Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

June 18 2024 - 4:04PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13A-16 OR 15D-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

| For the month of |

June |

|

2024 |

| Commission File Number |

001-41722 |

|

|

METALS ACQUISITION LIMITED

| (Translation of registrant’s name into English) |

| |

|

3rd Floor, 44 Esplanade, St.

St. Helier, Jersey, JE49WG

Tel: +(817) 698-9901 |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form 20-F x

Form 40-F ¨

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

METALS ACQUISITION LIMITED |

| |

|

(Registrant) |

| |

|

|

| Date: |

June 18, 2024 |

|

By: |

/s/ Michael James McMullen |

| |

|

|

|

Name: |

Michael James McMullen |

| |

|

|

|

Title: |

Chief Executive Officer |

Exhibit 99.1

18 June 2024

Update on Long Term Incentive

Plan and Deferred Share Unit Plan

Metals Acquisition Limited ARBN 671 963 198 (NYSE:

MTAL; ASX: MAC), a private limited company incorporated under the laws of Jersey, Channel Islands (“MAC” or the “Company”)

refers to the Appendix 3H - Notification of cessation of securities and Appendix 3G - Notification of Issue, Conversion or Payment up

of Unquoted Equity Securities both released today.

Long Term Incentive Plan

The Company has established a long-term incentive

plan (LTI Plan) to:

| · | attract and retain the best available personnel

to ensure its success and accomplish the Company’s goals; |

| · | incentivise employees, Directors and independent

contractors with long-term equity-based compensation to align their interests with Shareholders; and |

| · | promote the success of the Company’s business. |

The LTI Plan permits, among other awards, the

grant of restricted shares units (RSUs) and performance based restricted share units (PSUs) to eligible employees, Directors

and consultants. The holder of RSUs and PSUs may request the Company to issue the cash equivalent of fully paid ordinary shares in the

capital of the Company (Shares) in part of full satisfaction of MAC’s obligation to deliver Shares on vesting of the RSUs

or PSUs.

Deferred Share Unit Plan

The Company has established the non-employee Directors

deferred share unit plan (DSU Plan) to:

| · | assist the Company in the recruitment and retention

of qualified persons to serve on the Board; and |

| · | through the proposed issuance of DSUs under the

DSU Plan, to promote better alignment of the interests of Directors and the long-term interests of Shareholders. |

The DSU Plan permits the grant to

non-employee Directors of a deferred shares units (DSU), being a unit credited to a participant by way of a bookkeeping, the

value of which is equivalent to one share. Awards under the DSU Plan may be subject to terms and conditions determined by the Board,

but generally are only redeemable for value (including shares) after a director ceases to hold office as a Director.

ASX Waivers

In connection with its listing on ASX the Company

was granted a number of waivers from the ASX Listing Rules in connection with the LTI Plan, DSU Plan and underlying RSUs, PSUs and DSUs.

These waivers require, among other things, that the Company make an announcement upon the satisfaction of any milestones, conversion or

expiry of any RSUs, PSUs and DSUs.

Current Vesting and Forfeitures

The Company now notifies shareholders that:

| · | 12,002 RSUs and 11,814 PSUs were cancelled for

no consideration on 14 June 2024 as the holders forfeited their entitlement to the applicable RSUs and PSUs as a result of ceasing employment

with the Company; |

| · | 166,860 vested RSUs will be settled by way of

a cash equivalent payment, on the basis of the Company’s five day volume weighted average share price on the NYSE to 14 June 2024

(being US$14.30); and |

| · | 17,284 DSU’s have been converted into Shares

on 14 June 2024, when the underlying Shares were issued to former director, Mr Rhett Bennett following his resignation as a Director on

3 April 2024. |

-ENDS-

This announcement is authorised for release by

Chris Rosario and Trevor Hart, Joint Company Secretaries.

Contacts

Mick McMullen

Chief Executive Officer

Metals Acquisition Limited.

investors@metalsacqcorp.com |

Morne Engelbrecht

Chief Financial Officer

Metals Acquisition Limited |

About Metals Acquisition Limited

Metals Acquisition Limited (NYSE: MTAL; ASX:MAC) is a company focused

on operating and acquiring metals and mining businesses in high quality, stable jurisdictions that are critical in the electrification

and decarbonization of the global economy.

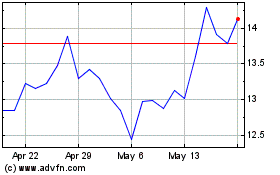

Metals Acquisition (NYSE:MTAL)

Historical Stock Chart

From May 2024 to Jun 2024

Metals Acquisition (NYSE:MTAL)

Historical Stock Chart

From Jun 2023 to Jun 2024