UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the Month of July 2023

1-15240

(Commission File Number)

JAMES HARDIE INDUSTRIES plc

(Translation of registrant’s name into English)

First Floor, Block A

One Park Place

Upper Hatch Street, Dublin 2, D02, FD79, Ireland

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F..X.... Form 40-F.........

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): Not Applicable

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): Not Applicable

TABLE OF CONTENTS

Forward-Looking Statements

This Form 6-K contains forward-looking statements. James Hardie Industries plc (the “company”) may from time to time make forward-looking statements in its periodic reports filed with or furnished to the Securities and Exchange Commission, on Forms 20-F and 6-K, in its annual reports to shareholders, in offering circulars, invitation memoranda and prospectuses, in media releases and other written materials and in oral statements made by the company’s officers, directors or employees to analysts, institutional investors, existing and potential lenders, representatives of the media and others. Statements that are not historical facts are forward-looking statements and such forward-looking statements are statements made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995.

Examples of forward-looking statements include:

•statements about the company’s future performance;

•projections of the company’s results of operations or financial condition;

•statements regarding the company’s plans, objectives or goals, including those relating to strategies, initiatives, competition, acquisitions, dispositions and/or its products;

•expectations concerning the costs associated with the suspension or closure of operations at any of the company’s plants and future plans with respect to any such plants;

•expectations concerning the costs associated with the significant capital expenditure projects at any of the company’s plants and future plans with respect to any such projects;

•expectations regarding the extension or renewal of the company’s credit facilities including changes to terms, covenants or ratios;

•expectations concerning dividend payments and share buy-backs;

•statements concerning the company’s corporate and tax domiciles and structures and potential changes to them, including potential tax charges;

•statements regarding tax liabilities and related audits, reviews and proceedings;

•statements regarding the possible consequences and/or potential outcome of legal proceedings brought against us and the potential liabilities, if any, associated with such proceedings;

•expectations about the timing and amount of contributions to AICF, a special purpose fund for the compensation of proven Australian asbestos-related personal injury and death claims;

•expectations concerning the adequacy of the company’s warranty provisions and estimates for future warranty-related costs;

•statements regarding the company’s ability to manage legal and regulatory matters (including but not limited to product liability, environmental, intellectual property and competition law matters) and to resolve any such pending legal and regulatory matters within current estimates and in anticipation of certain third-party recoveries; and

•statements about economic or housing market conditions in the regions in which we operate, including but not limited to, the levels of new home construction and home renovations, unemployment levels, changes in consumer income, changes or stability in housing values, the availability of mortgages and other financing, mortgage and other interest rates, housing affordability and supply, the levels of foreclosures and home resales, currency exchange rates, and builder and consumer confidence.

Words such as “believe,” “anticipate,” “plan,” “expect,” “intend,” “target,” “estimate,” “project,” “predict,” “forecast,” “guideline,” “aim,” “will,” “should,” “likely,” “continue,” “may,” “objective,” “outlook” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. Readers are cautioned not to place undue reliance on these forward-looking statements and all such forward-looking statements are qualified in their entirety by reference to the following cautionary statements.

Forward-looking statements are based on the Company’s current expectations, estimates and assumptions and because forward-looking statements address future results, events and conditions, they, by their very nature, involve inherent risks and uncertainties, many of which are unforeseeable and beyond the Company’s control. Such known and unknown risks, uncertainties and other factors may cause actual results, performance or other achievements to differ materially from the anticipated results, performance or achievements expressed, projected or implied by these forward-looking statements. These factors, some of which are discussed under “Risk Factors” in Section 3 of the Form 20-F filed with the Securities and Exchange Commission on 16 May 2023, include, but are not limited to: all matters relating to or arising out of the prior manufacture of products that contained asbestos by current and former Company subsidiaries; required contributions to AICF, any shortfall in AICF funding and the effect of currency exchange rate movements on the amount recorded in the Company’s financial statements as an asbestos liability; compliance with and changes in tax laws and treatments; competition and product pricing in the markets in which the Company operates; the consequences of product failures or defects; exposure to environmental, asbestos, putative consumer class action or other legal proceedings; general economic and market conditions; the supply and cost of raw materials; possible increases in competition and the potential that competitors could copy the Company’s products; compliance with and changes in environmental and health and safety laws; risks of conducting business internationally; compliance with and changes in laws and regulations; currency exchange risks; dependence on customer preference and the concentration of the Company’s customer base; dependence on residential and commercial construction markets; the effect of adverse changes in climate or weather patterns; use of accounting estimates; and all other risks identified in the Company’s reports filed with Australian, Irish and US securities regulatory agencies and exchanges (as appropriate). The Company cautions you that the foregoing list of factors is not exhaustive and that other risks and uncertainties may cause actual results to differ materially from those referenced in the Company’s forward-looking statements. Forward-looking statements speak only as of the date they are made and are statements of the Company’s current expectations concerning future results, events and conditions. The Company assumes no obligation to update any forward-looking statements or information except as required by law.

EXHIBIT INDEX

| | | | | | | | |

| Exhibit No. | | Description |

| | Change in Substantial Holding |

| | Q1 FY24 Results Notification |

| | Change in Substantial Holding |

| | |

| | |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| | |

| | James Hardie Industries plc |

| Date: 21 July 2023 | | By: /s/ Aoife Rockett |

| |

| | Aoife Rockett |

| | Company Secretary |

EXHIBIT INDEX

| | | | | | | | |

| Exhibit No. | | Description |

| | Change in Substantial Holding |

| | Q1 FY24 Results Notification |

| | Change in Substantial Holding |

| | |

| | |

| | |

James Hardie Industries plc 1st Floor, Block A, One Park Place, Upper Hatch Street, Dublin 2, D02 FD79, Ireland T: +353 (0) 1 411 6924 F: +353 (0) 1 479 1128 James Hardie Industries plc is a limited liability company incorporated in Ireland with its registered office at 1st Floor, Block A, One Park Place, Upper Hatch Street, Dublin 2, D02 FD79, Ireland. Directors: Anne Lloyd (Chairperson, USA), Peter-John Davis (Aus), Persio Lisboa (USA), Renee Peterson (USA), Rada Rodriguez (Sweden), Suzanne B. Rowland (USA), Nigel Stein (UK), Harold Wiens (USA). Chief Executive Officer and Director: Aaron Erter (USA) Company number: 485719 ARBN: 097 829 895 17 July 2023 The Manager Company Announcements Office Australian Securities Exchange Limited 20 Bridge Street SYDNEY NSW 2000 Dear Sir/Madam Substantial Holding Notice As required under ASX Listing Rule 3.17.3 please see attached copy of the substantial holding notice received by James Hardie on 14 July 2023. Regards Aoife Rockett Company Secretary This announcement has been authorised for release by the Company Secretary, Ms Aoife Rockett.

NOTICE OF NOTIFIABLE INTEREST IN RELEVANT SHARE CAPITAL OF JAMES HARDIE INDUSTRIES PUBLIC LIMITED COMPANY (THE “COMPANY”) IN FULFILMENT OF AN OBLIGATION ARISING UNDER CHAPTER 4 OF PART 17 OF THE COMPANIES ACT 2014 James Hardie Industries Plc Level 20, 60 Castlereagh Street Sydney, NSW 2000 Australia 14 July 2023 ATTN: Company Secretary BY EMAIL: investor.relations@jameshardie.com.au Aoife.Rockett@jameshardie.com James.Brennan-Chong@jameshardie.com.au Media.Investor@jameshardie.com.au Greetings, This notification relates to issued ordinary shares in the capital of the Company and is given in fulfillment of the obligations imposed by Sections 1048 to 1050 and otherwise by Chapter 4 of Part 17 of the Companies Act 2014. The Vanguard Group, Inc. hereby notifies you that at the date of this notice it has a total notifiable interest in aggregate of 22,013,078 ordinary shares in the capital of the Company. The identity of the registered holders of shares to which this notification relates (so far as known to The Vanguard Group, Inc.) is set out in the attached schedule. Each of the products managed by The Vanguard Group, Inc., (the “Funds”) named in the attached schedule gives notice that, at the date of this notice, it has a total notifiable interest in the number of ordinary shares in the capital of the Company which is set out against its name. The identity of the registered holders of shares to which its notification relates (so far as known) is also set out against its name in the attached schedule. The address of The Vanguard Group, Inc. is: P.O. Box 2600, V26, Valley Forge, PA 19482, USA Yours faithfully, By: Shawn Acker

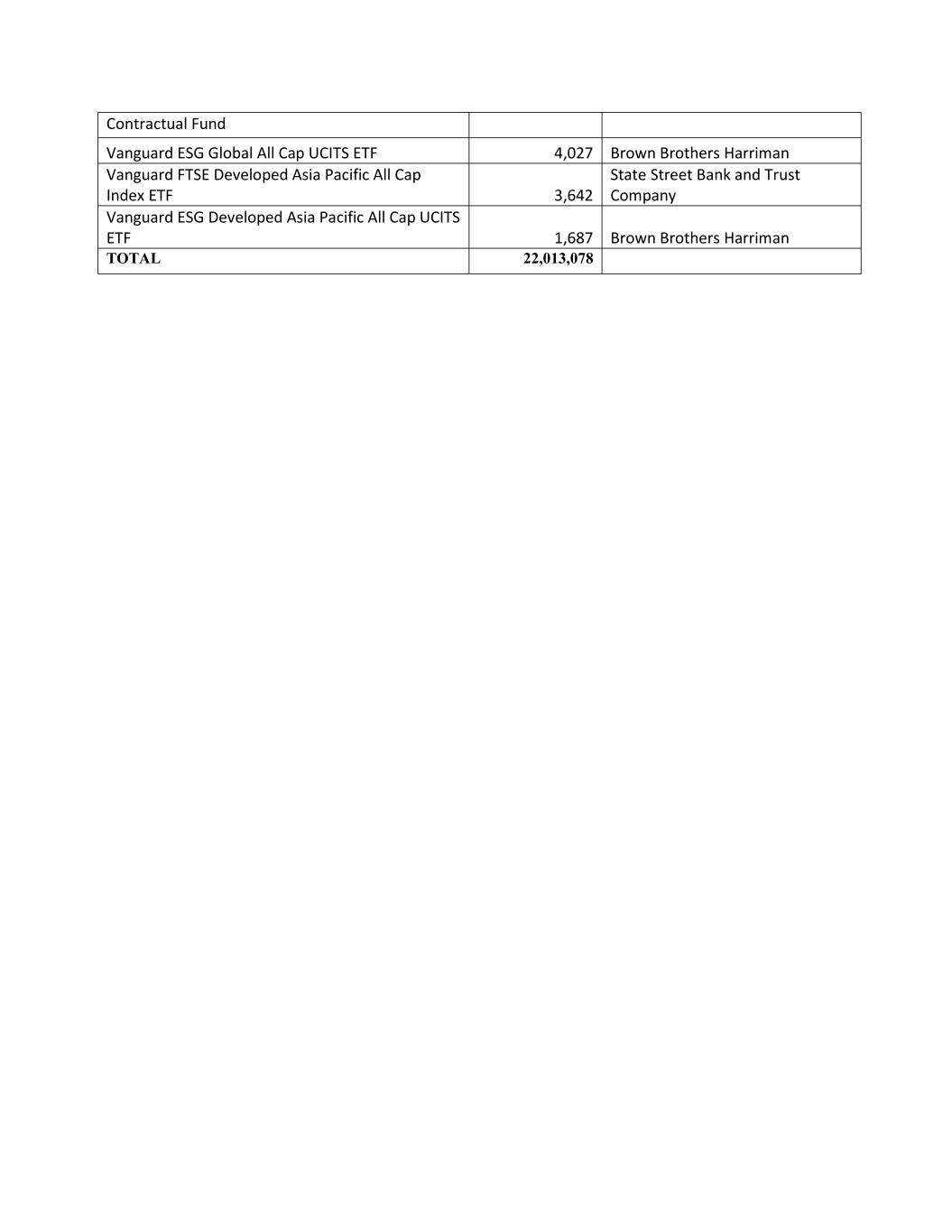

SCHEDULE Name and address of [Subsidiary]/[Fund] Number of shares Registered holder(s) of shares Vanguard Australian Shares Index Fund P.O. Box 2600, V26, Valley Forge, PA 19482, USA 6,034,129 JP Morgan Chase Bank Vanguard Total International Stock Index Fund 5,946,434 JP Morgan Chase Bank Vanguard Developed Markets Index Fund 3,530,415 State Street Bank and Trust Company Vanguard Institutional Total International Stock Market Index Trust II 2,736,371 JP Morgan Chase Bank Vanguard FTSE All-World ex-US Index Fund 895,042 Bank of New York Mellon Corporation Vanguard Pacific ex-Japan Stock Index Fund 833,928 Brown Brothers Harriman Vanguard Pacific Stock Index Fund 537,489 Bank of New York Mellon Corporation Vanguard Institutional Total International Stock Market Index Trust 360,360 JP Morgan Chase Bank Vanguard Total World Stock Index Fund 240,875 State Street Bank and Trust Company Vanguard FTSE Developed Asia Pacific ex Japan UCITS ETF 204,975 Brown Brothers Harriman Vanguard FTSE All-World UCITS ETF 128,470 Brown Brothers Harriman Vanguard FTSE Developed World ex-U.K. Equity Index Fund 125,587 State Street Bank and Trust Company Vanguard Global Stock Index Fund 116,462 Brown Brothers Harriman Vanguard ESG International Stock ETF 75,518 JP Morgan Chase Bank Vanguard FTSE Developed All Cap ex North America Index Fund 58,358 State Street Bank and Trust Company Vanguard Developed Markets Index Trust 54,177 State Street Bank and Trust Company Vanguard ESG Developed World All Cap Equity Index Fund 36,834 Brown Brothers Harriman Vanguard FTSE Developed World UCITS ETF 22,606 Brown Brothers Harriman Vanguard FTSE Global All Cap Index Fund 18,312 State Street Bank and Trust Company Vanguard SRI FTSE Developed World II (B) Common Contractual Fund 13,104 Brown Brothers Harriman Vanguard FTSE Developed World Common Contractual Fund 9,389 Brown Brothers Harriman Vanguard FTSE Developed World ex UK Common Contractual Fund 9,240 Brown Brothers Harriman Vanguard ESG Developed World All Cap Equity Index Fund (UK) 8,829 State Street Bank and Trust Company Vanguard SRI FTSE Developed World II Common 6,818 Brown Brothers Harriman

Contractual Fund Vanguard ESG Global All Cap UCITS ETF 4,027 Brown Brothers Harriman Vanguard FTSE Developed Asia Pacific All Cap Index ETF 3,642 State Street Bank and Trust Company Vanguard ESG Developed Asia Pacific All Cap UCITS ETF 1,687 Brown Brothers Harriman TOTAL 22,013,078

| | | | | |

Media Release 17 July 2023 | EXHIBIT 99.2 |

James Hardie Industries To Announce First Quarter Fiscal Year 2024 Financial Results on 8 August 2023

James Hardie Industries plc (ASX: JHX; NYSE: JHX) will announce financial results, for its first quarter ended 30 June 2023, on the ASX before market on Tuesday, 8 August 2023.

The Company will host a conference call that morning at 8:30am Australian Eastern Time (AET).

For those in North America the conference call will commence at 6:30pm Eastern Time (ET), Monday 7 August.

| | | | | |

Teleconference Registration: | https://s1.c-conf.com/diamondpass/10032004-gh81q3.html |

Webcast URL: | https://edge.media-server.com/mmc/p/fj9mx3qd |

Once registered, participants will receive a calendar invitation with global dial-in numbers and a unique PIN which will be required to join the call.

A replay of the call will be accessible shortly after the call and will be available at;

https://ir.jameshardie.com.au/financial-information/financial-results

This media release has been authorized by Mr. Aaron Erter, Chief Executive Officer.

END

Investor/Media/Analyst Enquiries:

James Brennan-Chong

Director of Investor Relations and Market Intelligence

| | | | | | | | |

| | |

Email: | | media@jameshardie.com.au |

James Hardie Industries plc is a limited liability company incorporated in Ireland with its registered office at 1st Floor, Block A, One Park Place, Upper Hatch Street, Dublin 2, D02 FD79, Ireland

| | | | | |

| Media Release: James Hardie to Announce First Quarter Fiscal Year 2024 Results | 1 |

James Hardie Industries plc 1st Floor, Block A, One Park Place, Upper Hatch Street, Dublin 2, D02 FD79, Ireland T: +353 (0) 1 411 6924 F: +353 (0) 1 479 1128 James Hardie Industries plc is a limited liability company incorporated in Ireland with its registered office at 1st Floor, Block A, One Park Place, Upper Hatch Street, Dublin 2, D02 FD79, Ireland. Directors: Anne Lloyd (Chairperson, USA), Peter-John Davis (Aus), Persio Lisboa (USA), Renee Peterson (USA), Rada Rodriguez (Sweden), Suzanne B. Rowland (USA), Nigel Stein (UK), Harold Wiens (USA). Chief Executive Officer and Director: Aaron Erter (USA) Company number: 485719 ARBN: 097 829 895 19 July 2023 The Manager Company Announcements Office Australian Securities Exchange Limited 20 Bridge Street SYDNEY NSW 2000 Dear Sir/Madam Substantial Holding Notice As required under ASX Listing Rule 3.17.3 please see attached copy of the substantial holding notice received by James Hardie on 18 July 2023. Regards Aoife Rockett Company Secretary This announcement has been authorised for release by the Company Secretary, Ms Aoife Rockett.

James Hardie Industries PLC Group Company Secretary 1st Floor, Block A, One Park Place, Upper Hatch Street, Dublin 2, D02 FD79, Ireland 18th July 2023 Dear Sir/Madam, Re: Disclosure of Holding below 3% Threshold. Mitsubishi UFJ Financial Group, Inc. (“MUFG”) on behalf of its subsidiaries: First Sentier Investors (Australia) IM Ltd, First Sentier Investors Realindex Pty Ltd, First Sentier Investors (Australia) RE Ltd, Mitsubishi UFJ Trust and Banking Corporation and Mitsubishi UFJ Kokusai Asset Management Co., Ltd. have a requirement to make subsequent disclosure under Section 1048/1050 of the Companies Act 2014. These entities have an aggregated interest in James Hardie Industries PLC, Chess Depository Interests of 2.98% ordinary share capital, as at 14th June 2023. This is based upon a total of 13,126,131 shares held and a total of 440,122,249 voting rights on issue. A previous announcement of 3.02% interest in relevant share capital was disclosed on the 7th July 2023 for value date 5th July 2023. The holdings dissection between entities within MUFG after notification obligation on 14th July 2023 are as follows. Entity Number of Securities % of the Total Issued Securities of the Class First Sentier Investors (Australia) IM Ltd 10,067,233 2.29% First Sentier Investors Realindex Pty Ltd 2,100,415 0.48% Mitsubishi UFJ Trust and Banking Corporation 768,263 0.17% Mitsubishi UFJ Kokusai Asset Management Co., Ltd 180,771 0.04% First Sentier Investors (Australia) RE Ltd 9,449 0.00% Total 13,126,131 2.98% (Note: Tallying up the individual entity’s percentage may not match the total percentage.)

Thank you for your attention in this matter. Yours Faithfully, …………………………………………. Signature Name and Title: Riyuuichirou Sakuma Managing Director Deputy Head of Credit Policy & Planning Division Mitsubishi UFJ Financial Group, Inc.

James Hardie Industries (NYSE:JHX)

Historical Stock Chart

From Mar 2024 to Apr 2024

James Hardie Industries (NYSE:JHX)

Historical Stock Chart

From Apr 2023 to Apr 2024