Siemens' Financing Solution for Tri-State - Analyst Blog

November 19 2013 - 6:08PM

Zacks

Siemens Financial Services (SFS), the financing arm of

industrial goods manufacturer Siemens AG (SI),

recently offered a customized financial package to medical imaging

company Tri-State Imaging Group to refinance its existing debt and

fund its expansion plans in Florida. In addition to strengthening

the business relationship with one of Siemens’ existing healthcare

clients, the transaction is mutually beneficial for both the

subsidiary and the parent company.

The Key Takeaways

In order to increase liquidity and boost the working capital

requirements, SFS provided Tri-State with a $50 million loan

payable in 5 years. Tri-State is likely to utilize a part of the

loan proceeds to refinance its existing debt to reduce its interest

burden. The remainder of the proceeds is likely to be used to

expand its presence in the outpatient diagnostic imaging services

market in Florida through the purchase of 16 new medical imaging

centers.

The transaction reinforces the long-standing business relationship

of Tri-State with Siemens. At the same time, it offers additional

revenue stream for Siemens through new orders for medical imaging

equipment and extension of equipment maintenance service contract

with Tri-State.

On the other side of the spectrum, the transaction augments SFS’

position as a leading financier in the healthcare sector. This

Siemens’ subsidiary provides structured finance and commercial

finance in the energy, healthcare and infrastructure sectors and

plays a key role in financing the supply chain of the industry by

leveraging its financial expertise and technical know-how.

Moving Forward

Siemens Healthcare is one of the rapidly growing segments of the

company with a healthy underlying profitability. The financing

solution package with Tri-State, one of the leading independent

providers of outpatient diagnostic radiology services in the

Delaware Valley, offers more and new opportunities for the segment

to augment its revenues.

Siemens continues to deliver innovative technological and financing

solutions for its customers. It aims to provide solutions that give

the maximum operational benefit to its clients. Siemens focuses on

key areas like information services, automation and controls,

medical equipment, power generation, transportation systems,

automotive electronics, lighting, and other similar areas. Given

its product breadth and geographic diversity, the company is a

major beneficiary of increased spending as developing nations build

up their infrastructure.

Siemens currently has a Zacks Rank #2 (Buy). Other players in the

industry worth reckoning include Garmin Ltd.

(GRMN), Control4 Corp. (CTRL) and Mistras

Group, Inc. (MG), each carrying a Zacks Rank #2 (Buy).

CONTROL4 CORP (CTRL): Free Stock Analysis Report

GARMIN LTD (GRMN): Free Stock Analysis Report

MISTRAS GROUP (MG): Free Stock Analysis Report

SIEMENS AG-ADR (SI): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

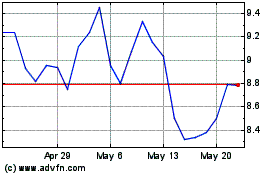

Mistras (NYSE:MG)

Historical Stock Chart

From Jun 2024 to Jul 2024

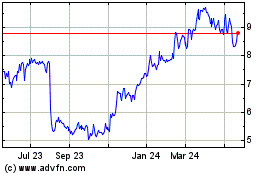

Mistras (NYSE:MG)

Historical Stock Chart

From Jul 2023 to Jul 2024