Consolidated Third Quarter Revenue Increases

to $73.4 Million compared with $71.4 Million in the Prior

Year

Third Quarter Net Income Increases 25% to

$5.7 Million, or $0.43 per diluted share, compared with $4.6

Million, or $0.32 per diluted share in Prior Year--Adjusted EBITDA

Increases 17% to $13.9 Million for the Third Quarter compared with

$11.9 Million in Fiscal 2023

Cash Flows From Operating Activities

Increase to $38.4 Million compared with $25.9 Million in the First

Three Quarters of Fiscal 2023 and Free Cash Flow Increases to $30.6

Million From $15.6 Million in the First Three Quarters of Fiscal

2023

Liquidity Remains Strong at nearly $100

Million, with $36.6 Million of Cash and No Drawdowns on the

Company’s $62.5 Million Credit Facility, even after Purchasing

$25.8 Million of its Common Stock through May 31, 2024

Company Reaffirms Guidance for Fiscal

2024

Franklin Covey Co. (NYSE: FC), a leader in organizational

performance improvement that creates, and on a subscription basis,

distributes world-class content, training, processes, and tools

that organizations and individuals use to achieve systemic changes

in human behavior to transform their results, today announced

financial results for the third quarter of fiscal 2024, which ended

on May 31, 2024.

Third Quarter

Performance

The Company’s consolidated revenue for the quarter ended May 31,

2024 grew 3% to $73.4 million compared with $71.4 million in the

third quarter of fiscal 2023. Revenue for the three quarters ended

May 31, 2024 increased to $203.1 million compared with $202.6

million in the prior year. The Company’s financial performance for

the third quarter included the following:

- Enterprise Division revenues for the third quarter of fiscal

2024 totaled $52.0 million compared with $53.2 million in fiscal

2023. Increased All Access Pass (AAP) revenues in the third quarter

were offset by decreased legacy training program revenue and

reduced international direct office and licensee revenues. AAP

subscription revenue grew 4% compared with the third quarter of

fiscal 2023 and AAP subscription plus subscription services revenue

grew 3% compared with the prior year. During the first three

quarters of fiscal 2024, AAP subscription revenue retention levels

in the United States and Canada remained strong and were greater

than 90%.

- Education Division revenues grew 18% to $20.1 million in the

third quarter of fiscal 2024 primarily due to increased classroom

materials revenue, due in part to a new initiative with a state

that began in the third quarter, and increased membership

subscription revenues. Delivery of training and coaching days

remained strong during the third quarter of fiscal 2024, as the

Education Division delivered nearly 100 more training and coaching

days than the prior year.

- Total Company subscription and subscription services revenues

reached $60.8 million, a 6% increase over the third quarter of

fiscal 2023. For the rolling four quarters ended May 31, 2024,

subscription and subscription service revenue reached $230.6

million, an $8.4 million, or 4%, increase over the rolling four

quarters ended May 31, 2023.

- Operating income for the quarter ended May 31, 2024 increased

27%, or $1.8 million, to $8.3 million compared with $6.6 million in

fiscal 2023. Net income for the third quarter increased 25%, or

$1.2 million, to $5.7 million, or $0.43 per diluted share, compared

with $4.6 million, or $0.32 per diluted share, in the third quarter

of fiscal 2023.

- Adjusted EBITDA for the third quarter of fiscal 2024 was a

better-than-expected $13.9 million compared with $11.9 million in

fiscal 2023. Adjusted EBITDA for the three quarters ended May 31,

2024 increased to $32.3 million compared with $31.6 million in

fiscal 2023.

- Consolidated deferred subscription revenue at May 31, 2024

increased 15% to $83.8 million compared with $72.7 million at May

31, 2023. Unbilled deferred subscription revenue at May 31, 2024,

grew to $69.4 million compared with $68.2 million at May 31, 2023.

At May 31, 2024, 55% of the Company’s AAP contracts are for at

least two years, compared with 50% at May 31, 2023, and the

percentage of contracted amounts represented by multi-year

contracts increased to 60% from 57% at May 31, 2023.

- Cash flows from operating activities for the first three

quarters of fiscal 2024 increased 48% to $38.4 million compared

with $25.9 million in the first three quarters of fiscal 2023. Free

Cash Flow increased to $30.6 million in the first three quarters of

fiscal 2024 from $15.6 million in the same period of fiscal

2023.

- The Company purchased 188,373 shares of its common stock on the

open market for $7.4 million during the quarter ended May 31, 2024.

For the first three quarters of fiscal 2024, the Company has

purchased approximately 649,000 shares of its common stock for

$25.8 million.

Paul Walker, President and Chief Executive Officer, commented,

“We are pleased with our results in the third quarter, where

revenue, Adjusted EBITDA, and cash flows were all stronger than

expected. We were further encouraged by the strengthening of

several key indicators during the quarter and believe that these

trends will lead to improved results in future periods. Our

consolidated revenue for the quarter increased to $73.4 million,

and our Adjusted EBITDA increased 17% to $13.9 million. Cash flows

provided by operating activities and Free Cash Flow were strong

through the end of the third quarter and we were able to return

$7.4 million of this cash flow back to investors through purchases

of our stock. The strength of our third quarter operating results

was generally broad based across the Enterprise and Education

Divisions and we continue to be pleased with the growth in our

balances of billed and unbilled deferred subscription revenue.

Combined with an improved subscription services booking pace, we

believe the third quarter created a strong foundation for continued

growth in our fourth quarter as we expect to achieve all-time highs

in revenue, Adjusted EBITDA, and Free Cash Flow in fiscal

2024.”

Walker added, “We believe there are 4 key factors which continue

to drive the growth and value of our business that were again

evident in the third quarter. The first of these drivers is the

mission critical nature of the opportunities and challenges we help

organizations and schools address and the strength and efficacy of

our solutions in addressing these challenges. These factors are

reflected in the continued resiliency of our business, despite an

uncertain and difficult economic environment, as our clients

recognize the value of our content and offerings. Second is the

strength of our leading indicators of growth, which showed renewed

momentum in the third quarter. These leading indicators include

growth in deferred revenue, growth in unbilled deferred revenue,

and growth in the amount of add-on services booked in the quarter.

The third driver of growth and value is the strength of our

subscription business model. Our business model is designed to

achieve high levels of recurring revenue with strong gross margins

and scalable levels of operating expenses that require very little

working capital investment. The combination of these factors

results in a high flow through of incremental revenue to Adjusted

EBITDA and cash flows. The fourth value driver is the ability to

invest our Free Cash Flow and excess cash into the business at a

high rate of return, with the balance being returned to

shareholders in the form of significant stock purchases. We believe

these drivers will continue to create strength in our business and

create value for our stakeholders during the remainder of fiscal

2024 and in future periods.”

Fiscal 2024 Guidance

Based on the Company’s third quarter results, combined with

improved leading indicators and the Company’s current expectations

regarding the fourth quarter, the Company looks forward to a strong

finish to fiscal 2024. Despite the challenges the Company faced in

the first half of fiscal 2024, the Company continues to expect that

its Adjusted EBITDA for fiscal 2024, while showing a strong

increase in the third quarter, will be at the low end of its

previously announced guidance range of $54.5 million to $58.0

million in constant currency, which excludes the impact of

approximately $0.5 million of negative foreign exchange. This

represents 13% growth over the $48.1 million of Adjusted EBITDA

achieved in fiscal 2023. The Company expects to achieve this growth

despite an uncertain economic environment and while continuing to

make additional growth investments. The Company is also confident

in the strength of its subscription offerings, which have driven

Franklin Covey’s growth across recent years, and which are expected

to deliver in fiscal 2024 the highest levels of revenue, Adjusted

EBITDA, and Free Cash Flow since the sale of the Company’s consumer

products division.

New Share Purchase

Program

On April 18, 2024, the Company’s Board of Directors approved a

new plan to purchase up to $50.0 million of its outstanding common

stock. The previously existing common stock purchase plan was

canceled, and the new common share purchase plan does not have an

expiration date. The actual timing, number, and value of common

shares purchased under the new board-approved plan will be

determined at the Company’s discretion and will depend on a number

of factors, including, among others, general market and business

conditions, the trading price of common shares, and applicable

legal requirements. The Company has no obligation to purchase any

common shares under the authorization, and the purchase plan may be

suspended, discontinued, or modified at any time for any reason.

All shares purchased through May 31, 2024 were made under the

previously existing purchase plan.

Earnings Conference Call

On Wednesday, June 26, 2024, at 5:00 p.m. Eastern (3:00 p.m.

Mountain) Franklin Covey will host a conference call to review its

third quarter fiscal 2024 financial results. Interested persons may

access a live audio webcast at

https://edge.media-server.com/mmc/p/ydczbpt5 or may participate via

telephone by registering at

https://register.vevent.com/register/BI4d35b960438748338e1607462bed1119.

Once registered, participants will have the option of 1) dialing

into the call from their phone (via a personalized PIN); or 2)

clicking the “Call Me” option to receive an automated call directly

to their phone. For either option, registration will be required to

access the call. A replay of the conference call webcast will be

archived on the Company’s website for at least 30 days.

Forward-Looking

Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995

including those statements related to the Company’s future results

and profitability and other goals relating to the growth and

operations of the Company. Forward-looking statements are based

upon management’s current expectations and are subject to various

risks and uncertainties including, but not limited to: general

macroeconomic conditions; renewals of subscription contracts;

growth in and client demand for add-on services; the impact of

deferred revenues on future financial results; impacts from

geopolitical conflicts; market acceptance of new products or

services, including new AAP portal upgrades and content launches;

inflation; the ability to achieve sustainable growth in future

periods; and other factors identified and discussed in the

Company’s most recent Annual Report on Form 10-K and other periodic

reports filed with the Securities and Exchange Commission. Many of

these conditions are beyond the Company’s control or influence, any

one of which may cause future results to differ materially from the

Company’s current expectations, and there can be no assurance that

the Company’s actual future performance will meet management’s

expectations. These forward-looking statements are based on

management’s current expectations and the Company undertakes no

obligation to update or revise these forward-looking statements to

reflect events or circumstances subsequent to this press

release.

Non-GAAP Financial

Information

This earnings release includes the concepts of Adjusted EBITDA

and Free Cash Flow, which are non-GAAP measures. The Company

defines Adjusted EBITDA as net income excluding the impact of

interest, income taxes, intangible asset amortization,

depreciation, stock-based compensation expense, and certain other

infrequently occurring items such as restructuring costs and

impaired assets. Free Cash Flow is defined as GAAP calculated cash

flows from operating activities less capitalized expenditures for

purchases of property and equipment and curriculum development. The

Company references these non-GAAP financial measures in its

decision-making because they provide supplemental information that

facilitates consistent internal comparisons to the historical

operating performance of prior periods and the Company believes

they provide investors with greater transparency to evaluate

operational activities and financial results. Refer to the attached

tables for the reconciliation of the non-GAAP financial measure,

Adjusted EBITDA, to consolidated net income, a related GAAP

financial measure, and for the calculation of Free Cash Flow.

The Company is unable to provide a reconciliation of the above

forward-looking estimate of non-GAAP Adjusted EBITDA to GAAP

measures because certain information needed to make a reasonable

forward-looking estimate is difficult to obtain and dependent on

future events which may be uncertain, or out of the Company’s

control, including the amount of AAP contracts invoiced, the number

of AAP contracts that are renewed, necessary costs to deliver the

Company’s offerings, such as unanticipated curriculum development

costs, and other potential variables. Accordingly, a reconciliation

is not available without unreasonable effort.

About Franklin Covey Co.

Franklin Covey Co. (NYSE: FC) is a global leadership company

with directly owned and licensee partner offices providing

professional services in over 160 countries and territories. The

Company transforms organizations by partnering with its clients to

build leaders, teams, and cultures that achieve breakthrough

results through collective action, which leads to a more engaging

work experience for their people. Available through the Franklin

Covey All Access Pass, the Company’s best-in-class content and

solutions, experts, technology, and metrics seamlessly integrate to

ensure lasting behavioral change at scale. Solutions are available

in multiple delivery modalities in more than 20 languages.

This approach to leadership and organizational change has been

tested and refined by working with tens of thousands of teams and

organizations over the past 30 years. Clients have included

organizations in the Fortune 100, Fortune 500, and thousands of

small- and mid-sized businesses, numerous governmental entities,

and educational institutions. To learn more, visit

www.franklincovey.com, and enjoy exclusive content from Franklin

Covey’s social media channels at: LinkedIn, Facebook, Twitter,

Instagram, and YouTube.

FRANKLIN COVEY CO.

Condensed Consolidated Income

Statements (in thousands, except per-share amounts, and

unaudited) Quarter Ended Three Quarters Ended May 31,

May 31, May 31, May 31,

2024

2023

2024

2023

Revenue

$

73,373

$

71,441

$

203,109

$

202,565

Cost of revenue

17,167

17,208

47,773

48,380

Gross profit

56,206

54,233

155,336

154,185

Selling, general, and administrative

45,110

45,641

130,088

131,991

Restructuring costs

701

-

3,008

-

Impaired asset

-

-

928

-

Depreciation

990

934

2,994

3,131

Amortization

1,062

1,086

3,204

3,270

Income from operations

8,343

6,572

15,114

15,793

Interest income (expense), net

21

8

(59

)

(369

)

Income before income taxes

8,364

6,580

15,055

15,424

Income tax provision

(2,643

)

(2,017

)

(3,609

)

(4,455

)

Net income

$

5,721

$

4,563

$

11,446

$

10,969

Net income per common share: Basic

$

0.43

$

0.33

$

0.87

$

0.79

Diluted

0.43

0.32

0.85

0.76

Weighted average common shares: Basic

13,160

13,621

13,222

13,799

Diluted

13,378

14,273

13,499

14,437

Other data: Adjusted EBITDA(1)

$

13,924

$

11,899

$

32,340

$

31,558

(1)

The term Adjusted EBITDA

(earnings before interest, income taxes, depreciation,

amortization, stock-based compensation, and certain other items) is

a non-GAAP financial measure that the Company believes is useful to

investors in evaluating its results. For a reconciliation of this

non-GAAP measure to a GAAP measure, refer to the Reconciliation of

Net Income to Adjusted EBITDA as shown below.

FRANKLIN COVEY CO.

Reconciliation of Net Income to Adjusted

EBITDA (in thousands and unaudited) Quarter Ended

Three Quarters Ended May 31, May 31, May 31, May 31,

2024

2023

2024

2023

Reconciliation of net income to Adjusted EBITDA: Net income

$

5,721

$

4,563

$

11,446

$

10,969

Adjustments: Interest expense (income), net

(21

)

(8

)

59

369

Income tax provision

2,643

2,017

3,609

4,455

Amortization

1,062

1,086

3,204

3,270

Depreciation

990

934

2,994

3,131

Stock-based compensation

2,828

3,307

7,092

9,357

Restructuring costs

701

-

3,008

-

Impaired asset

-

-

928

-

Increase in the fair value of contingent consideration liabilities

-

-

-

7

Adjusted EBITDA

$

13,924

$

11,899

$

32,340

$

31,558

Adjusted EBITDA margin

19.0

%

16.7

%

15.9

%

15.6

%

FRANKLIN COVEY CO.

Additional Financial

Information (in thousands and unaudited) Quarter

Ended Three Quarters Ended May 31, May 31, May 31, May 31,

2024

2023

2024

2023

Revenue by Division/Segment: Enterprise Division: Direct

offices

$

49,334

$

50,382

$

141,509

$

144,194

International licensees

2,701

2,835

8,826

9,048

52,035

53,217

150,335

153,242

Education Division

20,079

17,082

49,402

45,631

Corporate and other

1,259

1,142

3,372

3,692

Consolidated

$

73,373

$

71,441

$

203,109

$

202,565

Gross Profit by Division/Segment: Enterprise

Division: Direct offices

$

40,172

$

40,425

$

115,186

$

116,199

International licensees

2,435

2,549

7,861

8,184

42,607

42,974

123,047

124,383

Education Division

13,179

10,929

31,157

28,497

Corporate and other

420

330

1,132

1,305

Consolidated

$

56,206

$

54,233

$

155,336

$

154,185

Adjusted EBITDA by Division/Segment: Enterprise

Division: Direct offices

$

12,170

$

11,322

$

32,978

$

32,212

International licensees

1,334

1,415

4,571

4,787

13,504

12,737

37,549

36,999

Education Division

3,080

1,649

2,593

1,309

Corporate and other

(2,660

)

(2,487

)

(7,802

)

(6,750

)

Consolidated

$

13,924

$

11,899

$

32,340

$

31,558

FRANKLIN COVEY CO.

Condensed Consolidated Balance

Sheets (in thousands and unaudited) May 31,

August 31,

2024

2023

Assets Current assets: Cash and cash

equivalents

$

36,574

$

38,230

Accounts receivable, less allowance for doubtful accounts of $3,111

and $3,790

60,424

81,935

Inventories

4,644

4,213

Prepaid expenses and other current assets

18,389

20,639

Total current assets

120,031

145,017

Property and equipment, net

8,631

10,039

Intangible assets, net

38,808

40,511

Goodwill

31,220

31,220

Deferred income tax assets

1,636

1,661

Other long-term assets

20,645

17,471

$

220,971

$

245,919

Liabilities and Shareholders'

Equity Current liabilities: Current portion of notes payable

$

2,085

$

5,835

Current portion of financing obligation

3,810

3,538

Accounts payable

6,185

6,501

Deferred subscription revenue

80,092

95,386

Customer deposits

22,204

12,137

Accrued liabilities

22,215

28,252

Total current liabilities

136,591

151,649

Notes payable, less current portion

761

1,535

Financing obligation, less current portion

1,533

4,424

Other liabilities

8,076

7,617

Deferred income tax liabilities

1,847

2,040

Total liabilities

148,808

167,265

Shareholders' equity: Common stock

1,353

1,353

Additional paid-in capital

228,612

232,373

Retained earnings

111,248

99,802

Accumulated other comprehensive loss

(1,250

)

(987

)

Treasury stock at cost, 13,969 and 13,974 shares

(267,800

)

(253,887

)

Total shareholders' equity

72,163

78,654

$

220,971

$

245,919

FRANKLIN COVEY CO.

Condensed Consolidated Free Cash

Flow (in thousands and unaudited) Three Quarters

Ended May 31, May 31,

2024

2023

CASH FLOWS FROM OPERATING ACTIVITIES Net income $

11,446

$

10,969

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization

6,198

6,401

Amortization of capitalized curriculum costs

2,340

2,385

Impairment of asset

928

-

Stock-based compensation

7,092

9,357

Deferred income taxes

(169

)

2,399

Change in fair value of contingent consideration liabilities

-

7

Amortization of right-of-use operating lease assets

596

633

Changes in working capital

9,954

(6,204

)

Net cash provided by operating activities

38,385

25,947

CASH FLOWS FROM INVESTING ACTIVITIES Purchases of property

and equipment

(2,618

)

(3,545

)

Curriculum development costs

(5,195

)

(6,841

)

Net cash used for investing activities

(7,813

)

(10,386

)

Free Cash Flow $

30,572

$

15,561

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240626176012/en/

Investor Contact: Franklin Covey Boyd Roberts 801-817-5127

investor.relations@franklincovey.com

Media Contact: Franklin Covey Debra Lund 801-817-6440

Debra.Lund@franklincovey.com

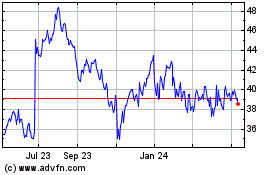

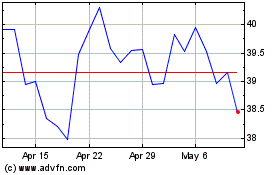

Franklin Covey (NYSE:FC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Franklin Covey (NYSE:FC)

Historical Stock Chart

From Nov 2023 to Nov 2024