Form PX14A6G - Notice of exempt solicitation submitted by non-management

July 08 2024 - 2:31PM

Edgar (US Regulatory)

240.14a-103 Notice of Exempt Solicitation (Voluntary)

U.S. Securities and Exchange Commission, Washington

DC 20549

NAME OF REGISTRANT: LL Flooring Holdings, Inc.

NAME OF PERSON RELYING ON EXEMPTION: Jerald Hammann

ADDRESS OF PERSON RELYING ON EXEMPTION: 1566 Sumter Ave. N, Minneapolis MN 55427

Written materials are submitted pursuant to Rule 14a-6(g)(1) promulgated under the Securities Exchange Act of 1934.*

*Submission is not required of this filer under the terms of the Rule, but is made voluntarily in the interest of public disclosure.

| |

Collaborative

Investor Engagement

|

Jerald Hammann publicly announces the withdrawal of his nomination for election to the Board of Directors of LL Flooring Holdings, Inc.

Dear LL Flooring Shareholders:

My name is Jerald ("Jerry") Hammann. I am an investor advocate. I own 10 shares of LL Flooring Holdings, Inc., ("LL Flooring" or the "Company") common stock, which I acquired on March 24, 2023. I nominated myself to serve on the Company's Board of Directors on November 10, 2023, and publicly announced my candidacy on June 20, 2024. I now publicly announce the withdrawal of my nomination for the 2024 annual meeting.

Because LL Flooring has a nine-member Board, from which only three members are up for election each year, it may take two election cycles for shareholders to exert meaningful governance change. Because it is extremely important that shareholders begin this process in the 2024 election cycle and because my continued candidacy could jeopardize this process, I am publicly announcing the withdrawal of my nomination. I urge shareholders to consider voting for all three of the director candidates nominated by F9 Investments, LLC ("F9"). If you are reluctant to vote for all three candidates, then I strongly urge you to vote for at least two of the F9 candidates so that if there is a director election in 2025, shareholders can collectively make a decision regarding the future direction of the Company.

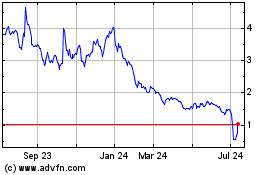

Since the June 20, 2024, public announcement of my candidacy, the market price of shares in the Company's stock has dropped from $1.37 per share down to $0.56 per share (as of close on July 5, 2025). Some, if not all, of this price decline is attributable to: (a) a June 27, 2024, Bloomberg news report that the Company has retained AlixPartners, a financial services consultancy that recently advised Bed Bath & Beyond on its bankruptcy proceedings, to receive assistance with operations and explore ways to boost its cash reserves,1 and, (b) a July 3, 2024, Bloomberg news report that the Company is considering filing for Chapter 11 bankruptcy.2

I believe that the potential for a Chapter 11 bankruptcy filing adds additional fiduciary conflicts to the F9 nominees. As disclosed in F9's May 31, 2024, Proxy Statement, the Company currently leases 30 locations from entities controlled by Mr. Sullivan. Based on my Chapter 11 bankruptcy experience involving large retail chains, AlixPartners is likely to evaluate each of the Company's leases to determine their economic value to the Company. This activity could potentially result in lease terminations or lease re-negotiations that could directly impact F9.

Withdrawing my nomination at this time was not an easy decision. I believe shareholders need a neutral board member employing an evidence-based methodology to sort through the competing plans for the Company being forwarded by the incumbent directors and the F9 nominees - an activity I have done the entirety of my professional career. I believe shareholders need a board member whose loyalty to their interests they would have no reason to question. I also believe that shareholders could benefit from my Chapter 11 bankruptcy experience involving large retail chains. In 1993, I provided financial projections of operations and cash flows relating to various prospective scenarios to interim management during the MEI Salons bankruptcy which affected approximately 1,700 U.S. hair salons.

However, while I believe my background and skills are ideally-suited to the challenges facing the Company right now, some of these critical challenges have risen to the forefront very late in the election cycle and only as a result of news reports on which the incumbent directors have not commented. Given this lateness, I do not believe there is sufficient time for me to promote the distinctive benefits of my candidacy to a sufficient number of shareholders to be elected. I also believe that promoting my candidacy at this time might take more votes away from F9 candidates than incumbent candidates, an outcome which I believe is more likely than not to be counter-productive to the interests of the Company's shareholders. For these reasons, I have made the difficult choice to publicly announce the withdrawal of my nomination for election at the 2024 annual meeting.

___________________________

1 Bloomberg News - "LL Flooring Taps AlixPartners For Operations as It Seeks Cash", June 27, 2024, available at: https://news.bloomberglaw.com/bankruptcy-law/ll-flooring-taps-alixpartners-for-operations-as-it-seeks-cash

2 Bloomberg News - "LL Flooring Mulls Bankruptcy Filing as Home Renovations Slow", July 3, 2024, available at: https://news.bloomberglaw.com/bankruptcy-law/ll-flooring-mulls-bankruptcy-filing-as-home-renovations-sputter

Disclaimers

This is not a solicitation of authority to vote your proxy. Please DO NOT send the author your proxy card. Unless expressly agreed to by the author, the author is not able to vote your proxy, nor does this communication contemplate such an event.

This is not an offer to enter into any agreement to act together with any shareholder for the purpose of acquiring, holding, voting, or disposing of equity securities. The author has no present intent to enter into a group pursuant to 17 CFR §

240.13d-5(b)(1).

The views expressed are those of the author as of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be a forecast of future events or a guarantee of future results. These

views may not be relied upon as investment advice. The information provided in this material should not be considered a recommendation to buy or sell any of the securities mentioned. It should not be assumed that investments in such securities

have been or will be profitable. This communication should not be construed as a research report.

LL Flooring (NYSE:LL)

Historical Stock Chart

From Jun 2024 to Jul 2024

LL Flooring (NYSE:LL)

Historical Stock Chart

From Jul 2023 to Jul 2024