John Hancock Bank and Thrift Opportunity Fund Declares Quarterly Managed Distribution

September 03 2004 - 1:50PM

PR Newswire (US)

John Hancock Bank and Thrift Opportunity Fund Declares Quarterly

Managed Distribution BOSTON, Sept. 3 /PRNewswire-FirstCall/ -- John

Hancock Bank and Thrift Opportunity Fund (NYSE:BTO) declared its

quarterly distribution pursuant to the fund's 10% managed

distribution policy today as follows: Declaration date: September

3, 2004 Ex-dividend date: September 9, 2004 Record date: September

13, 2004 Payment date: September 30, 2004 Source of Distribution

Per Share Long-term capital gain $0.27000 The plan requires the

fund to make quarterly distributions of at least 2.5 percent of the

fund's net asset value as of the preceding calendar year-end, or at

least 10 percent annually. To maximize tax efficiency, the

distributions will come first from net long-term capital gains (see

today's distribution), followed by ordinary income, net short-term

gains, and if necessary, a return of capital. Because net assets of

the fund will vary following each year-end, the quarterly

distribution may represent more or less than 2.5 percent of the

fund's net assets at the time of distribution. Also, if the

distributions under John Hancock Advisers' plan are less than the

amount the fund is required to distribute under the Internal

Revenue Code, the fund will distribute more than required under the

plan. The fund's board of trustees will periodically review the

plan to evaluate its effectiveness in reducing the fund's discount

to net asset value. As of the fund's most recent semiannual

reporting period ended April 30, 2004, BTO had over $865 million in

net assets of which 54% was net unrealized appreciation of

investments. For individual taxable accounts, long-term capital

gains are subject to at a maximum Federal tax rate of 15%. For the

1- year period ending July 31, 2004, BTO posted an average annual

total return at net asset value of 18.77%; 3-year, 11.41%; 5-year,

9.91% and since inception, 16.00%. John Hancock Bank and Thrift

Opportunity Fund is a diversified, closed-end fund. The Fund seeks

long-term capital appreciation by normally investing at least 80%

of its assets in equity securities of U.S. regional banks and

thrifts and holding companies that primarily own or receive a

substantial portion of their income from regional banks or thrifts.

John Hancock Funds, a premier investment management company,

managed $27 billion in open-end funds, closed-end funds, private

accounts and retirement plans for individual and institutional

investors as of June 30, 2004. Additional information about the

company can be found on the website: http://www.jhfunds.com/. John

Hancock Funds is a wholly owned subsidiary of John Hancock

Financial Services, Inc., a subsidiary of Manulife Financial

Corporation. Founded in 1862, John Hancock Financial Services and

its subsidiaries today offer a broad range of financial products

and services, including whole, term, variable, and universal life

insurance, as well as college savings products, mutual funds, fixed

and variable annuities, long-term care insurance and various forms

of business insurance. Manulife Financial is a leading

Canadian-based financial services group serving millions of

customers in 19 countries and territories worldwide. Operating as

Manulife Financial in Canada and most of Asia, and primarily

through John Hancock in the United States, the Company offers

clients a diverse range of financial protection products and wealth

management services through its extensive network of employees,

agents and distribution partners. Funds under management by

Manulife Financial and its subsidiaries were Cdn$360 billion

(US$269 billion) as at June 30, 2004. Manulife Financial

Corporation trades as 'MFC' on the TSX, NYSE and PSE, and under

'0945' on the SEHK. Manulife Financial can be found on the Internet

at http://www.manulife.com/. DATASOURCE: John Hancock Bank and

Thrift Opportunity Fund CONTACT: Kimberley Dietrich,

+1-617-375-0311, or Investors: +1-800-843-0090, both of John

Hancock

Copyright

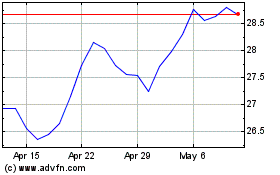

John Hancock Financial O... (NYSE:BTO)

Historical Stock Chart

From Jun 2024 to Jul 2024

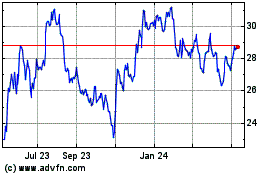

John Hancock Financial O... (NYSE:BTO)

Historical Stock Chart

From Jul 2023 to Jul 2024