Marcus Hotels & Resorts and Marcus Theatres

Significantly Outperformed Their Respective Industries; Record

Third Quarter for Company and Both Divisions; Company Completes $10

Million in Share Repurchases

The Marcus Corporation (NYSE: MCS) today reported record results

for the third quarter fiscal 2024 ended September 26, 2024.

“Results for the third quarter of fiscal 2024 were driven by

strong contributions from both divisions, with Marcus Hotels &

Resorts and Marcus Theatres each significantly outperforming their

respective industries,” said Gregory S. Marcus, chief executive

officer of The Marcus Corporation. “We delivered record third

quarter revenue and earnings in both of our divisions and as a

company. Marcus Hotels & Resorts benefited from strong room

rates during the Republican National Convention in Milwaukee, and

Marcus Theatres achieved growth with a markedly improved film slate

that played particularly well with audiences in our markets. As we

look ahead to the remainder of the year and into 2025, we are

encouraged by trends within both businesses, including an

impressive array of high-quality films headed for the big screen

this holiday season and into 2025 and continued improvements in

group bookings in our hotel division. Turning to our balance sheet,

we completed the retirement of our convertible debt to eliminate

any future dilution, and our confidence in the future was also

highlighted by our decision to repurchase nearly $10 million of our

shares during the quarter.”

Third Quarter Fiscal 2024

Highlights

- Total revenues for the third quarter of fiscal 2024 were a

record $232.7 million, an 11.4% increase from total revenues of

$208.8 million for the third quarter of fiscal 2023.

- Operating income was a record $32.8 million for the third

quarter of fiscal 2024, a 56.6% increase compared to operating

income of $20.9 million for the prior year quarter.

- Net earnings was a record $23.3 million for the third quarter

of fiscal 2024, a 90.6% increase compared to net earnings of $12.2

million for the same period in fiscal 2023. Net earnings for the

third quarter of fiscal 2024 was negatively impacted by $1.5

million, or $0.05 per share, of debt conversion expense and related

tax impacts of the previously announced convertible senior notes

repurchases. Excluding the impacts of the convertible senior notes

repurchases, net earnings was $24.8 million for the third quarter

of fiscal 2024.

- Net earnings per diluted common share was $0.73 for the third

quarter of fiscal 2024, a 128.1% increase compared to net earnings

per diluted common share of $0.32 for the third quarter of fiscal

2023. Excluding the impacts of the convertible senior notes

repurchases, net earnings per diluted common share was $0.78 for

the third quarter of fiscal 2024.

- Adjusted EBITDA was a record $52.3 million for the third

quarter of fiscal 2024, a 23.5% increase compared to Adjusted

EBITDA of $42.3 million for the prior year quarter.

First Three Quarters Fiscal 2024

Highlights

- Total revenues for the first three quarters of fiscal 2024 were

$547.2 million, a 3.7% decrease from total revenues of $568.0

million for the first three quarters of fiscal 2023.

- Operating income was $18.4 million for the first three quarters

of fiscal 2024, compared to operating income of $32.8 million for

the first three quarters of fiscal 2023.

- Net loss was $8.8 million for the first three quarters of

fiscal 2024, compared to net income of $16.2 million for the for

the first three quarters of fiscal 2023. Net loss for the first

three quarters of fiscal 2024 was negatively impacted by $16.5

million, or $0.52 per share, of debt conversion expense and related

tax impacts of the previously announced convertible senior notes

repurchases. Excluding the impacts of the convertible senior notes

repurchases, net earnings was $7.7 million for the first three

quarters of fiscal 2024.

- Net loss per diluted common share was $0.28 for the first three

quarters of fiscal 2024, compared to net earnings per diluted

common share of $0.46 for the first three quarters of fiscal 2023.

Excluding the impacts of the convertible senior notes repurchases,

net earnings per diluted common share was $0.24 for the first three

quarters of fiscal 2024.

- Adjusted EBITDA was $76.5 million for the first three quarters

of fiscal 2024, compared to Adjusted EBITDA of $90.5 million for

the first three quarters of fiscal 2023.

Marcus Theatres®

For the third quarter of fiscal 2024, Marcus Theatres reported

total revenues of $143.8 million, a 13.6% increase compared to the

third quarter of fiscal 2023. Division operating income of $21.8

million increased 91.3% in the third quarter of fiscal 2024 and

Adjusted EBITDA of $33.2 million increased 24.3% during the same

period compared to the prior year quarter. Division total revenue,

operating income, and Adjusted EBITDA were records for the fiscal

third quarter.

Marcus Theatres’ attendance grew 7.1% at same store theatres

during the third quarter of fiscal 2024 compared to the same period

the prior year. As a result, the division outperformed the industry

by 5.7 percentage points during the third quarter of fiscal 2024.

An improved film slate featuring record-breaking films that played

well with audiences in our markets drove growth and outperformance.

The division’s Everyday Matinee, which offers a $7 ticket for

children and seniors for all shows starting before 4 p.m., as well

as Marcus Theatres’ enhanced Value Tuesday promotion, which brought

back a free complimentary size popcorn for members of the Magical

Movie Rewards loyalty program, also positively contributed to

Marcus Theatres’ outperformance.

During the third quarter fiscal 2024, average ticket price

increased 2.6% with an increased percentage of ticket sales coming

from Premium Large Format (PLF) screens and evening showings,

partially offset by attendance associated with Value Tuesday and

other promotional offerings. Average concession revenues per person

increased 7.9% during the third quarter compared to the prior year

quarter.

“While the WGA and SAG-AFTRA strikes impacted results for the

first half of the year, we are pleased that the lingering effects

seem to be further in the rearview mirror as demonstrated by the

significant improvements in our third quarter fiscal 2024 results,”

said Mark A. Gramz, president of Marcus Theatres. “A larger number

of exciting blockbuster films performed particularly well in our

Midwestern markets during the quarter, including record-breaking

Inside Out 2 and Deadpool & Wolverine, as well as Despicable Me

4, Twisters and It Ends With Us. The remainder of the fourth

quarter of fiscal 2024 includes an exciting slate of diverse films,

including the highly anticipated debuts of Gladiator II, Wicked,

and Moana 2. Throughout this holiday season, moviegoers will be

treated to a full slate of great movies that appeal to a wide range

of audiences, ending the year on a much higher note than it

started.”

Marcus Theatres’ top five highest-performing films in the third

quarter of fiscal 2024 were Deadpool & Wolverine, Despicable Me

4, Twisters, Inside Out 2 and Beetlejuice Beetlejuice.

While film schedule changes may occur, new films planned to be

released during the remainder of fiscal 2024 that have the

potential to perform very well include: Gladiator II, Wicked, Moana

2, Lord of The Rings: The War of the Rohirrim, Mufasa: The Lion

King, and Sonic the Hedgehog 3.

Marcus® Hotels & Resorts

Marcus Hotels & Resorts reported total revenues before cost

reimbursements of $79.0 million in the third quarter of fiscal

2024, a 9.6% increase over the prior year period. Division

operating income of $17.0 million increased 18.5% in the third

quarter of fiscal 2024 and Adjusted EBITDA of $23.1 million

increased 18.7% over the same prior year period. Division total

revenue, operating income, and Adjusted EBITDA were records for the

fiscal third quarter.

Revenue per available room, or RevPAR, increased 9.8% at

comparable company-owned hotels during the third quarter of fiscal

2024 compared to the third quarter of fiscal 2023. As a result, the

division outperformed the industry by 8.4 percentage points.

“Our record third quarter fiscal 2024 results were favorably

impacted by the Republican National Convention in Milwaukee,

continued improvements in our group business, and the summer

leisure travel season,” said Michael R. Evans, president of Marcus

Hotels & Results. “While we anticipate some softening of our

leisure business as we head into the traditionally slower winter

travel months, our team is continuing to capitalize on the growth

of group business, especially midweek. Our high-quality hotels and

resorts - including the newly renovated Pfister Hotel in Milwaukee

and Grand Geneva Resort & Spa in Lake Geneva, Wisconsin – are

well positioned to continue capturing accelerating group demand

with our outstanding team delivering memorable moments for every

guest who walks through our doors.”

Group booking pace for the remainder of fiscal 2024 is running

ahead of the same period in fiscal 2023. Fiscal 2025 booking pace

is running significantly ahead compared to the same period last

year, excluding bookings related to the Republican National

Convention in July 2024, with banquet and catering booking pace

running similarly ahead.

In October, four Marcus Hotels & Resorts properties earned

high honors in Condé Nast Traveler’s Readers’ Choice Awards. The

Pfister Hotel and Saint Kate – The Arts Hotel, both in Milwaukee,

were named among the Top Hotels in the Midwest. Grand Geneva Resort

& Spa in Lake Geneva, Wisconsin was named the #2 Top Resort in

the Midwest, and the Kimpton Hotel Monaco Pittsburgh was recognized

as the #2 Top Hotel in the Mid-Atlantic. The Condé Nast Traveler

Readers’ Choice Awards are the longest-running and most prestigious

recognition of excellence in the travel industry and are commonly

known as “the best of the best of travel.”

Return of Capital to

Shareholders

During the third quarter of fiscal 2024, the Company repurchased

approximately 693,000 shares of common stock for $9.7 million in

cash. During the first three quarters of fiscal 2024, the Company

has returned $16.5 million in capital to shareholders through share

repurchases and dividends paid.

“Our strong balance sheet gives us the ability to return capital

to shareholders, while at the same time continuing to invest in our

two businesses and pursue potential growth opportunities,” said

Chad M. Paris, chief financial officer and treasurer of The Marcus

Corporation.

Balance Sheet and

Liquidity

The Marcus Corporation’s financial position remains strong with

$248.6 million in cash and revolving credit availability at the end

of the third quarter of fiscal 2024.

During the second and third quarters of fiscal 2024, the Company

completed the previously announced repurchases of $86.4 million

aggregate principal amount of its 5.00% Convertible Senior Notes

due 2025 (the “Convertible Senior Notes”). On September 19, 2024,

the Company entered into an agreement to repurchase and retire an

additional $13.5 million aggregate principal amount of Convertible

Senior Notes, and entered into unwind agreements to terminate a

corresponding portion of the existing capped call transactions. The

additional repurchase and unwind transactions closed on October 11,

2024. The final cash cost of the $99.9 million aggregate principal

amount of Convertible Senior Notes repurchases, net of the cash

received from the unwind of the capped call transactions, was

$103.3 million. Following the completion of the repurchases, the

Company has retired substantially all of the $100 million of

Convertible Senior Notes, with $0.1 million remaining

outstanding.

In connection with the repurchases, the required accounting for

the transactions resulted in the Company recognizing $1.4 million

and $15.3 million of debt conversion expense during the third

quarter and first three quarters of fiscal 2024, respectively,

while the unwind of the capped call transactions resulted in a $4.7

and $17.6 million increase in shareholders equity during the third

quarter and first three quarters of fiscal 2024, respectively. In

addition, income tax expense (benefit) during the first three

quarters of fiscal 2024 was negatively impacted by $1.2 million for

the related noncash tax impacts of the capped call unwind.

In addition, during the third quarter of fiscal 2024 the Company

completed a private placement offering of $100 million aggregate

principal amount of senior notes in two tranches: $60 million

aggregate principal amount of 6.89% senior notes due 2031 and $40

million aggregate principal amount of 7.02% senior notes due 2034.

The net proceeds of the offering were used to refinance the

repurchases and for general corporate purposes.

These refinancing transactions significantly simplified the

Company’s capital structure and extended debt maturities.

Conference Call and

Webcast

The Marcus Corporation management will hold a conference call

today, Thursday, October 31, 2024, at 10:00 a.m. Central/11:00 a.m.

Eastern time. Interested parties may listen to the call live on the

internet through the investor relations section of the company's

website: investors.marcuscorp.com, or by dialing 1-404-975-4839 and

entering the passcode 935227. Listeners should dial in to the call

at least 5-10 minutes prior to the start of the call or should go

to the website at least 15 minutes prior to the call to download

and install any necessary audio software.

A telephone replay of the conference call will be available

through Thursday, November 14, 2024, by dialing 1-866-813-9403 and

entering passcode 167289. The webcast will be archived on the

company’s website until its next earnings release.

Non-GAAP Financial

Measure

Adjusted EBITDA has been presented in this press release as a

supplemental measure of financial performance that is not required

by, or presented in accordance with, GAAP. The company defines

Adjusted EBITDA as net earnings (loss) attributable to The Marcus

Corporation before investment income or loss, interest expense,

other expense, gain or loss on disposition of property, equipment

and other assets, equity earnings or losses from unconsolidated

joint ventures, net earnings or losses attributable to

noncontrolling interests, income taxes, depreciation and

amortization and non-cash share-based compensation expense,

adjusted to eliminate the impact of certain items that the company

does not consider indicative of its core operating performance. A

reconciliation of this measure to the equivalent measure under

GAAP, along with reconciliations of this measure for each of our

operating segments, are set forth in the attached table.

Adjusted EBITDA is a key measure used by management and the

company’s board of directors to assess the company’s financial

performance and enterprise value. The company believes that

Adjusted EBITDA is a useful measure, as it eliminates certain

expenses and gains that are not indicative of the company’s core

operating performance and facilitates a comparison of the company’s

core operating performance on a consistent basis from period to

period. The company also uses Adjusted EBITDA as a basis to

determine certain annual cash bonuses and long-term incentive

awards, to supplement GAAP measures of performance to evaluate the

effectiveness of its business strategies, to make budgeting

decisions, and to compare its performance against that of other

peer companies using similar measures. Adjusted EBITDA is also used

by analysts, investors and other interested parties as a

performance measure to evaluate industry competitors.

Adjusted EBITDA is a non-GAAP measure of the company’s financial

performance and should not be considered as an alternative to net

earnings (loss) as a measure of financial performance, or any other

performance measure derived in accordance with GAAP and it should

not be construed as an inference that the company’s future results

will be unaffected by unusual or non-recurring items. Additionally,

Adjusted EBITDA is not intended to be a measure of liquidity or

free cash flow for management’s discretionary use. In addition,

this non-GAAP measure excludes certain non-recurring and other

charges and has its limitations as an analytical tool. You should

not consider Adjusted EBITDA in isolation or as a substitute for

analysis of the company’s results as reported under GAAP. In

evaluating Adjusted EBITDA, you should be aware that in the future

the company will incur expenses that are the same as or similar to

some of the items eliminated in the adjustments made to determine

Adjusted EBITDA, such as acquisition expenses, preopening expenses,

accelerated depreciation, impairment charges and other adjustments.

The company’s presentation of Adjusted EBITDA should not be

construed to imply that the company’s future results will be

unaffected by any such adjustments. Definitions and calculations of

Adjusted EBITDA differ among companies in our industries, and

therefore Adjusted EBITDA disclosed by the company may not be

comparable to the measures disclosed by other companies.

About The Marcus

Corporation

Headquartered in Milwaukee, The Marcus Corporation is a leader

in the lodging and entertainment industries, with significant

company-owned real estate assets. The Marcus Corporation’s theatre

division, Marcus Theatres®, is the fourth largest theatre circuit

in the U.S. and currently owns or operates 995 screens at 79

locations in 17 states under the Marcus Theatres, Movie Tavern® by

Marcus and BistroPlex® brands. The company’s lodging division,

Marcus® Hotels & Resorts, owns and/or manages 16 hotels,

resorts and other properties in eight states. For more information,

please visit the company’s website at www.marcuscorp.com.

Certain matters discussed in this press release are

“forward-looking statements” intended to qualify for the safe

harbors from liability established by the Private Securities

Litigation Reform Act of 1995. These forward-looking statements may

generally be identified as such because the context of such

statements include words such as we “believe,” “anticipate,”

“expect” or words of similar import. Similarly, statements that

describe our future plans, objectives or goals are also

forward-looking statements. Such forward-looking statements are

subject to certain risks and uncertainties which may cause results

to differ materially from those expected, including, but not

limited to, the following: (1) the adverse effects future pandemics

or epidemics may have on our theatre and hotels and resorts

businesses, results of operations, liquidity, cash flows, financial

condition, access to credit markets and ability to service our

existing and future indebtedness; (2) the availability, in terms of

both quantity and audience appeal, of motion pictures for our

theatre division (including disruptions in the production of films

due to events such as a strike by actors, writers or directors or

future pandemics); (3) the effects of theatre industry dynamics

such as the maintenance of a suitable window between the date such

motion pictures are released in theatres and the date they are

released to other distribution channels; (4) the effects of adverse

economic conditions in our markets; (5) the effects of adverse

economic conditions on our ability to obtain financing on

reasonable and acceptable terms, if at all; (6) the effects on our

occupancy and room rates caused by the relative industry supply of

available rooms at comparable lodging facilities in our markets;

(7) the effects of competitive conditions in our markets; (8) our

ability to achieve expected benefits and performance from our

strategic initiatives and acquisitions; (9) the effects of

increasing depreciation expenses, reduced operating profits during

major property renovations, impairment losses, and preopening and

start-up costs due to the capital intensive nature of our business;

(10) the effects of changes in the availability of and cost of

labor and other supplies essential to the operation of our

business; (11) the effects of weather conditions, particularly

during the winter in the Midwest and in our other markets; (12) our

ability to identify properties to acquire, develop and/or manage

and the continuing availability of funds for such development; (13)

the adverse impact on business and consumer spending on travel,

leisure and entertainment resulting from terrorist attacks in the

United States or other incidents of violence in public venues such

as hotels and movie theatres; and (14) a disruption in our business

and reputational and economic risks associated with civil

securities claims brought by shareholders. These statements are not

guarantees of future performance and are subject to risks,

uncertainties and other factors, some of which are beyond our

control and difficult to predict and could cause actual results to

differ materially from those expressed or forecasted in the

forward-looking statements. Our forward-looking statements are

based upon our assumptions, which are based upon currently

available information. Shareholders, potential investors and other

readers are urged to consider these factors carefully in evaluating

the forward-looking statements and are cautioned not to place undue

reliance on such forward-looking statements. The forward-looking

statements made herein are made only as of the date of this press

release and we undertake no obligation to publicly update such

forward-looking statements to reflect subsequent events or

circumstances.

THE MARCUS CORPORATION

Consolidated Statements of

Earnings (Loss)

(Unaudited)

(in thousands, except per share

data)

13 Weeks Ended

39 Weeks Ended

September 26,

2024

September 28,

2023

September 26,

2024

September 28,

2023

Revenues:

Theatre admissions

$

68,980

$

63,652

$

158,156

$

180,274

Rooms

40,019

36,456

88,728

82,959

Theatre concessions

62,118

54,551

141,230

156,633

Food and beverage

22,283

20,214

57,718

53,980

Other revenues

28,876

23,908

71,112

65,024

222,276

198,781

516,944

538,870

Cost reimbursements

10,392

9,985

30,303

29,179

Total revenues

232,668

208,766

547,247

568,049

Costs and expenses:

Theatre operations

68,460

62,742

165,563

180,716

Rooms

12,300

11,594

32,875

31,232

Theatre concessions

24,062

20,738

57,463

59,069

Food and beverage

16,084

15,266

45,027

43,285

Advertising and marketing

6,645

6,025

18,448

16,703

Administrative

23,202

19,854

67,234

59,171

Depreciation and amortization

17,274

19,158

49,988

51,028

Rent

6,631

6,592

19,474

19,679

Property taxes

4,442

4,663

12,061

13,952

Other operating expenses

10,279

10,290

29,890

29,577

Loss on disposition of property, equipment

and other assets

115

242

95

1,019

Impairment charges

—

684

472

684

Reimbursed costs

10,392

9,985

30,303

29,179

Total costs and expenses

199,886

187,833

528,893

535,294

Operating income

32,782

20,933

18,354

32,755

Other income (expense):

Investment income

809

445

1,674

1,064

Interest expense

(3,062

)

(2,869

)

(8,160

)

(8,970

)

Other income (expense)

(390

)

(477

)

(1,121

)

(1,355

)

Debt conversion expense

(1,410

)

—

(15,318

)

—

Equity earnings (losses) from

unconsolidated joint ventures

(9

)

75

(446

)

(127

)

(4,062

)

(2,826

)

(23,371

)

(9,388

)

Earnings (loss) before income

taxes

28,720

18,107

(5,017

)

23,367

Income tax expense

5,406

5,873

3,756

7,133

Net earnings (loss)

$

23,314

$

12,234

(8,773

)

16,234

Net earnings (loss) per common share -

diluted

$

0.73

$

0.32

$

(0.28

)

$

0.46

Weighted average shares outstanding -

diluted

32,031

40,974

32,002

40,935

THE MARCUS CORPORATION

Condensed Consolidated Balance

Sheets

(Unaudited)

(In thousands)

September 26,

2024

December 28,

2023

Assets:

Cash and cash equivalents

$

28,415

$

55,589

Restricted cash

4,630

4,249

Accounts receivable

28,309

19,703

Assets held for sale

—

—

Other current assets

26,391

22,175

Property and equipment, net

686,993

682,262

Operating lease right-of-use assets

168,404

179,788

Other assets

103,817

101,337

Total Assets

$

1,046,959

$

1,065,103

Liabilities and Shareholders'

Equity:

Accounts payable

$

39,284

$

37,384

Income taxes

847

—

Taxes other than income taxes

17,730

18,585

Other current liabilities

76,317

80,283

Current portion of finance lease

obligations

2,546

2,579

Current portion of operating lease

obligations

14,315

15,290

Current maturities of long-term debt

10,460

10,303

Finance lease obligations

10,989

12,753

Operating lease obligations

167,384

178,582

Long-term debt

162,633

159,548

Deferred income taxes

34,719

32,235

Other long-term obligations

47,443

46,389

Equity

462,292

471,172

Total Liabilities and Shareholders'

Equity

$

1,046,959

$

1,065,103

THE MARCUS CORPORATION

Business Segment

Information

(Unaudited)

(In thousands)

Theatres

Hotels/

Resorts

Corporate

Items

Total

13 Weeks Ended September 26,

2024

Revenues

$

143,843

$

88,738

$

87

$

232,668

Operating income (loss)

21,761

17,041

(6,020

)

32,782

Depreciation and amortization

11,347

5,789

138

17,274

Adjusted EBITDA

33,187

23,074

(3,986

)

52,275

13 Weeks Ended September 28,

2023

Revenues

$

126,585

$

82,098

$

83

$

208,766

Operating income (loss)

11,377

14,377

(4,821

)

20,933

Depreciation and amortization

14,258

4,817

83

19,158

Adjusted EBITDA

26,695

19,446

(3,811

)

42,330

39 Weeks Ended September 26,

2024

Revenues

$

326,565

$

220,432

$

250

$

547,247

Operating income (loss)

18,803

17,996

(18,445

)

18,354

Depreciation and amortization

33,900

15,701

387

49,988

Adjusted EBITDA

54,412

34,489

(12,375

)

76,526

39 Weeks Ended September 28,

2023

Revenues

$

359,811

$

207,975

$

263

$

568,049

Operating income (loss)

32,707

15,450

(15,402

)

32,755

Depreciation and amortization

37,063

13,706

259

51,028

Adjusted EBITDA

71,749

30,372

(11,635

)

90,486

Corporate items include amounts not

allocable to the business segments. Corporate revenues consist

principally of rent and the corporate operating loss includes

general corporate expenses. Corporate information technology costs

and accounting shared services costs are allocated to the business

segments based upon several factors, including actual usage and

segment revenues.

Supplemental Data

(Unaudited)

(In thousands)

13 Weeks Ended

39 Weeks Ended

Consolidated

September 26,

2024

September 28,

2023

September 26,

2024

September 28,

2023

Net cash flow provided by (used in)

operating activities

$

30,497

$

21,316

$

51,374

$

68,642

Net cash flow provided by (used in)

investing activities

(17,757

)

(10,240

)

(58,397

)

(26,882

)

Net cash flow provided by (used in)

financing activities

(17,480

)

(19,848

)

(19,770

)

(26,184

)

Capital expenditures

(18,487

)

(9,940

)

(53,770

)

(25,836

)

THE MARCUS CORPORATION

Reconciliation of Net earnings

(loss) to Adjusted EBITDA

(Unaudited)

(In thousands)

13 Weeks Ended

39 Weeks Ended

September 26,

2024

September 28,

2023

September 26,

2024

September 28,

2023

Net earnings (loss)

$

23,314

$

12,234

$

(8,773

)

$

16,234

Add (deduct):

Investment income

(809

)

(445

)

(1,674

)

(1,064

)

Interest expense

3,062

2,869

8,160

8,970

Other expense (income)

390

477

1,121

1,355

(Gain) Loss on disposition of property,

equipment and other assets

115

242

95

1,019

Equity (earnings) losses from

unconsolidated joint ventures

9

(75

)

446

127

Income tax expense (benefit)

5,406

5,873

3,756

7,133

Depreciation and amortization

17,274

19,158

49,988

51,028

Share-based compensation (a)

2,225

1,313

7,157

5,000

Impairment charges (b)

—

684

472

684

Theatre exit costs (c)

—

—

136

—

Insured losses (recoveries) (d)

(206

)

—

239

—

Debt conversion expense (e)

1,410

—

15,318

—

Other non-recurring (f)

85

—

85

—

Adjusted EBITDA

$

52,275

$

42,330

$

76,526

$

90,486

Reconciliation of Operating

income (loss) to Adjusted EBITDA by Reportable Segment

(Unaudited)

(In thousands)

13 Weeks Ended September 26,

2024

39 Weeks Ended September 26,

2024

Theatres

Hotels & Resorts

Corp. Items

Total

Theatres

Hotels & Resorts

Corp. Items

Total

Operating income (loss)

$

21,761

$

17,041

$

(6,020

)

$

32,782

$

18,803

$

17,996

$

(18,445

)

$

18,354

Depreciation and amortization

11,347

5,789

138

17,274

33,900

15,701

387

49,988

(Gain) loss on disposition of property,

equipment and other assets

126

(11

)

—

115

99

(4

)

—

95

Share-based compensation (a)

159

255

1,811

2,225

763

796

5,598

7,157

Impairment charges (b)

—

—

—

—

472

—

—

472

Theatre exit costs (c)

—

—

—

—

136

—

—

136

Insured losses (recoveries) (d)

(206

)

—

—

(206

)

239

—

—

239

Other non-recurring (f)

—

—

85

85

—

—

85

85

Adjusted EBITDA

$

33,187

$

23,074

$

(3,986

)

$

52,275

$

54,412

$

34,489

$

(12,375

)

$

76,526

13 Weeks Ended September 28,

2023

39 Weeks Ended September 28,

2023

Theatres

Hotels & Resorts

Corp. Items

Total

Theatres

Hotels & Resorts

Corp. Items

Total

Operating income (loss)

$

11,377

$

14,377

$

(4,821

)

$

20,933

$

32,707

$

15,450

$

(15,402

)

$

32,755

Depreciation and amortization

14,258

4,817

83

19,158

37,063

13,706

259

51,028

(Gain) loss on disposition of property,

equipment and other assets

233

9

—

242

537

482

—

1,019

Share-based compensation (a)

143

243

927

1,313

758

734

3,508

5,000

Impairment charges (b)

684

—

—

684

684

—

—

684

Adjusted EBITDA

$

26,695

$

19,446

$

(3,811

)

$

42,330

$

71,749

$

30,372

$

(11,635

)

$

90,486

(a)

Non-cash expense related to

share-based compensation programs.

(b)

Non-cash impairment charges

related to one permanently closed theatre location in the second

quarter of fiscal 2024 and one permanently closed theatre location

in fiscal 2023.

(c)

Non-recurring costs related to

the closure and exit of one theatre location in the second quarter

of fiscal 2024.

(d)

Repair costs and insurance

recoveries that are non-operating in nature related to insured

property damage at one theatre location.

(e)

Debt conversion expense for

repurchases of $99.9 million aggregate principal amount of

Convertible Notes. See Convertible Senior Notes Repurchases in the

“Liquidity and Capital Resources” section of MD&A included in

the fiscal 2024 third quarter Form 10-Q for further discussion.

(f)

Other non-recurring includes

professional fees related to convertible debt repurchase

transactions.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241031770635/en/

Chad Paris (414) 905-1100 investors@marcuscorp.com

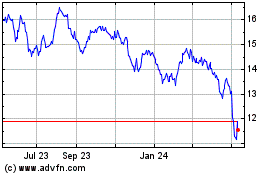

Marcus (NYSE:MCS)

Historical Stock Chart

From Nov 2024 to Dec 2024

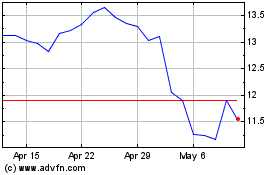

Marcus (NYSE:MCS)

Historical Stock Chart

From Dec 2023 to Dec 2024