Vulcan Completes Bond Issuance - Analyst Blog

June 17 2011 - 6:45AM

Zacks

Vulcan Materials Company (VMC) recently

announced the completion of its $1.1 billion bond issuance, which

has received orders worth $3.2 billion. The company reported

that the bond issuance was undertaken to reduce its debt that is

due over the next several years.

Vulcan Materials intends to use a part of the proceeds from the

issuance to buy $275 million in senior unsecured notes due 2012 and

2013. It also plans to prepay a $450 million term loan due 2015 and

reduce debt borrowed against its revolving credit facility.

However, the company will have to incur a pre-tax charge of about

$26.5 million in the second quarter related to the use of proceeds

from the bonds.

Vulcan Materials also entered into an agreement with a

consortium of banks to change the fixed rate of interest to

floating rates on $500 million in notes due 2016.

During the first quarter of 2011, Vulcan Materials reported a

net loss of 62 cents per share from continuing operations,

deteriorating sharply from last year’s net loss of 53 cents per

share from continuing operations. Total revenue dropped

marginally to $487.2 million from $493.3 million in the

corresponding quarter of 2010. The year-over-year decline was

primarily attributable to a decline in shipments in South Carolina,

Florida and regions along the Gulf Coast, despite a stronger demand

from public infrastructure projects in Tennessee, Virginia and

Georgia.

Vulcan Materials’ cash and cash equivalents improved to $63.2

million as of March 31, 2011 from $36 million at the end of the

prior-year period. However, long-term debt rose to $2.43 billion as

of the above date from $2.10 billion a year ago.

Based in Birmingham, Alabama, Vulcan Materials Corp. is engaged

in the production, distribution and sale of construction

aggregates, and other construction materials and related services

in the U.S. and Mexico. It is the nation’s largest producer of

construction aggregates and a leading producer of other

construction materials. Its key competitors include Cemex

S.A.B. de C.V. (CX), Lafarge S.A. (LFRGY)

and Martin Marietta Materials Inc. (MLM).

Vulcan Materials retains a Zacks #3 Rank, which translates into

a short-term (1 to 3 months) Hold rating.

CEMEX SA ADR (CX): Free Stock Analysis Report

LAFARGE SA-ADR (LFRGY): Free Stock Analysis Report

MARTIN MRT-MATL (MLM): Free Stock Analysis Report

VULCAN MATLS CO (VMC): Free Stock Analysis Report

Zacks Investment Research

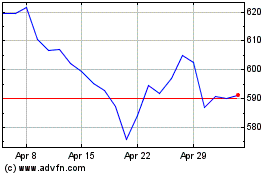

Martin Marietta Materials (NYSE:MLM)

Historical Stock Chart

From Jun 2024 to Jul 2024

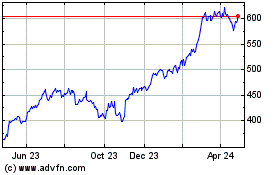

Martin Marietta Materials (NYSE:MLM)

Historical Stock Chart

From Jul 2023 to Jul 2024