Form SC TO-C - Written communication relating to an issuer or third party

June 13 2024 - 4:23PM

Edgar (US Regulatory)

AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON JUNE 13, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE TO

ISSUER TENDER OFFER STATEMENT

(PURSUANT TO SECTION 13(e)(1) OF THE

SECURITIES EXCHANGE ACT OF 1934)

INVESCO TRUST FOR INVESTMENT GRADE NEW YORK MUNICIPALS

(Name of Subject Company (Issuer))

INVESCO TRUST FOR INVESTMENT GRADE NEW YORK MUNICIPALS

(Name of Filing Person (Issuer))

COMMON SHARES OF BENEFICIAL INTEREST, NO PAR VALUE

(Title of Class of Securities)

46131T101

(CUSIP Number of Class of Securities)

Melanie Ringold, Esquire

11 Greenway Plaza,

Houston, TX 77046

(713) 626-1919

(Name, Address and Telephone Number of Person Authorized to Receive

Notices and Communications on Behalf of Filing Person(s))

CALCULATION OF FILING FEE

|

TRANSACTION VALUATION*

|

AMOUNT OF FILING FEE

|

| |

None

|

This filing relates solely to preliminary communications made before the commencement of a tender offer.

* Set forth the amount on which the filing fee is calculated and state how it was determined.

|

☐

|

Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number,

or the Form or Schedule and the date of its filing.

|

Amount Previously Paid: ____________________________________________________

Form or Registration No.: __________________________________________________

Filing Party: ______________________________________________________________

Date Filed: ________________________________________________________________

|

☒

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

|

Check the appropriate boxes below to designate any transactions to which the statement relates:

| ☐ |

third-party tender offer subject to Rule 14d-1.

|

|

☒

|

issuer tender offer subject to Rule 13e-4.

|

|

☐

|

going-private transaction subject to Rule 13e-3.

|

|

☐

|

amendment to Schedule 13D under Rule 13d-2.

|

Check the following box if the filing is a final amendment reporting the results of the tender offer: ☐

If applicable, check the appropriate box(es) to designate the appropriate provision(s) being relied upon:

|

☐

|

Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

|

|

☐

|

Rule 14d-1(d) (Cross-Border Third Party Tender Offer)

|

| |

Press Release

For immediate release

|

| |

Invesco Trust for Investment Grade New York Municipals and Invesco Pennsylvania Value Municipal Income Trust Announce

Tender Offers

|

ATLANTA,

June 13, 2024 – Invesco Trust for Investment Grade New York Municipals (VTN) and Invesco Pennsylvania Value Municipal Income Trust (VPV) (each, a “Fund”; together, the “Funds”) announced today plans to commence tender offers.

Each Fund will conduct a cash tender offer for 25% of its outstanding common shares at a price equal to 99% of the Fund’s net

asset value (NAV) per share. Each Fund’s tender offer will commence not earlier than October 31, 2024 and not later than November 8, 2024. Each Fund will repurchase shares tendered and accepted in the tender offer in exchange for cash. In

the event a tender offer is oversubscribed, shares will be repurchased by the relevant Fund on a pro rata basis.

The commencement of the tender offer by each Fund results from a Standstill Agreement with Saba Capital Management, L.P.

(“Saba”) pursuant to which Saba has agreed to be bound by, and to cause certain of its affiliates to comply with, certain standstill covenants.

The Funds have been advised that Saba will file a copy of each Agreement with the U.S. Securities and Exchange Commission

("SEC") as an exhibit to its relevant Schedule 13D.

TENDER OFFER STATEMENT

The above statements are not intended to constitute an offer to participate in a tender offer. Information about each Fund’s

tender offer, including its commencement, will be announced through future press releases. Shareholders of a Fund will be notified in accordance with the requirements of the Securities Exchange Act of 1934, as amended, and the Investment

Company Act of 1940, as amended, either by publication or mailing or both. Each Fund’s tender offer will be made only by an offer to purchase, a related letter of transmittal and other documents to be filed with the SEC. Shareholders of a

Fund should read the relevant offer to purchase and tender offer statement and related exhibits when those documents are filed and become available, as they will contain important information about the Fund’s tender offer. These and other

filed documents will be available to investors for free both at the website of the SEC and from the relevant Fund.

_____________________________________

For investor inquires call 1-800-341-2929.

For media relations inquiries

contact mediarelations@invesco.com

This communication is not intended to, and shall not, constitute an offer to purchase or sell shares

of any of the Invesco Funds, including either Fund.

About Invesco Ltd.

Invesco Ltd. is a global independent investment management firm dedicated to delivering an investment experience that helps

people get more out of life. Our distinctive investment teams deliver a comprehensive range of active, passive and alternative investment capabilities. With offices in more than 20 countries, Invesco managed $1.66 trillion in assets on

behalf of clients worldwide as of March 31, 2024. For more information, visit www.invesco.com.

Invesco Distributors, Inc. is the U.S. distributor for Invesco Ltd.’s retail products. Invesco Advisers, Inc. is an

investment adviser; it provides investment advisory services to individual and institutional clients and does not sell securities. Each entity is a wholly owned indirect subsidiary of Invesco Ltd.

Note: There is no

assurance that a closed-end fund will achieve its investment objective. Common shares are bought on the secondary market and may trade at a discount or premium to NAV. Regular brokerage commissions apply.

NOT A DEPOSIT l NOT FDIC INSURED l NOT GUARANTEED BY THE BANK | MAY LOSE VALUE | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

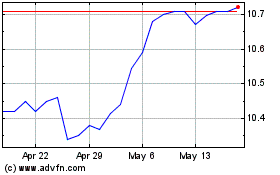

Invesco Trust for Invest... (NYSE:VTN)

Historical Stock Chart

From Nov 2024 to Dec 2024

Invesco Trust for Invest... (NYSE:VTN)

Historical Stock Chart

From Dec 2023 to Dec 2024