Genco Shipping & Trading Limited Enhances Dividend Policy to Increase Cash Distributable to Shareholders

September 10 2024 - 6:55AM

Genco Shipping & Trading Limited (NYSE:GNK) (“Genco” or

the “Company”), the largest U.S. headquartered drybulk shipowner

focused on the global transportation of commodities, today

announced the removal of the drydocking capex line item from its

formula used to calculate its quarterly dividend. This will

increase the amount of cash available for distribution to

shareholders beginning in the third quarter of 2024.

The amount available for quarterly dividends is to be calculated

based on the following updated formula, commencing in Q3 2024:

| |

|

|

| |

Dividend calculation |

|

| |

Net revenue |

|

| |

Less: operating expenses |

|

| |

Operating cash flow |

|

| |

Less: voluntary quarterly reserve |

|

| |

Cash flow distributable as dividends |

|

| |

|

|

The voluntary quarterly reserve for the third

quarter of 2024 under the Company’s dividend formula is $19.50

million, which remains fully within the Company’s discretion. We

plan to continue to review the voluntary reserve to further enhance

shareholder value over the long-term.

For the balance of 2024 and 2025, drydocking capex is estimated

to be as follows:

- Q3 2024: $11 million or $0.25 per share

- Q4 2024: $7 million or $0.16 per share

- FY 2025: $41 million or $0.95 per share

Actual drydocking capex will vary based on various factors,

including where the drydockings are actually performed.

John C. Wobensmith, Chief Executive Officer,

commented, “Based on Genco’s notable achievements in executing its

capital allocation strategy, we have enhanced our quarterly

dividend formula by eliminating the drydocking capex line item

within our calculation. As we approach our goal of net debt zero,

we are pleased to take another important step to reward

shareholders aimed at further strengthening shareholder returns.

This enhancement to our dividend formula reflects our belief that

our low leverage will support larger dividends to

shareholders. At the same time, we continue to maintain significant

financial strength to grow and renew our fleet and further improve

our earnings power.”

Mr. Wobensmith continued, “Since implementing

our comprehensive value strategy three years ago, we have made

demonstrable progress executing on all three core pillars. Notably,

Genco has distributed 20 consecutive quarterly dividends to

shareholders, returning a total of $5.915 per share, or ~35% of our

share price as of September 9, 2024. We have also further

modernized our sizeable drybulk fleet, while lowering our debt

nearly 80% since 2021, significantly reducing our net loan to value

and cash flow breakeven to industry lows.”

Note: Operating cash flow is defined as net

revenue (consisting of voyage revenue less voyage expenses, charter

hire expenses, and realized gains or losses on fuel hedges), less

operating expenses (consisting of vessel operating expenses,

general and administrative expenses other than non-cash restricted

stock expenses, technical management expenses, and interest expense

other than non-cash deferred financing costs), for purposes of the

foregoing calculation.

About Genco Shipping & Trading

LimitedGenco Shipping & Trading Limited is a U.S.

based drybulk ship owning company focused on the seaborne

transportation of commodities globally. We provide a full-service

logistics solution to our customers utilizing our in-house

commercial operating platform, as we transport key cargoes such as

iron ore, grain, steel products, bauxite, cement, nickel ore among

other commodities along worldwide shipping routes. Our wholly owned

high quality, modern fleet of dry cargo vessels consists of the

larger Capesize (major bulk) and the medium-sized Ultramax and

Supramax vessels (minor bulk) enabling us to carry a wide range of

cargoes. We make capital expenditures from time to time in

connection with vessel acquisitions. Genco’s fleet is expected to

consist of 41 vessels, including 15 Capesize, 15 Ultramax and 11

Supramax vessels with an aggregate capacity of approximately

4,266,000 dwt and an average age of 11.9 years, after agreed upon

vessel sales.

"Safe Harbor" Statement under the

Private Securities Litigation Reform Act of 1995This

release contains certain forward-looking statements pursuant to the

safe harbor provisions of the Private Securities Litigation Reform

Act of 1995. Such forward-looking statements use words such as

“expect,” “intend,” “plan,” “believe,” and other words and terms of

similar meaning in connection with a discussion of potential future

events, circumstances or future operating or financial performance.

These forward-looking statements are based on management’s current

expectations and observations. Included among the factors

that, in our view, could cause actual results to differ materially

from the forward looking statements contained in this release are

the following: (i) the financial results we achieve for each

quarter that apply to the formula under our dividend policy,

including without limitation the actual amounts earned by our

vessels and the amounts of various expenses we incur, as a

significant decrease in such earnings or a significant increase in

such expenses may affect our ability to carry out our comprehensive

value strategy; (ii) the exercise of the discretion of our Board

regarding the declaration of dividends, including without

limitation the amount that our Board determines to set aside for

reserves under our dividend policy and (iii) other factors listed

from time to time in our filings with the Securities and Exchange

Commission, including, without limitation, the Company’s Annual

Report on form 10-K for the year ended December 31, 2023 and the

Company's reports on Form 10-Q and Form 8-K subsequently filed with

the SEC. Our ability to pay dividends in any period will

depend upon various factors, including the limitations under any

credit agreements to which we may be a party, applicable provisions

of Marshall Islands law and the final determination by the Board of

Directors each quarter after its review of our financial

performance, market developments, and the best interests of the

Company and its shareholders. The timing and amount of dividends,

if any, could also be affected by factors affecting cash flows,

results of operations, required capital expenditures, or

reserves. As a result, the amount of dividends actually paid

may vary. We do not undertake any obligation to update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise. We do not undertake any

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or

otherwise.

CONTACT:Peter AllenChief

Financial OfficerGenco Shipping & Trading Limited(646)

443-8550

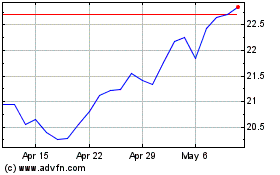

Genco Shipping and Trading (NYSE:GNK)

Historical Stock Chart

From Oct 2024 to Nov 2024

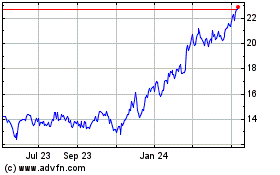

Genco Shipping and Trading (NYSE:GNK)

Historical Stock Chart

From Nov 2023 to Nov 2024