0001928446

false

0001928446

2023-08-25

2023-08-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 OR 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 25, 2023

GRANITE RIDGE RESOURCES, INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

001-41537 |

88-2227812 |

|

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

|

5217 McKinney Avenue, Suite 400

Dallas, Texas |

75205 |

| (Address of principal executive offices) |

(Zip Code) |

(214)

396-2850

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425

under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common

stock, par value $0.0001 per share |

GRNT |

New

York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

| Item 5.01 | Changes in Control of Registrant. |

Change in Control

On August 25, 2023, Grey Rock

Energy Fund III-A, LP, Grey Rock Energy Fund III-B, LP, and Grey Rock Energy Fund III-B Holdings, LP, each a Delaware limited partnership,

and their affiliates (collectively, “Grey Rock Fund III”), which collectively owned a majority of the voting common stock

of Granite Ridge Resources, Inc., a Delaware corporation (“Granite Ridge,” the “Company,” “us” or

“we”), distributed an aggregate of 31,649,616 shares of common stock of the Company, par value $0.0001 per share (the “Common

Stock”), pro rata to their limited partners (the “Distribution”). As a result of the Distribution, Grey Rock Fund III’s

aggregate ownership of shares of Common Stock was reduced from approximately 71% to approximately 47%.

Also on August 25, 2023, Grey

Rock Energy Partners GP III, L.P., a Delaware limited partnership (who has voting and dispositive power over Common Stock owned by Grey

Rock Fund III and certain of its affiliates) (“Grey Rock GP III”), Grey Rock Energy Partners GP II, L.P., a Delaware limited

partnership (who has voting and dispositive power over Common Stock owned by Grey Rock Energy Fund II, L.P., Grey Rock Energy Fund II-B,

LP, and Grey Rock Energy Fund II-B Holdings, L.P., each a Delaware limited partnership, and certain of their affiliates (collectively,

“Grey Rock Fund II”)), and Matthew Miller, Griffin Perry, Thaddeus Darden and Kirk Lazarine (collectively, the “Voting

Agreement Parties”), entered into a Stockholder Voting Agreement (the “Voting Agreement”).

Pursuant to the Voting Agreement,

the Voting Agreement Parties irrevocably and unconditionally agreed to vote the 75,957,927 shares of Common Stock which the Voting Agreement

Parties then held (and any other shares of Common Stock obtained by Voting Agreement Parties in the future) at any annual or special meeting

of the Company’s stockholders or in connection with any written consent of the Company’s stockholders. The 75,957,927 shares

held by the Voting Agreement Parties constitute approximately 56.3% of the total outstanding shares of Common Stock as of the date of

the Voting Agreement. The Voting Agreement continues indefinitely, but can be terminated on 30 days prior written notice by Voting Agreement

Parties holding a majority of the shares of Common Stock subject to the Voting Agreement. In connection with their entry into the Voting

Agreement, the Voting Agreement Parties provided Grey Rock GP III an irrevocable voting proxy to vote the shares subject to the Voting

Agreement. Additionally, during the term of such agreement, the Voting Agreement Parties agreed not to transfer the shares covered by

the Voting Agreement without the consent of Grey Rock GP III, except pursuant to certain limited exceptions. Due to the Voting Agreement,

Grey Rock GP III has voting and dispositive power over a majority of the shares of Company due to its ability to vote the outstanding

shares of Common Stock held by the Voting Agreement Parties. As a result, under the SEC’s rules with respect to the beneficial ownership

of securities, GREP GP III, LLC, a Delaware limited liability company (“Fund III GP”), the sole general partner of Grey Rock

GP III (with respect to the share of Common Stock held by members of the Voting Agreement), may be deemed to have acquired control of

the Company.

The Voting Agreement Parties

have informed the Company that no monetary consideration was given or received by any party in exchange for executing the Voting Agreement.

Other than as described above,

the Company is not aware of any arrangements, including any pledge by any person of securities of the Company or any of its parents, the

operation of which may at a subsequent date result in a change in control of the Company.

Controlled Company Exemptions

As discussed above, Fund III

GP, as the sole general partner of Grey Rock GP III, controls more than 50% of the voting power of the outstanding shares of capital stock

of the Company. As a result, the Company qualifies as a “controlled company” within the meaning of the corporate governance

standards of the rules of the New York Stock Exchange (the “NYSE”). Under these rules, a listed company of which more than

50% of the voting power is held by an individual, group or another company is a “controlled company” and may elect not to

comply with certain corporate governance requirements, including (i) the requirement that a majority of the board of directors of Granite

Ridge (the “Granite Ridge Board”) consist of independent directors; (ii) the requirement that our director nominations be

made, or recommended to the full Granite Ridge Board, by our independent directors or by a nominations committee that is comprised entirely

of independent directors and that we adopt a written charter or board resolution addressing the nominations process; and (iii) the requirement

that we have a compensation committee that is composed entirely of independent directors with a written charter addressing the committee’s

purpose and responsibilities.

As long as Granite Ridge remains

a “controlled company,” Granite Ridge may elect to take advantage of any of these exemptions. The Granite Ridge Board does

not have a majority of independent directors, its compensation committee does not consist entirely of independent directors, and it does

not have a nominating committee. Granite Ridge intends to elect all available controlled company exemptions under the corporate governance

standards of the rules of the NYSE.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit No. |

|

Description |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

|

|

|

| |

|

GRANITE RIDGE RESOURCES, INC. |

| |

|

|

| Date: August 31, 2023 |

By: |

/s/ Luke C. Brandenberg |

| |

|

Name: |

Luke C. Brandenberg |

| |

|

Title: |

President and Chief Executive Officer |

v3.23.2

Cover

|

Aug. 25, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 25, 2023

|

| Entity File Number |

001-41537

|

| Entity Registrant Name |

GRANITE RIDGE RESOURCES, INC.

|

| Entity Central Index Key |

0001928446

|

| Entity Tax Identification Number |

88-2227812

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

5217 McKinney Avenue

|

| Entity Address, Address Line Two |

Suite 400

|

| Entity Address, City or Town |

Dallas

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75205

|

| City Area Code |

214

|

| Local Phone Number |

396-2850

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

stock, par value $0.0001 per share

|

| Trading Symbol |

GRNT

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

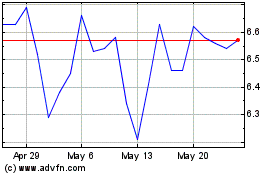

Granite Ridge Resources (NYSE:GRNT)

Historical Stock Chart

From Apr 2024 to May 2024

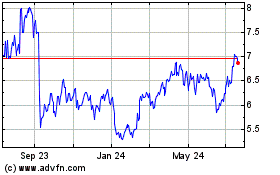

Granite Ridge Resources (NYSE:GRNT)

Historical Stock Chart

From May 2023 to May 2024