4

million. Services segment revenues were $147.7 million for

the second quarter of 2018, 10% higher than $134.0 million in the

prior year. The increase in revenues was due to the combined

effects of organic growth, acquisition expansion and favorable FX

rates. All three segments had organic revenue increases

year-over-year.

Operating income for the second quarter was $10.3 million, 106%

higher than the prior year period of $5.0 million. Second quarter

2018 net income was $6.0 million or $0.20 per diluted share,

compared with $2.2 million and $0.07 per diluted share in the prior

year period.

The Company generated $20.1 million of net cash from operations

during the first six months of 2018. Adjusted EBITDA for the

first six months of 2018 was $36.4 million. The Company’s net

debt (total debt and capital leases of $165.9 million less cash and

cash equivalents of $17.5 million) was $148.4 million at June 30,

2018.

Performance by segment was as follows:

Services segment Q2 revenues increased by $13.7

million or 10% over prior year, attributable to high-single digit

acquisition growth coupled with low-single digit organic growth.

Services segment Q2 operating income increased by $4.2 million or

35% over prior year. Services segment operating income margin

increased by 200 bps.

International segment Q2 revenue increased by

$7.2 million or 21% over prior year, attributable to mid-teens

organic growth and mid-single digit favorable FX rates.

International Q2 operating income increased $2.6 million from the

prior year's operating loss.

Products and Systems segment Q2 revenue

increased by $0.3 million or 6% over prior year. Products and

Systems Q2 operating loss improved by $0.2 million compared with

the prior year.

Dennis Bertolotti, Chief Executive Officer stated, "I am very

pleased with our robust top-line growth during Q2, as each segment

grew revenue organically. Our services segment also reached

another all-time high for Q2 revenue, even after excluding the

effect of all 2017 acquisitions. It is particularly

noteworthy that our Services segment achieved organic growth in Q2,

offsetting the previously disclosed large contract loss that

discontinued at the beginning of April 2018. Our strong overall

performance was attributable to solid organic growth, the benefit

of acquisitions completed last year as well as favorable FX

rates. Our consolidated operating margin improved by 250

basis points, driven by a 150 basis point improvement in our gross

margin and a 100 basis point improvement in our operating expense

ratio.”

Mr. Bertolotti added “Market conditions that strengthened during

the second half of 2017 continued to improve in the first half of

2018, with oil and gas customer spending patterns rebounding from

low prior year levels. In addition, we have agrowing aerospace

business and have also continued our successful push into expanding

our complimentary mechanical services." Mr. Bertolotti concluded,

stating “I believe macro-level economics drivers will be positive

throughout the second half of 2018, and am confident in maintaining

the forward momentum that we've built up over the past several

successive quarters."

The Company’s 2018 financial guidance was reaffirmed, with

expected revenue and capital expenditures trending towards the high

end of the stated ranges, as follows:

- Total revenues expected to be between $715 million to $730

million;

- Net income expected to be between $21 million to $24

million;

- Earnings per diluted share expected to be between $0.71 to

$0.83;

- Adjusted EBITDA expected to be between $78 million to $83

million;

- Operating cash flow expected to be approximately $70 million;

and

- Capital expenditures expected to be between $15 million and $20

million.

Conference CallIn connection with this release,

Mistras will hold a conference call on August 7, 2018 at 9:00 a.m.

(Eastern). The call will be broadcast over the Web and can be

accessed on Mistras' Website, www.mistrasgroup.com. Individuals in

the U.S. wishing to participate in the conference call by phone may

call 1-844-832-7227 and use confirmation code 6486346 when

prompted. The International dial-in number is 1-224-633-1529.

About Mistras Group, Inc.MISTRAS is a

leading “one source” global provider of technology-enabled asset

protection solutions used to evaluate the structural integrity of

critical energy, industrial and public infrastructure. Mission

critical services and solutions are delivered globally and provide

customers with asset life extension, improved productivity and

profitability, compliance with government safety and environmental

regulations, and enhanced risk management operational

decisions.

MISTRAS uniquely combines its industry-leading products and

technologies - 24/7 on-line monitoring of critical assets;

mechanical integrity (MI) and non-destructive testing (NDT)

services; destructive testing (DT) services; process and fixed

asset engineering and consulting services; and its world class

enterprise inspection data management and analysis software (PCMS™)

to provide comprehensive and competitive products, systems and

services solutions from a single source provider.

For more information, please visit the company's website at

www.mistrasgroup.com or contact Nestor S. Makarigakis, Group

Director, Marketing Communications at marcom@mistrasgroup.com.

Forward-Looking and Cautionary Statements

Certain statements made in this press release are

"forward-looking statements" about Mistras' financial results and

estimates, products and services, business model, strategy, growth

opportunities, profitability and competitive position, and other

matters. These forward-looking statements generally use words such

as "future," "possible," "potential," "targeted," "anticipate,"

"believe," "estimate," "expect," "intend," "plan," "predict,"

"project," "will," "may," "should," "could," "would" and other

similar words and phrases. Such statements are not guarantees of

future performance or results, and will not necessarily be accurate

indications of the times at, or by which, such performance or

results will be achieved, if at all. These statements are subject

to risks and uncertainties that could cause actual performance or

results to differ materially from those expressed in these

statements. A list, description and discussion of these and other

risks and uncertainties can be found in the "Risk Factors" section

of the Company's Annual Report on Form 10-K filed with the

Securities and Exchange Commission on March 14, 2018, as updated by

our reports on Form 10-Q and Form 8-K. The forward-looking

statements are made as of the date hereof, and Mistras undertakes

no obligation to update such statements as a result of new

information, future events or otherwise.

Use of Non-GAAP MeasuresIn addition to

financial information prepared in accordance with generally

accepted accounting principles in the U.S. (GAAP), this press

release also contains adjusted financial measures that we believe

provide investors and management with supplemental information

relating to operating performance and trends that facilitate

comparisons between periods and with respect to projected

information. The term "Adjusted EBITDA" used in this release is a

financial measurement not calculated in accordance with GAAP and is

defined as net income attributable to Mistras Group, Inc. plus:

interest expense, provision for income taxes, depreciation and

amortization, share-based compensation expense and certain

acquisition related costs (including transaction due diligence

costs and adjustments to the fair value of contingent

consideration), foreign exchange (gain) loss and, if applicable,

certain special items which are noted. A reconciliation of

Adjusted EBITDA to a financial measurement under GAAP is set forth

in a table attached to this press release. In addition, the Company

has also included in the attached tables non-GAAP measurement”

“Segment and Total Company Income (Loss) Before Special Items”,

reconciling these measurements to financial measurements under

GAAP. The Company uses the term “free cash flow”, a non-GAAP

measurement the Company defines as cash provided by operating

activities less capital expenditures (which is classified as an

investing activity). The Company also uses the term “net debt”, a

non-GAAP measurement defined as the sum of the current and

long-term portions of long-term debt and capital lease obligations,

less cash and cash equivalents.

| Mistras Group, Inc. and

SubsidiariesCondensed Consolidated Balance

Sheets(in thousands, except share and per share

data) |

| |

|

(unaudited) |

|

|

| |

|

June 30, 2018 |

|

December 31, 2017 |

|

ASSETS |

|

|

|

|

| Current Assets |

|

|

|

|

| Cash and

cash equivalents |

|

$ |

17,530 |

|

|

$ |

27,541 |

|

| Accounts

receivable, net |

|

144,200 |

|

|

138,080 |

|

|

Inventories |

|

11,580 |

|

|

10,503 |

|

| Prepaid

expenses and other current assets |

|

17,995 |

|

|

18,884 |

|

| Total

current assets |

|

191,305 |

|

|

195,008 |

|

| Property, plant and

equipment, net |

|

87,215 |

|

|

87,143 |

|

| Intangible assets,

net |

|

59,171 |

|

|

63,739 |

|

| Goodwill |

|

199,656 |

|

|

203,438 |

|

| Deferred income

taxes |

|

1,549 |

|

|

1,606 |

|

| Other assets |

|

5,093 |

|

|

3,507 |

|

| Total

assets |

|

$ |

543,989 |

|

|

$ |

554,441 |

|

| LIABILITIES AND

EQUITY |

|

|

|

|

| Current

Liabilities |

|

|

|

|

| Accounts payable |

|

$ |

14,627 |

|

|

$ |

10,362 |

|

| Accrued

expenses and other current liabilities |

|

63,922 |

|

|

65,561 |

|

| Current

portion of long-term debt |

|

2,225 |

|

|

2,358 |

|

| Current

portion of capital lease obligations |

|

5,294 |

|

|

5,875 |

|

| Income

taxes payable |

|

3,365 |

|

|

6,069 |

|

| Total

current liabilities |

|

89,433 |

|

|

90,225 |

|

| Long-term debt, net of

current portion |

|

150,024 |

|

|

164,520 |

|

| Obligations under

capital leases, net of current portion |

|

8,370 |

|

|

8,738 |

|

| Deferred income

taxes |

|

9,247 |

|

|

8,803 |

|

| Other long-term

liabilities |

|

9,061 |

|

|

11,363 |

|

| Total

liabilities |

|

266,135 |

|

|

283,649 |

|

| Commitments and

contingencies |

|

|

|

|

| Equity |

|

|

|

|

| Preferred

stock, 10,000,000 shares authorized |

|

— |

|

|

— |

|

| Common

stock, $0.01 par value, 200,000,000 shares authorized, 28,373,535

and 28,294,968 shares issued |

|

283 |

|

|

282 |

|

|

Additional paid-in capital |

|

224,634 |

|

|

222,425 |

|

| Retained

earnings |

|

73,624 |

|

|

64,717 |

|

|

Accumulated other comprehensive loss |

|

(20,870 |

) |

|

(16,805 |

) |

| Total

Mistras Group, Inc. stockholders’ equity |

|

277,671 |

|

|

270,619 |

|

|

Non-controlling interests |

|

183 |

|

|

173 |

|

| Total

equity |

|

277,854 |

|

|

270,792 |

|

| Total

liabilities and equity |

|

$ |

543,989 |

|

|

$ |

554,441 |

|

|

|

|

|

|

|

|

|

|

|

| Mistras Group, Inc. and

SubsidiariesUnaudited Condensed Consolidated Statements of

Income(in thousands, except per share data) |

|

|

| |

Three months ended |

|

Six months ended |

| |

June 30, 2018 |

|

June 30, 2017 |

|

June 30, 2018 |

|

June 30, 2017 |

| |

|

|

|

|

|

|

|

|

Revenue |

$ |

191,793 |

|

|

$ |

170,439 |

|

|

$ |

379,423 |

|

|

$ |

333,757 |

|

| Cost of

revenue |

131,084 |

|

|

118,825 |

|

|

264,872 |

|

|

233,828 |

|

|

Depreciation |

5,626 |

|

|

5,271 |

|

|

11,323 |

|

|

10,433 |

|

| Gross

profit |

55,083 |

|

|

46,343 |

|

|

103,228 |

|

|

89,496 |

|

| Selling,

general and administrative expenses |

41,267 |

|

|

37,973 |

|

|

80,301 |

|

|

75,273 |

|

| Research

and engineering |

913 |

|

|

552 |

|

|

1,669 |

|

|

1,195 |

|

|

Depreciation and amortization |

2,965 |

|

|

2,613 |

|

|

5,916 |

|

|

5,116 |

|

|

Acquisition-related expense (benefit), net |

(366 |

) |

|

202 |

|

|

(1,360 |

) |

|

(341 |

) |

| Income from

operations |

10,304 |

|

|

5,003 |

|

|

16,702 |

|

|

8,253 |

|

| Interest

expense |

1,895 |

|

|

1,015 |

|

|

3,686 |

|

|

2,033 |

|

| Income before

provision for income taxes |

8,409 |

|

|

3,988 |

|

|

13,016 |

|

|

6,220 |

|

| Provision

for income taxes |

2,409 |

|

|

1,770 |

|

|

4,096 |

|

|

2,304 |

|

| Net

income |

6,000 |

|

|

2,218 |

|

|

8,920 |

|

|

3,916 |

|

| Less: net

income attributable to non-controlling interests, net of taxes |

— |

|

|

1 |

|

|

12 |

|

|

7 |

|

| Net income

attributable to Mistras Group, Inc. |

$ |

6,000 |

|

|

$ |

2,217 |

|

|

$ |

8,908 |

|

|

$ |

3,909 |

|

| Earnings per common

share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.21 |

|

|

$ |

0.08 |

|

|

$ |

0.31 |

|

|

$ |

0.14 |

|

|

Diluted |

$ |

0.20 |

|

|

$ |

0.07 |

|

|

$ |

0.30 |

|

|

$ |

0.13 |

|

| Weighted average common

shares outstanding: |

|

|

|

|

|

|

|

|

Basic |

28,346 |

|

|

28,437 |

|

|

28,325 |

|

|

28,562 |

|

|

Diluted |

29,334 |

|

|

29,599 |

|

|

29,349 |

|

|

29,754 |

|

| Mistras Group, Inc. and

SubsidiariesUnaudited Operating Data by Segment(in

thousands) |

|

|

| |

Three months ended |

|

Six months ended |

| |

June 30, 2018 |

|

June 30, 2017 |

|

June 30, 2018 |

|

June 30, 2017 |

|

Revenues |

|

|

|

|

|

|

|

|

Services |

$ |

147,718 |

|

|

$ |

134,043 |

|

|

$ |

293,313 |

|

|

$ |

260,372 |

|

|

International |

41,111 |

|

|

33,904 |

|

|

79,567 |

|

|

68,160 |

|

| Products

and Systems |

5,386 |

|

|

5,107 |

|

|

11,570 |

|

|

10,657 |

|

| Corporate

and eliminations |

(2,422 |

) |

|

(2,615 |

) |

|

(5,027 |

) |

|

(5,432 |

) |

| |

$ |

191,793 |

|

|

$ |

170,439 |

|

|

$ |

379,423 |

|

|

$ |

333,757 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

Three months ended |

|

Six months ended |

| |

June 30, 2018 |

|

June 30, 2017 |

|

June 30, 2018 |

|

June 30, 2017 |

| Gross

profit |

|

|

|

|

|

|

|

|

Services |

$ |

40,127 |

|

|

$ |

35,490 |

|

|

$ |

74,837 |

|

|

$ |

65,703 |

|

|

International |

12,689 |

|

|

8,828 |

|

|

23,396 |

|

|

19,288 |

|

| Products

and Systems |

2,213 |

|

|

1,966 |

|

|

5,103 |

|

|

4,560 |

|

| Corporate

and eliminations |

54 |

|

|

59 |

|

|

(108 |

) |

|

(55 |

) |

| |

$ |

55,083 |

|

|

$ |

46,343 |

|

|

$ |

103,228 |

|

|

$ |

89,496 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mistras Group, Inc. and

SubsidiariesUnaudited Reconciliation ofSegment and

Total Company Income from Operations (GAAP) to Income before

Special Items (non-GAAP)(in

thousands) |

| |

| |

Three months ended |

|

Six months ended |

| |

June 30, 2018 |

|

June 30, 2017 |

|

June 30, 2018 |

|

June 30, 2017 |

|

Services: |

|

|

|

|

|

|

|

| Income

from operations (GAAP) |

$ |

16,328 |

|

|

$ |

12,132 |

|

|

$ |

28,603 |

|

|

$ |

19,513 |

|

| Bad debt

provision for a customer bankruptcy |

— |

|

|

— |

|

|

— |

|

|

1,200 |

|

|

Reorganization and other related costs |

— |

|

|

437 |

|

|

— |

|

|

453 |

|

|

Acquisition-related expense (benefit), net |

43 |

|

|

201 |

|

|

(990 |

) |

|

78 |

|

| Income

before special items (non-GAAP) |

16,371 |

|

|

12,770 |

|

|

27,613 |

|

|

21,244 |

|

|

International: |

|

|

|

|

|

|

|

| Income

(loss) from operations (GAAP) |

2,455 |

|

|

(190 |

) |

|

3,375 |

|

|

2,843 |

|

|

Reorganization and other related costs |

492 |

|

|

63 |

|

|

581 |

|

|

76 |

|

|

Acquisition-related expense (benefit), net |

(409 |

) |

|

— |

|

|

(409 |

) |

|

(501 |

) |

| Income

(loss) before special items (non-GAAP) |

2,538 |

|

|

(127 |

) |

|

3,547 |

|

|

2,418 |

|

| Products and

Systems: |

|

|

|

|

|

|

|

| Loss from

operations (GAAP) |

(656 |

) |

|

(892 |

) |

|

(384 |

) |

|

(1,340 |

) |

|

Reorganization and other related costs |

29 |

|

|

— |

|

|

29 |

|

|

— |

|

| Loss

before special items (non-GAAP) |

(627 |

) |

|

(892 |

) |

|

(355 |

) |

|

(1,340 |

) |

| Corporate and

Eliminations: |

|

|

|

|

|

|

|

| Loss from

operations (GAAP) |

(7,823 |

) |

|

(6,047 |

) |

|

(14,892 |

) |

|

(12,763 |

) |

|

Acquisition-related expense (benefit), net |

— |

|

|

1 |

|

|

39 |

|

|

82 |

|

| Loss

before special items (non-GAAP) |

(7,823 |

) |

|

(6,046 |

) |

|

(14,853 |

) |

|

(12,681 |

) |

| Total

Company |

|

|

|

|

|

|

|

| Income

from operations (GAAP) |

$ |

10,304 |

|

|

$ |

5,003 |

|

|

$ |

16,702 |

|

|

$ |

8,253 |

|

| Bad debt

provision for a customer bankruptcy |

— |

|

|

— |

|

|

— |

|

|

1,200 |

|

|

Reorganization and other related costs |

521 |

|

|

500 |

|

|

610 |

|

|

529 |

|

|

Acquisition-related expense (benefit), net |

(366 |

) |

|

202 |

|

|

(1,360 |

) |

|

(341 |

) |

| Income

before special items (non-GAAP) |

$ |

10,459 |

|

|

$ |

5,705 |

|

|

$ |

15,952 |

|

|

$ |

9,641 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mistras Group, Inc. and

SubsidiariesUnaudited Summary Cash Flow

Information(in thousands) |

| |

| |

Six months ended |

| |

June 30, 2018 |

|

June 30, 2017 |

| Net cash provided by

(used in): |

|

|

|

| Operating

activities |

$ |

20,095 |

|

|

$ |

22,972 |

|

| Investing

activities |

(10,287 |

) |

|

(14,218 |

) |

| Financing

activities |

(19,257 |

) |

|

(2,726 |

) |

| Effect of exchange rate

changes on cash |

(562 |

) |

|

1,602 |

|

| Net change in cash and

cash equivalents |

$ |

(10,011 |

) |

|

$ |

7,630 |

|

| |

|

|

|

|

|

|

|

| Mistras Group, Inc. and

SubsidiariesReconciliation of Net Cash Provided by

Operating Activities (GAAP) to Free Cash Flow (non-GAAP)(in

thousands) |

| |

| |

Six months ended |

| |

June 30, 2018 |

|

June 30, 2017 |

| GAAP: Net cash

provided by operating activities |

$ |

20,095 |

|

|

$ |

22,972 |

|

| Less: |

|

|

|

| Purchases of property,

plant and equipment |

(10,963 |

) |

|

(9,789 |

) |

| Purchases of intangible

assets |

(265 |

) |

|

(688 |

) |

| non-GAAP: Free

cash flow |

$ |

8,867 |

|

|

$ |

12,495 |

|

| |

|

|

|

|

|

|

|

| Mistras Group, Inc. and

SubsidiariesUnaudited Reconciliation ofNet Income

to Adjusted EBITDA(in thousands) |

| |

|

|

Three months ended |

|

Six months ended |

|

|

June 30, 2018 |

|

June 30, 2017 |

|

June 30, 2018 |

|

June 30, 2017 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

income |

$ |

6,000 |

|

|

$ |

2,218 |

|

|

$ |

8,920 |

|

|

$ |

3,916 |

|

| Less: net

income attributable to noncontrolling interests, net of taxes |

— |

|

|

1 |

|

|

12 |

|

|

7 |

|

| Net income

attributable to Mistras Group, Inc. |

$ |

6,000 |

|

|

$ |

2,217 |

|

|

$ |

8,908 |

|

|

$ |

3,909 |

|

| Interest expense |

1,895 |

|

|

1,015 |

|

|

3,686 |

|

|

2,033 |

|

| Provision for income

taxes |

2,409 |

|

|

1,770 |

|

|

4,096 |

|

|

2,304 |

|

| Depreciation and

amortization |

8,591 |

|

|

7,884 |

|

|

17,239 |

|

|

15,549 |

|

| Share-based

compensation expense |

1,703 |

|

|

1,697 |

|

|

2,829 |

|

|

3,380 |

|

| Acquisition-related

expense (benefit), net |

(366 |

) |

|

202 |

|

|

(1,360 |

) |

|

(341 |

) |

| Reorganization and

other related costs |

521 |

|

|

500 |

|

|

610 |

|

|

529 |

|

| Bad debt provision for

unexpected customer bankruptcy |

— |

|

|

— |

|

|

— |

|

|

1,200 |

|

| Foreign exchange

loss |

338 |

|

|

349 |

|

|

389 |

|

|

326 |

|

| Adjusted EBITDA |

$ |

21,091 |

|

|

$ |

15,634 |

|

|

$ |

36,397 |

|

|

$ |

28,889 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mistras Group, Inc. and

SubsidiariesUnaudited Reconciliation

ofNet Income (GAAP) and Diluted EPS (GAAP) to Net

Income Excluding Special Items (non-GAAP)and

Diluted EPS Excluding Special Items (non-GAAP)(in

thousands, except per share data) |

| |

|

|

|

|

| |

|

Three months ended June 30, |

|

Six months ended June 30, |

| |

|

2018 |

|

2017 |

|

2018 |

|

2017 |

| Net income (GAAP) |

|

$ |

6,000 |

|

|

$ |

2,217 |

|

|

$ |

8,908 |

|

|

$ |

3,909 |

|

| Special items, net of

tax |

|

44 |

|

|

396 |

|

|

(598 |

) |

|

1,166 |

|

| Net Income Excluding

Special Items (non-GAAP) |

|

$ |

6,044 |

|

|

$ |

2,613 |

|

|

$ |

8,310 |

|

|

$ |

5,075 |

|

| |

|

|

|

|

|

|

|

|

| Diluted EPS (GAAP) |

|

$ |

0.20 |

|

|

$ |

0.07 |

|

|

$ |

0.30 |

|

|

$ |

0.13 |

|

| Special items, net of

tax |

|

0.01 |

|

|

0.02 |

|

|

(0.02 |

) |

|

0.04 |

|

| Diluted EPS Excluding

Special Items (non-GAAP) |

|

$ |

0.21 |

|

|

$ |

0.09 |

|

|

$ |

0.28 |

|

|

$ |

0.17 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Media Contact: Nestor S. Makarigakis Group Director of Marketing

Communications,

marcom@mistrasgroup.com 1(609)716-4000

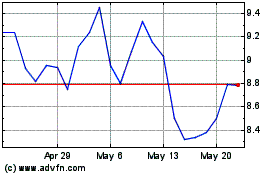

Mistras (NYSE:MG)

Historical Stock Chart

From Jun 2024 to Jul 2024

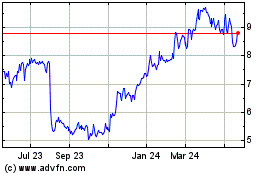

Mistras (NYSE:MG)

Historical Stock Chart

From Jul 2023 to Jul 2024