ATLANTA, Feb. 21 /PRNewswire-FirstCall/ -- Haverty Furniture

Companies, Inc. (NYSE:HVTNYSE:andNYSE:HVT.A) today reported

earnings for the fourth quarter and the year ended December 31,

2007. Earnings for the fourth quarter were $1.6 million, or $0.07

per diluted share, compared with $3.2 million, or $0.14 per diluted

share in the fourth quarter of 2006. Earnings for the year ended

December 31, 2007 were $1.8 million, or $0.08 per diluted share,

compared with $16.0 million, or $0.70 per diluted share for 2006.

As previously reported, sales for the fourth quarter were $205.8

million, or 4.7% less than the sales in the corresponding quarter

in 2006. Sales for the year ended December 31, 2007 decreased 8.7%

to $784.6 million from $859.1 million in 2006. Comparable-store

sales in 2007 decreased 7.7% for the fourth quarter and decreased

10.6% for the year. Clarence H. Smith, president and chief

executive officer, said, "Early last month we announced that our

fourth quarter sales declined once again in an increasingly

difficult macro environment. We face a continued challenge to

review all aspects of our business operations and have made good

progress in several areas. "Our better control of inventory is

reflected in improved gross margins as we had lower close out and

mark-down activity during the quarter. Gross margins were also

positively impacted by less volume of internally financed

no-interest credit promotions. We expect to continue showing modest

improvement in gross profit margin in 2008. "Cost controls in all

areas resulted in a reduction of our SG&A expenses by $1.2

million in the fourth quarter and $13.4 million for 2007 versus the

comparable prior periods. Significant improvement was made in our

advertising costs due to much closer analysis of individual markets

and the effectiveness of the media placement. We believe that the

enhanced print and television ad quality and stronger placement are

beginning to have a real payoff. Advertising expense to sales was

reduced by 46 basis points in the fourth quarter versus last year's

same period and our surveys indicate we are strengthening our brand

with increasing consumer top of mind awareness in our markets.

"Good reductions were shown in delivery and administrative expenses

for both the quarter and year. Occupancy costs have risen as four

new stores were opened during the year and two were relocated to

better sites. Expenses for third party credit promotions have grown

as we outsourced a larger portion of financed sales and used more

appealing and costly credit offerings. "Our inventories were very

well controlled at $102.5 million, down $22.3 million from the

beginning of the year. This is $8.7 million higher than the end of

the third quarter when we were at a lower level than optimal for

providing prompt service in fulfilling customer demand. We are

temporarily building inventories in the first quarter due to many

of our suppliers' factories in Asia closing for two weeks or more

around the Chinese New Year. "Accounts receivable reductions

provided another $11 million in cash flow for the year while total

cash provided by operating activities was $39.1 million. These

funds allowed us to pay down $23.0 million of debt for the year and

repurchase $12.4 million of our stock at an average price of $9.32

per share. That equates to 1,329,000 shares, 5.9% of the total

outstanding at the start of the year. "We are rolling out the

second phase of our new havertys.com next month which will provide

on-line sales transactions and other enhancements. The continued

main focus of havertys.com is to drive customers to our stores with

more knowledge about us and our merchandise and with a stronger

inclination to buy," Smith concluded. Havertys is a full-service

home furnishings retailer with 124 showrooms in 17 states in the

Southern and Midwestern regions providing its customers with a wide

selection of quality merchandise in middle- to upper-middle price

ranges. Additional information is available on the Company's

website at http://www.havertys.com/ . News releases include

forward-looking statements, which are subject to risks and

uncertainties. Factors that might cause actual results to differ

materially from future results expressed or implied by such

forward-looking statements include, but are not limited to, general

economic conditions, the consumer spending environment for large

ticket items, competition in the retail furniture industry and

other uncertainties detailed from time to time in the Company's

reports filed with the SEC. The Company will sponsor a conference

call Friday, February 22, 2008 at 10:00 a.m. Eastern Time to review

the fourth quarter and year end. Listen- only access to the call is

available via the web at http://www.havertys.com/ (About Us) and at

http://www.streetevents.com/ (Individual Investor Center), both

live and for a limited time, on a replay basis. HAVERTY FURNITURE

COMPANIES, INC. and SUBSIDIARIES Condensed Consolidated Statements

of Income (Amounts in thousands except per share data) (Unaudited)

Quarter Ended Year Ended December 31, December 31, 2007 2006 2007

2006 Net sales $205,770 $216,038 $784,613 $859,101 Cost of goods

sold 101,882 107,596 394,863 432,946 Gross profit 103,888 108,442

389,750 426,155 Credit service charges 597 687 2,450 2,823 Gross

profit and other revenue 104,485 109,129 392,200 428,978 Expenses:

Selling, general and administrative 102,467 103,621 391,105 404,518

Interest, net (584) (219) (1,307) (363) Provision for doubtful

accounts 543 388 1,328 656 Other (income) expense, net (143) (120)

(870) (1,457) Total expenses 102,283 103,670 390,256 403,354 Income

before income taxes 2,202 5,459 1,944 25,624 Income tax expense 566

2,289 186 9,624 Net income $1,636 $3,170 $1,758 $16,000 Basic

earnings per share: Common Stock $0.08 $0.14 $0.08 $0.72 Class A

Common Stock $0.07 $0.13 $0.07 $0.67 Diluted earnings per share:

Common Stock $0.07 $0.14 $0.08 $0.70 Class A Common Stock $0.07

$0.13 $0.07 $0.67 Weighted average shares - basic: Common Stock

17,702 18,460 18,300 18,336 Class A Common Stock 4,138 4,210 4,165

4,247 Weighted average shares - assuming dilution(1): Common Stock

21,956 22,935 22,589 22,895 Class A Common Stock 4,138 4,210 4,165

4,247 Cash dividends per common share: Common Stock $0.0675 $0.0675

$0.2700 $0.2700 Class A Common Stock $0.0625 $0.0625 $0.2500

$0.2500 (1) See additional details at the end of this release.

HAVERTY FURNITURE COMPANIES, INC. and SUBSIDIARIES Condensed

Consolidated Balance Sheets (Amounts in thousands) (Unaudited) Year

Ended December 31, 2007 2006 Assets Cash and cash equivalents $167

$12,139 Accounts receivable, net of allowance 58,748 63,996

Inventories, at LIFO cost 102,452 124,764 Other current assets

17,569 18,410 Total Current Assets 178,936 219,309 Accounts

receivable, long-term 8,003 14,974 Property and equipment, net

209,912 221,245 Other assets 25,086 14,226 $421,937 $469,754

Liabilities and Stockholders' Equity Notes payable to banks $--

$12,600 Accounts payable and accrued liabilities 67,344 79,826

Customer deposits 17,183 19,674 Current portion of long-term debt

and lease obligations 8,353 10,334 Total Current Liabilities 92,880

122,434 Long-term debt and lease obligations, less current portion

20,331 27,515 Other liabilities 29,881 27,882 Stockholders'

equity(1) 278,845 291,923 $421,937 $469,754 (1) See additional

details at the end of this release HAVERTY FURNITURE COMPANIES,

INC. and SUBSIDIARIES Condensed Consolidated Statements of Cash

Flows (Amounts in thousands) (Unaudited) Year Ended December 31,

2007 2006 Operating Activities Net income $1,758 $16,000

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization 22,416 21,663

Provision for doubtful accounts 1,328 656 Deferred income taxes

(6,063) (3,870) (Gain) loss on sale of property and equipment (221)

(1,162) Other 1,782 1,598 Changes in operating assets and

liabilities Accounts receivable 10,891 11,484 Inventories 22,312

(17,133) Customer deposits (2,491) (7,843) Other assets and

liabilities 764 10,242 Accounts payable and accrued liabilities

(13,367) (3,623) Net cash provided by operating activities 39,109

28,012 Investing Activities Capital expenditures (13,830) (23,640)

Proceeds from sale of land, property and equipment 3,523 3,659

Other investing activities 173 78 Net cash used in investing

activities (10,134) (19,903) Financing Activities Proceeds from

borrowings under revolving credit facilities 378,775 814,780

Payments of borrowings under revolving credit facilities (391,375)

(806,480) Net (decrease) increase in borrowings under revolving

credit facilities (12,600) 8,300 Payments on long-term debt and

lease obligations (10,367) (11,871) Treasury stock acquired

(12,385) - Proceeds from exercise of stock options 346 2,095

Dividends paid (5,979) (6,014) Tax benefits related to share-based

plans 38 399 Net cash used in financing activities (40,947) (7,091)

(Decrease) increase in cash and cash equivalents (11,972) 1,018

Cash and cash equivalents at beginning of the year 12,139 11,121

Cash and cash equivalents at end of year $167 $12,139 HAVERTY

FURNITURE COMPANIES, INC. and SUBSIDIARIES Earnings per Share The

following details how the number of shares in calculating the

diluted earnings per share for Common Stock are derived under SFAS

128 and EITF 03-6 (shares in thousands): Quarter Ended Year Ended

December 31, December 31, 2007 2006 2007 2006 Common Stock:

Weighted-average shares outstanding 17,702 18,460 18,300 18,336

Assumed conversion of Class A Common shares 4,138 4,210 4,165 4,247

Dilutive options and stock awards 116 265 124 312 Total

weighted-average diluted common shares 21,956 22,935 22,589 22,895

Contact for information: Dennis L. Fink, EVP & CFO or Jenny

Hill Parker, VP, Secretary & Treasurer 404-443-2900 DATASOURCE:

Haverty Furniture Companies, Inc. CONTACT: Dennis L. Fink, EVP

& CFO or Jenny Hill Parker, VP, Secretary & Treasurer,

+1-404-443-2900, both of Haverty Furniture Companies, Inc. Web

site: http://www.havertys.com/

Copyright

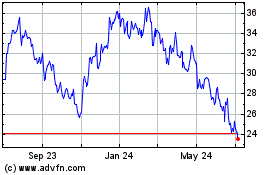

Haverty Furniture Compan... (NYSE:HVT)

Historical Stock Chart

From Sep 2024 to Oct 2024

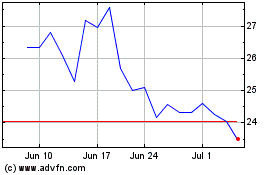

Haverty Furniture Compan... (NYSE:HVT)

Historical Stock Chart

From Oct 2023 to Oct 2024