Koninklijke Phillips

Electronics N.V. (PHG) reported net income of €412 million

($560.8 million) in the fourth quarter of 2013, compared to a net

loss of €420 million in the prior-year quarter. The year-over-year

growth was primarily due to overall improvement in operating

results and lower restructuring and acquisition related charges. In

addition, project Accelerate has also been a driving factor for the

robust increase in

income.

Phillips reported third-quarter

earnings of €0.44 (60 cents) compared to loss of €0.46 on earnings

in the prior year quarter.

Quarterly

Details

Fourth-quarter sales on a

comparable basis grew 7% year over year to €6.8 billion ($9.3

billion). However, group nominal sales increased marginally by 1%

year over year due to 6% impact from unfavorable currency

translations.

Earnings before Interest, Tax and

Amortization (EBITA), excluding restructuring and

acquisition-related charges, pension settlement loss, and loss on

the sale of industrial assets at Lighting, were €884 million ($1.2

billion) or 13.0% of sales versus 11.3% in the prior-year quarter.

Increase in adjusted EBITA was also driven by lower acquisition and

restructuring-related charges.

Segment

Details

Healthcare sales

on comparable basisfor the quarter were up 4% year

over year driven by growth across all of its businesses. Customer

services grew in high-single digits, while Home Healthcare

solutions increased mid single-digit and Patient Care &

Clinical Informatics reported low-single digit growth. In addition,

Imaging systems also reported a low-single digit decline.

Comparable sales in growth

geographies increased in double digits year-on-year, with strong

growth in China and Latin America. This was partly offset by a

decline in Russia & Central Asia. In addition, Western Europe

recorded low single-digit growth; while other mature geographies

achieved mid single-digit growth but North America reported a 1%

decline.

Orders in the Healthcare equipment

on a comparable basis declined 1% year over year in the reported

quarter. However, excluding multi-year deals in the prior-year

quarter, equipment order intake increased by 1%. Orders in the

Patient Care & Clinical Informatics grew low single digits,

while Imaging Systems showed a low single digit decline as orders

grew in low single digits, fully offset by 7% decline in both

Patient care and Clinical Informatics orders.

The Consumer

Lifestyle segment posted strong revenue growth of 8% to

€1.4 billion ($1.9 billion) in the quarter on a comparable basis.

During the quarter, the segment reported double-digit growth in

Domestic Appliances while Health & Wellness reported high

single-digit growth. The Personal Care division also grew in mid

single-digits during the quarter.

On geographical basis, Consumer

Lifestyle reported a double-digit comparable sales increase in

growth geographies while reporting low single-digit growth in

mature geographies. Western Europe and North America also showed

low single-digit growth.

During the reported quarter, the

Lightning segment reported sales

increase of 8.0% year over year on comparable basis. Segment

revenues were driven by double-digit growth at Lumileds and

Automotive. In addition, Light sources, Electronics and

Professional Lightning Solutions achieved mid single-digit growth,

partially offset by Consumer Luminaires which reported low

single-digit decline. LED sales grew 48% year over year and now

represent 34% of the total lighting sales.

Revenues in the Innovation,

Group & Services segment surged 22.2% to €237 million

($322.6 million), primarily due to due to higher IP royalties

related to one-time patent settlements in our Blu-ray and TV

licensing programs.

Geographical

Growth

On a geographical basis, comparable

sales in the growth geographies increased 15% in the fourth

quarter. The increase was driven by strong growth in China, Latin

America, Africa, the Middle East and Turkey.

The company’s growth markets

exclude the U.S., Canada, Western Europe, Australia, New Zealand,

South Korea and Japan.

The above mentioned geographies are

classified as mature markets and revenues increased 2% year over

year. The marginal decline in the mature markets was primarily

attributable to strong performance of the healthcare and Consumer

Lifestyle sectors, offset by flat Lightning sales.

Project

Accelerate

Phillips introduced project

Accelerate to improve its overall performance and reduce costs for

the company. The project is expected to be operational till 2017

and has five streams to enhance customer relevance, change company

culture, reduce overhead costs, streamline the End2End customer

value chains, and reallocate resources to profitable growth

opportunities.

In addition, the company has also

introduced a €1.1 billion cost reduction program. In fiscal 2013,

the company has achieved €641 million ($851 million) in gross

savings and has been able to reduce about 74% of the targeted

employees in fiscal 2013. This program is expected to be complete

by 2014.

Cash, Balance Sheet and

Share Repurchase

Net cash flow from operating

activities declined to €905 million ($1.2 billion) compared with

€1.1 billion in the comparable prior-year quarter. The decrease was

attributable to debt redemption and expenses related to

discontinued operations.

Capital expenditures for the

quarter were €297 million ($404.3 million) versus €303 million in

the year-ago period, due to lower investments in the Lighting and

Consumer Lifestyle segments.

At the end of fourth-quarter 2013,

Philips had a net debt position of €1.4 billion ($1.9 billion),

compared to €0.7 billion at the end of the fourth quarter of 2012.

During the quarter, the net debt decreased by €596 million ($811.2

million), largely due to a free cash inflow of €608 million ($828

million).

Phillips currently holds a Zacks

Rank #5 (Strong Sell). Other stocks that are worth considering in

the electronics products and general industry sector are

Mistras group Inc. (MG) , GigOptix

Inc. (GIG) and Altra Industrial Motion

Corp. (AIMC). Mistras carries a Zacks Rank #1 (Strong Buy)

while GigOptix and Altra carry a Zacks Rank #2 (Buy).

ALTRA HOLDINGS (AIMC): Free Stock Analysis Report

GIGOPTIX INC (GIG): Free Stock Analysis Report

MISTRAS GROUP (MG): Free Stock Analysis Report

KONINKLIJKE PHL (PHG): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

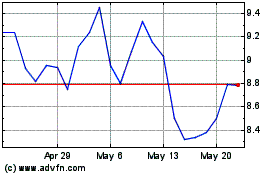

Mistras (NYSE:MG)

Historical Stock Chart

From Jun 2024 to Jul 2024

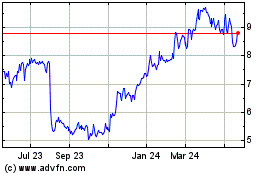

Mistras (NYSE:MG)

Historical Stock Chart

From Jul 2023 to Jul 2024