GSK to Acquire Canadian BELLUS Health for Around $2 Billion

April 18 2023 - 2:48AM

Dow Jones News

By Michael Susin

GSK PLC said Tuesday that it has reached an agreement to buy the

late-stage biopharmaceutical company BELLUS Health Inc. for $14.75

a share in cash, representing a total equity value of around $2.0

billion.

The pharmaceutical giant said the deal will provide access to

camlipixant, a treatment for refractory chronic cough currently in

phase III development.

Following the anticipated regulatory approval and launch of

camlipixant in 2026, the acquisition of the Canada-based company is

expected to be accretive to adjusted earnings per share--which

strips out exceptional and other one-off items--from 2027 and has

the potential to deliver significant sales through 2031 and beyond,

it added.

"This proposed acquisition complements our portfolio of

specialty medicines and builds on our expertise in respiratory

therapies," Chief Commercial Officer Luke Miels said.

Write to Michael Susin at michael.susin@wsj.com

(END) Dow Jones Newswires

April 18, 2023 02:33 ET (06:33 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

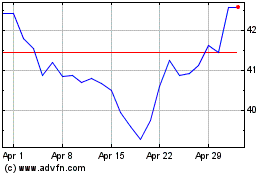

GSK (NYSE:GSK)

Historical Stock Chart

From Mar 2024 to Apr 2024

GSK (NYSE:GSK)

Historical Stock Chart

From Apr 2023 to Apr 2024