UPDATE:Energy Sector Issuance Galvanizes High-Yield Bond Market

September 08 2010 - 5:24PM

Dow Jones News

The energy sector produced a battery of high-yield debt

offerings Wednesday, with multiple new issues to raise cash to pay

down debt and fund mergers and acquisitions.

Linn Energy, LLC (LINE), Exco Resources Inc. (XCO), Chaparral

Energy, Mirant Corp. (MIR) and RRI Energy Inc. (RRI) all came to

market with note offerings. The deals come amid a wave of merger

and acquisition activity in the energy sector, as slumping energy

prices have led firms to consolidate in an effort to cut costs and

boost earnings.

"The energy sector has been a favored industry for the market

for much of the year, and it's a very capital-intensive industry so

there are a lot of funding needs there," said Ken Austin, senior

credit officer at Moody's Investors Service. "They're coming to

market now and taking the money at very attractive rates."

The deals brought the post-Labor Day wave of corporate bond

issuance to the high-yield market, one day after investment-grade

companies sold $15.5 billion in new bonds, the highest single-day

total since February. Investors have been flocking to corporate

debt at a time when stocks and Treasurys have offered paltry

returns.

Linn and its and its subsidiary Linn Energy Finance Corp. sold

$1 billion--increased from an initially announced $750 million--of

senior unsecured 10.5-year notes to yield 8% via joint bookrunners

Barclays, BNP Paribas, Citi, Credit Agricole, RBC, RBS and Wells

Fargo, according to a person familiar with the deal. The company

said it will use the majority of proceeds to reduce debt under its

revolving credit facility, with a portion of the proceeds used to

unwind certain interest rate derivative contracts.

The natural-gas independent, which has been expanding away from

its primary holdings in the Appalachian basin, on Tuesday said it

had signed three different agreements to buy oil and natural-gas

properties in Texas for a combined $352.2 million. The company said

it planned to fund the acquisitions through its credit line. In

July, Linn paid $95 million to buy properties in Texas, and in

March it said it would pay $330 million to acquire tracts in

Michigan as shale plays remain a hot sector.

Mirant and RRI, which are merging into a new company to be

called GenOn Energy, Inc., said they will commence syndication of a

new $500 million senior secured term loan along with a $1 billion

revolving credit facility. The company also announced a concurrent

senior unsecured bond offering, expected to weigh in around $1.4

billion.

The companies essentially have to come to market because they

have $1.8 billion of debt in need of refinancing due to change of

control provisions, which allow existing bondholders to force the

company to buy back bonds in the event of a merger, according to

Andrew DeVries, analyst with research firm Credit Sights.

"The key is, they are replacing secured subsidiary debt with

unsecured parent debt," DeVries said. "They also have several

months to get this done so the timing suggests they are taking

advantage of the very attractive interest rates being offered right

now from the massive inflows to bond funds, especially high yield

ones."

Exco Resources--an oil and natural gas exploration,

exploitation, development and production company headquartered in

Dallas, Texas with principal operations in East Texas, North

Louisiana, Appalachia and West Texas--is offering $750 million of

senior notes due 2018. A portion of net proceeds will go toward

redeeming all $444.7 million outstanding of Exco's 7.25% senior

notes due 2011, with the remainder to pay down outstanding bank

debt.

J.P. Morgan Securities LLC, Banc of America Securities LLC, BNP

Paribas Securities Corp., RBC Capital Markets Corporation and Wells

Fargo Securities, LLC are joint book-running managers for the bond

offering, which is expected to price later this week.

Chaparral Energy is in the market with $300 million in senior

unsecured 10-year notes via J.P. Morgan, with proceeds to pay down

existing debt. That deal is also expected to price later this week.

Chaparral is an independent oil and gas producer and operator

headquartered in Oklahoma City, Okla.

-By Michael Aneiro, Dow Jones Newswires; (212) 416-2203;

michael.aneiro@dowjones.com

(Tess Stynes also contributed to this article).

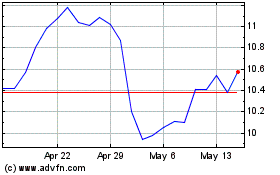

Mirion Technologies (NYSE:MIR)

Historical Stock Chart

From May 2024 to Jun 2024

Mirion Technologies (NYSE:MIR)

Historical Stock Chart

From Jun 2023 to Jun 2024