Mativ Holdings, Inc. ("Mativ" or the "Company") (NYSE: MATV)

reported earnings results for the three months ended September 30,

2024. On November 30, 2023, Mativ Holdings, Inc. (“Mativ” or the

“Company”) completed the sale of its Engineered Papers business.

Financial results for continuing operations exclude Engineered

Papers in all periods.

Adjusted measures are reconciled to GAAP at the end of this

release. Financial comparisons are versus the prior year period

unless stated otherwise. Figures may not sum to total due to

rounding. "Comparable" non-GAAP measures used to compare current

period Mativ results reflect prior period results revised to align

with our new segment reporting structure. The Company previously

also filed a separate Form 8-K on May 8, 2024, which includes

comparable financial statements for all fiscal quarters of 2023

revised to align with the new segment reporting structure.

Mativ Third Quarter 2024 Highlights

(Continuing Operations)

- Sales of $498.5 million increased 0.1% year over year, and 1.4%

on an organic basis

- GAAP loss was $20.8 million in Q3 2024, an improvement of

$443.5 million compared to $464.3 million in the prior year (which

included a $401.0 million goodwill impairment charge), GAAP EPS was

$(0.38); both included organizational realignment, impairment,

divestiture and purchase accounting expenses

- Adjusted income was $11.0 million, Adjusted EPS was $0.21, and

Adjusted EBITDA was $60.8 million (see non-GAAP

reconciliations)

- Adjusted EBITDA was up 10% versus the prior year, primarily

driven by improved manufacturing performance, lower SG&A and

distribution expenses, partially offset by lower volumes in

advanced films, and less favorable mix

- GAAP operating profit margin improved materially compared to

the prior year (which included a $401.0 million goodwill impairment

charge) and adjusted EBITDA margin increased 110 basis points

Management Commentary

Chief Executive Officer Julie Schertell commented, "We saw

meaningful increases in volume and profitability in Filtration and

our overall SAS segment during the third quarter, with SAS segment

adjusted EBITDA increasing almost 20% year over year. This was

somewhat offset by results in Advanced Films, which were impacted

by automotive and construction end markets. As such, we have

launched a turnaround effort specific to Advanced Films focused on

demand generation, operational performance and increased customer

and end market diversification. This turnaround effort will be

similar to the approach we used for Healthcare throughout 2023,

which year-to-date, resulted in above-market sales growth of more

than 5% and materially improved profitability versus the same

period in 2023.

Given the prevailing macro-economic conditions and the slow pace

of demand recovery, we continue to prioritize those things that we

can control and execute on actions to mitigate external market

factors, such as the $20 million reduction in non-operating cost

announced earlier this year. Additionally, we are increasing

capacity in our growth categories of filtration, specialty tapes,

release liners and medical films, while at the same time reducing

cost and optimizing our supply chain by reducing our plant

footprint from 48 sites at the time of the merger to 35 sites today

and our warehousing footprint by more than 25%. These actions

reduce cost and complexity, and support sustained margin

improvements as demand returns.”

Mativ Third Quarter 2024 Financial

Results (Continuing Operations)

Note: The Financial Results below reflect consolidated Mativ

results presented in our revised segment reporting structure in the

current and prior year period. See the supplemental tables titled

Business Segment Reporting From Continuing Operations for

additional information regarding the revised segment reporting

structure.

Filtration & Advanced Materials

(FAM)

Three Months Ended September

30,

(in millions; unaudited)

2024

2023

Change

2024

2023

Net Sales

$

189.6

$

195.8

$

(6.2

)

GAAP Operating Profit & Margin %

$

19.9

$

22.6

$

(2.7

)

10.5

%

11.5

%

Adjusted EBITDA & Margin %

$

36.5

$

39.2

$

(2.7

)

19.3

%

20.0

%

Filtration & Advanced Materials (FAM) segment sales,

comprised primarily of filtration media and components, advanced

films, coating and converting solutions, and extruded mesh

products, were $189.6 million, down 3.2% versus the prior year

period, as higher volumes in filtration & netting were more

than offset by lower volumes in advanced films along with lower

selling prices.

GAAP Operating Profit in 2024 included $0.8 million of

restructuring and impairment expenses primarily related to

organizational realignment and footprint rationalization. Adjusted

EBITDA (see non-GAAP reconciliations) decreased 7% versus prior

year as higher volumes in filtration & netting, lower selling

and general expenses, and improved manufacturing efficiencies were

more than offset by lower volumes in advanced films, and lower

selling prices.

Sustainable & Adhesive Solutions

(SAS)

Three Months Ended September

30,

(in millions; unaudited)

2024

2023

Change

2024

2023

Net Sales

$

308.9

$

302.4

$

6.5

GAAP Operating Profit & Margin %

$

10.3

$

(405.8

)

$

416.1

3.3

%

(134.2

)%

Adjusted EBITDA & Margin %

$

41.0

$

34.2

$

6.8

13.3

%

11.3

%

Sustainable & Adhesive Solutions (SAS) segment sales,

comprised primarily of tapes, labels, liners, specialty paper,

packaging and healthcare solutions, of $308.9 million were up 2.1%,

and 4.4% on an organic basis, versus the prior year period, as

higher volumes across all end-markets and higher selling prices

were partially offset by sales associated with closed and divested

plants.

GAAP Operating Profit in 2024 included $10.5 million in

restructuring, restructuring related, and impairment expenses

primarily related to organizational realignment and footprint

rationalization and included $401 million in goodwill impairment in

2023. Adjusted EBITDA (see non-GAAP reconciliations) increased $6.8

million (or almost 20%) compared to the prior year period, driven

by favorable manufacturing and distribution costs, favorable

relative net selling price versus input cost performance, and

higher volumes were partially offset by unfavorable mix and higher

SG&A expenses. Adjusted EBITDA margin of 13.3% increased 200

basis points versus the prior year.

Unallocated

Three Months Ended September

30,

(in millions; unaudited)

2024

2023

Change

2024

2023

GAAP Operating Expense & % of

Sales

$

(23.2

)

$

(36.7

)

$

13.5

(4.7

)%

(7.4

)%

Adjusted EBITDA & % of Sales

$

(16.7

)

$

(18.0

)

$

1.3

(3.4

)%

(3.6

)%

Adjusted unallocated expenses (EBITDA) (see non-GAAP

reconciliations) were in line with prior year. GAAP operating

expenses in 2024 included $1.5 million in organizational

realignment and integration costs, and $0.4 million of EP

divestiture expenses.

Interest expense was $18.3 million versus $16.8

million in the prior year period. The increase was primarily due to

higher average interest rates and higher average balances on the

floating portion of our outstanding debt in 2024.

Other expense, net was $12.7 million increased $12.4

million compared with the prior year $0.3 million primarily driven

by foreign currency losses and other asset related charges.

Tax rate was 13.3% for the three months ended September

30, 2024. The lower tax rate was driven by impact of one-time tax

adjustments. Excluding the impact of these one-time tax

adjustments, the Company's tax rate was 21.1%.

Non-GAAP Adjustments reflect items included in GAAP

operating profit, income, and EPS, but excluded from adjusted

results (see non-GAAP reconciliation tables for additional

details). The most significant adjustments to the third quarter

2024 results were as follows:

- $0.22 per share of purchase accounting expenses (purchase

accounting expenses reflect primarily ongoing non-cash intangible

asset amortizations associated with mergers and acquisitions)

- $0.20 per share of restructuring, restructuring related,

impairment, and other expenses

Cash Flow & Debt

Year-to-date 2024 cash provided by operating activities was

$70.7 million. Capital spending and software costs totaled $35.6

million. Working capital was a $0.8 million source of cash due to

an increase in accounts payable and other current liabilities,

partially offset by an increase in accounts receivable and an

increase in inventories.

Total debt was $1,143.4 million as of September 30, 2024 and

total cash was $162.2 million resulting in net debt of $981.2

million. Total liquidity was approximately $463 million, consisting

of $162 million of cash and $301 million of revolver availability.

The Company's debt matures on a staggered basis between 2027 and

2029. The Company redeemed the 2026 senior unsecured notes on

October 7, 2024 and issued $400 million senior unsecured notes due

October 1, 2029.

Dividend & Share

Repurchases

On November 6, 2024 the Company announced its next quarterly

cash dividend of $0.10 per share payable on December 20, 2024 to

stockholders of record as of November 29, 2024.

During the third quarter, the company did not repurchase shares.

The Company intends to repurchase shares periodically and

opportunistically to offset dilution due to stock compensation.

Conference Call

Mativ will hold a conference call to review third quarter 2024

results with investors and analysts at 8:30 a.m. Eastern time on

Thursday, November 7, 2024. The earnings conference call will be

simultaneously broadcast over the Internet at http://ir.mativ.com.

To listen to the call, please go to the Company’s website at least

15 minutes prior to the call to register and to download and

install any necessary audio software. For those unable to listen to

the live broadcast, a replay will be available on the Company’s

website shortly after the call.

About Mativ

Mativ Holdings, Inc. is a global leader in specialty materials,

solving our customers’ most complex challenges by engineering bold,

innovative solutions that connect, protect and purify our world.

Headquartered in Alpharetta, Georgia, we manufacture on three

continents and generate sales in over 100 countries through our

family of business-to-business and consumer product brands. The

company’s two operating segments, Filtration & Advanced

Materials and Sustainable & Adhesive Solutions, target premium

applications across diversified and growing categories. Our broad

portfolio of technologies combines polymers, fibers and resins to

optimize the performance of our customers’ products across multiple

stages of the value chain. Our leading positions are a testament to

our best-in-class global manufacturing, supply chain and materials

science capabilities. We drive innovation and enhance performance,

finding potential in the impossible.

Forward-Looking

Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995

(the "Act") that are subject to the safe harbor created by that Act

and other legal protections. Forward-looking statements include,

without limitation, those regarding EPS and other financial

guidance, acquisition integration and performance, growth

prospects, future end-market trends, future macro-economic trends,

the future effects of supply chain challenges and price increases,

future cash flows, net leverage, purchase accounting impacts,

effective tax rates, planned investments, profitability, and cash

flow, the expected benefits of the Neenah merger and integration,

whether the strategic benefits and accretion of the sale of the

Company's Engineered Papers business can be achieved, the expected

benefits, of our organizational restructuring, our ability to

execute our growth strategy for 2024, and integration and other

statements generally identified by words such as "believe,"

"expect," "intend," "guidance," "plan," "forecast," "potential,"

"anticipate," "confident," "project," "appear," "future," "should,"

"likely," "could," "may," "will," "typically," and similar words.

In addition, the amount of the goodwill impairment charge

previously announced is based in part on estimates of future

performance, so this announcement should also be considered a

forward-looking statement.

These forward-looking statements are prospective in nature and

not based on historical facts, but rather on current expectations

and on numerous assumptions regarding the business strategies and

the environment in which Mativ will operate in the future and are

subject to risks and uncertainties that could cause actual results

to differ materially from those expressed or implied by those

statements. No assurance can be given that such expectations will

prove to have been correct and persons reading this presentation

are therefore cautioned not to place undue reliance on these

forward-looking statements which speak only as at the date of this

press release. These statements are not guarantees of future

performance and involve certain risks and uncertainties, and

assumptions that may cause actual results to differ materially from

our expectations as of the date of this release. These risks

include, among other things, the following factors:

- Risks associated with the implementation of our strategic

growth initiatives, including diversification, and the Company's

understanding of, and entry into, new industries and

technologies;

- Risks associated with acquisitions, dispositions, strategic

transactions and global asset realignment initiatives of Mativ,

including the recent EP divestiture;

- Adverse changes in our end-market sectors impacting key

customers;

- Changes in the source and intensity of competition in our

commercial end-markets;

- Adverse changes in sales or production volumes, pricing and/or

manufacturing costs;

- Seasonal or cyclical market and industry fluctuations which may

result in reduced net sales and operating profits during certain

periods;

- Risks associated with our technological advantages in our

intellectual property and the likelihood that our current

technological advantages are unable to continue indefinitely;

- Supply chain disruptions, including the failure of one or more

material suppliers, including energy, resin, fiber, and chemical

suppliers, to supply materials as needed to maintain our product

plans and cost structure;

- Increases in operating costs due to inflation and continuing

increases in the inflation rate or otherwise, such as labor

expense, compensation and benefits costs;

- Our ability to attract and retain key personnel, labor

shortages, labor strikes, stoppages or other disruptions;

- Changes in general economic, financial and credit conditions in

the U.S., Europe, China and elsewhere, including the impact thereof

on currency exchange rates (including any weakening of the Euro)

and on interest rates;

- A failure in our risk management and/or currency or interest

rate swaps and hedging programs, including the failures of any

insurance company or counterparty;

- Changes in the manner in which we finance our debt and future

capital needs, including potential acquisitions;

- Changes in tax rates, the adoption of new U.S. or international

tax legislation or exposure to additional tax liabilities;

- Uncertainty as to the long-term value of the common stock of

Mativ;

- Changes in employment, wage and hour laws and regulations in

the U.S. and elsewhere, including the unionization rules and

regulations by the National Labor Relations Board, equal pay

initiatives, additional anti-discrimination rules or tests and

different interpretations of exemptions from overtime laws;

- The impact of tariffs, and the imposition of any future

additional tariffs and other trade barriers, and the effects of

retaliatory trade measures;

- Existing and future governmental regulation and the enforcement

thereof that may materially restrict or adversely affect how we

conduct business and our financial results;

- Weather conditions, including potential impacts, if any, from

climate change, known and unknown, and natural disasters or unusual

weather events;

- International conflicts and disputes, such as the ongoing

conflict between Russia and Ukraine, the war between Israel and

Hamas and the broader regional conflict in the Middle East, which

restrict our ability to supply products into affected regions, due

to the corresponding effects on demand, the application of

international sanctions, or practical consequences on

transportation, banking transactions, and other commercial

activities in troubled regions;

- Compliance with the FCPA and other anti-corruption laws or

trade control laws, as well as other laws governing our

operations;

- Risks associated with pandemics and other public health

emergencies, including the COVID-19 pandemic and its variant

strains;

- The number, type, outcomes (by judgment or settlement) and

costs of legal, tax, regulatory or administrative proceedings,

litigation and/or amnesty programs;

- Increased scrutiny from stakeholders related to environmental,

social and governance (“ESG”) matters, as well as our ability to

achieve our broader ESG goals and objectives;

- Costs and timing of implementation of any upgrades or changes

to our information technology systems;

- Failure by us to comply with any privacy or data security laws

or to protect against theft of customer, employee and corporate

sensitive information;

- The impact of cybersecurity risks related to breaches of

security pertaining to sensitive Company, customer or vendor

information, as well as breaches in the technology that manages

operations and other business processes; and

- Other factors described elsewhere in this document and from

time to time in documents that we file with the U.S. Securities and

Exchange Commission (the “SEC”).

All forward-looking statements made in this document are

qualified by these cautionary statements. Forward-looking

statements herein are made only as of the date of this document,

and Mativ undertakes no obligation, other than as may be required

by law, to update or revise any forward-looking or cautionary

statements to reflect changes in assumptions, the occurrence of

events, unanticipated or otherwise, or changes in future operating

results over time or otherwise. For a more detailed discussion of

these factors, also see the information under the captions “Risk

Factors” and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” in Mativ's most recent annual

report on Form 10-K for the year ended December 31, 2023 and any

material updates to these factors contained in any of Mativ’s

future filings with the SEC. The discussion of these risks is

specifically incorporated by reference into this release. The

financial results reported in this release are unaudited.

Comparisons of results for current and any prior periods are not

intended to express any future trends or indications of future

performance unless expressed as such and should only be viewed as

historical data. The financial results reported in this release are

unaudited.

Non-GAAP Financial

Measures

Certain financial measures and comments contained in this press

release exclude restructuring and impairment expenses, certain

purchase accounting adjustments related to prior acquisitions,

organizational realignment and integration costs, divestiture

costs, interest expense, stock compensation expense, inventory

step-up expense, the effect of income tax provisions and other tax

impacts, capital spending, capitalized software costs, cloud-based

software costs and depreciation and amortization. This press

release also provides certain information regarding the Company's

financial results excluding currency impacts. This information

estimates the impact of changes in foreign currency rates on the

translation of the Company's current financial results as compared

to the applicable comparable period and is derived by translating

the current local currency results into U.S. Dollars based upon the

foreign currency exchange rates for the applicable comparable

period. Financial measures which exclude or include these items

have not been determined in accordance with accounting principles

generally accepted in the United States (GAAP) and are therefore

"non-GAAP" financial measures. Reconciliations of these non-GAAP

financial measures to the most closely analogous measure determined

in accordance with GAAP are included in the financial schedules

attached to this release.

The Company believes that the presentation of non-GAAP financial

measures in addition to the related GAAP measures provides

investors with greater transparency on the information used by the

Company’s management in its financial and operational

decision-making. Management also believes that the non-GAAP

financial measures provide additional insight for analysts and

investors in evaluating the Company’s financial and operational

performance in the same way that management evaluates the Company's

financial performance. Management believes that providing this

information enables investors to better understand the Company’s

operating performance and financial condition. These non-GAAP

financial measures are not calculated or presented in accordance

with, and are not intended to be considered in isolation or as

alternatives or substitutes for, or superior to, financial measures

prepared and presented in accordance with GAAP, and should be read

only in conjunction with the Company's financial measures prepared

and presented in accordance with GAAP. The non-GAAP financial

measures used in this release may be different from the measures

used by other companies.

MATIV HOLDINGS, INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

(LOSS) FROM CONTINUING OPERATIONS

(in millions, except per share

amounts)

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

% Change

2024

2023

% Change

Net sales

$

498.5

$

498.2

0.1%

$

1,522.5

$

1,573.7

(3.3)%

Cost of products sold

404.9

411.5

(1.6)%

1,236.0

1,303.8

(5.2)%

Gross profit

93.6

86.7

8.0%

286.5

269.9

6.2%

Selling expense

18.1

20.5

(11.7)%

54.6

60.6

(9.9)%

Research and development expense

5.7

5.4

5.6%

17.5

16.6

5.4%

General expense

51.6

63.4

(18.6)%

173.3

185.8

(6.7)%

Total nonmanufacturing expenses

75.4

89.3

(15.6)%

245.4

263.0

(6.7)%

Goodwill impairment expense

—

401.0

N.M.

—

401.0

N.M.

Restructuring and other impairment

expense

11.2

16.3

(31.3)%

37.4

17.6

N.M.

Operating profit (loss)

7.0

(419.9

)

N.M.

3.7

(411.7

)

N.M.

Interest expense

18.3

16.8

8.9%

55.0

48.8

12.7%

Other expense, net

(12.7

)

(0.3

)

N.M.

(12.1

)

(3.6

)

N.M.

Loss from continuing operations before

income taxes

(24.0

)

(437.0

)

(94.5)%

(63.4

)

(464.1

)

(86.3)%

Income tax expense (benefit), net

(3.2

)

27.3

N.M.

(13.2

)

30.0

N.M.

Net loss from continuing operations

(20.8

)

(464.3

)

(95.5)%

(50.2

)

(494.1

)

(89.8)%

Net income from discontinued

operations

—

9.3

N.M.

—

26.9

N.M.

Net loss

(20.8

)

(455.0

)

(95.4)%

(50.2

)

(467.2

)

(89.3)%

Dividends to participating securities

(0.1

)

(0.5

)

(80.0)%

(0.2

)

(0.7

)

(71.4)%

Net loss attributable to Common

Stockholders

$

(20.9

)

$

(455.5

)

(95.4)%

$

(50.4

)

$

(467.9

)

(89.2)%

Net loss per share - basic:

Loss per share from continuing

operations

$

(0.38

)

$

(8.50

)

(95.5)%

$

(0.93

)

$

(9.06

)

(89.7)%

Income per share from discontinued

operations

—

0.17

N.M.

—

0.49

N.M.

Basic

$

(0.38

)

$

(8.33

)

(95.4)%

$

(0.93

)

$

(8.57

)

(89.1)%

Net loss per share – diluted:

Loss per share from continuing

operations

$

(0.38

)

$

(8.50

)

(95.5)%

$

(0.93

)

$

(9.06

)

(89.7)%

Income per share from discontinued

operations

—

0.17

N.M.

—

0.49

N.M.

Diluted

$

(0.38

)

$

(8.33

)

(95.4)%

$

(0.93

)

$

(8.57

)

(89.1)%

Weighted average shares outstanding:

Basic

54,327,500

54,659,100

54,305,800

54,600,100

Diluted

54,327,500

54,659,100

54,305,800

54,600,100

N.M. - Not Meaningful

MATIV HOLDINGS, INC. AND

SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in millions)

(Unaudited)

September 30,

2024

December 31,

2023

ASSETS

Cash and cash equivalents

$

162.2

$

120.2

Accounts receivable, net

208.5

176.5

Inventories, net

354.3

352.9

Income taxes receivable

16.6

30.6

Other current assets

35.7

32.3

Total current assets

777.3

712.5

Property, plant and equipment, net

635.5

672.5

Finance lease right-of-use assets

17.3

18.2

Operating lease right-of-use assets

44.6

45.6

Deferred income tax benefits

10.4

6.4

Goodwill

475.6

474.1

Intangible assets, net

585.5

631.3

Other assets

76.9

81.8

Total assets

$

2,623.1

$

2,642.4

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current debt

$

2.8

$

2.8

Finance lease liabilities

1.6

1.4

Operating lease liabilities

9.5

9.9

Accounts payable

172.7

139.3

Income taxes payable

10.1

14.3

Accrued expenses and other current

liabilities

131.3

113.7

Total current liabilities

328.0

281.4

Long-term debt

1,140.6

1,101.8

Finance lease liabilities, noncurrent

17.2

18.2

Operating lease liabilities,

noncurrent

34.8

35.3

Long-term income tax payable

—

7.7

Pension and other postretirement

benefits

58.5

62.2

Deferred income tax liabilities

116.1

142.3

Other liabilities

45.6

44.4

Total liabilities

1,740.8

1,693.3

Stockholders’ equity:

Preferred stock, $0.10 par value;

10,000,000 shares authorized; none issued or outstanding

—

—

Common stock, $0.10 par value; 100,000,000

shares authorized; $54,328,913 and 54,211,124 shares issued and

outstanding at September 30, 2024 and December 31, 2023,

respectively

5.4

5.4

Additional paid-in-capital

671.9

669.6

Retained earnings

168.3

235.0

Accumulated other comprehensive income,

net of tax

36.7

39.1

Total stockholders’ equity

882.3

949.1

Total liabilities and stockholders’

equity

$

2,623.1

$

2,642.4

MATIV HOLDINGS, INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOW

FROM CONTINUING OPERATIONS

(in millions)

(Unaudited)

Nine Months Ended September

30,

2024

2023

Operating

Loss from continuing operations

$

(50.2

)

$

(494.1

)

Non-cash items included in net loss:

Depreciation and amortization

108.4

112.4

Amortization of deferred issuance

costs

5.9

5.6

Goodwill impairment

—

401.0

Asset impairments

16.2

14.8

Deferred income tax

(22.2

)

24.9

Pension and other postretirement

benefits

(4.5

)

(10.4

)

Stock-based compensation

8.7

9.3

Loss on sale of assets

9.7

—

(Gain) loss on foreign currency

transactions

3.0

(1.2

)

Other non-cash items

(2.9

)

(7.3

)

Other operating

(2.2

)

(3.8

)

Net changes in operating working

capital

0.8

(13.4

)

Net cash provided by operating activities

of:

Continuing operations

70.7

37.8

Discontinued operations

—

14.6

Net cash provided by operations

70.7

52.4

Investing

Capital spending

(32.9

)

(49.4

)

Capitalized software costs

(0.5

)

(0.5

)

Proceeds from sale of assets

4.5

—

Cash received from (paid on) settlement of

cross-currency swap contracts

(1.7

)

—

Other investing

1.2

0.5

Net cash used in investing of:

Continuing operations

(29.4

)

(49.4

)

Discontinued operations

(12.0

)

(8.8

)

Net cash used in investing

(41.4

)

(58.2

)

Financing

Cash dividends paid

(16.2

)

(49.8

)

Proceeds from long-term debt

127.0

180.0

Payments on long-term debt

(97.0

)

(134.2

)

Payments for debt issuance costs

—

(1.5

)

Payments on financing lease

obligations

(0.8

)

(0.7

)

Purchases of common stock

(0.8

)

(7.0

)

Net cash provided by (used in) financing

of:

Continuing operations

12.2

(13.2

)

Discontinued operations

—

(0.9

)

Net cash provided by (used in)

financing

12.2

(14.1

)

Effect of exchange rate changes on cash

and cash equivalents

0.5

(0.9

)

Increase (decrease) in cash and cash

equivalents

42.0

(20.8

)

Cash and cash equivalents at beginning of

period

120.2

124.4

Cash and cash equivalents at end of

period

$

162.2

$

103.6

MATIV HOLDINGS, INC. AND

SUBSIDIARIES

BUSINESS SEGMENT REPORTING FROM

CONTINUING OPERATIONS

(in millions)

(Unaudited)

NOTE REGARDING SEGMENT REPORTING AND

COMPARABILITY

The Company filed a Current Report on Form

8-K/A on December 6, 2023 to reflect the impact of the Engineered

Papers (“EP”) Divestiture as discontinued operations and to present

certain Non-GAAP financial measures quarterly on a comparable basis

beginning with the first quarter of 2022 (the "EP Supplemental

Financial Information"). The Company filed a Current Report in form

8-K on May 8, 2024 to update the presentation of such Non-GAAP

financial measures previously disclosed in the EP Supplemental

Financial Information in order to reflect the changes to the

Company's reportable segments discussed below and enhance the

Company's shareholders' ability to evaluate Company operating

performance. The EP business is presented as a discontinued

operation for all periods and certain prior period amounts were

retrospectively revised to reflect these changes.

As part of the organizational realignment

effective during the first quarter of 2024, we have reorganized

into two new reportable segments: (1) Filtration & Advanced

Materials ("FAM") focused primarily on filtration media and

components, advanced films, coating and converting solutions, and

extruded mesh products, and (2) Sustainable & Adhesive

Solutions ("SAS"), focused primarily on tapes, labels, liners,

specialty paper, packaging and healthcare solutions. The change in

reportable segments reflects the realignment of segment level

management and the related internal review of our operating

segments. The prior period segment results have been revised to

align with our current segment reporting structure and is presented

on a continuing operations basis.

Net Sales from Continuing

Operations

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

% Change

2024

2023

% Change

FAM

$

189.6

$

195.8

(3.2

)%

$

598.7

$

628.1

(4.7

)%

SAS

308.9

302.4

2.1

%

923.8

945.6

(2.3

)%

Total Consolidated

$

498.5

$

498.2

0.1

%

$

1,522.5

$

1,573.7

(3.3

)%

Operating Profit (Loss) from Continuing

Operations

Three Months Ended September

30,

Nine Months Ended September

30,

Return on Net Sales

Return on Net Sales

2024

2023

2024

2023

2024

2023

2024

2023

FAM

$

19.9

$

22.6

10.5

%

11.5

%

$

59.7

$

78.3

10.0

%

12.5

%

SAS

10.3

(405.8

)

3.3

%

(134.2

)%

30.1

(385.4

)

3.3

%

(40.8

)%

Unallocated

(23.2

)

(36.7

)

(4.7

)%

(7.4

)%

(86.1

)

(104.6

)

(5.7

)%

(6.6

)%

Total Consolidated

$

7.0

$

(419.9

)

1.4

%

(84.3

)%

$

3.7

$

(411.7

)

0.2

%

(26.2

)%

Non-GAAP Adjustments to Operating

Profit (Loss)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

FAM - Amortization of intangibles and

other purchase accounting adjustments

$

8.7

$

8.4

$

26.0

$

25.1

FAM - Restructuring, restructuring

related, impairment, and other expenses

0.8

1.1

5.2

2.4

FAM - Organizational realignment and

integration costs(2)

0.1

—

0.2

—

SAS - Amortization of intangibles and

other purchase accounting adjustments

7.1

7.2

21.3

21.8

SAS - Restructuring, restructuring

related, impairment, and other expenses

10.5

418.9

28.2

419.3

SAS - Organizational realignment and

integration costs(2)

—

—

(0.1

)

—

Unallocated - Restructuring, restructuring

related, impairment, and other expenses

—

—

3.4

1.1

Unallocated - Organizational realignment

and integration costs(2)

1.5

9.2

8.0

28.7

Unallocated - Divestiture costs

0.4

5.3

3.6

5.3

Unallocated - Financing fees(1)

2.3

2.4

6.9

2.4

Unallocated - Amortization of cloud-based

software costs

0.1

—

0.3

—

Total Consolidated

$

31.5

$

452.5

$

103.0

$

506.1

(1) Financing fees incurred for the

Receivables Sales Agreement for the three and nine months ended

September 30, 2024 and for the three months ended September 30,

2023.

(2) Costs associated with the

organizational realignment plan (“the Plan”) announced on January

24, 2024 totaled $0.7 million and $3.7 million for the three and

nine months ended September 30, 2024, respectively, which included

advisory fees and system-related initiatives. Integration costs

totaled $0.8 million and $4.4 million for the three and nine months

ended September 30, 2024, respectively, which included stock-based

compensation, employee compensation, and consulting fees.

Adjusted Operating Profit from

Continuing Operations

Three Months Ended September

30,

Nine Months Ended September

30,

Return on Net Sales

Return on Net Sales

2024

2023

2024

2023

2024

2023

2024

2023

FAM

$

29.5

$

32.1

15.6

%

16.4

%

$

91.1

$

105.8

15.2

%

16.8

%

SAS

27.9

20.3

9.0

%

6.7

%

79.5

55.7

8.6

%

5.9

%

Unallocated

(18.9

)

(19.8

)

(3.8

)%

(4.0

)%

(63.9

)

(67.1

)

(4.2

)%

(4.3

)%

Total Consolidated

$

38.5

$

32.6

7.7

%

6.5

%

$

106.7

$

94.4

7.0

%

6.0

%

Non-GAAP Adjustments to Adjusted

Operating Profit

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

FAM - Depreciation

$

6.7

$

7.0

$

20.2

$

20.6

FAM - Stock-based compensation(1)

0.3

0.1

0.7

0.3

SAS - Depreciation

12.6

13.5

39.4

41.5

SAS - Stock-based compensation(1)

0.5

0.4

0.6

0.4

Unallocated - Depreciation

0.6

0.9

1.5

3.0

Unallocated - Stock-based

compensation(1)

1.6

0.9

4.1

3.2

Total Consolidated

$

22.3

$

22.8

$

66.5

$

69.0

(1) Stock-based compensation excludes

stock-based compensation included in restructuring and integration

costs.

Adjusted EBITDA from Continuing

Operations

Three Months Ended September

30,

Nine Months Ended September

30,

Return on Net Sales

Return on Net Sales

2024

2023

2024

2023

2024

2023

2024

2023

FAM

$

36.5

$

39.2

19.3

%

20.0

%

$

112.0

$

126.7

18.7

%

20.2

%

SAS

41.0

34.2

13.3

%

11.3

%

119.5

97.6

12.9

%

10.3

%

Unallocated

(16.7

)

(18.0

)

(3.4

)%

(3.6

)%

(58.3

)

(60.9

)

(3.8

)%

(3.9

)%

Total Consolidated

$

60.8

$

55.4

12.2

%

11.1

%

$

173.2

$

163.4

11.4

%

10.4

%

Non-GAAP Reconciliation of Organic Net

Sales Growth

FAM

SAS

Consolidated Mativ

Three Months Ended September

30,

Mativ 2023 Net Sales from Continuing

Operations

$

195.8

$

302.4

$

498.2

Divestiture/closure adjustments

—

(6.5

)

(6.5

)

Mativ 2023 comparable Net Sales from

Continuing Operations

$

195.8

$

295.9

$

491.7

Mativ 2024 Net Sales

$

189.6

$

308.9

$

498.5

Divestiture/closure adjustments

—

—

—

Mativ 2024 comparable Net Sales from

Continuing Operations

$

189.6

$

308.9

$

498.5

Organic growth

(3.2

)%

4.4

%

1.4

%

Currency effects on 2024

$

0.9

$

0.7

$

1.6

Mativ 2024 comparable Net Sales from

Continuing Operations with Currency Adjustment

$

188.7

$

308.2

$

496.9

Organic constant currency growth

(3.6

)%

4.2

%

1.1

%

MATIV HOLDINGS, INC. AND

SUBSIDIARIES

RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES AND SUPPLEMENTAL DATA

(in millions, except per share

amounts)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Operating profit (loss) from continuing

operations

$

7.0

$

(419.9

)

$

3.7

$

(411.7

)

Plus: Restructuring, restructuring

related, impairment, and other expenses

11.3

19.0

36.8

21.8

Plus: Goodwill impairment

—

401.0

—

401.0

Plus: Purchase accounting adjustments

15.8

15.6

47.3

46.9

Plus: Organizational realignment and

integration costs

1.6

9.2

8.1

28.7

Plus: Divestiture costs

0.4

5.3

3.6

5.3

Plus: Financing fees

2.3

2.4

6.9

2.4

Plus: Amortization of cloud-based software

costs

0.1

—

0.3

—

Adjusted Operating Profit from continuing

operations

$

38.5

$

32.6

$

106.7

$

94.4

Income (loss) from continuing

operations

$

(20.8

)

$

(464.3

)

$

(50.2

)

$

(494.1

)

Plus: Restructuring, restructuring

related, impairment, and other expenses

10.7

16.8

31.8

18.9

Plus: Goodwill impairment

—

401.0

—

401.0

Plus: Gain/loss on sale of assets

5.8

—

5.8

—

Plus: Purchase accounting adjustments

12.2

13.1

36.5

36.7

Plus: Litigation/tax settlement

—

1.2

—

4.9

Plus: Organizational realignment and

integration costs

1.2

7.5

6.1

22.4

Plus: Divestiture costs

0.3

4.1

2.8

4.0

Plus: Other

1.1

—

1.1

—

Less: Luxembourg valuation allowance

release

—

31.7

—

31.7

Plus: Reversal of valuation allowance on

prior year tax credits

—

6.4

—

6.4

Plus: Tax legislative changes, net of

other discrete items

0.5

(6.3

)

(2.8

)

2.2

Adjusted Income from continuing

operations

$

11.0

$

11.2

$

31.1

$

34.1

Earnings (loss) per share from continuing

operations - diluted

$

(0.38

)

$

(8.50

)

$

(0.93

)

$

(9.06

)

Plus: Restructuring, restructuring

related, impairment, and other expenses

0.20

0.32

0.58

0.36

Plus: Goodwill impairment

—

7.30

—

7.30

Plus: Gain/loss on sale of assets

0.11

—

0.11

—

Plus: Purchase accounting adjustments

0.22

0.23

0.67

0.67

Plus: Litigation/tax settlement

—

0.02

—

0.09

Plus: Organizational realignment and

integration costs

0.02

0.14

0.11

0.42

Plus: Divestiture costs

0.01

0.08

0.05

0.08

Plus: Other

0.02

—

0.02

—

Less: Luxembourg valuation allowance

release

—

0.59

—

0.59

Plus: Reversal of valuation allowance on

prior year tax credits

—

0.13

—

0.12

Plus: Tax legislative changes, net of

other discrete items

0.01

(0.10

)

(0.05

)

0.05

Adjusted Earnings Per Share from

continuing operations - diluted

$

0.21

$

0.21

$

0.56

$

0.62

MATIV HOLDINGS, INC. AND

SUBSIDIARIES

RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES AND SUPPLEMENTAL DATA

(in millions, except per share

amounts)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Net loss from continuing operations

$

(20.8

)

$

(464.3

)

$

(50.2

)

$

(494.1

)

Plus: Interest expense

18.3

16.8

55.0

48.8

Plus: Financing fees

2.3

2.4

6.9

2.4

Plus: Provision for income taxes

(3.2

)

27.3

(13.2

)

30.0

Plus: Depreciation & amortization

35.7

36.9

108.4

110.5

Plus: Amortization of cloud-based software

costs

0.1

—

0.3

—

Plus: Stock compensation expense

2.4

1.4

5.4

4.0

Plus: Inventory step up expense

—

—

—

1.4

Plus: Restructuring, restructuring

related, impairment, and other expenses

11.3

16.3

36.8

17.6

Plus: Goodwill impairment

—

401.0

—

401.0

Plus: Other restructuring related

expense

—

2.8

—

4.2

Plus: Organizational realignment and

integration costs

1.6

9.2

8.1

28.7

Plus: Divestiture costs

0.4

5.3

3.6

5.3

Plus: Litigation/tax settlement

—

—

—

4.9

Plus: Other income (expense), net

12.7

0.3

12.1

(1.3

)

Adjusted EBITDA from continuing

operations

$

60.8

$

55.4

$

173.2

$

163.4

Cash used in operating activities of

continuing operations

$

37.6

$

32.3

$

70.7

$

37.8

Less: Capital spending

(12.1

)

(14.7

)

(32.9

)

(49.4

)

Less: Capitalized software costs

(0.4

)

—

(0.5

)

(0.5

)

Less: Cloud-based software costs

(1.2

)

—

(2.2

)

—

Free Cash Flow from continuing

operations

$

23.9

$

17.6

$

35.1

$

(12.1

)

September 30, 2024

December 31, 2023

Total Debt

$

1,143.4

$

1,104.6

Less: Cash

162.2

120.2

Net Debt from continuing operations

$

981.2

$

984.4

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106250893/en/

Chris Kuepper, IRC Director, Investor Relations

+1-770-569-4229

Website: http://www.mativ.com

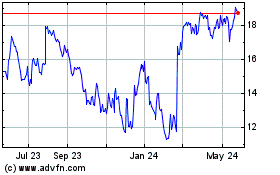

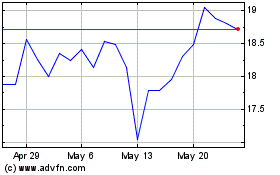

Mativ (NYSE:MATV)

Historical Stock Chart

From Nov 2024 to Dec 2024

Mativ (NYSE:MATV)

Historical Stock Chart

From Dec 2023 to Dec 2024