00-00000000001844224false00018442242023-11-092023-11-090001844224freyr:OrdinarySharesWithoutNominalValueMember2023-11-092023-11-090001844224freyr:WarrantsEachWholeWarrantExercisableForOneOrdinaryShareAtAnExercisePriceOf1150Member2023-11-092023-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 9, 2023

FREYR Battery

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Luxembourg | | 001-40581 | | Not Applicable |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer

Identification No.) |

22-24, Boulevard Royal, L-2449 Luxembourg

Grand Duchy of Luxembourg

| | | | | | | | |

| | |

| (Address of principal executive offices, including zip code) |

| | | |

Registrant’s telephone number, including area code: +352 621 727 777

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Ordinary Shares, without nominal value | | FREY | | The New York Stock Exchange |

| Warrants, each whole warrant exercisable for one Ordinary Share at an exercise price of $11.50 | | FREY WS | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 9, 2023, FREYR Battery, a Luxembourg limited liability company (société anonyme) (“FREYR Battery”), issued a press release announcing its financial results for the third quarter ended September 30, 2023.

The information set forth under Item 9.01 of this Current Report on Form 8-K is incorporated herein by reference.

The information in this Item 2.02, including the Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 7.01. Regulation FD Disclosure.

FREYR Battery is also furnishing a Third Quarter 2023 Earnings Call presentation, dated November 9, 2023 (the “Presentation”), attached as Exhibit 99.2 to this Current Report on Form 8-K, which may be referred to on FREYR Battery’s third quarter 2023 conference call to be held on November 9, 2023. The Presentation will also be available on FREYR Battery’s website at https://www.freyrbattery.com.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | |

| | FREYR BATTERY |

| | |

Date: November 9, 2023 | By: | /s/ Oscar K. Brown |

| | Name: | Oscar K. Brown |

| | Title: | Group Chief Financial Officer |

News Release

FREYR Battery Reports Third Quarter 2023 Results

New York, Oslo, and Luxembourg, November 9, 2023, FREYR Battery (NYSE: FREY) (“FREYR” or the “Company”), a developer of clean, next-generation battery cell production capacity, today reported financial results for the third quarter of 2023.

Highlights of the Third Quarter 2023 and Subsequent Events:

•Following operations updates published on September 6, 2023 and October 4, 2023 highlighting the achievements of interim technical milestones, the timeline for completing the highly complex commissioning of the Casting and Unit Cell Assembly equipment at the Customer Qualification Plant (“CQP”) has moved beyond 4Q 2023. FREYR has implemented a plan intended to prevent further delays, which includes enhanced involvement of technology and battery subject matter experts, increased coordination and day-to-day involvement with vendors and partners, and the formation of a Technology Advisory Board consisting of subject matter experts. FREYR will continue to provide updates on the Company’s progress at the CQP as commissioning and testing activity continues.

•FREYR is positioning the Company for the current capital markets environment by prioritizing balance sheet strength, liquidity runway, and strategic agility tied to real options. Having ended 3Q 2023 with $328 million of cash and no debt, the Company expects to exit 2023 with cash of approximately $250 million after satisfying its remaining commitments and fourth quarter overhead. FREYR has begun to implement cost rationalization initiatives, which include rightsizing the organization, which are expected to result in total 2024 cash uses of less than half that of 2023, aligned with our strategic priorities, equating to a cash runway of two-plus years.

•FREYR has elected to minimize Giga Arctic spending in 2024. The decision to minimize spending is intended to allow for continued technology development at the CQP while FREYR continues to work with stakeholders in Norway and Europe to establish competitive regulatory framework conditions for scaling battery manufacturing. Norway and Europe have yet to offer a competitive response to the U.S. Inflation Reduction Act (“IRA”) or similar incentives from Canada. Accordingly, FREYR plans to minimize spending on the project in 2024, secure the asset with the remaining committed capital spending, and continue to work with stakeholders in Norway and Europe to develop a mutually attractive policy solution.

•FREYR is continuing to engage with potential financial sponsors and strategic partners about the Giga America project-level equity raise. As the Company has indicated previously, the timing of the financing is expected to follow technical validation of the 24M manufacturing platform and sample cell performance characteristics at the CQP. In accordance with the updated timeline at the CQP, FREYR’s Giga America team has terminated the two-line project and has updated the development plan to pursue the larger project that was initially planned for the site on two parallel tracks. The Company is pursuing these paths to align the timing of multiple financing options including the U.S. Department of Energy (“DOE”) process and the project-level equity raise. Track 1 is based on the 24M SemiSolidTM platform, and Track 2 is based on conventional production line equipment.

•On November 6, 2023, FREYR announced that it will be holding an extraordinary general meeting (“EGM”) of shareholders on December 15, 2023 in connection with its previously announced process to redomicile from Luxembourg to the U.S. Proxy materials have been mailed out to the Company’s shareholders of record as of the October 25, 2023, record date. Pending a successful shareholder vote, closing of the planned redomicile to the U.S. is expected to be completed by December 31, 2023. FREYR’s board of directors believes that redomiciling to the U.S. will enhance FREYR’s eligibility for inclusion in equity indexes and trigger associated benchmarking from actively managed funds, thereby potentially delivering an uplift in fund flows to its shares.

•On October 4, 2023, FREYR published an operations update indicating that the teams at the CQP had successfully begun automatic electrode casting with solvent slurry. This technically complex step was an

1 | News Release | FREYR Battery | www.freyrbattery.com/news

important milestone in the ongoing commissioning process at the CQP and a precursor to automated production of in-spec, customer-testable cells at the CQP.

•On September 6, 2023, FREYR published an operations update highlighting the successful start-up and operation of the cathode Multi-Carrier System (“MCS”) at the CQP. The MCS, which is a core part of the Casting and Unit Cell Assembly production line equipment, utilizes a conveyor belt and pallet configuration that is the front end of the automatic cathode casting process. The successful software-hardware calibration of the MCS was an important precursor to automated production of in-spec, customer-testable cells at the CQP.

•On September 5, 2023, FREYR announced that SAP SE (FSE: SAP; “SAP”), one of the world’s leading producers of software for the management of business processes, had joined FREYR’s Energy Transition Acceleration Coalition (“ETAC”) alongside Nidec Corporation (TSE: 6594), Glencore Plc (LN: GLEN), Caterpillar Inc. (NYSE: CAT), and Siemens AG (GY: SIE).

“FREYR is navigating a highly volatile environment in which time and optionality are valuable,” remarked Birger Steen, FREYR’s Chief Executive Officer. “Against this fluid industry, policy, and financing backdrop, we will prioritize financial strength, make dispassionate business decisions based on the evolving market dynamics, and allocate resources towards key priorities to maximize the value of our real options for our shareholders, customers, partners, and employees. We are excited about the path ahead, and the entire FREYR team is unified in our purpose to establish the Company as a global developer and scaler of clean battery solutions.”

“As stated previously, the speed at which FREYR has been maturing the SemiSolidTM production platform is impressive,” commented Laurent Demortier, President of Nidec’s Energy & Infrastructure Division. ”The extension of the CQP timeline to reach automated production is understandable given the complexity of the commissioning packages, and we are confident that the FREYR team will continue to make strides at the CQP by collaborating with their ecosystem of partners. Nidec remains committed to our long-term partnership with FREYR to develop integrated, fit-for-purpose Energy Storage Systems solutions through our Nidec Energy AS Joint Venture, and we continue to explore avenues to further strengthen our partnership.”

Business Update

•FREYR’s teams at the CQP continue to progress the commissioning of the Casting and Unit Cell Assembly equipment to enable automated production of in-spec, customer-testable battery cells in 2024. As of this morning, FREYR had completed the handovers of 337 of 388 discrete commissioning and testing packages. At the CQP Test Center, which is a comprehensive modularized test facility with 480 battery test-channels, lab facilities, and data collection systems, all 150 of the additional Test Center commissioning packages have been completed and 137 have been handed over to Operations.

•Following the announcement in June that FREYR entered into a Heads of Terms (“HoT”) agreement with Sunwoda Mobility Energy Technology Co., Ltd. (“Sunwoda”) to form a partnership with the intention to expand business in the western hemisphere based on Sunwoda’s conventional technology, FREYR continues to pursue its technology diversification strategy. Options under consideration with a conventional technology partner include a potential development track of Giga America based on conventional production line equipment.

•FREYR is executing a plan to enhance the Company’s competitive and financial positions in the dynamic prevailing industry, regulatory, and capital markets environments. The key tenets of this initiative are to protect the Company’s balance sheet and liquidity runway; continue to pursue non-dilutive growth capital through the targeted Giga America project equity raise, DOE Title XVII loan process, and ongoing grant applications; and to maximize the value of FREYR’s project development opportunities. In accordance with this plan, FREYR is implementing a cost rationalization program that is expected to reduce the Company’s total cash burn rate by 50% as compared to 2023, providing a projected liquidity runway of two plus years.

2 | News Release | FREYR Battery | www.freyrbattery.com/news

Overview of Financial Results

•FREYR reported a net loss attributable to ordinary shareholders for the third quarter of 2023 of $(9.8) million, or $(0.07) per diluted share compared to net loss for the third quarter 2022 of $(93.9) million or $(0.80) per diluted share. The net loss in the third quarter of 2023 was primarily due to corporate overhead, spending to support FREYR's projects and business development activities, and research and development spending, partially offset by a non-cash gain on warrant liability fair value adjustment.

•As of September 30, 2023, FREYR had cash, cash equivalents, and restricted cash of $327.9 million, and no debt.

Business Outlook

FREYR is focused on advancing the following strategic mandates and milestones:

•Complete the commissioning packages of the Casting and Unit Cell Assembly production line equipment and producing in-spec, customer-testable batteries at the CQP.

•Complete the project-level equity raise for Giga America with strategic and prospective financial partners to start construction of the re-scoped project in 2024.

•Maintain the Company’s strong balance sheet and liquidity profile while making selected strategic investments to advance FREYR’s strategic development.

•Finalize the redomiciling process to the U.S. by year-end 2023. The redomiciling to the U.S. is expected to enhance FREYR’s eligibility for inclusion in equity indexes and trigger associated benchmarking from actively managed funds, thereby potentially delivering an uplift in fund flows to FREYR’s common equity.

•Maximize the value of FREYR’s real options, which include the formalization of a potential conventional technology partnership; the possible development of a cathode active materials production facility; and parallel development tracks for the Giga America project.

•Complete the current phase of construction at Giga Arctic with previously authorized capital expenditures to secure and protect the asset’s option value.

Presentation of Third Quarter 2023 Results

A presentation will be held today, November 9, 2023, at 8:30 am Eastern Standard Time (2:30 pm Central European Time) to discuss financial results for the third quarter 2023. The results and presentation material will be available for download at https://ir.freyrbattery.com.

To access the conference call, listeners should contact the conference call operator at the appropriate number listed below approximately 10 minutes prior to the start of the call.

Participant conference call dial-in numbers:

United States: 1 (646) 307-1963

United Kingdom: +44 20 3481 4247

Norway: +47 57 98 94 30

Denmark: +45 32 74 07 10

Spain: +34 910 489 958

Germany: +49 69 589964217

Sweden: +46 8 505 246 90

The participant passcode for the call is: 4087726

A webcast of the conference call will be broadcast simultaneously at https://app.webinar.net/ZpzL2e52jo0 on a listen-only basis. Please log in at least 10 minutes in advance to register and download any necessary software.

3 | News Release | FREYR Battery | www.freyrbattery.com/news

A replay of the webcast will be available at https://ir.freyrbattery.com/events-and-presentations/Events-Calendar/default.aspx.

***

About FREYR Battery

FREYR Battery aims to provide industrial scale clean battery solutions to reduce global emissions. Listed on the New York Stock Exchange, FREYR’s mission is to produce clean battery cells to accelerate the decarbonization of energy and transportation systems globally. FREYR has commenced building the first of its planned factories in Mo i Rana, Norway and announced potential development of industrial scale battery cell production in the United States. To learn more about FREYR, please visit www.freyrbattery.com.

Investor contact:

Jeffrey Spittel

Vice President, Investor Relations

jeffrey.spittel@freyrbattery.com

Tel: (+1) 281-222-0161

Media contact:

Katrin Berntsen

Vice President, Communication

katrin.berntsen@freyrbattery.com

Tel: (+47) 920 54 570

Cautionary Statement Concerning Forward-Looking Statements

All statements, other than statements of present or historical fact included in this press release, including, without limitation, FREYR Battery’s (“FREYR”) ability to achieve automated, in-spec, customer-testable battery production beyond 4Q 2023; the development, financing, construction, timeline, capacity, and other usefulness of FREYR’s CQP, Giga Arctic, Giga America, and other planned or future production facilities or Gigafactories; FREYR’s plan to prevent additional delays; any potential project equity raise for the development of Giga America; the competitiveness of the Norwegian battery cell production and any potential governmental incentives; any potential benefits of the U.S. Inflation Reduction Act; FREYR’s ability to navigate a highly volatile environment; the development of any potential conventional technology partnerships; FREYR’s ability to reduce spending, including in connection with Giga Arctic; any potential benefits of redomiciling to the U.S.; the giga-scalability of the 24M platform; and the implementation and effectiveness of FREYR’s overall business, technology, capital-raising, and liquidity strategies are forward-looking statements.

These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside FREYR’s control and are difficult to predict. Additional information about factors that could materially affect FREYR is set forth under the “Risk Factors” section in (i) FREYR’s Registration Statement on Form S-3 filed with the Securities and Exchange Commission (the “SEC”) on September 1, 2022, (ii) FREYR Battery, Inc.’s Registration Statement on Form S-4 filed with the SEC on September 8, 2023 and subsequent amendments thereto filed on October 13, 2023, October 19, 2023, and October 31, 2023, (iii) FREYR’s Annual Report on Form 10-K filed with the SEC on February 27, 2023, and (iv) FREYR’s Quarterly Reports on Form 10-Q filed with the SEC on May 15, 2023 and August 10, 2023 and available on the SEC’s website at www.sec.gov. Except as otherwise required by applicable law, FREYR disclaims any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this presentation. Should underlying assumptions prove incorrect, actual results and projections could differ materially from those expressed in any forward-looking statements.

4 | News Release | FREYR Battery | www.freyrbattery.com/news

FREYR intends to use its website as a channel of distribution to disclose information which may be of interest or material to investors and to communicate with investors and the public. Such disclosures will be included on FREYR’s website in the ‘Investor Relations’ sections. FREYR also intends to use certain social media channels, including, but not limited to, Twitter and LinkedIn, as means of communicating with the public and investors about FREYR, its progress, products, and other matters. While not all the information that FREYR posts to its digital platforms may be deemed to be of a material nature, some information may be. As a result, FREYR encourages investors and others interested to review the information that it posts and to monitor such portions of FREYR’s website and social media channels on a regular basis, in addition to following FREYR’s press releases, SEC filings, and public conference calls and webcasts. The contents of FREYR’s website and other social media channels shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended.

5 | News Release | FREYR Battery | www.freyrbattery.com/news

FREYR BATTERY

CONDENSED CONSOLIDATED BALANCE SHEETS

(In Thousands)

(Unaudited)

| | | | | | | | | | | | | | |

| | September 30,

2023 | | December 31,

2022 |

| | |

| ASSETS |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 299,419 | | | $ | 443,063 | |

| Restricted cash | | 28,442 | | | 119,982 | |

| Prepaid assets | | 5,690 | | | 8,293 | |

| Other current assets | | 7,317 | | | 8,117 | |

| Total current assets | | 340,868 | | | 579,455 | |

| | | | |

| Property and equipment, net | | 349,388 | | | 210,777 | |

| Intangible assets, net | | 2,850 | | | 2,963 | |

| Long-term investments | | 22,475 | | | — | |

| Convertible note | | — | | | 19,954 | |

| Right-of-use asset under operating leases | | 23,233 | | | 14,538 | |

| Other long-term assets | | 14 | | | 11 | |

| Total assets | | $ | 738,828 | | | $ | 827,698 | |

| | | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY |

| Current liabilities: | | | | |

| Accounts payable | | $ | 18,751 | | | $ | 6,765 | |

| Accrued liabilities and other | | 27,793 | | | 51,446 | |

| | | | |

| | | | |

| Share-based compensation liability | | 1,806 | | | 4,367 | |

| Total current liabilities | | 48,350 | | | 62,578 | |

| | | | |

| Warrant liability | | 10,540 | | | 33,849 | |

| Operating lease liability | | 18,353 | | | 11,144 | |

| Other long-term liabilities | | 27,145 | | | — | |

| | | | |

| Total liabilities | | 104,388 | | | 107,571 | |

| | | | |

| Commitments and contingencies | | | | |

| | | | |

| Shareholders’ equity: | | | | |

| Ordinary share capital, no par value, 245,000 ordinary shares authorized, and 139,854 and 139,705 ordinary shares issued and outstanding, respectively, as of both September 30, 2023 and December 31, 2022 | | 139,854 | | | 139,854 | |

| Additional paid-in capital | | 783,234 | | | 772,602 | |

| Treasury stock | | (1,041) | | | (1,041) | |

| Accumulated other comprehensive (loss) income | | (38,915) | | | 9,094 | |

| Accumulated deficit | | (250,847) | | | (203,054) | |

| Total ordinary shareholders' equity | | 632,285 | | | 717,455 | |

| | | | |

| Non-controlling interests | | 2,155 | | | 2,672 | |

| Total equity | | 634,440 | | | 720,127 | |

| | | | |

| Total liabilities and equity | | $ | 738,828 | | | $ | 827,698 | |

6 | News Release | FREYR Battery | www.freyrbattery.com/news

FREYR BATTERY

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(In Thousands, Except per Share Amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended

September 30, | | Nine months ended

September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Operating expenses: | | | | | | | | |

| General and administrative | | $ | 27,772 | | | $ | 25,124 | | | $ | 85,405 | | | $ | 77,888 | |

| Research and development | | 7,086 | | | 3,253 | | | 18,295 | | | 9,194 | |

| Share of net loss of equity method investee | | 153 | | | 668 | | | 208 | | | 1,131 | |

| Total operating expenses | | 35,011 | | | 29,045 | | | 103,908 | | | 88,213 | |

| Loss from operations | | (35,011) | | | (29,045) | | | (103,908) | | | (88,213) | |

| | | | | | | | |

| Other income (expense): | | | | | | | | |

| Warrant liability fair value adjustment | | 24,399 | | | (70,292) | | | 23,248 | | | (45,588) | |

| | | | | | | | |

| Convertible note fair value adjustment | | — | | | (224) | | | 1,074 | | | 267 | |

| Interest income, net | | 1,284 | | | 60 | | | 6,042 | | | 89 | |

| | | | | | | | |

| Foreign currency transaction (loss) gain | | (3,213) | | | 4,325 | | | 20,546 | | | 5,415 | |

| Other income, net | | 2,537 | | | 1,326 | | | 5,029 | | | 3,944 | |

| Total other income (expense) | | 25,007 | | | (64,805) | | | 55,939 | | | (35,873) | |

| Loss before income taxes | | (10,004) | | | (93,850) | | | (47,969) | | | (124,086) | |

| Income tax expense | | — | | | — | | | (341) | | | — | |

| Net loss | | (10,004) | | | (93,850) | | | (48,310) | | | (124,086) | |

| Net loss attributable to non-controlling interests | | 219 | | | — | | | 517 | | | — | |

| Net loss attributable to ordinary shareholders | | $ | (9,785) | | | $ | (93,850) | | | $ | (47,793) | | | $ | (124,086) | |

| | | | | | | | |

| | | | | | | | |

| Weighted average ordinary shares outstanding - basic and diluted | | 139,705 | | | 116,704 | | | 139,705 | | | 116,795 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net loss attributable to ordinary shareholders per share - basic and diluted | | $ | (0.07) | | | $ | (0.80) | | | $ | (0.34) | | | $ | (1.06) | |

| | | | | | | | |

| | | | | | | | |

| Other comprehensive income (loss): | | | | | | | | |

| Net loss | | $ | (10,004) | | | $ | (93,850) | | | $ | (48,310) | | | $ | (124,086) | |

| Foreign currency translation adjustments | | 6,134 | | | (9,089) | | | (48,009) | | | (16,547) | |

| Total comprehensive loss | | $ | (3,870) | | | $ | (102,939) | | | $ | (96,319) | | | $ | (140,633) | |

| Comprehensive loss attributable to non-controlling interests | | 219 | | | — | | | 517 | | | — | |

| Comprehensive loss attributable to ordinary shareholders | | $ | (3,651) | | | $ | (102,939) | | | $ | (95,802) | | | $ | (140,633) | |

| | | | | | | | |

7 | News Release | FREYR Battery | www.freyrbattery.com/news

FREYR BATTERY

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In Thousands)

(Unaudited)

| | | | | | | | | | | | | | |

| | Nine months ended

September 30, |

| | 2023 | | 2022 |

| Cash flows from operating activities: | | | | |

| Net loss | | $ | (48,310) | | | $ | (124,086) | |

| Adjustments to reconcile net loss to cash used in operating activities: | | | | |

| Share-based compensation expense | | 7,859 | | | 9,280 | |

| Depreciation and amortization | | 1,922 | | | 298 | |

| | | | |

| Reduction in the carrying amount of right-of-use assets | | 1,005 | | | 1,096 | |

| Warrant liability fair value adjustment | | (23,248) | | | 45,588 | |

| | | | |

| Convertible note fair value adjustment | | (1,074) | | | (267) | |

| Share of net loss of equity method investee | | 208 | | | 1,131 | |

| | | | |

| Foreign currency transaction net unrealized gain | | (19,346) | | | (4,864) | |

| Other | | 145 | | | — | |

| Changes in assets and liabilities: | | | | |

| Prepaid assets and other current assets | | 1,672 | | | (7,059) | |

| | | | |

| Accounts payable, accrued liabilities and other | | 28,401 | | | 6,692 | |

| | | | |

| | | | |

| | | | |

| Operating lease liability | | (3,212) | | | (802) | |

| Net cash used in operating activities | | (53,978) | | | (72,993) | |

| | | | |

| Cash flows from investing activities: | | | | |

| Proceeds from property related grants | | 3,500 | | | 10,461 | |

| Purchases of property and equipment | | (168,811) | | | (77,687) | |

| Investments in equity method investee | | (1,655) | | | (3,000) | |

| Purchases of other long-term assets | | (1,000) | | | — | |

| Net cash used in investing activities | | (167,966) | | | (70,226) | |

| | | | |

| Cash flows from financing activities: | | | | |

| Repurchase of treasury shares | | — | | | (1,052) | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Net cash used in financing activities | | — | | | (1,052) | |

| | | | |

| Effect of changes in foreign exchange rates on cash, cash equivalents, and restricted cash | | (13,240) | | | (2,765) | |

| Net decrease in cash, cash equivalents, and restricted cash | | (235,184) | | | (147,036) | |

| Cash, cash equivalents, and restricted cash at beginning of period | | 563,045 | | | 565,627 | |

| Cash, cash equivalents, and restricted cash at end of period | | $ | 327,861 | | | $ | 418,591 | |

| | | | |

| Significant non-cash investing and financing activities: | | | | |

| Accrued purchases of property and equipment | | $ | 11,187 | | | $ | 18,514 | |

| | | | |

| | | | |

| Reconciliation to condensed consolidated balance sheets: | | | | |

| Cash and cash equivalents | | $ | 299,419 | | | $ | 416,431 | |

| Restricted cash | | 28,442 | | | 2,160 | |

| Cash, cash equivalents, and restricted cash | | $ | 327,861 | | | $ | 418,591 | |

8 | News Release | FREYR Battery | www.freyrbattery.com/news

1 3Q 2023 CONFERENCE CALL # November 9, 2023

2 Forward Looking Statements IMPORTANT NOTICES All statements, other than statements of present or historical fact included in this presentation, including, without limitation, FREYR Battery’s (“FREYR”) ability to achieve automated, in-spec, customer-testable battery production beyond 4Q 2023; the development, financing, construction, timeline, capacity, and other usefulness of FREYR’s CQP, Giga Arctic, Giga America, and other planned or future production facilities or Gigafactories; FREYR’s plan to prevent additional delays; any potential project equity raise for the development of Giga America; the competitiveness of the Norwegian battery cell production and any potential governmental incentives; any potential benefits of the U.S. Inflation Reduction Act; FREYR’s ability to navigate a highly volatile environment; the development of any potential conventional technology partnerships; FREYR’s ability to reduce spending, including in connection to Giga Arctic; any potential benefits of redomiciling to the U.S.; the giga-scalability of the 24M platform; and the implementation and effectiveness of FREYR’s overall business, technology, capital-raising and liquidity strategies are forward-looking statements. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside FREYR’s control and are difficult to predict. Additional information about factors that could materially affect FREYR is set forth under the “Risk Factors” section in (i) FREYR’s Registration Statement on Form S-3 filed with the Securities and Exchange Commission (the “SEC”) on September 1, 2022, (ii) FREYR Battery, Inc.’s Registration Statement on Form S-4 filed with the SEC on September 8, 2023 and subsequent amendments thereto filed on October 13, 2023, October 19, 2023 and October 31, 2023, (iii) FREYR’s annual report on Form 10-K filed with the SEC on February 27, 2023, and (iv) FREYR’s quarterly reports on Form 10-Q filed with the SEC on May 15, 2023 and August 10, 2023 and available on the SEC’s website at www.sec.gov. Except as otherwise required by applicable law, FREYR disclaims any duty to update any forward- looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this presentation. Should underlying assumptions prove incorrect, actual results and projections could differ materially from those expressed in any forward-looking statements. FREYR intends to use its website as a channel of distribution to disclose information which may be of interest or material to investors and to communicate with investors and the public. Such disclosures will be included on FREYR’s website in the ‘Investor Relations’ sections. FREYR also intends to use certain social media channels, including, but not limited to, Twitter and LinkedIn, as means of communicating with the public and investors about FREYR, its progress, products and other matters. While not all the information that FREYR posts to its digital platforms may be deemed to be of a material nature, some information may be. As a result, FREYR encourages investors and others interested to review the information that it posts and to monitor such portions of FREYR’s website and social media channels on a regular basis, in addition to following FREYR’s press releases, SEC filings, and public conference calls and webcasts. The contents of FREYR’s website and other social media channels shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended.

3 The balance sheet, team, and strategy to build a global battery technology industrialization engine REVISITING THE FREYR INVESTMENT CASE WESTERN BATTERY DEVELOPMENT IS ESSENTIAL TO ENERGY TRANSITION & SECURITY Ongoing decarbonization of global power and transportation markets requires 115 TWh of incremental battery supply1 Recently announced Chinese graphite export restrictions and unstable geopolitical climate underscore need to establish Western supply chains ROBUST BALANCE SHEET AND LIQUIDITY No debt and two+ years of projected liquidity without any new project-level financing Advancing several capital formation initiatives in parallel (Giga America project equity, DOE programs, EUIF grant, Norwegian IRA response framework) COMMITTED TO MAXIMIZING U.S. INFLATION REDUCTION ACT (IRA) BENEFITS Re-scoped Giga America project in two parallel tracks to optimize economics, scale, capital access, and technology development Financing processes ongoing with DOE and potential project equity sponsors to source Giga America development capital REAL OPTION VALUE IN A VOLATILE ENVIRONMENT Executing plan to diversify on technology spectrum and battery value chain Exploring conventional partnership opportunities to complement scale up of 24M platform Evaluating expansion into LFP cathode production DIFFERENTIATED COMPETITIVE POSITION AND ATTRACTIVE END MARKET EXPOSURE FREYR is uniquely positioned as a U.S.-listed, debt free, pure play battery technology development and scaling company FREYR is focused on large and growing addressable battery market opportunities for ESS and E-mobility applications Implementing a plan to develop 24M and conventional technology in parallel to unlock new opportunities 1 Tesla 2023 Analyst Day Presentation.

4 KEY MESSAGES 4 1. BUSINESS UPDATE Work continues at the CQP: • The timeline for completion of commissioning has pushed beyond 4Q 2023 • Implementing detailed plan that is expected to prevent additional delays Giga America development: • Focusing on two parallel tracks for development of large-scale project • Track 1: 24M platform • Track 2: Conventional technology 2. MINIMIZING GIGA ARCTIC SPENDING IN 2024 • Prioritizing liquidity during scale up efforts at CQP and focusing on scaling opportunities to capture IRA incentives • Neither Norway nor the EU have offered a competitive scaling response to the IRA and/or Canada’s variable cost offsets, which are designed to counter China’s structural cost advantages • Continuing to work with local, national, and European government stakeholders to place Norwegian battery cell production on globally competitive economic footing

KEY MESSAGES CONT. 5 3. RATIONALIZING COSTS AND EXTENDING THE RUNWAY • Maintaining robust liquidity profile and clean balance sheet ahead of anticipated next phase of capital formation • Intending to reduce total cash spending by over 50%, extending liquidity runway to two + years without any new project- level financing • Strategically positioning FREYR to be nimble in dynamic industry, regulatory, and capital markets environments 4. FREYR HAS A PLAYBOOK TO NAVIGATE A HIGH VOLATILITY ENVIRONMENT • Leveraging strong ecosystem of committed partners • Pursuing conventional technology partnerships to mitigate risk and develop new market opportunities • Rationalizing spending while continuing to fund critical initiatives; focusing organization on top priorities • Executing against a clear plan while maintaining the value of real options

6 CQP UPDATE WHAT’S CHANGED AND WHAT WE’VE LEARNED • Completion of commissioning has proven to be more difficult than we originally thought • High complexity of commissioning Casting & Unit Cell Assembly equipment • Problem solving during commissioning process continues to reveal difficult but surmountable engineering and scaling challenges IMPLEMENTING PLAN TO PREVENT FURTHER DELAYS • Applying One Plan and One Team approach • Enhanced involvement of technology and battery subject matter experts • Increased coordination and day-to- day involvement with vendors and partners • FREYR has established a dedicated Technology Advisory Board consisting of subject matter experts CURRENT STATUS • The timeline to complete commissioning has pushed beyond 4Q 2023 • FREYR announced two key technical milestones at the CQP during 3Q 2023 • Introduction of automated casting with live electrolyte in dry room environment and commissioning and testing of merge unit have not been completed • Continuing to identify and address tasks on critical path

PURSUING OUR TECHNOLOGY DIVERSIFICATION STRATEGY 7 PURSUING CONVENTIONAL TECHNOLOGY PARTNERSHIPS • Fits with FREYR’s previously communicated technology diversification strategy • Creates strategic alternatives to complement 24M and new paths to potential financing and commercial opportunities • Conversations ongoing with multiple conventional technology partnership candidates • Creates opportunity to accelerate project development timelines and start of production 24M FITS FREYR’S TECHNOLOGY STRATEGY • Scaling the 24M platform is proving to be more challenging and time consuming than expected • The commercial potential of 24M as a problem-solving technology across a large total addressable market makes the extra effort worthwhile • We believe that FREYR has the financial and organizational resources necessary to demonstrate scalability of 24M at the CQP Exploring additional technology partnerships in parallel to complement 24M

MINIMIZING GIGA ARCTIC SPENDING FOR 2024 8 THE BACKGROUND • Prioritizing liquidity during scale up efforts at CQP and focusing on scaling opportunities to capture IRA incentives • FREYR sent a letter in March 2023 to Ministry of Trade and Industry outlining a prerequisite financial support package approximating €800 million plus Production Tax Credits through EU Temporary Crisis and Transition Framework (TCTF) • Request for competitive framework conditions intended to support access to private capital, FREYR’s part in Norwegian national battery strategy, and long-term economic viability of the project THE REGULATORY ENVIRONMENT • The U.S. IRA and associated policy responses in other countries, all of which took place after construction at Giga Arctic was initially sanctioned, have shifted the relative competitive economic dynamics of Gigafactory projects • Neither Norway nor the EU have offered a competitive scaling response to the IRA and/or Canada’s variable cost offsets, which are designed to counter China’s structural cost advantages FREYR’S FACT-BASED CAPITAL ALLOCATION DECISION • Complete initial phase of Giga Arctic construction by end of 2023 and secure the asset • No additional capital spending at Giga Arctic will be authorized until a globally competitive incentive program is delivered Preserving real option value of the project based on current market and policy dynamics

9 Timing of project development driven by CQP and Financing GIGA AMERICA UPDATE PROJECT EQUITY FINANCING • CQP performance will drive customer acceptance of 24M platform • Customer acceptance unlocks financing (project equity and debt) • Financing timing expected to follow automated production of testable, in-spec sample cells PROJECT DEVELOPMENT PLAN • The value of the previously announced Phase 1a development is minimized by the revised CQP timeline • FREYR is updating options to maximize project economics and access to capital to drive the start of production as early as possible in Georgia • Continuing to pursue two tracks in parallel to align timing of multiple financing options including the DOE process and a project-level equity raise • Giga America site can comfortably accommodate both Track 1 and Track 2 projects TRACK 3 Advanced process design of the 24M production line equipment to be validated with FID in 1Q 2025 TRACK 1 Multi-line 24M scaled technology with potential FID in 2024 TRACK 2 Conventional technology with potential FID in 2024 (intended to provide alternative to accelerate SOP timing)

TRANSACTION RATIONALE • Simplifies corporate structure and streamlines reporting requirements • Enhances FREYR's eligibility for inclusion in equity indexes and triggers associated benchmarking from actively managed funds • Benefit from corporate governance under Delaware law, which is more closely aligned with the NYSE listing standards and U.S. SEC governance requirements • Better long-term positioning for global tax developments and U.S. incentive programs for battery manufacturers 10 REDOMICILE UPDATE Headquarters move from Luxembourg to the U.S. expected by the end of this year CURRENT STATUS • S-4 registration statement filed with SEC and has been declared effective • Shareholder record date is October 25 • Proxy cards mailed November 6 • Extraordinary General Meeting and shareholder vote set for December 15 • A quorum of at least 50% of shareholders of record is required to vote, and a two-thirds majority of in favor votes is required for transaction approval • Okapi Partners serving as FREYR's proxy solicitor

FINANCIAL RESULTS 11 • Ended 3Q 2023 with $328 million of cash, and no debt • ~$35-40 million in Q4 to complete and secure initial buildings of Giga Arctic and for continued progress on the CQP & Test Center • No material new 2024 CapEx deployed until additional funding secured • Cutting costs and prioritizing resources; targeting reduction of 2024 cash uses by more than half vs 2023; extending liquidity to more than two years without any new project financing Preserving liquidity, extending the runway and ensuring optionality and financial discipline FREYR YTD 2023 Cash Bridge Note: Cash includes cash, cash equivalents and restricted cash: amounts may not reconcile due to rounding.

WELL- POSITIONED FOR CURRENT ENVIRONMENT FREYR has liquidity, real options, and a flexible plan PROTECTING THE BALANCE SHEET AND LIQUIDITY RUNWAY • Targeting total cash spend in 2024 of less than half that of 2023, prioritizing the CQP and Giga America • Material incremental CapEx only deployed when new project-level funding is committed • Built-in liquidity flexibility to invest in focused R&D and technology investments to enhance the projects • Intending to extend cash runway to two + years before any new financing PURSUING NON-DILUTIVE GROWTH CAPITAL TO FUND KEY INITIATIVES • Liquidity position and lower burn rate intended to eliminate any need to raise common equity from our shareholder base • Focused on closing Giga America project equity raise, DOE Title XVII loan process, and grant applications MAXIMIZING VALUE OF PROJECT DEVELOPMENT OPPORTUNITIES • Giga America development prioritized based on superior projected economic returns driven by eligibility for IRA incentives, especially Section 45X Production Tax Credits • Evaluating partnership-based Cathode Active Material factory project and other initiatives based on strategic value and business case • Preserving Giga Arctic optionality with EUIF grant and continued efforts to establish competitive framework conditions • Leverage and grow industrial partnerships where possible; continue discussions with potential conventional technology partners

THE WAY FORWARD 13 • Reducing costs to extend liquidity runway to two + years • Authorizing no material new CapEx in 2024 until new financing is committed • Pursuing conventional technology partnerships to mitigate risk, reduce time to market, and diversify product offerings • FREYR will continue to provide regular updates on the CQP, redomiciling, and conventional technology partnership opportunities • Collaborating with customers, partners, and Energy Transition Acceleration Coalition members to catalyze capital formation and commercialization • Working with local, state, and European governmental stakeholders to formulate a globally competitive incentive program in Norway • Executing strategic plan with clear priorities and real options in a highly volatile environment ONE FREYR TEAM unified to deliver for our shareholders, customers, and strategic partners

v3.23.3

Cover

|

Nov. 09, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 09, 2023

|

| Entity Registrant Name |

FREYR Battery

|

| Entity Incorporation, State or Country Code |

N4

|

| Entity File Number |

001-40581

|

| Entity Address, Address Line One |

22-24, Boulevard Royal

|

| Entity Address, Postal Zip Code |

-2449

|

| Entity Address, City or Town |

Luxembourg

|

| Entity Address, Country |

LU

|

| City Area Code |

352

|

| Local Phone Number |

621 727 777

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Tax Identification Number |

00-0000000

|

| Entity Central Index Key |

0001844224

|

| Amendment Flag |

false

|

| OrdinarySharesWithoutNominalValueMember |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Ordinary Shares, without nominal value

|

| Trading Symbol |

FREY

|

| Security Exchange Name |

NYSE

|

| WarrantsEachWholeWarrantExercisableForOneOrdinaryShareAtAnExercisePriceOf1150Member |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each whole warrant exercisable for one Ordinary Share at an exercise price of $11.50

|

| Trading Symbol |

FREY WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=freyr_OrdinarySharesWithoutNominalValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=freyr_WarrantsEachWholeWarrantExercisableForOneOrdinaryShareAtAnExercisePriceOf1150Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

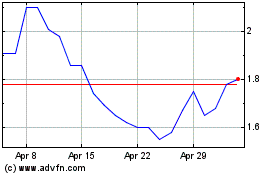

FREYR Battery (NYSE:FREY)

Historical Stock Chart

From Mar 2024 to Apr 2024

FREYR Battery (NYSE:FREY)

Historical Stock Chart

From Apr 2023 to Apr 2024