0001391437

false

N-CSRS

0001391437

2023-01-01

2023-06-30

0001391437

grx:CommonStocksMember

2023-01-01

2023-06-30

0001391437

grx:CumulativePreferredStocksMember

2023-01-01

2023-06-30

0001391437

grx:SeriesECumulativePreferredStockMember

2023-01-01

2023-06-30

0001391437

grx:SeriesGCumulativePreferredStockMember

2023-01-01

2023-06-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

June 30, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22021

The Gabelli Healthcare & WellnessRx Trust

(Exact name of registrant as specified in charter)

One Corporate Center

Rye, New York 10580-1422

(Address of principal executive offices) (Zip code)

John C. Ball

Gabelli Funds, LLC

One Corporate Center

Rye, New York 10580-1422

(Name and address of agent for service)

Registrant’s telephone number, including area

code: 1-800-422-3554

Date of fiscal year end: December 31

Date of reporting period: June 30, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission

to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of

1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection,

and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A

registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid

Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden

estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington,

DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

| (a) | The Report to Shareholders

is attached herewith. |

The Gabelli Healthcare & WellnessRx Trust

Semiannual Report — June 30, 2023

To Our Shareholders,

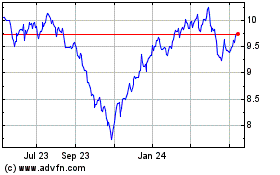

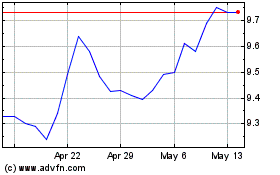

For the six months ended June 30, 2023, the net asset value (NAV) total return of The Gabelli Healthcare & WellnessRx Trust (the Fund) was 2.8%, compared with a total return of (1.5)% for the Standard & Poor’s (S&P) 500 Health Care Index. The total return for the Fund’s publicly traded shares was (0.2)%. The Fund’s NAV per share was $12.03, while the price of the publicly traded shares closed at $9.96 on the New York Stock Exchange (NYSE). See page 3 for additional performance information.

Enclosed are the financial statements, including the schedule of investments, as of June 30, 2023.

Investment Objective and Strategy (Unaudited)

The Fund’s investment objective is long term growth of capital. Under normal market conditions, the Fund will invest at least 80% of its net assets (plus borrowings made for investment purposes) in equity securities (such as common stock and preferred stock) and income producing securities (such as fixed income debt securities and securities convertible into common stock) of domestic and foreign companies in the healthcare and wellness industries. Companies in the healthcare and wellness industries are defined as those companies which are primarily engaged in providing products, services and/or equipment related to healthcare, medical, or lifestyle needs (i.e., nutrition, weight management, and food and beverage companies primarily engaged in healthcare and wellness). “Primarily engaged,” as defined in this registration statement, means a company that derives at least 50% of its revenues or earnings from, or devotes at least 50% of its assets to, the indicated business. The above 80% policy includes investments in derivatives that have similar economic characteristics to the securities included in the 80% policy. The Fund values derivatives at market value for purposes of the 80% policy. Specific sector investments for the Fund will include, but are not limited to, dental, orthopedics, cardiology, hearing aid, life science, in-vitro diagnostics, medical supplies and products, aesthetics and plastic surgery, veterinary, pharmacy benefits management, healthcare distribution, healthcare imaging, pharmaceuticals, biotechnology, healthcare plans, healthcare services, and healthcare equipment, as well as food, beverages, nutrition and weight management. The Fund will focus on companies that are growing globally due to favorable demographic trends and may invest without limitation in securities of foreign issuers, including issuers in emerging markets.

As

permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semiannual

shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the

reports will be made available on the Fund’s website (www.gabelli.com), and you will be notified by mail each time a report

is posted and provided with a website link to access the report. If you already elected to receive sharehold-er reports electronically,

you will not be affected by this change and you need not take any action. To elect to receive all future reports on paper free

of charge, please contact your financial intermediary, or, if you invest directly with the Fund, you may call 800-422-3554 or

send an email request to info@gabelli.com. |

Performance Discussion (Unaudited)

Both the global economy and stock market have proven to be very resilient in the first half of 2023. While economic growth has slowed, it has remained robust enough to keep recessionary fears at bay. Continued interest rate hikes around the world are bringing inflation under control, although more work remains to be done. Falling energy and commodity prices have been a big component of this, and are a significant tailwind to consumers around the world, especially in Europe. The U.S. dollar has also weakened, which helps the revenue and earnings of U.S. multinational companies and also helps the value of our foreign holdings. However, corporate earnings growth have slowed down this year and most of the market’s return has come from multiple expansion.

The healthcare system has continued to return to normal, addressing the backlog of deferred care from the COVID-19 pandemic and last year’s labor shortages. Surgeries continued to shift to outpatient surgery centers, but hospital chains HCA Healthcare and Tenet Healthcare have been building out their networks of these facilities for years. Their medical device suppliers continued to benefit from this pent-up demand, most notably orthopedic companies Zimmer Biomet, Stryker, and Boston Scientific. However, this strong demand is finally starting to impact health insurance companies such as UnitedHealth, most notably in their Medicare Advantage business. On the negative side, drug manufacturer Catalent fired their chief financial officer after finding accounting and forecasting problems, forcing them to cut guidance for the year and make a small financial restatement. The decline in COVID-19 drug and vaccine manufacturing has been a headwind for Bio-Rad Laboratories and Thermo Fisher Scientific.

Stock performance for the Fund’s consumer holdings was mixed, as the market pivoted towards tech-driven growth stocks and away from “defensive” companies. Bright spots included Japanese soy sauce producer Kikkoman Corp. (1.8% of total investments as of June 30, 2023), protein drink manufacturer BellRing Brands (1.8%), which continues to see exceptional growth for its Premier Protein brand, and global snack maker Mondelez International (1.7%). Top detractors included Japanese probiotic drink maker Yakult Honsha Co. (1.5%), condiment and packaged food maker The Kraft Heinz Co. (1.2%), and CVS Health Corp. (2.6%).

Thank you for your investment in The Gabelli Healthcare & WellnessRx Trust.

The

views expressed reflect the opinions of the Fund’s portfolio managers and Gabelli Funds, LLC, the Adviser, as of the date

of this report and are subject to change without notice based on changes in market, economic, or other conditions. These views

are not intended to be a forecast of future events and are no guarantee of future results. |

Comparative Results

Average

Annual Returns through June 30, 2023 (a) (Unaudited)

| |

|

Six

Months |

|

|

1

Year |

|

|

3

year |

|

|

5

year |

|

|

10

year |

|

|

15

year |

|

|

Since

Inception

(6/28/07) |

|

| The

Gabelli Healthcare & WellnessRx Trust (GRX) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NAV

Total Return (b) |

|

|

2.75 |

% |

|

|

2.41 |

% |

|

|

6.05 |

% |

|

|

5.52 |

% |

|

|

7.43 |

% |

|

|

9.61 |

% |

|

|

8.33 |

% |

| Investment

Total Return (c) |

|

|

(0.17 |

) |

|

|

(1.37 |

) |

|

|

6.06 |

|

|

|

5.88 |

|

|

|

6.65 |

|

|

|

9.37 |

|

|

|

7.09 |

|

| S&P

500 Health Care Index |

|

|

(1.48 |

) |

|

|

5.37 |

|

|

|

11.69 |

|

|

|

11.79 |

|

|

|

12.78 |

|

|

|

12.42 |

|

|

|

10.70 |

|

| S&P

500 Consumer Staples Index |

|

|

1.28 |

|

|

|

6.60 |

|

|

|

11.91 |

|

|

|

11.07 |

|

|

|

9.61 |

|

|

|

10.31 |

|

|

|

9.68 |

|

| 50%

S&P 500 Health Care Index and 50% S&P 500 Consumer Staples Index |

|

|

(0.10 |

) |

|

|

5.99 |

|

|

|

11.80 |

|

|

|

11.43 |

|

|

|

11.20 |

|

|

|

11.37 |

|

|

|

10.19 |

|

|

(a) |

Performance returns for periods of less than one year are not annualized. Returns represent past performance and do not guarantee future results. Investment returns and the principal value of an investment will fluctuate. The Fund’s use of leverage may magnify the volatility of net asset value changes versus funds that do not employ leverage. When shares are sold, they may be worth more or less than their original cost. Current performance may be lower or higher than the performance data presented. Visit www.gabelli.com for performance information as of the most recent month end. The S&P 500 Health Care Index is an unmanaged indicator of health care equipment and services, pharmaceuticals, biotechnology, and life sciences stock performance. The S&P 500 Consumer Staples Index is an unmanaged indicator of food and staples retailing, food, beverage and tobacco, and household and personal products stock performance. Dividends are considered reinvested. You cannot invest directly in an index. |

|

(b) |

Total returns and average annual returns reflect changes in the NAV per share, reinvestment of distributions at NAV on the ex-dividend date, and adjustments for rights offerings and are net of expenses. Since inception return is based on an initial NAV of $8.00. |

|

(c) |

Total returns and average annual returns reflect changes in closing market values on the NYSE, reinvestment of distributions, and adjustments for rights offerings. Since inception return is based on an initial offering price of $8.00. |

Investors

should carefully consider the investment objectives, risks, charges, and expenses of the Fund before investing.

Summary of Portfolio Holdings (Unaudited)

The following table presents portfolio holdings as a percent of total investments as of June 30, 2023:

The Gabelli Healthcare & WellnessRx Trust

| Health

Care Providers and Services |

|

|

21.4 |

% |

| Health

Care Equipment and Supplies |

|

|

21.0 |

% |

| Food |

|

|

19.8 |

% |

| Pharmaceuticals |

|

|

16.9 |

% |

| Food

and Staples Retailing |

|

|

6.9 |

% |

| U.S.

Government Obligations |

|

|

3.7 |

% |

| Biotechnology |

|

|

3.6 |

% |

| Household

and Personal Products |

|

|

2.5 |

% |

| Beverages |

|

|

2.2 |

% |

| Electronics |

|

|

2.0 |

% |

| Specialty

Chemicals |

|

|

0.0 |

%* |

| |

|

|

100.0 |

% |

|

* |

Amount represents less than 0.05%. |

The Fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission (the SEC) for the first and third quarters of each fiscal year on Form N-PORT. Shareholders may obtain this information at www.gabelli.com or by calling the Fund at 800-GABELLI (800-422-3554). The Fund’s Form N-PORT is available on the SEC’s website at www.sec.gov and may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330.

Proxy Voting

The Fund files Form N-PX with its complete proxy voting record for the twelve months ended June 30, no later than August 31 of each year. A description of the Fund’s proxy voting policies, procedures, and how each Fund voted proxies relating to portfolio securities is available without charge, upon request, by (i) calling 800-GABELLI (800-422-3554); (ii) writing to The Gabelli Funds at One Corporate Center, Rye, NY 10580-1422; or (iii) visiting the SEC’s website at www.sec.gov.

The Gabelli Healthcare & WellnessRx Trust

Schedule of Investments — June 30, 2023 (Unaudited)

Shares |

|

|

|

|

Cost |

|

|

Market

Value |

|

| |

|

|

|

COMMON

STOCKS — 96.2% |

|

|

|

|

|

|

|

|

| |

|

|

|

Beverages

— 2.2% |

|

|

|

|

|

|

|

|

| |

60,000 |

|

|

China

Mengniu Dairy Co. Ltd. |

|

$ |

134,296 |

|

|

$ |

225,881 |

|

| |

28,000 |

|

|

Danone

SA |

|

|

1,499,475 |

|

|

|

1,715,279 |

|

| |

40,000 |

|

|

ITO

EN Ltd. |

|

|

954,106 |

|

|

|

1,100,246 |

|

| |

7,000 |

|

|

Morinaga

Milk Industry Co. Ltd. |

|

|

121,875 |

|

|

|

228,878 |

|

| |

5,000 |

|

|

PepsiCo

Inc. |

|

|

423,100 |

|

|

|

926,100 |

|

| |

30,000 |

|

|

Suntory

Beverage & Food Ltd. |

|

|

1,001,275 |

|

|

|

1,083,614 |

|

| |

424,000 |

|

|

Vitasoy

International Holdings Ltd. |

|

|

253,570 |

|

|

|

528,106 |

|

| |

|

|

|

|

|

|

4,387,697 |

|

|

|

5,808,104 |

|

| |

|

|

|

Biotechnology

— 3.5% |

|

|

|

|

|

|

|

|

| |

1,000 |

|

|

10X

Genomics Inc., Cl. A† |

|

|

35,020 |

|

|

|

55,840 |

|

| |

833 |

|

|

2seventy

bio Inc.† |

|

|

22,951 |

|

|

|

8,430 |

|

| |

7,500 |

|

|

Bio-Rad

Laboratories Inc., Cl. A† |

|

|

3,215,659 |

|

|

|

2,843,400 |

|

| |

55,000 |

|

|

Catalent

Inc.† |

|

|

4,544,462 |

|

|

|

2,384,800 |

|

| |

8,300 |

|

|

Charles

River Laboratories International Inc.† |

|

|

1,759,702 |

|

|

|

1,745,075 |

|

| |

500 |

|

|

Galapagos

NV, ADR† |

|

|

28,752 |

|

|

|

20,330 |

|

| |

957 |

|

|

Guardant

Health Inc.† |

|

|

26,190 |

|

|

|

34,260 |

|

| |

3,000 |

|

|

Idorsia

Ltd.† |

|

|

39,699 |

|

|

|

21,619 |

|

| |

3,600 |

|

|

Illumina

Inc.† |

|

|

272,208 |

|

|

|

674,964 |

|

| |

700 |

|

|

Incyte

Corp.† |

|

|

56,772 |

|

|

|

43,575 |

|

| |

1,000 |

|

|

Intellia

Therapeutics Inc.† |

|

|

52,000 |

|

|

|

40,780 |

|

| |

5,000 |

|

|

Invitae

Corp.† |

|

|

18,361 |

|

|

|

5,650 |

|

| |

300 |

|

|

Natera

Inc.† |

|

|

32,019 |

|

|

|

14,598 |

|

| |

300 |

|

|

PhenomeX

Inc.† |

|

|

23,091 |

|

|

|

147 |

|

| |

1,200 |

|

|

Regeneron

Pharmaceuticals Inc.† |

|

|

452,650 |

|

|

|

862,248 |

|

| |

3,037 |

|

|

Vericel

Corp.† |

|

|

73,289 |

|

|

|

114,100 |

|

| |

1,400 |

|

|

Waters

Corp.† |

|

|

218,778 |

|

|

|

373,156 |

|

| |

|

|

|

|

|

|

10,871,603 |

|

|

|

9,242,972 |

|

| |

|

|

|

Electronics

— 2.0% |

|

|

|

|

|

|

|

|

| |

10,150 |

|

|

Thermo

Fisher Scientific Inc. |

|

|

2,551,790 |

|

|

|

5,295,762 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Food

— 19.8% |

|

|

|

|

|

|

|

|

| |

10,000 |

|

|

Calavo

Growers Inc. |

|

|

321,804 |

|

|

|

290,200 |

|

| |

35,000 |

|

|

Campbell

Soup Co. |

|

|

1,736,558 |

|

|

|

1,599,850 |

|

| |

1,500 |

|

|

Chr.

Hansen Holding A/S |

|

|

89,852 |

|

|

|

104,111 |

|

| |

30,000 |

|

|

Conagra

Brands Inc. |

|

|

915,733 |

|

|

|

1,011,600 |

|

| |

52,500 |

|

|

Flowers

Foods Inc. |

|

|

522,586 |

|

|

|

1,306,200 |

|

| |

25,000 |

|

|

General

Mills Inc. |

|

|

1,946,671 |

|

|

|

1,917,500 |

|

| |

27,200 |

|

|

Kellogg

Co. |

|

|

1,494,776 |

|

|

|

1,833,280 |

|

| |

35,000 |

|

|

Kerry

Group plc, Cl. A |

|

|

1,331,659 |

|

|

|

3,381,901 |

|

| |

83,500 |

|

|

Kikkoman

Corp. |

|

|

1,028,151 |

|

|

|

4,740,511 |

|

| |

15,000 |

|

|

Lamb

Weston Holdings Inc. |

|

|

1,149,351 |

|

|

|

1,724,250 |

|

| Shares |

|

|

|

|

Cost |

|

|

Market

Value |

|

| |

10,000 |

|

|

Maple

Leaf Foods Inc. |

|

$ |

169,092 |

|

|

$ |

195,358 |

|

| |

30,000 |

|

|

MEIJI

Holdings Co. Ltd. |

|

|

310,384 |

|

|

|

669,046 |

|

| |

60,000 |

|

|

Mondelēz

International Inc., Cl. A |

|

|

2,246,745 |

|

|

|

4,376,400 |

|

| |

66,000 |

|

|

Nestlé

SA |

|

|

4,235,654 |

|

|

|

7,934,305 |

|

| |

45,000 |

|

|

Nomad

Foods Ltd.† |

|

|

831,419 |

|

|

|

788,400 |

|

| |

45,000 |

|

|

Post

Holdings Inc.† |

|

|

1,205,896 |

|

|

|

3,899,250 |

|

| |

10,000 |

|

|

Sovos

Brands Inc.† |

|

|

124,309 |

|

|

|

195,600 |

|

| |

9,500 |

|

|

The

Hain Celestial Group Inc.† |

|

|

166,536 |

|

|

|

118,845 |

|

| |

28,000 |

|

|

The

J.M. Smucker Co. |

|

|

2,595,380 |

|

|

|

4,134,760 |

|

| |

90,000 |

|

|

The

Kraft Heinz Co. |

|

|

3,566,885 |

|

|

|

3,195,000 |

|

| |

120,000 |

|

|

Tingyi

(Cayman Islands) Holding Corp. |

|

|

196,545 |

|

|

|

186,524 |

|

| |

28,000 |

|

|

TreeHouse

Foods Inc.† |

|

|

1,349,460 |

|

|

|

1,410,640 |

|

| |

60,000 |

|

|

Unilever

plc, ADR |

|

|

2,212,942 |

|

|

|

3,127,800 |

|

| |

63,200 |

|

|

Yakult

Honsha Co. Ltd. |

|

|

1,865,581 |

|

|

|

3,987,914 |

|

| |

|

|

|

|

|

|

31,613,969 |

|

|

|

52,129,245 |

|

| |

|

|

|

Food

and Staples Retailing — 6.9% |

|

|

|

|

|

|

|

|

| |

4,000 |

|

|

BARK

Inc.† |

|

|

30,439 |

|

|

|

5,320 |

|

| |

130,000 |

|

|

BellRing

Brands Inc.† |

|

|

1,945,273 |

|

|

|

4,758,000 |

|

| |

99,400 |

|

|

CVS

Health Corp. |

|

|

4,375,338 |

|

|

|

6,871,522 |

|

| |

30,000 |

|

|

Ingles

Markets Inc., Cl. A |

|

|

454,430 |

|

|

|

2,479,500 |

|

| |

1,500 |

|

|

Petco

Health & Wellness Co. Inc.† |

|

|

27,610 |

|

|

|

13,350 |

|

| |

13,000 |

|

|

Pets

at Home Group plc |

|

|

72,880 |

|

|

|

62,177 |

|

| |

20,000 |

|

|

Sprouts

Farmers Market Inc.† |

|

|

403,296 |

|

|

|

734,600 |

|

| |

60,000 |

|

|

The

Kroger Co. |

|

|

896,473 |

|

|

|

2,820,000 |

|

| |

6,000 |

|

|

United

Natural Foods Inc.† |

|

|

48,857 |

|

|

|

117,300 |

|

| |

9,000 |

|

|

Walgreens

Boots Alliance Inc. |

|

|

354,473 |

|

|

|

256,410 |

|

| |

|

|

|

|

|

|

8,609,069 |

|

|

|

18,118,179 |

|

| |

|

|

|

Health

Care Equipment and Supplies — 21.0% |

|

|

|

|

|

|

|

|

| |

500 |

|

|

Agilent

Technologies Inc. |

|

|

64,443 |

|

|

|

60,125 |

|

| |

21,661 |

|

|

Axogen

Inc.† |

|

|

234,839 |

|

|

|

197,765 |

|

| |

1,000 |

|

|

Azenta

Inc.† |

|

|

36,550 |

|

|

|

46,680 |

|

| |

120,000 |

|

|

Bausch

+ Lomb Corp.† |

|

|

2,064,608 |

|

|

|

2,408,400 |

|

| |

55,000 |

|

|

Baxter

International Inc. |

|

|

2,881,159 |

|

|

|

2,505,800 |

|

| |

2,200 |

|

|

Becton

Dickinson & Co. |

|

|

524,122 |

|

|

|

580,822 |

|

| |

18,500 |

|

|

Boston

Scientific Corp.† |

|

|

109,940 |

|

|

|

1,000,665 |

|

| |

23,000 |

|

|

Cutera

Inc.† |

|

|

361,119 |

|

|

|

347,990 |

|

| |

75,000 |

|

|

DENTSPLY

SIRONA Inc. |

|

|

3,404,577 |

|

|

|

3,001,500 |

|

| |

17,325 |

|

|

Electromed

Inc.† |

|

|

165,149 |

|

|

|

185,551 |

|

| |

40 |

|

|

Embecta

Corp. |

|

|

1,210 |

|

|

|

864 |

|

| |

800 |

|

|

Exact

Sciences Corp.† |

|

|

48,049 |

|

|

|

75,120 |

|

| |

7,000 |

|

|

Gerresheimer

AG |

|

|

298,976 |

|

|

|

787,519 |

|

| |

14,800 |

|

|

Globus

Medical Inc., Cl. A† |

|

|

347,630 |

|

|

|

881,192 |

|

| |

51,919 |

|

|

Halozyme

Therapeutics Inc.† |

|

|

2,570,497 |

|

|

|

1,872,718 |

|

| |

45,000 |

|

|

Henry

Schein Inc.† |

|

|

2,765,202 |

|

|

|

3,649,500 |

|

See accompanying notes to financial statements.

The Gabelli Healthcare & WellnessRx Trust

Schedule of Investments (Continued) — June 30, 2023 (Unaudited)

| |

|

|

|

|

|

|

|

Market |

|

| Shares |

|

|

|

|

Cost |

|

|

Value |

|

| |

|

|

|

COMMON

STOCKS (Continued) |

|

|

|

|

|

|

|

|

| |

|

|

|

Health

Care Equipment and Supplies (Continued) |

|

|

|

|

|

|

|

|

| |

800 |

|

|

Hologic

Inc.† |

|

$ |

57,920 |

|

|

$ |

64,776 |

|

| |

8,000 |

|

|

Horizon

Therapeutics plc† |

|

|

736,160 |

|

|

|

822,800 |

|

| |

8,500 |

|

|

ICU

Medical Inc.† |

|

|

1,898,745 |

|

|

|

1,514,615 |

|

| |

182,000 |

|

|

InfuSystem

Holdings Inc.† |

|

|

1,422,953 |

|

|

|

1,752,660 |

|

| |

45,000 |

|

|

Integer

Holdings Corp.† |

|

|

2,298,100 |

|

|

|

3,987,450 |

|

| |

200 |

|

|

Intuitive

Surgical Inc.† |

|

|

65,290 |

|

|

|

68,388 |

|

| |

35,000 |

|

|

Lantheus

Holdings Inc.† |

|

|

1,963,077 |

|

|

|

2,937,200 |

|

| |

25,000 |

|

|

Medtronic

plc |

|

|

1,924,703 |

|

|

|

2,202,500 |

|

| |

15,000 |

|

|

Merit

Medical Systems Inc.† |

|

|

957,300 |

|

|

|

1,254,600 |

|

| |

1,400 |

|

|

Neogen

Corp.† |

|

|

33,155 |

|

|

|

30,450 |

|

| |

47,274 |

|

|

Neuronetics

Inc.† |

|

|

288,545 |

|

|

|

101,639 |

|

| |

1,000 |

|

|

Nevro

Corp.† |

|

|

45,405 |

|

|

|

25,420 |

|

| |

15,751 |

|

|

NuVasive

Inc.† |

|

|

677,810 |

|

|

|

655,084 |

|

| |

14,000 |

|

|

Patterson

Cos. Inc. |

|

|

312,303 |

|

|

|

465,640 |

|

| |

24,100 |

|

|

QuidelOrtho

Corp.† |

|

|

2,142,941 |

|

|

|

1,996,926 |

|

| |

500 |

|

|

Revvity

Inc. |

|

|

84,547 |

|

|

|

59,395 |

|

| |

33,473 |

|

|

Semler

Scientific Inc.† |

|

|

1,617,688 |

|

|

|

878,332 |

|

| |

35,000 |

|

|

Silk

Road Medical Inc.† |

|

|

1,642,440 |

|

|

|

1,137,150 |

|

| |

10,000 |

|

|

SmileDirectClub

Inc.† |

|

|

19,949 |

|

|

|

5,300 |

|

| |

3,000 |

|

|

Smith

& Nephew plc, ADR |

|

|

99,190 |

|

|

|

96,750 |

|

| |

25,000 |

|

|

Stericycle

Inc.† |

|

|

1,294,786 |

|

|

|

1,161,000 |

|

| |

14,000 |

|

|

Stryker

Corp. |

|

|

1,517,787 |

|

|

|

4,271,260 |

|

| |

17,000 |

|

|

SurModics

Inc.† |

|

|

478,044 |

|

|

|

532,270 |

|

| |

2,000 |

|

|

Tactile

Systems Technology Inc.† |

|

|

39,325 |

|

|

|

49,860 |

|

| |

4,000 |

|

|

Tandem

Diabetes Care Inc.† |

|

|

136,425 |

|

|

|

98,160 |

|

| |

12,000 |

|

|

The

Cooper Companies Inc. |

|

|

1,891,881 |

|

|

|

4,601,160 |

|

| |

76,293 |

|

|

Treace

Medical Concepts Inc.† |

|

|

1,621,668 |

|

|

|

1,951,575 |

|

| |

34,400 |

|

|

Zimmer

Biomet Holdings Inc. |

|

|

3,541,576 |

|

|

|

5,008,640 |

|

| |

|

|

|

|

|

|

44,687,783 |

|

|

|

55,333,211 |

|

| |

|

|

|

Health

Care Providers and Services — 21.4% |

|

|

|

|

|

|

|

|

| |

35,000 |

|

|

AmerisourceBergen

Corp. |

|

|

4,102,456 |

|

|

|

6,735,050 |

|

| |

160,000 |

|

|

Avantor

Inc.† |

|

|

3,693,338 |

|

|

|

3,286,400 |

|

| |

137,276 |

|

|

CareCloud

Inc.† |

|

|

1,022,000 |

|

|

|

404,964 |

|

| |

6,000 |

|

|

Chemed

Corp. |

|

|

2,684,296 |

|

|

|

3,250,020 |

|

| |

30,000 |

|

|

DaVita

Inc.† |

|

|

1,711,551 |

|

|

|

3,014,100 |

|

| |

19,084 |

|

|

DLH

Holdings Corp.† |

|

|

162,085 |

|

|

|

195,611 |

|

| |

9,200 |

|

|

Elevance

Health Inc. |

|

|

1,674,307 |

|

|

|

4,087,468 |

|

| |

187,500 |

|

|

Evolent

Health Inc., Cl. A† |

|

|

2,536,249 |

|

|

|

5,681,250 |

|

| |

4,000 |

|

|

Glaukos

Corp.† |

|

|

183,035 |

|

|

|

284,840 |

|

| |

8,000 |

|

|

GoodRx

Holdings Inc., Cl. A† |

|

|

56,308 |

|

|

|

44,160 |

|

| |

22,200 |

|

|

HCA

Healthcare Inc. |

|

|

3,052,150 |

|

|

|

6,737,256 |

|

| |

500 |

|

|

IQVIA

Holdings Inc.† |

|

|

101,974 |

|

|

|

112,385 |

|

| |

16,385 |

|

|

Laboratory

Corp. of America Holdings |

|

|

1,866,661 |

|

|

|

3,954,192 |

|

| |

|

|

|

|

|

|

|

Market |

|

| Shares |

|

|

|

|

Cost |

|

|

Value |

|

| |

8,000 |

|

|

McKesson

Corp. |

|

$ |

489,752 |

|

|

$ |

3,418,480 |

|

| |

600 |

|

|

Medpace

Holdings Inc.† |

|

|

90,570 |

|

|

|

144,102 |

|

| |

173,400 |

|

|

Option

Care Health Inc.† |

|

|

1,809,644 |

|

|

|

5,633,766 |

|

| |

10,000 |

|

|

Orthofix

Medical Inc.† |

|

|

287,098 |

|

|

|

180,600 |

|

| |

55,053 |

|

|

PetIQ

Inc.† |

|

|

1,195,570 |

|

|

|

835,154 |

|

| |

500 |

|

|

Quest

Diagnostics Inc. |

|

|

75,022 |

|

|

|

70,280 |

|

| |

1,000 |

|

|

Teladoc

Health Inc.† |

|

|

36,234 |

|

|

|

25,320 |

|

| |

96,000 |

|

|

Tenet

Healthcare Corp.† |

|

|

2,136,170 |

|

|

|

7,812,480 |

|

| |

1,050 |

|

|

UnitedHealth

Group Inc. |

|

|

128,919 |

|

|

|

504,672 |

|

| |

|

|

|

|

|

|

29,095,389 |

|

|

|

56,412,550 |

|

| |

|

|

|

Household

and Personal Products — 2.5% |

|

|

|

|

|

|

|

|

| |

12,000 |

|

|

Church

& Dwight Co. Inc. |

|

|

774,331 |

|

|

|

1,202,760 |

|

| |

15,000 |

|

|

Colgate-Palmolive

Co. |

|

|

965,686 |

|

|

|

1,155,600 |

|

| |

60,000 |

|

|

Edgewell

Personal Care Co. |

|

|

1,794,131 |

|

|

|

2,478,600 |

|

| |

12,000 |

|

|

The

Procter & Gamble Co. |

|

|

923,445 |

|

|

|

1,820,880 |

|

| |

|

|

|

|

|

|

4,457,593 |

|

|

|

6,657,840 |

|

| |

|

|

|

Pharmaceuticals

— 16.9% |

|

|

|

|

|

|

|

|

| |

21,900 |

|

|

Abbott

Laboratories |

|

|

992,108 |

|

|

|

2,387,538 |

|

| |

47,400 |

|

|

AbbVie

Inc. |

|

|

5,282,833 |

|

|

|

6,386,202 |

|

| |

4,000 |

|

|

ACADIA

Pharmaceuticals Inc.† |

|

|

90,650 |

|

|

|

95,800 |

|

| |

25,000 |

|

|

Achaogen

Inc.†(a) |

|

|

360 |

|

|

|

0 |

|

| |

36,111 |

|

|

AstraZeneca

plc, ADR |

|

|

1,972,428 |

|

|

|

2,584,464 |

|

| |

24,000 |

|

|

Bausch

Health Cos. Inc.† |

|

|

222,216 |

|

|

|

192,000 |

|

| |

66,800 |

|

|

Bristol-Myers

Squibb Co. |

|

|

3,094,045 |

|

|

|

4,271,860 |

|

| |

75,000 |

|

|

Elanco

Animal Health Inc.† |

|

|

2,055,183 |

|

|

|

754,500 |

|

| |

10,000 |

|

|

IVERIC

bio Inc.† |

|

|

378,000 |

|

|

|

393,400 |

|

| |

43,900 |

|

|

Johnson

& Johnson |

|

|

5,247,789 |

|

|

|

7,266,328 |

|

| |

22,000 |

|

|

Merck

& Co. Inc. |

|

|

795,769 |

|

|

|

2,538,580 |

|

| |

25,000 |

|

|

Paratek

Pharmaceuticals Inc.† |

|

|

97,781 |

|

|

|

55,250 |

|

| |

66,000 |

|

|

Perrigo

Co. plc |

|

|

2,373,693 |

|

|

|

2,240,700 |

|

| |

93,425 |

|

|

Pfizer

Inc. |

|

|

3,117,946 |

|

|

|

3,426,829 |

|

| |

12,000 |

|

|

Roche

Holding AG, ADR |

|

|

250,094 |

|

|

|

458,400 |

|

| |

34,200 |

|

|

Teva

Pharmaceutical Industries Ltd., ADR† |

|

|

387,845 |

|

|

|

257,526 |

|

| |

20,400 |

|

|

The

Cigna Group |

|

|

2,884,304 |

|

|

|

5,724,240 |

|

| |

7,808 |

|

|

Vertex

Pharmaceuticals Inc.† |

|

|

1,761,477 |

|

|

|

2,747,714 |

|

| |

25,000 |

|

|

Viatris

Inc. |

|

|

370,532 |

|

|

|

249,500 |

|

| |

6,040 |

|

|

Zimvie

Inc.† |

|

|

48,794 |

|

|

|

67,829 |

|

| |

15,200 |

|

|

Zoetis

Inc. |

|

|

745,437 |

|

|

|

2,617,592 |

|

| |

|

|

|

|

|

|

32,169,284 |

|

|

|

44,716,252 |

|

| |

|

|

|

Specialty

Chemicals — 0.0% |

|

|

|

|

|

|

|

|

| |

1,000 |

|

|

International

Flavors & Fragrances Inc. |

|

|

93,119 |

|

|

|

79,590 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

TOTAL

COMMON STOCKS |

|

|

168,537,296 |

|

|

|

253,793,705 |

|

See accompanying notes to financial statements.

The Gabelli Healthcare & WellnessRx Trust

Schedule of Investments (Continued) — June 30, 2023 (Unaudited)

| |

|

|

|

|

|

|

|

Market |

|

| Shares |

|

|

|

|

Cost |

|

|

Value |

|

| |

|

|

|

PREFERRED

STOCKS — 0.1% |

|

|

|

|

|

|

|

|

| |

|

|

|

Biotechnology

— 0.1% |

|

|

|

|

|

|

|

|

| |

5,600 |

|

|

XOMA

Corp., Ser. A, 8.625% |

|

$ |

127,311 |

|

|

$ |

134,232 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

RIGHTS

— 0.0% |

|

|

|

|

|

|

|

|

| |

|

|

|

Biotechnology

— 0.0% |

|

|

|

|

|

|

|

|

| |

6,907 |

|

|

Tobira

Therapeutics Inc., CVR†(a) |

|

|

414 |

|

|

|

0 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Pharmaceuticals

— 0.0% |

|

|

|

|

|

|

|

|

| |

3,500 |

|

|

Ipsen

SA/Clementia, CVR†(a) |

|

|

4,725 |

|

|

|

0 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

TOTAL

RIGHTS |

|

|

5,139 |

|

|

|

0 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

WARRANTS

— 0.0% |

|

|

|

|

|

|

|

|

| |

|

|

|

Health

Care Providers and Services — 0.0% |

|

|

|

|

|

|

|

|

| |

420 |

|

|

Option

Care Health Inc., Cl. A, expire 07/27/25† |

|

|

384 |

|

|

|

1,529 |

|

| |

420 |

|

|

Option

Care Health Inc., Cl. B, expire 12/31/25† |

|

|

363 |

|

|

|

1,180 |

|

| |

|

|

|

|

|

|

747 |

|

|

|

2,709 |

|

| Principal |

|

|

|

|

|

|

|

|

|

| Amount |

|

|

|

|

|

|

|

|

|

| |

|

|

|

U.S.

GOVERNMENT OBLIGATIONS — 3.7% |

|

|

|

|

|

|

|

|

| $ |

9,889,000 |

|

|

U.S.

Treasury Bills, 4.914% to 5.313%††,07/13/23 to 11/02/23 |

|

|

9,829,949 |

|

|

|

9,831,591 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL INVESTMENTS

— 100.0% |

|

$ |

178,500,442 |

|

|

|

263,762,237 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Other Assets

and Liabilities (Net) |

|

|

|

|

|

|

786,286 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| PREFERRED SHAREHOLDERS |

|

|

|

|

|

|

|

|

| (6,395,500 preferred shares outstanding) |

|

|

|

|

|

|

(63,955,000 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| NET ASSETS —

COMMON SHAREHOLDERS |

|

|

|

|

|

|

|

|

| (16,679,968 common shares outstanding) |

|

|

|

|

|

$ |

200,593,523 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| NET ASSET VALUE

PER COMMON SHARE |

|

|

|

|

|

|

|

|

| ($200,593,523 ÷ 16,679,968 shares outstanding) |

|

|

|

|

|

$ |

12.03 |

|

|

(a) |

Security is valued using significant unobservable inputs and is classified as Level 3 in the fair value hierarchy. |

|

† |

Non-income producing security. |

|

†† |

Represents annualized yields

at dates of purchase. |

ADR American Depositary Receipt

CVR Contingent Value Right

| Geographic

Diversification |

|

%

of Total

Investments |

|

|

Market

Value |

|

| North

America |

|

|

85.4 |

% |

|

$ |

225,227,736 |

|

| Europe |

|

|

9.8 |

|

|

|

25,783,782 |

|

| Japan |

|

|

4.5 |

|

|

|

11,810,208 |

|

| Asia/Pacific |

|

|

0.3 |

|

|

|

940,511 |

|

| Total

Investments |

|

|

100.0 |

% |

|

$ |

263,762,237 |

|

See accompanying notes to financial statements.

The

Gabelli Healthcare & WellnessRx Trust

Statement of Assets and Liabilities

June 30, 2023 (Unaudited)

| Assets: |

|

|

|

|

| Investments,

at value (cost $178,500,442) |

|

$ |

263,762,237 |

|

| Cash |

|

|

35,034 |

|

| Foreign

currency, at value (cost $5,051) |

|

|

5,045 |

|

| Receivable

for investments sold |

|

|

857,515 |

|

| Dividends

and interest receivable |

|

|

470,252 |

|

| Deferred

offering expense |

|

|

155,475 |

|

| Prepaid

expenses |

|

|

6,624 |

|

| Total

Assets |

|

|

265,292,182 |

|

| Liabilities: |

|

|

|

|

| Distributions

payable |

|

|

39,523 |

|

| Payable

for Fund shares repurchased |

|

|

45,741 |

|

| Payable

for investment advisory fees |

|

|

216,479 |

|

| Payable

for payroll expenses |

|

|

74,062 |

|

| Payable

for offering costs |

|

|

30,591 |

|

| Payable

for accounting fees |

|

|

7,500 |

|

| Payable

for preferred offering expenses |

|

|

136,809 |

|

| Series

E Cumulative Preferred Stock, callable and mandatory redemption 12/26/25 (See Notes 2 and 6) |

|

|

40,000,000 |

|

| Series

G Cumulative Preferred Shares, callable and mandatory redemption 06/26/25 (See Notes 2 and 6) |

|

|

23,955,000 |

|

| Other

accrued expenses |

|

|

192,954 |

|

| Total

Liabilities |

|

|

64,698,659 |

|

| Net

Assets Attributable to Common Shareholders |

|

$ |

200,593,523 |

|

| |

|

|

|

|

| Net

Assets Attributable to Common Shareholders Consist of: |

|

|

|

|

| Paid-in

capital |

|

$ |

116,246,187 |

|

| Total

distributable earnings |

|

|

84,347,336 |

|

| Net

Assets |

|

$ |

200,593,523 |

|

| |

|

|

|

|

| Net

Asset Value per Common Share: |

|

|

|

|

| ($200,593,523

÷ 16,679,968 shares outstanding at $0.001 par value; unlimited number of shares authorized) |

|

$ |

12.03 |

|

Statement of Operations

For the Six Months Ended June 30, 2023 (Unaudited)

| Investment

Income: |

|

|

|

|

| Dividends

(net of foreign withholding taxes of $67,727) |

|

$ |

1,815,997 |

|

| Interest |

|

|

405,900 |

|

| Total

Investment Income |

|

|

2,221,897 |

|

| Expenses: |

|

|

|

|

| Investment

advisory fees |

|

|

1,316,108 |

|

| Interest

expense on preferred shares |

|

|

1,358,894 |

|

| Shareholder

communications expenses |

|

|

89,515 |

|

| Payroll

expenses |

|

|

84,828 |

|

| Legal

and audit fees |

|

|

54,840 |

|

| Shareholder

services fees |

|

|

52,537 |

|

| Trustees’

fees |

|

|

34,453 |

|

| Accounting

fees |

|

|

22,500 |

|

| Custodian

fees |

|

|

13,609 |

|

| Offering

expense for issuance of preferred shares |

|

|

11,807 |

|

| Interest

expense |

|

|

4 |

|

| Miscellaneous

expenses |

|

|

44,167 |

|

| Total

Expenses |

|

|

3,083,262 |

|

| Less: |

|

|

|

|

| Expenses

paid indirectly by broker (See Note 5) |

|

|

(790 |

) |

| Net

Expenses |

|

|

3,082,472 |

|

| Net

Investment Loss |

|

|

(860,575 |

) |

| |

|

|

|

|

| Net

Realized and Unrealized Gain/(Loss) on Investments and Foreign Currency: |

|

|

|

|

| Net

realized gain on investments |

|

|

545,995 |

|

| Net

realized loss on foreign currency transactions |

|

|

(4,014 |

) |

| Net

realized gain on investments and foreign currency transactions |

|

|

541,981 |

|

| Net

change in unrealized appreciation/depreciation: |

|

|

|

|

| on

investments |

|

|

5,111,440 |

|

| on

foreign currency translations |

|

|

5,124 |

|

| Net

change in unrealized appreciation/depreciation on investments and foreign currency translations |

|

|

5,116,564 |

|

| Net

Realized and Unrealized Gain/(Loss) on Investments and Foreign Currency |

|

|

5,658,545 |

|

| Net

Increase in Net Assets Attributable to Common Shareholders Resulting from Operations |

|

$ |

4,797,970 |

|

See accompanying notes to financial statements.

The Gabelli Healthcare & WellnessRx Trust

Statement of Changes in Net Assets Attributable to Common Shareholders

| |

|

Six

Months Ended

June 30,

2023

(Unaudited) |

|

|

Year

Ended

December 31,

2022 |

|

| Operations: |

|

|

|

|

|

|

|

|

| Net

investment loss |

|

$ |

(860,575 |

) |

|

$ |

(2,873,611 |

) |

| Net realized

gain on investments and foreign currency transactions |

|

|

541,981 |

|

|

|

11,529,079 |

|

| Net

change in unrealized appreciation/depreciation on investments and foreign currency translations |

|

|

5,116,564 |

|

|

|

(56,097,958 |

) |

| Net

Increase/(Decrease) in Net Assets Attributable to Common Shareholders Resulting from Operations |

|

|

4,797,970 |

|

|

|

(47,442,490 |

) |

| |

|

|

|

|

|

|

|

|

| Distributions

to Common Shareholders: |

|

|

|

|

|

|

|

|

| Accumulated

earnings |

|

|

— |

|

|

|

(10,190,611 |

) |

| Return

of capital |

|

|

(5,064,513 |

)* |

|

|

(69,324 |

) |

| Total

Distributions to Common Shareholders |

|

|

(5,064,513 |

) |

|

|

(10,259,935 |

) |

| |

|

|

|

|

|

|

|

|

| Fund Share

Transactions: |

|

|

|

|

|

|

|

|

| Net decrease

from repurchase of common shares |

|

|

(3,592,980 |

) |

|

|

(1,596,912 |

) |

| Offering

costs for preferred shares charged to paid-in capital |

|

|

(200,000 |

) |

|

|

— |

|

| Net

Decrease in Net Assets from Fund Share Transactions |

|

|

(3,792,980 |

) |

|

|

(1,596,912 |

) |

| |

|

|

|

|

|

|

|

|

| Net

Decrease in Net Assets Attributable to Common Shareholders |

|

|

(4,059,523 |

) |

|

|

(59,299,337 |

) |

| |

|

|

|

|

|

|

|

|

| Net

Assets Attributable to Common Shareholders: |

|

|

|

|

|

|

|

|

| Beginning

of year |

|

|

204,653,046 |

|

|

|

263,952,383 |

|

| End

of period |

|

$ |

200,593,523 |

|

|

$ |

204,653,046 |

|

|

* |

Based on year to date book income. Amounts are subject to change and recharacterization at year end. |

See accompanying notes to financial statements.

The

Gabelli Healthcare & WellnessRx Trust

Statement of Cash Flows

For the Six Months Ended June 30, 2023 (Unaudited)

| Net

increase in net assets attributable to common shareholders resulting from operations |

|

$ |

4,797,970 |

|

| |

|

|

|

|

| Adjustments

to Reconcile Net Increase in Net Assets Resulting from Operations to Net Cash from Operating Activities: |

|

|

|

|

| Purchase

of long term investment securities |

|

|

(33,940,114 |

) |

| Proceeds

from sales of long term investment securities |

|

|

13,934,395 |

|

| Net

sales of short term investment securities |

|

|

4,166,275 |

|

| Net

realized gain on investments |

|

|

(545,995 |

) |

| Net

change in unrealized appreciation on investments |

|

|

(5,111,440 |

) |

| Net

amortization of discount |

|

|

(405,052 |

) |

| Decrease

in receivable for investments sold |

|

|

5,349,047 |

|

| Increase

in dividends and interest receivable |

|

|

(50,146 |

) |

| Increase

in prepaid expenses |

|

|

(2,893 |

) |

| Decrease

in payable for investments purchased |

|

|

(3,505,373 |

) |

| Increase

in payable for offering costs |

|

|

11,807 |

|

| Decrease

in payable for investment advisory fees |

|

|

(24,285 |

) |

| Increase

in payable for payroll expenses |

|

|

29,353 |

|

| Decrease

in payable for accounting fees |

|

|

(3,750 |

) |

| Increase

in payable for preferred offering expenses |

|

|

128,380 |

|

| Increase

in other accrued expenses |

|

|

865 |

|

| Net

cash used in operating activities |

|

|

(15,170,956 |

) |

| |

|

|

|

|

| Net

increase in net assets resulting from financing activities: |

|

|

|

|

| Issuance

of Series G 5.200% Cumulative Preferred Stock |

|

|

23,955,000 |

|

| Offering

costs for preferred shares charged to paid-in capital |

|

|

(200,000 |

) |

| Distributions

to common shareholders |

|

|

(5,047,212 |

) |

| Increase

in payable for Fund shares redeemed |

|

|

45,741 |

|

| Decrease

from repurchase of common shares |

|

|

(3,592,980 |

) |

| Net

cash provided by financing activities |

|

|

15,160,549 |

|

| Net

decrease in cash |

|

|

(10,407 |

) |

| Cash

(including foreign currency): |

|

|

|

|

| Beginning

of year |

|

|

50,486 |

|

| End

of period |

|

$ |

40,079 |

|

|

|

|

|

|

|

| Supplemental

disclosure of cash flow information and non-cash activities: |

|

|

|

|

| Interest

paid on preferred shares |

|

$ |

(1,358,894 |

) |

| Interest

paid on bank overdrafts |

|

|

4 |

|

See accompanying notes to financial statements.

The Gabelli Healthcare & WellnessRx Trust

Financial Highlights

Selected data for a common share of beneficial interest outstanding throughout each period:

| |

|

Six

Months Ended

June 30,

2023 |

|

|

Year

Ended December 31, |

|

| |

|

(Unaudited) |

|

|

2022 |

|

|

2021 |

|

|

2020 |

|

|

2019 |

|

|

2018 |

|

| Operating

Performance: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

asset value, beginning of year |

|

$ |

12.01 |

|

|

$ |

15.36 |

|

|

$ |

13.81 |

|

|

$ |

13.10 |

|

|

$ |

10.95 |

|

|

$ |

11.74 |

|

| Net

investment income/(loss) |

|

|

(0.05 |

) |

|

|

(0.17 |

) |

|

|

(0.13 |

) |

|

|

(0.00 |

)(a) |

|

|

0.02 |

|

|

|

0.07 |

|

| Net

realized and unrealized gain/(loss) on investments and foreign currency transactions |

|

|

0.35 |

|

|

|

(2.59 |

) |

|

|

2.61 |

|

|

|

1.38 |

|

|

|

2.87 |

|

|

|

(0.23 |

) |

| Total

from investment operations |

|

|

0.30 |

|

|

|

(2.76 |

) |

|

|

2.48 |

|

|

|

1.38 |

|

|

|

2.89 |

|

|

|

(0.16 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Distributions

to Preferred Shareholders: (b) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

investment income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(0.00 |

)(a) |

|

|

(0.01 |

) |

|

|

(0.02 |

) |

| Net

realized gain |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(0.14 |

) |

|

|

(0.20 |

) |

|

|

(0.18 |

) |

| Total

distributions to preferred shareholders |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(0.14 |

) |

|

|

(0.21 |

) |

|

|

(0.20 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

Increase/(Decrease) in Net Assets Attributable to Common Shareholders Resulting from Operations |

|

|

0.30 |

|

|

|

(2.76 |

) |

|

|

2.48 |

|

|

|

1.24 |

|

|

|

2.68 |

|

|

|

(0.36 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Distributions

to Common Shareholders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

investment income |

|

|

— |

|

|

|

(0.02 |

) |

|

|

— |

|

|

|

(0.01 |

) |

|

|

(0.02 |

) |

|

|

(0.05 |

) |

| Net

realized gain |

|

|

— |

|

|

|

(0.57 |

) |

|

|

(0.96 |

) |

|

|

(0.57 |

) |

|

|

(0.53 |

) |

|

|

(0.47 |

) |

| Return

of capital |

|

|

(0.30 |

)* |

|

|

(0.01 |

) |

|

|

— |

|

|

|

— |

|

|

|

(0.01 |

) |

|

|

— |

|

| Total

distributions to common shareholders |

|

|

(0.30 |

) |

|

|

(0.60 |

) |

|

|

(0.96 |

) |

|

|

(0.58 |

) |

|

|

(0.56 |

) |

|

|

(0.52 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fund

Share Transactions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Increase

in net asset value from repurchase of common shares |

|

|

0.03 |

|

|

|

0.01 |

|

|

|

0.03 |

|

|

|

0.06 |

|

|

|

0.03 |

|

|

|

0.09 |

|

| Offering

costs for preferred shares charged to paid-in capital |

|

|

(0.01 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Offering

costs and adjustment to offering costs for common shares charged to paid-in capital |

|

|

— |

|

|

|

— |

|

|

|

(0.00 |

)(a) |

|

|

(0.01 |

) |

|

|

— |

|

|

|

0.00 |

(a) |

| Total

Fund share transactions |

|

|

0.02 |

|

|

|

0.01 |

|

|

|

0.03 |

|

|

|

0.05 |

|

|

|

0.03 |

|

|

|

0.09 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

Asset Value Attributable to Common Shareholders, End of Period |

|

$ |

12.03 |

|

|

$ |

12.01 |

|

|

$ |

15.36 |

|

|

$ |

13.81 |

|

|

$ |

13.10 |

|

|

$ |

10.95 |

|

| NAV

total return † |

|

|

2.75 |

% |

|

|

(17.98 |

)% |

|

|

18.47 |

% |

|

|

10.82 |

% |

|

|

25.22 |

% |

|

|

(2.65 |

)% |

| Market

value, end of period |

|

$ |

9.96 |

|

|

$ |

10.28 |

|

|

$ |

13.57 |

|

|

$ |

11.95 |

|

|

$ |

11.52 |

|

|

$ |

9.25 |

|

| Investment

total return †† |

|

|

(0.17 |

)% |

|

|

(19.96 |

)% |

|

|

22.04 |

% |

|

|

9.94 |

% |

|

|

31.16 |

% |

|

|

(5.78 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ratios

to Average Net Assets and Supplemental Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

assets including liquidation value of preferred shares, end of period (in 000’s) |

|

$ |

264,549 |

|

|

$ |

244,653 |

|

|

$ |

343,952 |

|

|

$ |

282,174 |

|

|

$ |

305,775 |

|

|

$ |

271,649 |

|

| Net

assets attributable to common shares, end of period (in 000’s) |

|

$ |

200,594 |

|

|

$ |

204,653 |

|

|

$ |

263,952 |

|

|

$ |

242,174 |

|

|

$ |

238,739 |

|

|

$ |

204,613 |

|

| Ratio

of net investment income/(loss) to average net assets attributable to common shares before preferred share distributions |

|

|

(0.85 |

)%(c) |

|

|

(1.29 |

)% |

|

|

(0.86 |

)% |

|

|

(0.02 |

)% |

|

|

0.20 |

% |

|

|

0.60 |

% |

| Ratio

of operating expenses to average net assets attributable to common shares (d)(e) |

|

|

3.05 |

%(c) |

|

|

3.11 |

% |

|

|

2.24 |

% |

|

|

1.60 |

% |

|

|

1.57 |

% |

|

|

1.61 |

% |

| Portfolio

turnover rate |

|

|

6 |

% |

|

|

14 |

% |

|

|

29 |

% |

|

|

15 |

% |

|

|

25 |

% |

|

|

32 |

% |

See accompanying notes to financial statements.

The Gabelli Healthcare & WellnessRx Trust

Financial Highlights (Continued)

Selected data for a common share of beneficial interest outstanding throughout each period:

| |

|

Six Months Ended

June 30,

2023 |

|

|

Year Ended December 31, |

|

| |

|

(Unaudited) |

|

|

2022 |

|

|

2021 |

|

|

2020 |

|

|

2019 |

|

|

2018 |

|

| Cumulative

Preferred Shareholders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 5.760%

Series A Preferred |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liquidation

value, end of period (in 000’s) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

$ |

30,000 |

|

|

$ |

30,000 |

|

| Total

shares outstanding (in 000’s) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,200 |

|

|

|

1,200 |

|

| Liquidation

preference per share |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

$ |

25.00 |

|

|

$ |

25.00 |

|

| Average

market value (f) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

$ |

25.86 |

|

|

$ |

25.43 |

|

| Asset

coverage per share (g) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

$ |

114.03 |

|

|

$ |

101.31 |

|

| 5.875%

Series B Preferred |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liquidation

value, end of period (in 000’s) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

$ |

37,036 |

|

|

$ |

37,036 |

|

| Total

shares outstanding (in 000’s) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,481 |

|

|

|

1,481 |

|

| Liquidation

preference per share |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

$ |

25.00 |

|

|

$ |

25.00 |

|

| Average

market value (f) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

$ |