McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) today

reported its second quarter (Q2) results for the period ended June

30th, 2022.

- Fox Complex performed well,

producing 11,200 GEOs, the highest quarterly

production in over three years, at cash costs of

$985 per GEO and AISC of $1,290

per GEO.

- Average cash costs(2) per GEO sold

from our 100%-owned mines in Q2 was $1,169,

15% below our guidance midpoint of $1,380 per GEO.

Average all-in sustaining costs ("AISC")(2) per

GEO sold from our 100%-owned mines was $1,549,

11% below our guidance midpoint of $1,740 per

GEO.

- Production was

27,600 gold ounces and 704,600

silver ounces, or 36,100 gold equivalent ounces(1)

(GEOs)(see Table 1), compared to 40,700 GEOs

during Q2 2021.

- San José mine

delivered solid results producing 19,600 GEOs at

cash costs and AISC per GEO sold of $1,144 and

$1,468, respectively.

- Gold Bar mine

progressed the development of the Gold Bar South deposit, which is

expected to contribute to lower-cost production later this year and

through 2023.

- Our consolidated net loss in Q2 was

$12.4 million, or $0.26 per share

(giving effect to the 1-for-10 reverse share split on July 28th),

which relates primarily to $14.4 million

investment in our Los Azules copper project, $4.8

million in other exploration and advanced projects, and a

gross profit of $4.2 million from our

operations.

- Our 100%-owned mines generated a

cash gross profit(2) of $7.7 million in Q2 and a

gross profit of $4.2 million. Cash gross profit is

calculated by adding back depletion and depreciation to gross

profit.

- Cash and cash equivalents at June

30th, 2022, totaled $47.8 million.

- We are saddened to announce that

Dr. Donald R. M. Quick, a Director of the Company and its

predecessors since 2008, passed away in July following a brief

illness. Dr. Quick made important contributions to the boards of

McEwen Mining and Minera Andes during his 14 years with the

companies. Among his many qualities, he was a great friend and

colleague, and will be dearly missed.

- A webcast will be held on

Thursday, Aug 11th at

11:00 am EDT. Please see the details further below.

Operations Update

Fox Complex, Canada (100%

interest)

Fox produced 11,200 GEOs

in Q2 at total cash costs and AISC

of $985 and $1,290 per

GEO sold, respectively. This compares to 7,100 GEOs at total cash

costs and AISC of $917 and $1,088 per GEO sold,

respectively, in Q2 2021.

Fox achieved the highest quarterly production

since Q3 2018 of 11,200 GEOs, as the mine

rebounded from a slow start to 2022, resulting from mechanical

issues at the mill and a COVID-related labour shortage. Fox

production benefitted from the large stockpile accumulated during

Q1 and increased during Q2, and the effects of the ongoing mill

debottlenecking process. Mill throughput is expected to continue to

improve during the remainder of the year resulting in strong H2

production. Drilling below the mineral resources envelop at Froome

has been successful and is expected to extend the mine life.

In Q2, we incurred $2.6 million

for exploration. Our exploration spend at Fox for 2022 & 2023

is forecasted to be $10.0 million and

$15.0 million, respectively. During the remainder

of 2022, exploration will complete up to 39,000 m (128,000 ft)

of drilling and will focus on:

-

Continuing delineation and expansion of the Stock West deposit,

particularly toward the West;

- Expansion

of shallow mineralization identified near the Stock Mine;

- Test

areas of high grade from 2021 drilling at the Gibson and Whiskey

Jack targets at Grey Fox to potentially expand the resource;

- Follow up

on deeper priority targets at the Stock property, where attractive

results from initial drilling show significant potential.

The objective of all our work is to continue to

improve upon the Preliminary Economic Assessment (PEA) for the Fox

Complex (see news release dated January 26, 2022). The PEA presents

estimates for a positive business case for the Fox Complex

expansion project, with potential average gold production of 80,800

gold ounces per year over nine (9) years, after the depletion of

Froome. The economic analysis estimates an after-tax IRR of 21% at

a gold price of $1,650 per ounce and average cash costs and AISC

per ounce of gold sold of $769 and $1,246, respectively. Ongoing

exploration is designed to reduce the funding requirements and

improve the payback period by delineating additional resources in

strategic locations to facilitate a greater degree of internal

funding.

Recent encouraging drill results at the Stock

Property that may support improvement to the PEA include:

|

• 5.47 g/t Au over 7.7

m true width (TW) |

(Hole SM22-070) |

| • 6.62

g/t Au over 8.3 m TW |

(Hole SM22-090) |

| • 5.62

g/t Au over 11.4 m

TW |

(Hole SM22-089) |

Holes SM22-070 and SM22-090 intercepted shallower footwall green

carbonate mineralization between 250 m to 300 m (800 to 1,000 ft)

below the surface. Hole SM22-089 intersected mineralization 457 m

(1,500 ft) below surface in the separate footwall grey carbonate

host unit.

Gold Bar Mine, USA (100%

interest)

Gold Bar produced 5,100

GEOs in Q2 at total cash costs and AISC

of $1,562 and $2,108 per

GEO sold, respectively. This compares to 14,100 GEOs at total cash

costs and AISC of $1,463 and $1,619 per GEO

sold, respectively, in Q2 2021.

Gold production continued to be below

expectations due to the presence of carbonaceous material that is

being treated as waste and lower contract mining rates resulting

from a staffing shortage. During the quarter, 505,000 tonnes of

mineralized material was mined but only 171,000 tonnes was

processed, compared to 646,000 tonnes mined and 727,000 tonnes

processed during the same period of 2021. However, heap leach

recovery rates are outperforming our model, resulting in a

potential increase in the leach pad inventory and assumed gold

recovery. Drilling conducted at the Central Zone of the Pick

deposit, designed to evaluate the presence of carbonaceous

material, has encountered significantly less carbon; further

metallurgical testing is underway.

On April 1st, 2022, we received regulatory

approval to amend the plan of operations to include the Gold Bar

South (GBS) deposit. We are planning to start construction of the

access road in Q3, and GBS is expected to contribute to production

in Q4. GBS has positive attributes compared to the current mining

areas, such as a much lower waste tripping ratio, oxide

mineralization with no carbonaceous material, and a higher average

gold grade partially offset by lower heap leach recovery. Most of

the ore mined in 2023 is expected to be sourced from GBS.

In Q2, we spent $1.2 million

for exploration and conducted some 3,660 m (12,000 ft) of drilling,

with a focus on drilling around the Pick and Atlas pits. At Pick,

drilling targeted in-fill of the Phase 2 pit to improve the

confidence in non-carbonaceous oxide mineralization. In addition,

drilling targeted extensions of mineralization at the North pit

wall along the controlling faults. At Atlas, drilling included a

sonic program to evaluate mineral potential within the historic

Atlas waste dump and targeted three attractive areas around the

historic open pit.

San José Mine, Argentina (49%

interest)

San José attributable production for Q2 was

11,100 gold ounces and 704,600

silver ounces, for a total of 19,600 GEOs. Total

cash costs and AISC for the quarter were $1,144

and $1,468 per GEO sold, respectively. This

compares to 18,200 GEOs at total cash costs and AISC

of $1,105 and $1,500 per GEO sold,

respectively, in Q2 2021.

San José production recovered from

COVID-19-related issues experienced in Q1. Despite the slow start

to the year, the San José mine is expected to meet production

guidance of 69,500 to 77,500 GEOs (49%).

In Q2, 3,600 m (11,800 ft) of exploration

drilling were completed around the mine area (Agostina and Ayelen

SE veins), and 700 m (2,300 ft) were completed at the Ciclon

project. Drilling highlights include 7.5 g/t gold

and 84 g/t silver over 4.1 m

(hole SJD-2468) and 6.9 g/t gold and 648

g/t silver over 1.5 m (hole SJM-594). An

additional 2,000 m (6,600 ft) of exploration drilling is planned in

Q3.

McEwen Copper (76%

interest)

The Los Azules project, located in San Juan,

Argentina, is one of the world's largest undeveloped open-pit

copper porphyry deposits. Surface drilling at Los Azules concluded

in late May, with some 13,500 m (44,300 ft) completed to date in

2022. Three primary objectives of the program include:

- Improve confidence in the resource

by converting Inferred mineral resources to the Indicated

category;

- Accelerate project advancement with

metallurgical, hydrological and geotechnical drilling and

- Test the limits of the depth

extension of the higher-grade mineralization.

Results from this drilling program will be used

to update the 2017 Preliminary Economic Assessment (PEA). In the

PEA, estimated Indicated and Inferred mineral resources were 10.2

and 19.3 billion lbs. of copper, respectively. Extensive enterprise

optimization work is underway on potential larger scale, lower cost

and lower carbon footprint alternatives. The updated study is

planned to be released in Q1 2023.

Future drilling will evaluate the potential to

expand the deposit at depth. While the median depth of drill

holes within the Los Azules resource database is 175 m (575 ft), it

is not uncommon for porphyry copper mineralization to extend well

beyond 1,000 m (3,280 ft) of depth. Numerous drill holes at Los

Azules have encountered strong copper grades below the 2017 PEA pit

bottom, with all three holes drilled to a depth of over one

kilometer ending in copper mineralization.

McEwen Copper spent $14.4

million in Q2 to advance the Los Azules project. On June

21st, 2022, McEwen Copper announced the closing of the second

tranche of a private placement offering comprised of a $10 million

investment by the Victor Smorgon Group advised by Arete Capital

Partners, both of Australia, and $5 million from other investors,

for total gross proceeds of $15.0 million. The amount raised in the

first and second tranches of the private placement now stands at

$55.0 million.

McEwen Copper has built an experienced

management team in Argentina to advance to a feasibility level of

technical study after completion of the updated preliminary

economic assessment. Planning is underway for the next drilling

season that will start in Q4 2022.

NYSE Listing

On July 28th a 1-for-10 reverse split of the

Company’s common stock became effective on the NYSE and TSX

exchanges. As a result, the Company has regained compliance with

the NYSE’s continued listing standards.

Table 1 below provides

production and cost results for Q2 & H1 2022 with comparative

results for Q2 & H1 2021 and our guidance range for 2022.

|

|

Q2 |

H1 |

Full Year 2022Guidance Range |

|

2022 |

2021 |

2022 |

2021 |

|

Consolidated Production |

|

|

|

|

|

|

Gold (oz) |

27,600 |

31,700 |

48,450 |

55,000 |

118,000-133,000 |

|

Silver (oz) |

704,600 |

611,700 |

1,039,500 |

1,104,900 |

2,520,000-2,800,000 |

|

GEOs(1) |

36,100 |

40,700 |

61,200 |

71,300 |

153,000-172,000 |

|

Gold Bar Mine, Nevada |

|

|

|

|

|

|

GEOs(1) |

5,100 |

14,100 |

11,400 |

21,500 |

38,000-44,000 |

|

Cash Costs ($/GEO)(1) |

1,562 |

1,463 |

1,951 |

1,598 |

|

|

AISC ($/GEO)(1) |

2,108 |

1,619 |

2,377 |

1,725 |

|

|

Fox Complex, Canada |

|

|

|

|

|

|

GEOs(1) |

11,200 |

7,100 |

18,900 |

12,300 |

44,000-49,000 |

|

Cash Costs ($/GEO)(1) |

985 |

917 |

1,066 |

1,066 |

|

|

AISC ($/GEO)(1) |

1,290 |

1,088 |

1,460 |

1,282 |

|

|

San José Mine, Argentina (49%) |

|

|

|

|

|

|

Gold production (oz)(3) |

11,100 |

9,300 |

17,550 |

18,800 |

34,500-38,500 |

|

Silver production (oz)(3) |

704,600 |

607,000 |

1,039,500 |

1,099,600 |

2,520,000-2,800,000 |

|

GEOs(1)(3) |

19,600 |

18,200 |

30,300 |

34,800 |

69,500-77,500 |

|

Cash Costs ($/GEO)(1) |

1,144 |

1,105 |

1,351 |

1,097 |

|

|

AISC ($/GEO)(1) |

1,468 |

1,500 |

1,737 |

1,418 |

|

Our El Gallo project produced 200 GEOs in Q2

2022, 600 GEOs in H1 2022, 1,300 GEOs in Q2 2021, and 2,500 GEOs in

H1 2021. Residual heap leaching ceased in July 2022.

Notes:

- 'Gold Equivalent Ounces' are

calculated based on a gold to silver price ratio of 83:1 for Q2

2022, 78:1 for Q1 2022 and 68:1 for Q1 & Q2 2021. 2022

production guidance is calculated based on 72:1 gold to silver

price ratio.

- Cash gross profit, cash costs per

ounce sold, all-in sustaining costs (AISC) per ounce sold are

non-GAAP financial performance measures with no standardized

definition under U.S. GAAP. For definition of the non-GAAP

measures see "Non-GAAP Financial Measures" section in

this press release; for the reconciliation of the non-GAAP measures

to the closest U.S. GAAP measures, see the Management Discussion

and Analysis for the year ended December 31, 2021 (as amended)

filed on Edgar and SEDAR.

- Represents the portion attributable

to us from our 49% interest in the San José Mine.

For the SEC Form 10-Q Financial Statements and MD&A refer

to:

http://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0000314203

Conference Call and Webcast

Management will discuss our Q2 financial results

and project developments and follow with a question-and-answer

session. Questions can be asked directly by participants over the

phone during the webcast.

|

Thursday August

11th, 2022 at 11:00 am

EDT |

Webcast URL: |

https://events.q4inc.com/attendee/976450200 |

|

Call into the conference over the phone: |

Please register here:https://conferencingportals.com/event/ZSafhHZi

Participants who cannot access the internet can dial-in using the

numbers below:Participant Toll-Free Dial-In Number: 1 (888)

330-2398Participant Toll Dial-In Number: 1 (240) 789-2709

Conference ID: 67121 |

The webcast will be archived on McEwen Mining's website at

https://www.mcewenmining.com/media following the call.

Technical InformationThe

technical content of this news release related to financial

results, mining and development projects has been reviewed and

approved by William (Bill) Shaver, P.Eng., COO of McEwen Mining and

a Qualified Person as defined by SEC S-K 1300 and the Canadian

Securities Administrators National Instrument 43-101 "Standards of

Disclosure for Mineral Projects."

The technical content of this news release

related to geology, exploration and drilling results has been

reviewed and approved by Stephen McGibbon, P.Geo, SVP Exploration

of McEwen Mining and a Qualified Person as defined by NI

43-101.

|

Hole ID |

Azimuth |

Dip |

Length (m) |

UTM North (m) |

UTM East (m) |

Elevation (m) |

|

SM22-070 |

316̊ |

-61̊ |

363 |

5377411 |

517959 |

267 |

|

SM22-089 |

337̊ |

-55̊ |

651 |

5377204 |

528073 |

272 |

|

SM22-090 |

272̊ |

-50̊ |

384 |

5377515 |

518063 |

267 |

Reliability of Information Regarding San

JoséMinera Santa Cruz S.A., the owner of the San José

Mine, is responsible for and has supplied to the Company all

reported results from the San José Mine. McEwen Mining's joint

venture partner, a subsidiary of Hochschild Mining plc, and its

affiliates other than MSC do not accept responsibility for the use

of project data or the adequacy or accuracy of this release.

CAUTIONARY NOTE REGARDING NON-GAAP

MEASURES

In this release, we have provided information

prepared or calculated according to United States Generally

Accepted Accounting Principles ("U.S. GAAP"), as well as provided

some non-U.S. GAAP ("non-GAAP") performance measures. Because the

non-GAAP performance measures do not have any standardized meaning

prescribed by U.S. GAAP, they may not be comparable to similar

measures presented by other companies.

Cash Costs and All-in Sustaining CostsCash costs

consist of mining, processing, on-site general and administrative

costs, community and permitting costs related to current

operations, royalty costs, refining and treatment charges (for both

doré and concentrate products), sales costs, export taxes and

operational stripping costs, and exclude depreciation and

amortization. All-in sustaining costs consist of cash costs (as

described above), plus accretion of retirement obligations and

amortization of the asset retirement costs related to operating

sites, sustaining exploration and development costs, sustaining

capital expenditures, and sustaining lease payments. Both cash

costs and all-in sustaining costs are divided by the gold

equivalent ounces sold to determine cash costs and all-in

sustaining costs on a per ounce basis. We use and report these

measures to provide additional information regarding operational

efficiencies on an individual mine basis, and believe that these

measures provide investors and analysts with useful information

about our underlying costs of operations. A reconciliation to

production costs applicable to sales, the nearest U.S. GAAP measure

is provided in McEwen Mining's Form 10-Q for the period ended June

30th, 2022.

Cash Gross ProfitCash gross profit is a non-GAAP

financial measure and does not have any standardized meaning. We

use cash gross profit to evaluate our operating performance and

ability to generate cash flow; we disclose cash gross profit as we

believe this measure provides valuable assistance to investors and

analysts in evaluating our ability to finance our ongoing business

and capital activities. The most directly comparable measure

prepared in accordance with GAAP is gross profit. Cash gross profit

is calculated by adding depletion and depreciation to gross profit.

A reconciliation to gross profit, the nearest U.S. GAAP measure is

provided in McEwen Mining's Form 10-Q for the period ended June

30th, 2022.

CAUTION CONCERNING FORWARD-LOOKING

STATEMENTS

This news release contains certain

forward-looking statements and information, including

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. The forward-looking

statements and information expressed, as at the date of this news

release, McEwen Mining Inc.'s (the "Company") estimates, forecasts,

projections, expectations or beliefs as to future events and

results. Forward-looking statements and information are necessarily

based upon a number of estimates and assumptions that, while

considered reasonable by management, are inherently subject to

significant business, economic and competitive uncertainties, risks

and contingencies, and there can be no assurance that such

statements and information will prove to be accurate. Therefore,

actual results and future events could differ materially from those

anticipated in such statements and information. Risks and

uncertainties that could cause results or future events to differ

materially from current expectations expressed or implied by the

forward-looking statements and information include, but are not

limited to, effects of the COVID-19 pandemic, fluctuations in the

market price of precious metals, mining industry risks, political,

economic, social and security risks associated with foreign

operations, the ability of the corporation to receive or receive in

a timely manner permits or other approvals required in connection

with operations, risks associated with the construction of mining

operations and commencement of production and the projected costs

thereof, risks related to litigation, the state of the capital

markets, environmental risks and hazards, uncertainty as to

calculation of mineral resources and reserves, and other risks.

Readers should not place undue reliance on forward-looking

statements or information included herein, which speak only as of

the date hereof. The Company undertakes no obligation to

reissue

or update forward-looking statements or

information as a result of new information or events after the date

hereof except as may be required by law. See McEwen Mining's Annual

Report on Form 10-K/A for the fiscal year ended December 31, 2021

and other filings with the Securities and Exchange Commission,

under the caption "Risk Factors", for additional information on

risks, uncertainties and other factors relating to the

forward-looking statements and information regarding the Company.

All forward-looking statements and information made in this news

release are qualified by this cautionary statement.

The NYSE and TSX have not reviewed and do not

accept responsibility for the adequacy or accuracy of the contents

of this news release, which has been prepared by management of

McEwen Mining Inc.

ABOUT MCEWEN MINING

McEwen Mining is a diversified gold and silver

producer and explorer focused in the Americas with operating mines

in Nevada, Canada, Mexico and Argentina. It also has a large

exposure to copper through its subsidiary McEwen Copper, owner of

the Los Azules copper deposit in Argentina.

|

CONTACT INFORMATION: |

|

Investor Relations:(866)-441-0690 Toll

Free(647)-258-0395Mihaela Iancu ext.

320info@mcewenmining.comJoin our email list for

updates:https://www.mcewenmining.com/contact-us/ |

Website:

www.mcewenmining.comFacebook:

facebook.com/mcewenminingFacebook:

facebook.com/mcewenrobTwitter:

twitter.com/mcewenminingTwitter:

twitter.com/robmcewenmuxInstagram:

instagram.com/mcewenmining |

150 King Street WestSuite 2800, P.O. Box 24Toronto, ON,

Canada M5H 1J9 |

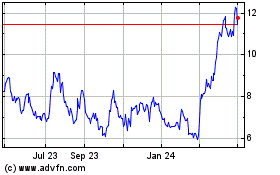

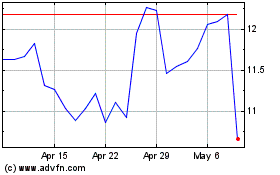

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Aug 2024 to Sep 2024

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Sep 2023 to Sep 2024