Global Net Lease, Inc. (NYSE: GNL) (“GNL” or the “Company”), an

internally managed real estate investment trust that focuses on

acquiring and managing a globally diversified portfolio of

strategically located commercial real estate properties, announced

today its financial and operating results for the quarter ended

September 30, 2024.

Third Quarter 2024

Highlights

- Revenue was $196.6 million compared

to $203.3 million in second quarter 2024, primarily as a

result of asset dispositions during the third quarter

- Net loss attributable to common

stockholders was $76.6 million, compared to net loss of $46.6

million in second quarter 2024

- Core Funds from Operations (“Core

FFO”) was $53.9 million compared to $50.9 million in second quarter

2024

- Adjusted Funds from Operations

(“AFFO”) was $73.9 million, or $0.32 per share, compared to $76.7

million in second quarter 2024, or $0.33 per share

- Closed plus disposition pipeline

totaled $950.2 million2 at a cash cap rate of 7.1% on occupied

assets and a weighted average remaining lease term of 5.1 years;

includes $187.5 million of vacant closed plus pipeline dispositions

that are expected to reduce annualized operating expenses by over

$3 million per year

- Closed $568.7 million of

dispositions through third quarter 2024; plan to use the net

proceeds from $371.4 million disposition pipeline to further reduce

leverage, keeping us on track with our guidance

- Reduced net debt by

$445 million so far this year, improving Net Debt to Adjusted

EBITDA from 8.4x to 8.0x

- Addressed 100% of the outstanding

debt that was set to mature in 2024; no debt maturities through

third quarter 2025

- Recognized $85 million in cost

synergies, significantly surpassing the anticipated $75 million

projected at the close of the Merger, underscoring the

effectiveness of GNL’s integration efforts and highlighting its

strong execution capabilities

- Leased 1.2 million square feet

across the portfolio, resulting in nearly $16 million of new

straight-line rent

- Renewal leasing spread of 4.2% with

a weighted average lease term of 5.2 years; new leases completed in

the quarter had a weighted average lease term of 6.5 years

- Weighted average annual rent

increase of 1.3% provides organic rental growth, excluding 15.3% of

the portfolio with CPI-linked leases that have historically

experienced significantly higher rental increase

- Sector-leading 61% of annualized

straight-line rent comes from investment-grade or implied

investment-grade tenants3

“The third quarter was another successful period

for GNL that showcased our steady progress toward achieving key

financial objectives established at the beginning of the year,”

stated Michael Weil, CEO of GNL. “We significantly exceeded our

stated $75 million cost synergy target by reaching a total of $85

million of annual, recurring savings, and further reduced net debt

by $162 million, totaling $445 million through the third

quarter. Our leasing momentum remained strong, with occupancy

rising from 94% to 96%, and proactively managed near-term debt

maturities with no debt maturities until the third quarter of 2025.

We believe we are well-positioned to reach the upper end of our

disposition target of $800 million, with closed plus

disposition pipeline totaling $950 million at a cash cap rate

of 7.1% on occupied assets. We are particularly pleased with our

recent occupied office sales, which reduced our exposure to this

sector and were sold at a 7.7% cash cap rate. This highlights our

ability to reduce our exposure to non-core office at attractive cap

rates, underscoring our commitment to enhancing our overall

portfolio. The 7.1% cash cap rate we are achieving on the announced

disposition of occupied assets represents a significant premium

compared to the implied value of this portfolio based on the

current trading price. We are excited to build on this positive

momentum and finish the year on a strong note.”

Full Year 2024 Guidance

Update4

- GNL reaffirms its disposition

guidance range of $650 million to $800 million in total proceeds in

2024.

- GNL reaffirms its 2024 AFFO per

share guidance range of $1.30 to $1.40 and a net debt to Adjusted

EBITDA range of 7.4x to 7.8x.

Summary of Results

| |

|

Three Months Ended September 30, |

|

Three Months Ended June 30, |

|

(In thousands, except per share data) |

|

|

2024 |

|

|

|

2024 |

|

|

Revenue from tenants |

|

$ |

196,564 |

|

|

$ |

203,286 |

|

| |

|

|

|

|

| Net loss attributable to

common stockholders |

|

$ |

(76,571 |

) |

|

$ |

(46,600 |

) |

| Net loss per diluted common

share |

|

$ |

(0.33 |

) |

|

$ |

(0.20 |

) |

| |

|

|

|

|

| NAREIT defined FFO

attributable to common stockholders |

|

$ |

51,722 |

|

|

$ |

36,196 |

|

| NAREIT defined FFO per diluted

common share |

|

$ |

0.22 |

|

|

$ |

0.16 |

|

| |

|

|

|

|

| Core FFO attributable to

common stockholders |

|

$ |

53,940 |

|

|

$ |

50,855 |

|

| Core FFO per diluted common

share |

|

$ |

0.23 |

|

|

$ |

0.22 |

|

| |

|

|

|

|

| AFFO attributable to common

stockholders |

|

$ |

73,856 |

|

|

$ |

76,692 |

|

| AFFO per diluted common

share |

|

$ |

0.32 |

|

|

$ |

0.33 |

|

| |

|

|

|

|

|

|

|

|

Property Portfolio

As of September 30, 2024, the Company’s

portfolio of 1,223 net lease properties is located in ten countries

and territories, and is comprised of 61.9 million rentable square

feet. The Company operates in four reportable segments, consistent

with its current management internal financial reporting purposes:

(1) Industrial & Distribution, (2) Multi-Tenant Retail, (3)

Single-Tenant Retail and (4) Office. The real estate portfolio

metrics include:

- 96% leased with a

remaining weighted-average lease term of 6.3 years5

- 80% of the portfolio

contains contractual rent increases based on annualized

straight-line rent

- 61% of portfolio

annualized straight-line rent derived from investment grade and

implied investment grade rated tenants

- 80% U.S. and Canada,

20% Europe (based on annualized straight-line rent)

- 33% Industrial &

Distribution, 27% Multi-Tenant Retail, 22% Single-Tenant Retail and

18% Office (based on an annualized straight-line rent)

Capital Structure and Liquidity

Resources6

As of September 30, 2024, the Company had

liquidity of $252.7 million and $366.0 million of capacity

under its revolving credit facility. The Company had net debt of

$4.8 billion7, including $2.4 billion of mortgage debt. The Company

successfully reduced its outstanding net debt balance by

$162 million from second quarter 2024.

As of September 30, 2024, the percentage of

debt that is fixed rate (including variable rate debt fixed with

swaps) was 91% compared to 90% as of June 30, 2024. The Company’s

total combined debt had a weighted average interest rate of 4.8%

resulting in an interest coverage ratio of 2.5 times8.

Weighted-average debt maturity was 3.2 years as of

September 30, 2024.

Footnotes/Definitions

1 While we consider AFFO a useful indicator of

our performance, we do not consider AFFO as an alternative to net

income (loss) or as a measure of liquidity. Furthermore, other

REITs may define AFFO differently than we do. Projected AFFO per

share data included in this release is for informational purposes

only and should not be relied upon as indicative of future

dividends or as a measure of future liquidity. AFFO for the fourth

quarter also contains a number of adjustments for items that the

Company believes were non-recurring, one-time items including

adjustments for items that were settled in cash such as merger and

proxy related expenses.

2 Closed plus disposition pipeline of

$950.2 million as of November 1, 2024. Includes $762.7 million

of closed plus pipeline occupied dispositions at a cash cap rate of

7.1% and $187.5 million of vacant closed plus pipeline dispositions

that is expected to reduce annualized operating expenses by over $3

million. The properties included in our disposition pipeline for

such purposes include those for which we have entered into purchase

and sale agreements (“PSAs”) or non-binding letters of intents

(“LOIs”). There can be no assurance that the transactions

contemplated by such PSAs or LOIs will be completed on the terms

contemplated, if at all.

3 As used herein, “Investment Grade Rating”

includes both actual investment grade ratings of the tenant or

guarantor, if available, or implied investment grade. Implied

Investment Grade may include actual ratings of tenant parent,

guarantor parent (regardless of whether or not the parent has

guaranteed the tenant’s obligation under the lease) or by using a

proprietary Moody's analytical tool, which generates an implied

rating by measuring a company's probability of default. The term

"parent" for these purposes includes any entity, including any

governmental entity, owning more than 50% of the voting stock in a

tenant or a guarantor. Ratings information is as of

September 30, 2024. Comprised of 31.8% leased to tenants with

an actual investment grade rating and 28.7% leased to tenants with

an Implied Investment Grade rating based on annualized cash rent as

of September 30, 2024.

4 We do not provide guidance on net income. We

only provide guidance on AFFO per share and our Net Debt to

Adjusted EBITDA ratio and do not provide reconciliations of this

forward-looking non-GAAP guidance to net income per share or our

debt to net income due to the inherent difficulty in quantifying

certain items necessary to provide such reconciliations as a result

of their unknown effect, timing and potential significance.

Examples of such items include impairment of assets, gains and

losses from sales of assets, and depreciation and amortization from

new acquisitions and other non-recurring expenses.

5 Weighted-average remaining lease term in years

is based on square feet as of September 30, 2024.

6 During the three months ended September 30, 2024, the

Company did not sell any shares of Common Stock or Series B

Preferred Stock through its Common Stock or Series B Preferred

Stock "at-the-market" programs.

7 Comprised of the principal amount of GNL's

outstanding debt totaling $5.0 billion less cash and cash

equivalents totaling $127.2 million, as of September 30,

2024.

8 The interest coverage ratio is calculated by

dividing adjusted EBITDA for the applicable quarter by cash paid

for interest (calculated based on the interest expense less

non-cash portion of interest expense and amortization of mortgage

(discount) premium, net). Management believes that Interest

Coverage Ratio is a useful supplemental measure of our ability to

service our debt obligations. Adjusted EBITDA and Cash Paid for

Interest are Non-GAAP metrics and are reconciled below.

Conference Call

GNL will host a webcast and conference call on

November 6, 2024 at 11:00 a.m. ET to discuss its financial and

operating results. To listen to the live call, please go to

GNL’s “Investor Relations” section of the website at least 15

minutes prior to the start of the call to register and download any

necessary audio software.

Dial-in instructions for the conference call and

the replay are outlined below.

Conference Call Details

Live CallDial-In (Toll Free):

1-877-407-0792International Dial-In: 1-201-689-8263

Conference Replay*For those who are not able to

listen to the live broadcast, a replay will be available shortly

after the call on the GNL website at www.globalnetlease.com

Or dial in below:Domestic Dial-In (Toll Free):

1-844-512-2921International Dial-In: 1-412-317-6671Conference

Number: 13746750*Available from 2:00 p.m. ET on November 7, 2024

through February 7, 2025.

Supplemental Schedules

The Company will furnish supplemental

information packages with the Securities and Exchange Commission

(the “SEC”) to provide additional disclosure and financial

information. Once posted, the supplemental package can be found

under the “Presentations” tab in the Investor Relations section of

GNL’s website at www.globalnetlease.com and on the SEC website

at www.sec.gov.

About Global Net Lease, Inc.

Global Net Lease, Inc. is a publicly traded real

estate investment trust listed on the NYSE, which focuses on

acquiring and managing a global portfolio of income producing net

lease assets across the United States, and Western and Northern

Europe. Additional information about GNL can be found on its

website at www.globalnetlease.com.

Forward-Looking Statements

The statements in this press release that are

not historical facts may be forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

These forward-looking statements involve risks and uncertainties

that could cause the outcome to be materially different. The words

such as "may," "will," "seeks," "anticipates," "believes,"

"expects," "estimates," "projects," “potential,” “predicts,”

"plans," "intends," “would,” “could,” "should" and similar

expressions are intended to identify forward-looking statements,

although not all forward-looking statements contain these

identifying words. These forward-looking statements are subject to

a number of risks, uncertainties and other factors, many of which

are outside of the Company's control, which could cause actual

results to differ materially from the results contemplated by the

forward-looking statements. These risks and uncertainties include

the risks associated with realization of the anticipated benefits

of the merger with The Necessity Retail REIT, Inc. and the

internalization of the Company’s property management and advisory

functions; that any potential future acquisition or disposition by

the Company is subject to market conditions and capital

availability and may not be identified or completed on favorable

terms, or at all. Some of the risks and uncertainties, although not

all risks and uncertainties, that could cause the Company’s actual

results to differ materially from those presented in the Company’s

forward-looking statements are set forth in the Risk Factors and

“Quantitative and Qualitative Disclosures about Market Risk”

sections in the Company’s Annual Report on Form 10-K, its Quarterly

Reports on Form 10-Q, and all of its other filings with the U.S.

Securities and Exchange Commission, as such risks, uncertainties

and other important factors may be updated from time to time in the

Company’s subsequent reports. Further, forward-looking statements

speak only as of the date they are made, and the Company undertakes

no obligation to update or revise any forward-looking statement to

reflect changed assumptions, the occurrence of unanticipated events

or changes to future operating results over time, unless required

by law.

Contacts:

Investors and Media:Email:

investorrelations@globalnetlease.comPhone: (332) 265-2020

|

Global Net Lease, Inc.Consolidated Balance

Sheets(In thousands) |

| |

| |

September 30,2024 |

|

December 31,2023 |

| ASSETS |

(Unaudited) |

|

|

| Real estate investments, at

cost: |

|

|

|

|

Land |

$ |

1,268,106 |

|

|

$ |

1,430,607 |

|

|

Buildings, fixtures and improvements |

|

5,505,148 |

|

|

|

5,842,314 |

|

|

Construction in progress |

|

5,504 |

|

|

|

23,242 |

|

|

Acquired intangible lease assets |

|

1,128,991 |

|

|

|

1,359,981 |

|

|

Total real estate investments, at cost |

|

7,907,749 |

|

|

|

8,656,144 |

|

|

Less accumulated depreciation and amortization |

|

(1,138,714 |

) |

|

|

(1,083,824 |

) |

|

Total real estate investments, net |

|

6,769,035 |

|

|

|

7,572,320 |

|

| Assets held for sale |

|

9,391 |

|

|

|

3,188 |

|

| Cash and cash equivalents |

|

127,249 |

|

|

|

121,566 |

|

| Restricted cash |

|

53,526 |

|

|

|

40,833 |

|

| Derivative assets, at fair

value |

|

1,114 |

|

|

|

10,615 |

|

| Unbilled straight-line

rent |

|

98,914 |

|

|

|

84,254 |

|

| Operating lease right-of-use

asset |

|

78,278 |

|

|

|

77,008 |

|

| Prepaid expenses and other

assets |

|

130,077 |

|

|

|

121,997 |

|

| Deferred tax assets |

|

4,822 |

|

|

|

4,808 |

|

| Goodwill |

|

52,255 |

|

|

|

46,976 |

|

| Deferred financing costs,

net |

|

11,209 |

|

|

|

15,412 |

|

|

Total Assets |

$ |

7,335,870 |

|

|

$ |

8,098,977 |

|

| |

|

|

|

| LIABILITIES AND

EQUITY |

|

|

|

| Mortgage notes payable,

net |

$ |

2,273,464 |

|

|

$ |

2,517,868 |

|

| Revolving credit facility |

|

1,583,936 |

|

|

|

1,744,182 |

|

| Senior notes, net |

|

900,905 |

|

|

|

886,045 |

|

| Acquired intangible lease

liabilities, net |

|

80,125 |

|

|

|

95,810 |

|

| Derivative liabilities, at

fair value |

|

18,656 |

|

|

|

5,145 |

|

| Accounts payable and accrued

expenses |

|

90,653 |

|

|

|

99,014 |

|

| Operating lease liability |

|

50,126 |

|

|

|

48,369 |

|

| Prepaid rent |

|

44,821 |

|

|

|

46,213 |

|

| Deferred tax liability |

|

6,152 |

|

|

|

6,009 |

|

| Dividends payable |

|

11,830 |

|

|

|

11,173 |

|

|

Total Liabilities |

|

5,060,668 |

|

|

|

5,459,828 |

|

| Commitments and

contingencies |

|

— |

|

|

|

— |

|

| Stockholders'

Equity: |

|

|

|

| 7.25% Series A cumulative

redeemable preferred stock |

|

68 |

|

|

|

68 |

|

| 6.875% Series B cumulative

redeemable perpetual preferred stock |

|

47 |

|

|

|

47 |

|

| 7.50% Series D cumulative

redeemable perpetual preferred stock |

|

79 |

|

|

|

79 |

|

| 7.375% Series E cumulative

redeemable perpetual preferred stock |

|

46 |

|

|

|

46 |

|

| Common stock |

|

3,638 |

|

|

|

3,639 |

|

| Additional paid-in

capital |

|

4,354,823 |

|

|

|

4,350,112 |

|

| Accumulated other

comprehensive loss |

|

(16,751 |

) |

|

|

(14,096 |

) |

|

Accumulated deficit |

|

(2,069,400 |

) |

|

|

(1,702,143 |

) |

|

Total Stockholders' Equity |

|

2,272,550 |

|

|

|

2,637,752 |

|

| Non-controlling interest |

|

2,652 |

|

|

|

1,397 |

|

|

Total Equity |

|

2,275,202 |

|

|

|

2,639,149 |

|

|

Total Liabilities and Equity |

$ |

7,335,870 |

|

|

$ |

8,098,977 |

|

|

Global Net Lease, Inc.Consolidated

Statements of Operations (Unaudited)(In thousands,

except share and per share data) |

| |

| |

Three Months Ended September 30, |

|

Three Months Ended June 30, |

|

|

|

2024 |

|

|

|

2024 |

|

| Revenue from

tenants |

$ |

196,564 |

|

|

$ |

203,286 |

|

| |

|

|

|

|

Expenses: |

|

|

|

|

Property operating |

|

33,515 |

|

|

|

35,533 |

|

|

Impairment charges |

|

38,583 |

|

|

|

27,402 |

|

|

Merger, transaction and other costs |

|

1,901 |

|

|

|

1,572 |

|

|

General and administrative |

|

12,598 |

|

|

|

15,196 |

|

|

Equity-based compensation |

|

2,309 |

|

|

|

2,340 |

|

|

Depreciation and amortization |

|

85,430 |

|

|

|

89,493 |

|

|

Total expenses |

|

174,336 |

|

|

|

171,536 |

|

|

Operating income before gain on dispositions of real estate

investments |

|

22,228 |

|

|

|

31,750 |

|

|

(Loss) gain on dispositions of real estate investments |

|

(4,280 |

) |

|

|

34,102 |

|

|

Operating income |

|

17,948 |

|

|

|

65,852 |

|

| Other income

(expense): |

|

|

|

|

Interest expense |

|

(77,130 |

) |

|

|

(89,815 |

) |

|

Loss on extinguishment of debt |

|

(317 |

) |

|

|

(13,090 |

) |

|

(Loss) gain on derivative instruments |

|

(4,742 |

) |

|

|

530 |

|

|

Unrealized gains on undesignated foreign currency advances and

other hedge ineffectiveness |

|

— |

|

|

|

300 |

|

|

Other (expense) income |

|

(49 |

) |

|

|

309 |

|

|

Total other expense, net |

|

(82,238 |

) |

|

|

(101,766 |

) |

| Net loss before income

taxes |

|

(64,290 |

) |

|

|

(35,914 |

) |

| Income tax (provision)

benefit |

|

(1,345 |

) |

|

|

250 |

|

| Net loss |

|

(65,635 |

) |

|

|

(35,664 |

) |

| Preferred stock dividends |

|

(10,936 |

) |

|

|

(10,936 |

) |

| Net loss attributable

to common stockholders |

$ |

(76,571 |

) |

|

$ |

(46,600 |

) |

| |

|

|

|

| Basic and Diluted Loss

Per Share: |

|

|

|

|

Net loss per share attributable to common stockholders — Basic and

Diluted |

$ |

(0.33 |

) |

|

$ |

(0.20 |

) |

|

|

|

|

|

|

Weighted average shares outstanding — Basic and Diluted |

|

230,463 |

|

|

|

230,381 |

|

|

Global Net Lease, Inc.Quarterly

Reconciliation of Non-GAAP Measures (Unaudited)(In

thousands) |

| |

| |

Three Months Ended September 30, |

|

Three Months Ended June 30, |

|

|

|

2024 |

|

|

|

2024 |

|

| Adjusted

EBITDA |

|

|

|

|

Net loss |

$ |

(65,635 |

) |

|

$ |

(35,664 |

) |

|

Depreciation and amortization |

|

85,430 |

|

|

|

89,493 |

|

|

Interest expense |

|

77,130 |

|

|

|

89,815 |

|

|

Income tax expense (benefit) |

|

1,345 |

|

|

|

(250 |

) |

|

Impairment charges |

|

38,583 |

|

|

|

27,402 |

|

|

Equity-based compensation |

|

2,309 |

|

|

|

2,340 |

|

|

Merger, transaction and other costs[1] |

|

1,901 |

|

|

|

1,572 |

|

|

Gain on dispositions of real estate investments |

|

4,280 |

|

|

|

(34,102 |

) |

|

Gain on derivative instruments |

|

4,742 |

|

|

|

(530 |

) |

|

Unrealized gains on undesignated foreign currency advances and

other hedge ineffectiveness |

|

— |

|

|

|

(300 |

) |

|

Loss on extinguishment of debt |

|

317 |

|

|

|

13,090 |

|

|

Other expense (income) |

|

49 |

|

|

|

(309 |

) |

|

Expenses attributable to European tax restructuring[2] |

|

— |

|

|

|

16 |

|

|

Transition costs related to the Merger and Internalization[3] |

|

138 |

|

|

|

995 |

|

|

Adjusted EBITDA |

|

150,589 |

|

|

|

153,568 |

|

| |

|

|

|

| Net operating income

(NOI) |

|

|

|

|

General and administrative |

|

12,598 |

|

|

|

15,196 |

|

|

Expenses attributable to European tax restructuring[2] |

|

— |

|

|

|

(16 |

) |

|

Transition costs related to the Merger and Internalization[3] |

|

(138 |

) |

|

|

(995 |

) |

|

NOI |

|

163,049 |

|

|

|

167,753 |

|

|

Amortization related to above- and below- market lease intangibles

and right-of-use assets, net |

|

1,805 |

|

|

|

1,901 |

|

|

Straight-line rent |

|

(5,343 |

) |

|

|

(5,349 |

) |

|

Cash NOI |

$ |

159,511 |

|

|

$ |

164,305 |

|

| |

|

|

|

| Cash Paid for

Interest: |

|

|

|

|

Interest Expense |

$ |

77,130 |

|

|

$ |

89,815 |

|

|

Non-cash portion of interest expense |

|

(2,496 |

) |

|

|

(2,580 |

) |

|

Amortization of discounts on mortgages and senior notes |

|

(14,156 |

) |

|

|

(24,080 |

) |

|

Total cash paid for interest |

$ |

60,478 |

|

|

$ |

63,155 |

|

_____________[1] For the three months ended

September 30, 2024 and June 30, 2024, these costs primarily consist

of advisory, legal and other professional costs that were directly

related to the Merger and Internalization.[2] Amounts relate to

costs incurred related to the tax restructuring of our European

entities. We do not consider these expenses to be part of our

normal operating performance and have, accordingly, increased

Adjusted EBITDA for these amounts.[3] Amounts include costs related

to (i) compensation incurred for our former Co-Chief Executive

Officer who retired effective March 31, 2024; (ii) a transition

service agreement with the former Advisor and; (iii) insurance

premiums related to expiring directors and officers insurance of

former RTL directors. We do not consider these expenses to be part

of our normal operating performance and have, accordingly,

increased Adjusted EBITDA for these amounts.

|

Global Net Lease, Inc.Quarterly

Reconciliation of Non-GAAP Measures (Unaudited)(In

thousands) |

| |

| |

Three Months Ended September 30, |

|

Three Months Ended June 30, |

|

|

|

2024 |

|

|

|

2024 |

|

| Net loss attributable

to stockholders (in accordance with GAAP) |

$ |

(76,571 |

) |

|

$ |

(46,600 |

) |

|

Impairment charges |

|

38,583 |

|

|

|

27,402 |

|

|

Depreciation and amortization |

|

85,430 |

|

|

|

89,493 |

|

|

Loss (gain) on dispositions of real estate investments |

|

4,280 |

|

|

|

(34,102 |

) |

| FFO (defined by

NAREIT) |

|

51,722 |

|

|

|

36,193 |

|

|

Merger, transaction and other costs[1] |

|

1,901 |

|

|

|

1,572 |

|

|

Loss on extinguishment of debt |

|

317 |

|

|

|

13,090 |

|

| Core FFO attributable

to common stockholders |

|

53,940 |

|

|

|

50,855 |

|

|

Non-cash equity-based compensation |

|

2,309 |

|

|

|

2,340 |

|

|

Non-cash portion of interest expense |

|

2,496 |

|

|

|

2,580 |

|

|

Amortization related to above- and below-market lease intangibles

and right-of-use assets, net |

|

1,805 |

|

|

|

1,901 |

|

|

Straight-line rent |

|

(5,343 |

) |

|

|

(5,349 |

) |

|

Unrealized gains on undesignated foreign currency advances and

other hedge ineffectiveness |

|

— |

|

|

|

(300 |

) |

|

Eliminate unrealized losses (gains) on foreign currency

transactions[2] |

|

4,360 |

|

|

|

(230 |

) |

|

Amortization of discounts on mortgages and senior notes |

|

14,156 |

|

|

|

24,080 |

|

|

Expenses attributable to European tax restructuring[3] |

|

— |

|

|

|

16 |

|

|

Transition costs related to the Merger and Internalization[4] |

|

138 |

|

|

|

995 |

|

|

Forfeited disposition deposit[5] |

|

(5 |

) |

|

|

(196 |

) |

| Adjusted funds from

operations (AFFO) attributable to common stockholders |

$ |

73,856 |

|

|

$ |

76,692 |

|

__________

[1] For the three months ended September 30,

2024 and March 31, 2024, these costs primarily consist of advisory,

legal and other professional costs that were directly related to

the Merger and Internalization.

[2] For AFFO purposes, we add back unrealized

(gain) loss. For the three months ended September 30, 2024,

loss on derivative instruments was $4.7 million, which consisted of

unrealized losses of $4.4 million and realized losses of

$0.3 million. For the three months ended June 30, 2024, gain

on derivative instruments was $0.5 million, which consisted of

unrealized gains of $0.2 million and realized gains of $0.3

million.

[3] Amounts relate to costs incurred related to

the tax restructuring of our European entities. We do not consider

these expenses to be part of our normal operating performance and

have, accordingly, increased AFFO for these amounts.

[4] Amounts include costs related to (i)

compensation incurred for our former Co-Chief Executive Officer who

retired effective March 31, 2024; (ii) a transition service

agreement with the former Advisor and; (iii) insurance premiums

related to expiring directors and officers insurance of former RTL

directors. We do not consider these expenses to be part of our

normal operating performance and have, accordingly, increased AFFO

for these amounts.

[5] Represents a forfeited deposit from a

potential buyer of one of our properties, which is recorded in

other income in our consolidated statement of operations. We do not

consider this income to be part of our normal operating performance

and have, accordingly, decreased AFFO for this amount.

The following table provides operating financial information for

the Company’s four reportable segments:

| |

|

Three Months Ended September 30, |

|

Three Months Ended June 30, |

|

(In thousands) |

|

|

2024 |

|

|

|

2024 |

|

|

Industrial & Distribution: |

|

|

|

|

|

Revenue from tenants |

|

$ |

59,654 |

|

|

$ |

61,436 |

|

|

Property operating expense |

|

|

5,494 |

|

|

|

4,952 |

|

|

Net Operating Income |

|

$ |

54,160 |

|

|

$ |

56,484 |

|

| |

|

|

|

|

| Multi-Tenant

Retail: |

|

|

|

|

|

Revenue from tenants |

|

$ |

62,380 |

|

|

$ |

66,966 |

|

|

Property operating expense |

|

|

20,170 |

|

|

|

22,562 |

|

|

Net Operating Income |

|

$ |

42,210 |

|

|

$ |

44,404 |

|

| |

|

|

|

|

| Single-Tenant

Retail: |

|

|

|

|

|

Revenue from tenants |

|

$ |

38,378 |

|

|

$ |

38,948 |

|

|

Property operating expense |

|

|

2,868 |

|

|

|

3,776 |

|

|

Net Operating Income |

|

$ |

35,510 |

|

|

$ |

35,172 |

|

| |

|

|

|

|

| Office: |

|

|

|

|

|

Revenue from tenants |

|

$ |

36,152 |

|

|

$ |

35,936 |

|

|

Property operating expense |

|

|

4,983 |

|

|

|

4,243 |

|

|

Net Operating Income |

|

$ |

31,169 |

|

|

$ |

31,693 |

|

Caution on Use of Non-GAAP Measures

Funds from Operations (“FFO”), Core Funds from

Operations (“Core FFO”), Adjusted Funds from Operations (“AFFO”),

Adjusted Earnings before Interest, Taxes, Depreciation and

Amortization (“Adjusted EBITDA”), Net Operating Income (“NOI”) and

Cash Net Operating Income (“Cash NOI”) should not be construed to

be more relevant or accurate than the current GAAP methodology in

calculating net income or in its applicability in evaluating our

operating performance. The method utilized to evaluate the value

and performance of real estate under GAAP should be construed as a

more relevant measure of operational performance and considered

more prominently than the non-GAAP measures.

Other REITs may not define FFO in accordance

with the current National Association of Real Estate Investment

Trusts (“NAREIT”) definition (as we do), or may interpret the

current NAREIT definition differently than we do, or may calculate

Core FFO or AFFO differently than we do. Consequently, our

presentation of FFO, Core FFO and AFFO may not be comparable to

other similarly-titled measures presented by other REITs.

We consider FFO, Core FFO and AFFO useful

indicators of our performance. Because FFO, Core FFO and AFFO

calculations exclude such factors as depreciation and amortization

of real estate assets and gain or loss from sales of operating real

estate assets (which can vary among owners of identical assets in

similar conditions based on historical cost accounting and

useful-life estimates), FFO, Core FFO and AFFO presentations

facilitate comparisons of operating performance between periods and

between other REITs.

As a result, we believe that the use of FFO,

Core FFO and AFFO, together with the required GAAP presentations,

provide a more complete understanding of our operating performance

including relative to our peers and a more informed and appropriate

basis on which to make decisions involving operating, financing,

and investing activities. However, FFO, Core FFO and AFFO are not

indicative of cash available to fund ongoing cash needs, including

the ability to make cash distributions. Investors are cautioned

that FFO, Core FFO and AFFO should only be used to assess the

sustainability of our operating performance excluding these

activities, as they exclude certain costs that have a negative

effect on our operating performance during the periods in which

these costs are incurred.

Funds from Operations, Core Funds from Operations and

Adjusted Funds from Operations

Funds from Operations

Due to certain unique operating characteristics

of real estate companies, as discussed below, NAREIT, an industry

trade group, has promulgated a measure known as FFO, which we

believe to be an appropriate supplemental measure to reflect the

operating performance of a REIT. FFO is not equivalent to net

income or loss as determined under GAAP.

We calculate FFO, a non-GAAP measure, consistent

with the standards established over time by the Board of Governors

of NAREIT, as restated in a White Paper approved by the Board of

Governors of NAREIT effective in December 2018 (the "White Paper").

The White Paper defines FFO as net income or loss computed in

accordance with GAAP, excluding depreciation and amortization

related to real estate, gain and loss from the sale of certain real

estate assets, gain and loss from change in control and impairment

write-downs of certain real estate assets and investments in

entities when the impairment is directly attributable to decreases

in the value of depreciable real estate held by the entity.

Adjustments for unconsolidated partnerships and joint ventures are

calculated to exclude the proportionate share of the

non-controlling interest to arrive at FFO, Core FFO, AFFO and NOI

attributable to stockholders, as applicable. Our FFO calculation

complies with NAREIT's definition.

The historical accounting convention used for

real estate assets requires straight-line depreciation of buildings

and improvements, and straight-line amortization of intangibles,

which implies that the value of a real estate asset diminishes

predictably over time. We believe that, because real estate values

historically rise and fall with market conditions, including

inflation, interest rates, unemployment and consumer spending,

presentations of operating results for a REIT using historical

accounting for depreciation and certain other items may be less

informative. Historical accounting for real estate involves the use

of GAAP. Any other method of accounting for real estate such as the

fair value method cannot be construed to be any more accurate or

relevant than the comparable methodologies of real estate valuation

found in GAAP. Nevertheless, we believe that the use of FFO, which

excludes the impact of real estate related depreciation and

amortization, among other things, provides a more complete

understanding of our performance to investors and to management,

and when compared year over year, reflects the impact on our

operations from trends in occupancy rates, rental rates, operating

costs, general and administrative expenses, and interest costs,

which may not be immediately apparent from net income.

Core Funds from Operations

In calculating Core FFO, we start with FFO, then

we exclude certain non-core items such as merger, transaction and

other costs, settlement costs related to our Blackwells/Related

Parties litigation, as well as certain other costs that are

considered to be non-core, such as debt extinguishment costs. The

purchase of properties, and the corresponding expenses associated

with that process, is a key operational feature of our core

business plan to generate operational income and cash flows in

order to make dividend payments to stockholders. In evaluating

investments in real estate, we differentiate the costs to acquire

the investment from the subsequent operations of the investment. We

also add back non-cash write-offs of deferred financing costs and

prepayment penalties incurred with the early extinguishment of debt

which are included in net income but are considered financing cash

flows when paid in the statement of cash flows. We consider these

write-offs and prepayment penalties to be capital transactions and

not indicative of operations. By excluding expensed acquisition,

transaction and other costs as well as non-core costs, we believe

Core FFO provides useful supplemental information that is

comparable for each type of real estate investment and is

consistent with management's analysis of the investing and

operating performance of our properties.

Adjusted Funds from Operations

In calculating AFFO, we start with Core FFO,

then we exclude certain income or expense items from AFFO that we

consider more reflective of investing activities, other non-cash

income and expense items and the income and expense effects of

other activities or items, including items that were paid in cash

that are not a fundamental attribute of our business plan or were

one time or non-recurring items. These items include, for example,

early extinguishment of debt and other items excluded in Core FFO

as well as unrealized gain and loss, which may not ultimately be

realized, such as gain or loss on derivative instruments, gain or

loss on foreign currency transactions, and gain or loss on

investments. In addition, by excluding non-cash income and expense

items such as amortization of above-market and below-market leases

intangibles, amortization of deferred financing costs,

straight-line rent and equity-based compensation from AFFO, we

believe we provide useful information regarding income and expense

items which have a direct impact on our ongoing operating

performance. We also exclude revenue attributable to the

reimbursement by third parties of financing costs that we

originally incurred because these revenues are not, in our view,

related to operating performance. We also include the realized gain

or loss on foreign currency exchange contracts for AFFO as such

items are part of our ongoing operations and affect our current

operating performance.

In calculating AFFO, we also exclude certain

expenses which under GAAP are treated as operating expenses in

determining operating net income. All paid and accrued acquisition,

transaction and other costs (including prepayment penalties for

debt extinguishments and merger related expenses) and certain other

expenses, including expenses incurred for our 2023 proxy contest

and related Blackwells/Related Parties litigation, expenses related

to our European tax restructuring and transition costs related to

the Merger and Internalization, negatively impact our operating

performance during the period in which expenses are incurred or

properties are acquired and will also have negative effects on

returns to investors, but are not reflective of our on-going

performance. Further, under GAAP, certain contemplated non-cash

fair value and other non-cash adjustments are considered operating

non-cash adjustments to net income. In addition, as discussed

above, we view gain and loss from fair value adjustments as items

which are unrealized and may not ultimately be realized and not

reflective of ongoing operations and are therefore typically

adjusted for when assessing operating performance. Excluding income

and expense items detailed above from our calculation of AFFO

provides information consistent with management's analysis of our

operating performance. Additionally, fair value adjustments, which

are based on the impact of current market fluctuations and

underlying assessments of general market conditions, but can also

result from operational factors such as rental and occupancy rates,

may not be directly related or attributable to our current

operating performance. By excluding such changes that may reflect

anticipated and unrealized gain or loss, we believe AFFO provides

useful supplemental information. By providing AFFO, we believe we

are presenting useful information that can be used to, among other

things, assess our performance without the impact of transactions

or other items that are not related to our portfolio of properties.

AFFO presented by us may not be comparable to AFFO reported by

other REITs that define AFFO differently. Furthermore, we believe

that in order to facilitate a clear understanding of our operating

results, AFFO should be examined in conjunction with net income

(loss) calculated in accordance with GAAP and presented in our

consolidated financial statements. AFFO should not be considered as

an alternative to net income (loss) as an indication of our

performance or to cash flows as a measure of our liquidity or

ability to make distributions.

Adjusted Earnings before Interest,

Taxes, Depreciation and Amortization, Net Operating Income, Cash

Net Operating Income and Cash Paid for Interest

We believe that Adjusted EBITDA, which is

defined as earnings before interest, taxes, depreciation and

amortization adjusted for acquisition, transaction and other costs,

other non-cash items and including our pro-rata share from

unconsolidated joint ventures, is an appropriate measure of our

ability to incur and service debt. We also exclude revenue

attributable to the reimbursement by third parties of financing

costs that we originally incurred because these revenues are not,

in our view, related to operating performance. All paid and accrued

acquisition, transaction and other costs (including prepayment

penalties for debt extinguishments) and certain other expenses,

including general and administrative expenses incurred for the 2023

proxy contest and related Blackwells/Related Parties litigation,

expenses related to our European tax restructuring and transition

costs related to the Merger and Internalization, negatively impact

our operating performance during the period in which expenses are

incurred or properties are acquired and will also have negative

effects on returns to investors, but are not reflective of on-going

performance. Due to the increase in general and administrative

expenses as a result of the 2023 proxy contest and related

litigation as a portion of our total general and administrative

expenses in the first quarter of 2023, we began including this

adjustment to arrive at Adjusted EBITDA in order to better reflect

our operating performance. Adjusted EBITDA should not be considered

as an alternative to cash flows from operating activities, as a

measure of our liquidity or as an alternative to net income as an

indicator of our operating activities. Other REITs may calculate

Adjusted EBITDA differently and our calculation should not be

compared to that of other REITs.

NOI is a non-GAAP financial measure equal to net

income (loss), the most directly comparable GAAP financial measure,

less discontinued operations, interest, other income and income

from preferred equity investments and investment securities, plus

corporate general and administrative expense, acquisition,

transaction and other costs, depreciation and amortization, other

non-cash expenses and interest expense. We use NOI internally as a

performance measure and believe NOI provides useful information to

investors regarding our financial condition and results of

operations because it reflects only those income and expense items

that are incurred at the property level. Therefore, we believe NOI

is a useful measure for evaluating the operating performance of our

real estate assets and to make decisions about resource

allocations. Further, we believe NOI is useful to investors as a

performance measure because, when compared across periods, NOI

reflects the impact on operations from trends in occupancy rates,

rental rates, operating costs and acquisition activity on an

unlevered basis, providing perspective not immediately apparent

from net income. NOI excludes certain components from net income in

order to provide results that are more closely related to a

property's results of operations. For example, interest expense is

not necessarily linked to the operating performance of a real

estate asset and is often incurred at the corporate level as

opposed to the property level. In addition, depreciation and

amortization, because of historical cost accounting and useful life

estimates, may distort operating performance at the property level.

NOI presented by us may not be comparable to NOI reported by other

REITs that define NOI differently. We believe that in order to

facilitate a clear understanding of our operating results, NOI

should be examined in conjunction with net income (loss) as

presented in our consolidated financial statements. NOI should not

be considered as an alternative to net income (loss) as an

indication of our performance or to cash flows as a measure of our

liquidity.

Cash NOI is a non-GAAP financial measure that is

intended to reflect the performance of our properties. We define

Cash NOI as net operating income (which is separately defined

herein) excluding amortization of above/below market lease

intangibles and straight-line rent adjustments that are included in

GAAP lease revenues. We believe that Cash NOI is a helpful measure

that both investors and management can use to evaluate the current

financial performance of our properties and it allows for

comparison of our operating performance between periods and to

other REITs. Cash NOI should not be considered as an alternative to

net income, as an indication of our financial performance, or to

cash flows as a measure of liquidity or our ability to fund all

needs. The method by which we calculate and present Cash NOI may

not be directly comparable to the way other REITs calculate and

present Cash NOI.

Cash Paid for Interest is calculated based on

the interest expense less non-cash portion of interest expense and

amortization of mortgage (discount) premium, net. Management

believes that Cash Paid for Interest provides useful information to

investors to assess our overall solvency and financial flexibility.

Cash Paid for Interest should not be considered as an alternative

to interest expense as determined in accordance with GAAP or any

other GAAP financial measures and should only be considered

together with and as a supplement to our financial information

prepared in accordance with GAAP.

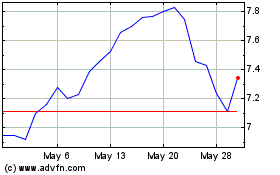

Global Net Lease (NYSE:GNL)

Historical Stock Chart

From Jan 2025 to Feb 2025

Global Net Lease (NYSE:GNL)

Historical Stock Chart

From Feb 2024 to Feb 2025