Invitation Homes Announces Voluntary Prepayment of IH 2018-4 Securitization

November 11 2024 - 6:45AM

Business Wire

Earliest Debt Maturity Now in 2027; 90 Percent

of Wholly-Owned Homes Now Unencumbered

Invitation Homes Inc. (NYSE: INVH) (“Invitation Homes” or the

“Company”) announced today that it has voluntarily prepaid without

penalty the outstanding balance of its IH 2018-4 securitization, as

planned.

As of September 30, 2024, the IH 2018-4 securitization had an

outstanding principal balance of approximately $630.2 million,

inclusive of approximately $31.6 million of retained certificates

held by Invitation Homes to comply with risk retention rules. The

Company prepaid the IH 2018-4 securitization using unrestricted

cash from its August 2023 bond issuance for the purpose of debt

prepayment, consistent with the Company’s previously stated use of

proceeds.

With the prepayment of IH 2018-4, the Company now has no debt

maturing prior to 2027, and on a pro forma basis as of September

30, 2024, approximately 90 percent of the Company’s wholly-owned

properties are unencumbered.

About Invitation Homes Invitation Homes, an S&P 500

company, is the nation's premier single-family home leasing and

management company, meeting changing lifestyle demands by providing

access to high-quality, updated homes with valued features such as

close proximity to jobs and access to good schools. The Company's

mission, "Together with you, we make a house a home," reflects its

commitment to providing homes where individuals and families can

thrive and high-touch service that continuously enhances residents'

living experiences.

Forward-Looking Statements This press release contains

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, which include, but are

not limited to, statements related to the Company’s expectations

regarding the performance of the Company’s business, its financial

results, its liquidity and capital resources, and other

non-historical statements. In some cases, you can identify these

forward looking statements by the use of words such as “outlook,”

“guidance,” “believes,” “expects,” “potential,” “continues,” “may,”

“will,” “should,” “could,” “seeks,” “projects,” “predicts,”

“intends,” “plans,” “estimates,” “anticipates,” or the negative

version of these words or other comparable words. Such

forward-looking statements are subject to various risks and

uncertainties, including, among others, risks inherent to the

single-family rental industry and the Company’s business model,

macroeconomic factors beyond the Company’s control, competition in

identifying and acquiring properties, competition in the leasing

market for quality residents, increasing property taxes,

homeowners’ association and insurance costs, poor resident

selection and defaults and non-renewals by the Company’s residents,

the Company’s dependence on third parties for key services, risks

related to the evaluation of properties, performance of the

Company’s information technology systems, development and use of

artificial intelligence, risks related to the Company’s

indebtedness, and risks related to the potential negative impact of

unfavorable global and United States economic conditions (including

inflation), uncertainty in financial markets (including as a result

of events affecting financial institutions), geopolitical tensions,

natural disasters, climate change, and public health crises, on the

Company’s financial condition, results of operations, cash flows,

business, associates, and residents. Accordingly, there are or will

be important factors that could cause actual outcomes or results to

differ materially from those indicated in these statements. The

Company believes these factors include, but are not limited to,

those described under Part I. Item 1A. “Risk Factors” of its Annual

Report on Form 10-K for the year ended December 31, 2023 (the

“Annual Report”), as such factors may be updated from time to time

in the Company’s periodic filings with the Securities and Exchange

Commission (the “SEC”), which are accessible on the SEC’s website

at www.sec.gov. These factors should not be construed as exhaustive

and should be read in conjunction with the other cautionary

statements that are included in this release, in the Annual Report,

and in the Company’s other periodic filings. The forward-looking

statements speak only as of the date of this press release, and the

Company expressly disclaims any obligation or undertaking to

publicly update or review any forward-looking statement, whether as

a result of new information, future developments or otherwise,

except to the extent otherwise required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241111888456/en/

Investor Relations Contact: Scott McLaughlin 844.456.INVH

(4684) IR@InvitationHomes.com

Media Relations Contact: Kristi DesJarlais 844.456.INVH

(4684) Media@InvitationHomes.com

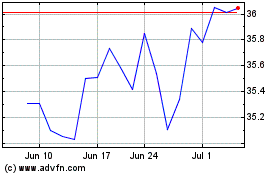

Invitation Homes (NYSE:INVH)

Historical Stock Chart

From Nov 2024 to Dec 2024

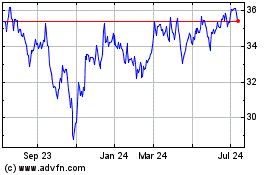

Invitation Homes (NYSE:INVH)

Historical Stock Chart

From Dec 2023 to Dec 2024