Mistras Group, Inc. (NYSE:MG), a leading "one source" global

provider of technology-enabled asset protection solutions, reported

financial results for its first quarter ended March 31, 2017.

Revenues for the first quarter of 2017 were $163.3

million, 2% lower than in the comparable period of 2016. Net

income during the first quarter of 2017 was $1.7 million or $0.06

per diluted share, inclusive of an $0.8 million after-tax charge

pertaining to a bad debt provision taken in relation to the

bankruptcy filing of a large customer in the nuclear industry.

Exclusive of the bad debt provision, first quarter 2017 net income

and earnings per diluted share were $2.5 million and $0.08 per

diluted share, respectively, compared with $3.4 million and $0.11

per diluted share, respectively, in the prior year’s first

quarter.

The Company generated $13.4 million of cash from

operating activities and $9.6 million of free cash flow during the

first quarter of fiscal year 2017, both amounts reduced by a $6.3

million outflow pertaining to a prior year legal settlement. The

Company utilized $4.5 million of its free cash flow for an

acquisition and $6 million to repurchase its common stock during

the first quarter of 2017. The Company’s net debt (total debt less

cash) of $85.4 million at March 31, 2017 was approximately 1.1x

Adjusted EBITDA.

Adjusted EBITDA for the first quarter of 2017 was

$13.3 million, compared with $15.0 million in the comparable period

of the prior year. Performance by segment was as follows:

Services segment operating income

declined from prior year by 35% in the first quarter of fiscal year

2017, on revenues that declined by 4%. Excluding the special bad

debt provision, Services operating income declined by $2.8 million

or 24%. The decline in operating income was driven by a mid-single

digit organic revenue decline which reflected soft market

conditions and a weak spring turnaround season, which in turn

caused an 80 basis point reduction in Services gross margin to

23.9% of revenues.

International segment operating

income more than tripled prior year levels, growing by $2.3 million

over the prior year’s first quarter, on revenues that grew by $3.3

million or 11%, driven primarily by strong performance in aerospace

business. The Company enjoyed double digit first quarter organic

revenue growth compared with prior year in Germany and France,

which led to a 250 basis point improvement in the segment gross

margin rate to 30.5%.

Products and Systems segment

operating income declined by $0.3 million compared with the prior

year’s first quarter, driven by a volume-driven revenue decline of

$1.1 million or 17%.

Dr. Sotirios Vahaviolos, Chairman and Chief

Executive Officer stated, "As mentioned in our recent earnings

calls, the fall 2016 and spring 2017 seasons were especially

challenging in North America, as workloads from many customers were

less than in the prior year. These conditions caused results in our

Services segment to suffer poor comparisons to prior year that more

than offset continued positive performance in our International

segment.”

Dr. Vahaviolos added: “Although the market rebound

has not yet occurred, we are using this time to make further

adjustments to our cost structure, and to enhance our competitive

position by adding capabilities that will help our customers in new

and exciting ways. We are actively quoting new business and are

using this time to position Mistras to drive incrementally more

value for our customers, and to make investments that will reignite

our profitable growth in 2018 and beyond."

Updated Guidance for 2017

Information from North American oil and gas

customers continues to suggest that their spending for inspection

services in the first half of calendar 2017 will be lower than

prior year. However, spending levels are expected to pick up

modestly in the second half of 2017. The Company’s results for the

first half and second half of 2017 are expected to reflect this

dynamic.

The Company’s 2017 financial guidance remains

unchanged, as follows:

- Total revenues from $670 million to $700 million;

- Net income for 2017 from $20 million to $23 million;

- Earnings per diluted share from 68 cents to 78 cents;

- Adjusted EBITDA from $73 million to $78 million;

- Operating cash flow of approximately $50 million;

- Capital expenditures of approximately $20 million.

Conference Call

In connection with this release, Mistras will hold

a conference call on May 9, 2017 at 9:00 a.m. (Eastern). The call

will be broadcast over the Web and can be accessed on Mistras'

Website, www.mistrasgroup.com. Individuals in the U.S. wishing to

participate in the conference call by phone may call 1-844-832-7227

and use confirmation code 17141113 when prompted. The International

dial-in number is 1-224-633-1529.

About Mistras Group, Inc.

Mistras offers one of the broadest "one source"

services and technology-enabled asset protection solution

portfolios in the industry used to evaluate the structural

integrity of energy, industrial and public infrastructure. Mission

critical services and solutions are delivered globally and provide

customers with the ability to extend the useful life of their

assets, improve productivity and profitability, comply with

government safety and environmental regulations and enhance risk

management operational decisions.

Mistras uniquely combines its industry leading

products and technologies - 24/7 on-line monitoring of critical

assets; mechanical integrity ("MI") and non-destructive testing

("NDT") services; destructive testing services; and its proprietary

world class data warehousing and analysis software - to provide

comprehensive and competitive products, systems and services

solutions from a single source provider.

For more information, please visit the company's

website at www.mistrasgroup.com.

Forward-Looking and Cautionary

Statements

Certain statements made in this press release are

"forward-looking statements" about Mistras' financial results and

estimates, products and services, business model, strategy, growth

opportunities, profitability and competitive position, and other

matters. These forward-looking statements generally use words such

as "future," "possible," "potential," "targeted," "anticipate,"

"believe," "estimate," "expect," "intend," "plan," "predict,"

"project," "will," "may," "should," "could," "would" and other

similar words and phrases. Such statements are not guarantees of

future performance or results, and will not necessarily be accurate

indications of the times at, or by which, such performance or

results will be achieved, if at all. These statements are subject

to risks and uncertainties that could cause actual performance or

results to differ materially from those expressed in these

statements. A list, description and discussion of these and other

risks and uncertainties can be found in the "Risk Factors" section

of the Company's Transition Report on Form 10-K filed with the

Securities and Exchange Commission on March 20, 2017, as updated by

our reports on Form 10-Q and Form 8-K. The forward-looking

statements are made as of the date hereof, and Mistras undertakes

no obligation to update such statements as a result of new

information, future events or otherwise.

Use of Non-GAAP Measures

In addition to financial information prepared in

accordance with generally accepted accounting principles in the

U.S. (GAAP), this press release also contains adjusted financial

measures that we believe provide investors and management with

supplemental information relating to operating performance and

trends that facilitate comparisons between periods and with respect

to projected information. The term "Adjusted EBITDA" used in this

release is a financial measurement not calculated in accordance

with GAAP and is defined as net income attributable to Mistras

Group, Inc. plus: interest expense, provision for income taxes,

depreciation and amortization, share-based compensation expense and

certain acquisition related costs (including transaction due

diligence costs and adjustments to the fair value of contingent

consideration), foreign exchange (gain) loss and, if applicable,

certain special items which are noted. A Reconciliation of

Adjusted EBITDA to a financial measurement under GAAP is set forth

in a table attached to this press release. In addition, the Company

has also included in the attached tables non-GAAP measurement”

“Segment and Total Company Income (Loss) Before Special Items”,

reconciling these measurements to financial measurements under

GAAP. The Company uses the term “free cash flow”, a non-GAAP

measurement the Company defines as cash provided by operating

activities less capital expenditures (which is classified as an

investing activity). The Company also uses the term “net

debt”, a non-GAAP measurement defined as the sum of the current and

long-term portions of long-term debt and capital lease obligations,

less cash and cash equivalents.

| Mistras Group, Inc. and

Subsidiaries |

| Condensed Consolidated Balance

Sheets |

| (in thousands, except share and per share

data) |

| |

| |

|

(unaudited) |

|

|

| |

|

March 31, 2017 |

|

December 31, 2016 |

|

ASSETS |

|

|

|

|

| Current Assets |

|

|

|

|

| Cash and

cash equivalents |

|

$ |

27,592 |

|

|

$ |

19,154 |

|

| Accounts

receivable, net |

|

124,221 |

|

|

130,852 |

|

|

Inventories |

|

10,589 |

|

|

10,017 |

|

| Deferred

income taxes |

|

— |

|

|

6,230 |

|

| Prepaid

expenses and other current assets |

|

14,772 |

|

|

16,399 |

|

| Total

current assets |

|

177,174 |

|

|

182,652 |

|

| Property, plant and

equipment, net |

|

72,898 |

|

|

73,149 |

|

| Intangible assets,

net |

|

41,226 |

|

|

40,007 |

|

| Goodwill |

|

173,907 |

|

|

169,940 |

|

| Deferred income

taxes |

|

1,897 |

|

|

1,086 |

|

| Other assets |

|

2,628 |

|

|

2,593 |

|

| Total

assets |

|

$ |

469,730 |

|

|

$ |

469,427 |

|

| LIABILITIES AND

EQUITY |

|

|

|

|

| Current

Liabilities |

|

|

|

|

| Accounts

payable |

|

$ |

9,345 |

|

|

$ |

6,805 |

|

| Accrued

expenses and other current liabilities |

|

53,637 |

|

|

58,697 |

|

| Current

portion of long-term debt |

|

1,766 |

|

|

1,379 |

|

| Current

portion of capital lease obligations |

|

6,357 |

|

|

6,488 |

|

| Income

taxes payable |

|

3,659 |

|

|

4,342 |

|

| Total

current liabilities |

|

74,764 |

|

|

77,711 |

|

| Long-term debt, net of

current portion |

|

96,042 |

|

|

85,917 |

|

| Obligations under

capital leases, net of current portion |

|

8,861 |

|

|

9,682 |

|

| Deferred income

taxes |

|

12,024 |

|

|

17,584 |

|

| Other long-term

liabilities |

|

8,180 |

|

|

7,789 |

|

| Total

liabilities |

|

199,871 |

|

|

198,683 |

|

| Commitments and

contingencies |

|

|

|

|

| Equity |

|

|

|

|

| Preferred

stock, 10,000,000 shares authorized |

|

— |

|

|

— |

|

| Common

stock, $0.01 par value, 200,000,000 shares authorized, 29,257,763

and 29,216,745 shares issued |

|

293 |

|

|

292 |

|

|

Additional paid-in capital |

|

219,176 |

|

|

217,211 |

|

| Treasury

stock, at cost, 676,512 and 420,258 shares |

|

(15,000 |

) |

|

(9,000 |

) |

| Retained

earnings |

|

93,496 |

|

|

91,803 |

|

|

Accumulated other comprehensive loss |

|

(28,274 |

) |

|

(29,724 |

) |

| Total

Mistras Group, Inc. stockholders’ equity |

|

269,691 |

|

|

270,582 |

|

|

Noncontrolling interests |

|

168 |

|

|

162 |

|

| Total

equity |

|

269,859 |

|

|

270,744 |

|

| Total

liabilities and equity |

|

$ |

469,730 |

|

|

$ |

469,427 |

|

| Mistras Group, Inc. and

Subsidiaries |

| Unaudited Condensed Consolidated Statements of

Income |

| (in thousands, except per share

data) |

| |

| |

|

Three months ended |

| |

|

March 31, 2017 |

|

March 31, 2016 |

| |

|

|

|

|

|

Revenue |

|

$ |

163,318 |

|

|

$ |

167,455 |

|

| Cost of

revenue |

|

115,002 |

|

|

118,230 |

|

|

Depreciation |

|

5,163 |

|

|

5,255 |

|

| Gross

profit |

|

43,153 |

|

|

43,970 |

|

| Selling,

general and administrative expenses |

|

37,302 |

|

|

35,053 |

|

| Research

and engineering |

|

643 |

|

|

662 |

|

|

Depreciation and amortization |

|

2,502 |

|

|

2,762 |

|

|

Acquisition-related expense (benefit), net |

|

(544 |

) |

|

(153 |

) |

| Income from

operations |

|

3,250 |

|

|

5,646 |

|

| Interest

expense |

|

1,018 |

|

|

1,100 |

|

| Income before

provision for income taxes |

|

2,232 |

|

|

4,546 |

|

| Provision

for income taxes |

|

534 |

|

|

1,088 |

|

| Net

income |

|

1,698 |

|

|

3,458 |

|

| Less: net

income attributable to noncontrolling interests, net of taxes |

|

6 |

|

|

11 |

|

| Net income

attributable to Mistras Group, Inc. |

|

$ |

1,692 |

|

|

$ |

3,447 |

|

| Earnings per common

share |

|

|

|

|

|

Basic |

|

$ |

0.06 |

|

|

$ |

0.12 |

|

|

Diluted |

|

$ |

0.06 |

|

|

$ |

0.11 |

|

| Weighted average common

shares outstanding: |

|

|

|

|

|

Basic |

|

|

28,687 |

|

|

28,915 |

|

|

Diluted |

|

29,905 |

|

|

29,980 |

|

| Mistras Group, Inc. and

Subsidiaries |

| Unaudited Operating Data by

Segment |

| (in thousands) |

| |

| |

Three months ended |

| |

March 31, 2017 |

|

March 31, 2016 |

|

Revenues |

|

|

|

|

Services |

$ |

126,329 |

|

|

$ |

131,579 |

|

|

International |

34,256 |

|

|

30,980 |

|

| Products

and Systems |

5,550 |

|

|

6,680 |

|

| Corporate

and eliminations |

(2,817 |

) |

|

(1,784 |

) |

| |

$ |

163,318 |

|

|

$ |

167,455 |

|

| |

|

|

|

| |

|

|

|

| |

Three months ended |

| |

March 31, 2017 |

|

March 31, 2016 |

| Gross

profit |

|

|

|

|

Services |

$ |

30,213 |

|

|

$ |

32,458 |

|

|

International |

10,460 |

|

|

8,673 |

|

| Products

and Systems |

2,594 |

|

|

2,738 |

|

| Corporate

and eliminations |

(114 |

) |

|

101 |

|

| |

$ |

43,153 |

|

|

$ |

43,970 |

|

| |

|

|

|

| Mistras Group, Inc. and

Subsidiaries |

| Unaudited Reconciliation of |

| Segment and Total Company Income (Loss) from

Operations (GAAP) to Income before Special Items

(non-GAAP) |

| (in thousands) |

| |

| |

Three months ended |

| |

March 31, 2017 |

|

March 31, 2016 |

|

Services: |

|

|

|

| Income

from operations |

$ |

7,380 |

|

|

$ |

11,339 |

|

| Bad debt

provision for a customer bankruptcy |

1,200 |

|

|

— |

|

| Severance

costs |

16 |

|

|

— |

|

|

Acquisition-related expense (benefit), net |

(124 |

) |

|

(173 |

) |

| Income

before special items |

8,472 |

|

|

11,166 |

|

|

International: |

|

|

|

| Income

from operations |

3,034 |

|

|

720 |

|

| Severance

costs |

13 |

|

|

65 |

|

|

Acquisition-related expense (benefit), net |

(501 |

) |

|

20 |

|

| Income

before special items |

2,546 |

|

|

805 |

|

| Products and

Systems: |

|

|

|

| Loss from

operations |

(449 |

) |

|

(132 |

) |

| Severance

costs |

— |

|

|

(11 |

) |

|

Acquisition-related expense (benefit), net |

— |

|

|

— |

|

| Loss

before special items |

(449 |

) |

|

(143 |

) |

| Corporate and

Eliminations: |

|

|

|

| Loss from

operations |

(6,715 |

) |

|

(6,281 |

) |

|

Acquisition-related expense (benefit), net |

81 |

|

|

— |

|

| Loss

before special items |

(6,634 |

) |

|

(6,281 |

) |

| Total

Company |

|

|

|

| Income

from operations |

$ |

3,250 |

|

|

$ |

5,646 |

|

| Bad debt

provision for a customer bankruptcy |

$ |

1,200 |

|

|

$ |

— |

|

| Severance

costs |

$ |

29 |

|

|

$ |

54 |

|

|

Acquisition-related expense (benefit), net |

$ |

(544 |

) |

|

$ |

(153 |

) |

| Income

before special items |

$ |

3,935 |

|

|

$ |

5,547 |

|

| Mistras Group, Inc. and

Subsidiaries |

| Unaudited Summary Cash Flow

Information |

| (in thousands) |

| |

| |

Three months ended |

| |

March 31, 2017 |

|

March 31, 2016 |

| |

|

| Net cash provided by

(used in): |

|

|

|

| Operating

activities |

$ |

13,413 |

|

|

$ |

29,113 |

|

| Investing

activities |

(8,137 |

) |

|

(4,109 |

) |

| Financing

activities |

2,853 |

|

|

(18,888 |

) |

| Effect of exchange rate

changes on cash |

309 |

|

|

(89 |

) |

| Net change in cash and

cash equivalents |

$ |

8,438 |

|

|

$ |

6,027 |

|

| |

|

|

|

| Mistras Group, Inc. and

Subsidiaries |

| Reconciliation of Net Cash Provided from

Operating Activities (GAAP) to Free Cash Flow

(non-GAAP) |

| (in thousands) |

| |

| |

Three months ended March 31, 2017 |

| GAAP: Net cash

provided by operating activities |

$ |

13,413 |

|

| Less: |

|

| Purchases

of property, plant and equipment |

(3,416 |

) |

| Purchases

of intangible assets |

(376 |

) |

| non-GAAP: Free

cash flow |

$ |

9,621 |

|

| Mistras Group, Inc. and

Subsidiaries |

| Unaudited Reconciliation of |

| Net Income to Adjusted EBITDA |

| (in thousands) |

| |

| |

Three months ended |

| |

March 31, 2017 |

|

March 31, 2016 |

| |

|

|

|

|

|

|

|

| Net

income |

$ |

1,698 |

|

|

$ |

3,458 |

|

| Less: net

income attributable to noncontrolling interests, net of taxes |

6 |

|

|

11 |

|

| Net income attributable

to Mistras Group, Inc. |

$ |

1,692 |

|

|

$ |

3,447 |

|

| Interest expense |

1,018 |

|

|

1,100 |

|

| Provision for income

taxes |

534 |

|

|

1,088 |

|

| Depreciation and

amortization |

7,665 |

|

|

8,017 |

|

| Share-based

compensation expense |

1,683 |

|

|

1,729 |

|

| Acquisition-related

expense (benefit), net |

(544 |

) |

|

(153 |

) |

| Severance |

29 |

|

|

54 |

|

| Bad debt provision for

customer bankruptcy |

1,200 |

|

|

— |

|

| Foreign exchange (gain)

loss |

(23 |

) |

|

(282 |

) |

| Adjusted EBITDA |

$ |

13,254 |

|

|

$ |

15,000 |

|

| Mistras Group, Inc. and

Subsidiaries |

| Unaudited Reconciliation of |

| Net Income (GAAP) and Diluted EPS (GAAP) to Net

Income Excluding Bad Debt Provision for a Customer Bankruptcy

(non-GAAP) and Diluted |

| EPS Excluding Bad Debt Provision for a Customer

Bankruptcy (non-GAAP) |

| (in thousands) |

| |

| |

|

Three months ended March 31, 2017 |

| Net income (GAAP) |

|

$ |

1,692 |

|

| Bad debt provision for

a customer bankruptcy, net of tax |

|

770 |

|

| Net Income Excluding

Bad Debt Provision for a Customer Bankruptcy (non-GAAP) |

|

$ |

2,462 |

|

| |

|

|

| Diluted EPS (GAAP) |

|

$ |

0.06 |

|

| Bad debt provision for

a customer bankruptcy, net of tax |

|

0.02 |

|

| Diluted EPS Excluding

Bad Debt Provision for a Customer Bankruptcy (non-GAAP) |

|

$ |

0.08 |

|

Media Contact:

Nestor S. Makarigakis, Group Director of Marketing Communications,

marcom@mistrasgroup.com

1(609)716-4000

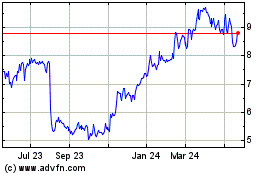

Mistras (NYSE:MG)

Historical Stock Chart

From Jun 2024 to Jul 2024

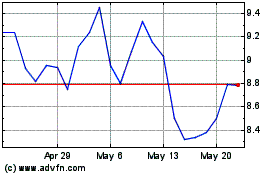

Mistras (NYSE:MG)

Historical Stock Chart

From Jul 2023 to Jul 2024