Vitran Corporation Inc. Receives Offer of US$6.50 Per Share From TransForce Inc.

December 20 2013 - 4:30PM

Vitran Corporation Inc. ("Vitran" or the "Company") (Nasdaq:VTNC)

(TSX:VTN), a premier Canadian less-than-truckload transportation

firm, announced today that it has received an unsolicited offer

from an affiliate of TransForce Inc.

("

TransForce") to acquire all of the outstanding

common shares of Vitran for US$6.50 in cash per share (the

"

TransForce Offer"). The Board of Directors of

Vitran (the "

Board") has determined, after

receiving the advice of its financial advisors and legal counsel,

that the TransForce Offer constitutes a "Superior Proposal" as

defined in the arrangement agreement among Vitran, 2398946 Ontario

Inc. and North Channel of Georgian Bay Holdings Ltd. (collectively,

"

Manitoulin Transport"), announced on December 9,

2013 (the "

Manitoulin Agreement"). In accordance

with the terms of the Manitoulin Agreement, Vitran has provided

notice of such determination to Manitoulin Transport.

At this time, the Board has not changed its recommendation with

respect to the pending transaction with Manitoulin Transport. Under

the terms of the Manitoulin Agreement, Manitoulin has a period of

five business days, expiring at 11:59 pm EST on December 31, 2013

(the "Response Period"), during which it can offer

to amend the terms of the Manitoulin Agreement. Manitoulin

Transport is under no obligation to make such an offer. If, within

the Response Period, Manitoulin offers to amend the Manitoulin

Agreement such that the Board determines that the TransForce Offer

would cease to be a Superior Proposal, Vitran will be required to

enter into an amendment to the Manitoulin Agreement and implement

the amended agreement. If, within the Response Period,

Manitoulin does not offer to amend the Manitoulin Agreement, or if

the proposed TransForce Offer continues to be a Superior Proposal

following a proposed amendment to the Manitoulin Agreement, Vitran

intends to accept the TransForce Offer, terminate the Manitoulin

Agreement and pay to Manitoulin Transport the agreed termination

fee of US$4 million, all in accordance with the terms of the

Manitoulin Agreement.

The Board cautions that there can be no assurance that the

TransForce Offer will lead to the termination of the Manitoulin

Agreement and the execution of an arrangement agreement with

TransForce, or that the transaction contemplated by the TransForce

Offer will be approved by shareholders or consummated.

Stephens Inc. is serving as financial advisor to Vitran in

connection with the transaction. McMillan LLP is Canadian legal

counsel to Vitran and Dorsey & Whitney LLP is United States

legal counsel to Vitran.

About Vitran Corporation Inc.

Vitran Corporation Inc., through its wholly-owned subsidiaries,

is a group of transportation companies offering national, regional,

expedited and transborder less-than-truckload services throughout

Canada. To find out more about Vitran Corporation Inc.

(Nasdaq:VTNC) (TSX:VTN), visit the website at www.vitran.com.

This press release contains forward‐looking statements within

the meaning of the United States Private Securities Litigation

Reform Act of 1995 and applicable Canadian securities laws.

Forward‐looking statements may be generally identifiable by use of

the words "believe", "anticipate", "intend", "estimate", "expect",

"project", "may", "plans", "continue", "will", "focus", "should",

"endeavour" or the negative of these words or other variations on

these words or comparable terminology. These forward-looking

statements are based on current expectations and are naturally

subject to uncertainty and changes in circumstances that may cause

actual results to differ materially from those expressed or implied

by such forward‐looking statements.

Such forward-looking statements involve known and unknown risks,

uncertainties and other factors that may cause Vitran's actual

results, performance or achievements to differ materially from

those projected in the forward‐looking statements. Factors that may

cause such differences include, but are not limited to,

technological change, increases in fuel costs, regulatory changes,

the general health of the economy, seasonal fluctuations,

unanticipated changes in railroad capacities, exposure to credit

risks, changes in labour relations and competitive factors. More

detailed information about these and other factors is included in

the annual MD&A on Form 10K under the heading "General Risks

and Uncertainties." Many of these factors are beyond the Company's

control; therefore, future events may vary substantially from what

the Company currently foresees. You should not place undue reliance

on such forward‐looking statements. Vitran Corporation Inc. does

not assume the obligation to revise or update these forward-looking

statements after the date of this document or to revise them to

reflect the occurrence of future unanticipated events, except as

may be required under applicable securities laws.

CONTACT: William Deluce, Interim President/CEO

Fayaz Suleman, VP Finance/CFO

Vitran Corporation Inc.

416/596-7664

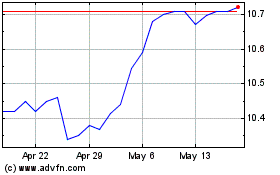

Invesco Trust for Invest... (NYSE:VTN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Invesco Trust for Invest... (NYSE:VTN)

Historical Stock Chart

From Nov 2023 to Nov 2024