Harmony Gold Mining: New Study Increases Production Forecast at Wafi-Golpu

March 19 2018 - 2:47AM

Dow Jones News

By Oliver Griffin

Harmony Gold Mining Co. (HAR.JO) said Monday that a new

feasibility study for its Wafi-Golpu project in Papua New Guinea

has led to an increase in the forecast for annual copper and gold

production to 161,000 tons and 266,000 ounces respectively.

The South African gold miner said that the net present value of

the mine grew 33% to $2.6 billion as a result of the study, adding

that average annual free cash flow for the mine in the first 10

years of production is forecast at $900 million.

Harmony Gold Mining, which owns 50% of the Wafi-Golpu project,

said that it expects the first ore to be milled just under five

years after it is granted a special mining lease by the government

of Papua New Guinea.

The gold miner intends to submit amended supporting

documentation toward the special mining lease on March 20, Harmony

Gold Mining said.

Harmony Gold Mining also said that it hopes to submit an

environmental-impact statement for the mine by the end of June.

Write to Oliver Griffin

(END) Dow Jones Newswires

March 19, 2018 02:32 ET (06:32 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

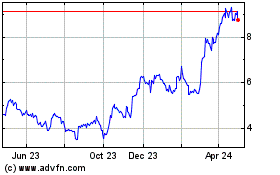

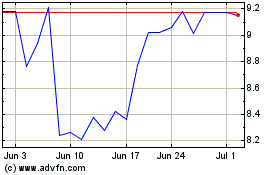

Harmony Gold Mining (NYSE:HMY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Harmony Gold Mining (NYSE:HMY)

Historical Stock Chart

From Apr 2023 to Apr 2024