0001031296false00010312962024-02-082024-02-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 8, 2024

| | | | | | | | | | | | | | | | | | | | | | | |

| Commission | | Registrant; State of Incorporation; | | I.R.S. Employer |

| File Number | | Address; and Telephone Number | | Identification No. |

| | | | | | | | |

| 333-21011 | | FIRSTENERGY CORP | | 34-1843785 |

| | | (An | Ohio | Corporation) | | |

| | | 76 South Main Street | | |

| | | Akron | OH | 44308 | | |

| | | Telephone | (800) | 736-3402 | | |

| | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

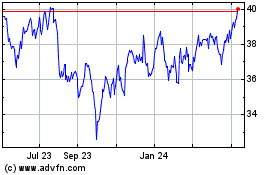

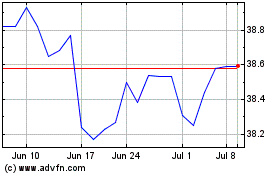

| Common Stock, $0.10 par value per share | | FE | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On February 8, 2024, FirstEnergy Corp. (“FirstEnergy” or the “Company”) issued a press release (the “Release”) announcing its financial results for the three months and full year ended December 31, 2023 and providing earnings guidance for the three months ended March 31, 2024 and full year ended December 31, 2024. A copy of the Release is included as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The Company has presented certain financial information in accordance with U.S. generally accepted accounting principles (“GAAP”) and also on a non-GAAP basis. Management uses these non-GAAP financial measures to evaluate the Company’s and its segments’ performance and manage its operations and frequently references these non-GAAP financial measures in its decision-making, using them to facilitate historical and ongoing performance comparisons. Management believes that the non-GAAP financial measures included in Exhibits 99.1 and 99.2 and 99.3, referenced below, provide consistent and comparable measures of performance of its businesses on an ongoing basis. Management also believes that such measures are useful to shareholders and other interested parties to understand performance trends and evaluate the Company against its peer group by presenting period-over-period operating results without the effect of certain special items that may not be consistent or comparable across periods or across the Company’s peer group. The Company has provided, where possible without unreasonable effort, quantitative reconciliations of the non-GAAP financial measures to the most directly comparable GAAP financial measures in the table on pages five and six of the Release.

The information set forth in and incorporated into this Item 2.02 of this Current Report on Form 8-K is being furnished pursuant to Item 2.02 of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any of the Company’s filings under the Securities Act of 1933, as amended (the “Securities Act”) or the Exchange Act, whether made before or after the date hereof and regardless of any general incorporation language in such filings, except to the extent expressly set forth by specific reference in such a filing.

Item 7.01 Regulation FD Disclosure

In connection with the Release, the Company also made available FirstEnergy’s 4Q 2023 Strategic and Financial Highlights and latest annual investor FactBook (the “FactBook”), which are attached as Exhibit 99.2 and Exhibit 99.3 to this Current Report on Form 8-K and incorporated herein by reference. The 4Q 2023 Strategic and Financial Highlights and FactBook are available under the “Investor Relations” section of the Company’s website, located at investors.firstenergycorp.com. Website addresses are included as inactive textual references only. Information on the Company’s website is not, and will not be deemed to be, a part of this Current Report on Form 8-K or incorporated into any other filings the Company may make with the Securities and Exchange Commission. Important information may be disseminated initially or exclusively via the Company’s Investor Relations website; investors should consult the site to access this information.

The information set forth in and incorporated into this Item 7.01 of this Current Report on Form 8-K is being furnished pursuant to Item 7.01 of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any of the Company’s filings under the Securities Act or the Exchange Act, whether made before or after the date hereof and regardless of any general incorporation language in such filings, except to the extent expressly set forth by specific reference in such a filing. The furnishing of this Item 7.01 of this Current Report on Form 8-K shall not be deemed an admission as to the materiality of any information herein that is required to be disclosed solely by reason of Regulation FD.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 99.2 | | |

| 99.3 | | |

| 104 | | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document) |

Forward-Looking Statements: This Form 8-K includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 based on information currently available to management. Such statements are subject to certain risks and uncertainties and readers are cautioned not to place undue reliance on these forward-looking statements. These statements include declarations regarding management's intents, beliefs and current expectations. These statements typically contain, but are not limited to, the terms “anticipate,” “potential,” “expect,” "forecast," "target," "will," "intend," “believe,” "project," “estimate," "plan" and similar words. Forward-looking statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements, which may include the following: the potential liabilities, increased costs and unanticipated developments resulting from government investigations and agreements, including those associated with compliance with or failure to comply with the Deferred Prosecution Agreement entered into July 21, 2021 with the U.S. Attorney’s Office for the Southern District of Ohio; the risks and uncertainties associated with government investigations and audits regarding Ohio House Bill 6, as passed by Ohio’s 133rd General Assembly (“HB 6”) and related matters, including potential adverse impacts on federal or state regulatory matters, including, but not limited to, matters relating to rates; the risks and uncertainties associated with litigation, arbitration, mediation, and similar proceedings, particularly regarding HB 6 related matters, including risks associated with obtaining dismissal of the derivative shareholder lawsuits; changes in national and regional economic conditions, including recession, rising interest rates, inflationary pressure, supply chain disruptions, higher energy costs, and workforce impacts, affecting us and/or our customers and those vendors with which we do business; weather conditions, such as temperature variations and severe weather conditions, or other natural disasters affecting future operating results and associated regulatory actions or outcomes in response to such conditions; legislative and regulatory developments, including, but not limited to, matters related to rates, compliance and enforcement activity, cyber security, and climate change; the risks associated with physical attacks, such as acts of war, terrorism, sabotage or other acts of violence, and cyber-attacks and other disruptions to our, or our vendors’, information technology system, which may compromise our operations, and data security breaches of sensitive data, intellectual property and proprietary or personally identifiable information; the ability to meet our goals relating to employee, environmental, social and corporate governance opportunities, improvements, and efficiencies, including our greenhouse gas (“GHG”) reduction goals; the ability to accomplish or realize anticipated benefits through establishing a culture of continuous improvement and our other strategic and financial goals, including, but not limited to, overcoming current uncertainties and challenges associated with the ongoing government investigations, executing our Energize365 transmission and distribution investment plan, executing on our rate filing strategy, controlling costs, improving our credit metrics, growing earnings, strengthening our balance sheet, and satisfying the conditions necessary to close the sale of additional membership interests of FirstEnergy Transmission, LLC; changing market conditions affecting the measurement of certain liabilities and the value of assets held in our pension trusts may negatively impact our forecasted growth rate, results of operations, and may also cause us to make contributions to our pension sooner or in amounts that are larger than currently anticipated; mitigating exposure for remedial activities associated with retired and formerly owned electric generation assets; changes to environmental laws and regulations, including but not limited to those related to climate change; changes in customers’ demand for power, including but not limited to, economic conditions, the impact of climate change, emerging technology, particularly with respect to electrification, energy storage and distributed sources of generation; the ability to access the public securities and other capital and credit markets in accordance with our financial plans, the cost of such capital and overall condition of the capital and credit markets affecting us, including the increasing number of financial institutions evaluating the impact of climate change on their investment decisions; future actions taken by credit rating agencies that could negatively affect either our access to or terms of financing or our financial condition and liquidity; changes in assumptions regarding factors such as economic conditions within our territories, the reliability of our transmission and distribution system, or the availability of capital or other resources supporting identified transmission and distribution investment opportunities; the potential of non-compliance with debt covenants in our credit facilities; the ability to comply with applicable reliability standards and energy efficiency and peak demand reduction mandates; human capital management challenges, including among other things, attracting and retaining appropriately trained and qualified employees and labor disruptions by our unionized workforce; changes to significant accounting policies; any changes in tax laws or regulations, including, but not limited to, the Inflation Reduction Act of 2022, or adverse tax audit results or rulings; and the risks and other factors discussed from time to time in our Securities and Exchange Commission (“SEC”) filings. Dividends declared from time to time on FirstEnergy Corp.’s common stock during any period may in the aggregate vary from prior periods due to circumstances considered by FirstEnergy Corp.’s Board of Directors at the time of the actual declarations. A security rating is not a recommendation to buy or hold securities and is subject to revision or withdrawal at any time by the assigning rating agency. Each rating should be evaluated independently of any other rating. These forward-looking statements are also qualified by, and should be read together with, the risk factors included in FirstEnergy Corp.’s filings with the SEC, including, but not limited to, the most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q, and any subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. The foregoing review of factors also should not be construed as exhaustive. New factors emerge from time to time, and it is not possible for management to predict all such factors, nor assess the impact of any such factor on FirstEnergy Corp.’s business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statements. FirstEnergy Corp. expressly disclaims any obligation to update or revise, except as required by law, any forward-looking statements contained herein or in the information incorporated by reference as a result of new information, future events or otherwise.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

February 8, 2024

| | | | | |

| FIRSTENERGY CORP. |

| Registrant |

| |

| |

| By: | /s/ Jason J. Lisowski |

| Jason J. Lisowski Vice President, Controller and Chief Accounting Officer |

| | | | | | | | |

| FirstEnergy Corp. | | For Release: February 8, 2024 |

| 76 South Main Street | | |

| Akron, Ohio 44308 | | |

www.firstenergycorp.com | | |

| | |

| | |

| News Media Contact: | | Investor Contact: |

Tricia Ingraham | | Irene Prezelj |

| (330) 384-5247 | | (330) 384-3859 |

| | |

FirstEnergy Announces Fourth Quarter and Full Year 2023 Financial Results

Reports full year 2023 GAAP earnings from continuing operations of $1.96 per share

Delivers 2023 Operating (non-GAAP) earnings of $2.56 per share, above the midpoint of guidance

Provides 2024 operating guidance of $2.61 to $2.81 per share for the full year, a 7% increase over the 2023 guidance mid-point, driven by robust regulated growth

Introduces Energize365, a $26 billion capital investment plan from 2024 to 2028 to enhance the customer experience and support the energy transition

Targeted 6-8% long-term annual operating earnings per share growth with significantly improved earnings quality

Akron, Ohio – FirstEnergy Corp. (NYSE: FE) today reported full year 2023 GAAP earnings from continuing operations of $1.123 billion, or $1.96 per basic and diluted share, on revenue of $12.9 billion. This compares to 2022 GAAP earnings from continuing operations of $406 million, or $0.71 per basic and diluted share, on revenue of $12.5 billion. Results for both periods reflect the impact of special items listed below.

Driven by solid execution on capital deployment, cost discipline and operating performance, FirstEnergy delivered 2023 Operating (non-GAAP) earnings* of $2.56 per share, which was above the midpoint of the company’s guidance range. In 2022, Operating (non-GAAP) earnings were $2.41 per share.

“Throughout 2023, FirstEnergy employees demonstrated innovation, operational excellence and financial discipline to overcome challenges, drive our strategy and deliver on our financial commitments. It was pivotal year for FirstEnergy, in which we strengthened our foundation and greatly accelerated our progress toward our goal of becoming a premier utility,” said Brian X. Tierney, President and Chief Executive Officer. “In 2024, we plan to continue this transformation through customer-focused investments, financial and operational excellence and a relentless focus on continuous improvement.”

Outlook

FirstEnergy provided a 2024 earnings guidance range of $1.5 billion to $1.62 billion, or $2.61 to $2.81 per share, representing robust growth in its regulated businesses with significantly improved earnings quality from lower planned earnings contributions from legacy investments. In addition, the company is providing a guidance range of $275 million to $335 million, or $0.48 to $0.58 per share for the first quarter of 2024.

The company affirmed its long-term, 6% to 8% targeted annual operating earnings per share growth rate, which is based off the previous year’s operating earnings guidance midpoint and supported by the company’s refreshed and extended five-year capital investment plan, released today. A centerpiece of the forecast is Energize365, FirstEnergy’s $26 billion systemwide capital investment program from 2024-2028 focused on investments in the electric grid to deliver the energy customers depend on today, while also meeting the challenges and opportunities of the clean energy transition.

“Through a series of successful strategic actions, FirstEnergy is entering 2024 with a stronger, sustainable financial foundation that supports a robust and comprehensive long-term capital plan funded with strong cash from operations, regulated debt capital and the previously announced sale of a 30% interest in FET LLC, which is expected to close early this year. We are also pleased to announce Energize365, which is designed to better serve our customers by further enhancing our transmission and distribution systems to reduce power outages, increase resiliency and enable a smarter, cleaner energy future without compromising on affordability,” Tierney said.

Fourth Quarter Results

Fourth quarter 2023 GAAP earnings from continuing operations were $175 million, or $0.30 per basic and diluted share, on revenue of $3.2 billion. In the fourth quarter of 2022, the company reported a GAAP loss of $(403) million, or $(0.71) per basic and diluted share, on revenue of $3.2 billion. Results for both periods include the special items listed below.

Operating (non-GAAP) earnings* were $0.62 per share in the fourth quarter of 2023, above the midpoint of the company’s guidance range. Operating (non-GAAP) earnings in the fourth quarter of 2022 were $0.50 per share.

In the Regulated Distribution business, fourth quarter operating earnings were flat compared to the fourth quarter of 2022. In 2023, lower operating expenses, higher revenues related to utility investment programs, lower Ohio rate credits and new rates that went into effect in Maryland in October were offset by lower weather-related demand, a lower pension credit and higher interest expense from debt to fund the company’s capital investment programs.

Mild December temperatures drove a 1.3% decrease in total distribution deliveries for the fourth quarter of 2023 compared to the fourth quarter of 2022. Heating degree days during the quarter were 11% below normal and the fourth quarter of 2022. Usage decreased 4.9% among residential customers and 1.1% in the commercial sector, while industrial sales increased 2%.

On a weather-adjusted basis, distribution deliveries increased just over 1% in 2023 compared to the fourth quarter of 2022. Weather-adjusted sales to residential customers decreased slightly, while deliveries to commercial and industrial customers increased 2%.

In the Regulated Transmission business, fourth quarter 2023 operating results benefited from the company’s ongoing investment program and an adjustment associated with recovery of certain costs. Rate base increased by more than 9% from the fourth quarter of 2022.

In Corporate/Other, fourth quarter 2023 operating results improved as compared to the fourth quarter of 2022, primarily as a result of lower operating expenses and a lower consolidated effective tax rate, partially offset by higher interest expense primarily associated with the low-cost convertible debt offering in the first half of 2023.

Full Year 2023 Results

Full year 2023 Operating (non-GAAP) earnings benefited from lower operating expenses, continued growth from customer-focused regulated investments, stronger weather-adjusted load and a lower consolidated effective tax rate. These drivers offset the impact of lower weather-related demand, lower pension credits and higher financing costs.

Heating degree days in 2023 were 15% below normal and 14% below 2022, while cooling degree days were 15% below normal and 23% below 2022. This resulted in a 3% decrease in total distribution deliveries in 2023. On a weather-adjusted basis, overall load increased approximately 1% compared to 2022, comprising a 1.5% increase in residential sales, a slight increase in commercial deliveries and stronger industrial demand of nearly 1%.

FirstEnergy deployed $3.7 billion in capital investment in 2023, surpassing its original capital investment plan by $300 million despite continuing supply chain challenges. These customer-focused investments were aimed at modernizing and improving the reliability and resiliency of the transmission and distribution systems.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Consolidated GAAP Earnings (Losses) from Continuing Operations Per Share (EPS) to Operating (Non-GAAP) EPS* Reconciliation | |

| | | | Three Months Ended Dec 31, | | Year Ended Dec 31 | | | |

| | | | 2023 | 2022 | | 2023 | 2022 | | | |

| Earnings (Losses) Attributable to FirstEnergy Corp. from Continuing Operations (GAAP) - $M | | $175 | $(403) | | $1,123 | $406 | | | |

| Basic – Continuing Operations EPS (GAAP) | | $0.30 | $(0.71) | | $1.96 | $0.71 | | | |

| Excluding Special Items*: | | | | | | | | | |

| | Debt-related costs | | — | 0.02 | | 0.05 | 0.25 | | | |

| | Enhanced employee retirement and other related costs | | 0.03 | — | | 0.13 | — | | | |

| | FE Forward cost to achieve | | 0.01 | 0.01 | | 0.09 | 0.03 | | | |

| | Investigation and other related costs | | 0.03 | 0.03 | | 0.10 | 0.08 | | | |

| | Mark-to-market adjustments – Pension/OPEB actuarial assumptions | | 0.12 | (0.13) | | 0.05 | (0.13) | | | |

| | Strategic transaction costs | | 0.11 | 1.23 | | 0.11 | 1.23 | | | |

| | Regulatory charges | | 0.02 | 0.03 | | 0.05 | 0.21 | | | |

| | State tax legislative changes | | — | 0.01 | | — | 0.01 | | | |

| | Exit of generation | | — | 0.01 | | 0.02 | 0.02 | | | |

| | Total Special Items* | | 0.32 | 1.21 | | 0.60 | 1.70 | | | |

| Operating EPS (Non-GAAP) | | $0.62 | $0.50 | | $2.56 | $2.41 | | | |

| | | | | | | | | | | |

| Per share amounts for the special items above are based on the after-tax effect of each item divided by the number of shares outstanding for the period. The current and deferred income tax effect was calculated by applying the subsidiaries' statutory tax rate to the pre-tax amount if deductible/taxable. The income tax rate ranges from 21% to 29%. Basic continuing operations EPS (GAAP) and Operating EPS (Non-GAAP) is based on 572 million and 571 million shares for the Fourth Quarter and Full Year 2022, respectively, and 574 million and 573 million shares for the Fourth Quarter and Full Year 2023, respectively. | |

Non-GAAP financial measures

* We refer to certain financial measures, including Operating earnings (loss), Operating earnings (loss) per share (“EPS”), including by segment, as “non-GAAP financial measures,” which are not calculated in accordance with U.S. Generally Accepted Accounting Principles (GAAP) and exclude the impact of “special items,” as described below. Management uses these non-GAAP financial measures to evaluate the Company’s and its segments’ performance and manage its operations and frequently references these non-GAAP financial measures in its decision-making, using them to facilitate historical and ongoing performance comparisons. Management believes that the non-GAAP financial measures of Operating earnings (loss) and Operating EPS, including by segment, provide consistent and comparable measures of performance of its businesses on an ongoing basis. Management also believes that such measures are useful to shareholders and other interested parties to understand performance trends and evaluate the Company against its peer group by presenting period-over-period operating results without the effect of certain special items that may not be consistent or comparable across periods or across the Company’s peer group. These non-GAAP financial measures are intended to complement, and are not considered as alternatives to, the most directly comparable GAAP financial measures, which for Operating EPS is Continuing Operations EPS (GAAP), as reconciled in the above table. Also, the non-GAAP financial measures may not be comparable to similarly titled measures used by other entities.

Special items represent charges incurred or benefits realized that management believes are not indicative of, or may obscure trends useful in evaluating the Company’s ongoing core activities and results of operations or otherwise warrant separate classification. Operating EPS is calculated by dividing Operating earnings (loss), which excludes special items as discussed above, for the periods presented by the weighted average number of common shares outstanding, which is 572 million shares for the fourth quarter of 2022, 571 million shares for full year 2022, 574 million shares for the fourth quarter of 2023, 573 million shares for the full year 2023, 575 million shares in the first quarter of 2024 and 576 million shares for the full year 2024.

A reconciliation of forward-looking non-GAAP measures, including 2024 Operating EPS and long-term annual Operating EPS growth projections, to the most directly comparable GAAP measures is not provided because comparable GAAP measures for such measures are not reasonably accessible or reliable due to the inherent difficulty in forecasting and quantifying measures that would be necessary for such reconciliation. Specifically, management cannot, without reasonable effort, predict the impact of these special items in the context of operating EPS guidance and long-term annual operating EPS growth rate projections because these items, which could be significant, are difficult to predict and may be highly variable. In addition, the company believes such a reconciliation would imply a degree of precision and certainty that could be confusing to investors. These items are uncertain, depend on various factors and may have a material impact on our future GAAP results.

Investor Materials and Teleconference

FirstEnergy’s Strategic and Financial Highlights presentation is posted on the company’s Investor Information website – www.firstenergycorp.com/ir. It can be accessed through the Fourth Quarter 2023 Financial Results link.

The company invites investors, customers and other interested parties to listen to a live webcast of its teleconference for financial analysts and view presentation slides at 10:00 a.m. EST tomorrow. FirstEnergy management will present an overview of the company’s financial results followed by a question-and-answer session. The teleconference and presentation can be accessed on the website by selecting the Fourth Quarter 2023 Earnings Webcast link. The webcast and presentation will be archived on the website.

FirstEnergy is dedicated to integrity, safety, reliability and operational excellence. Its electric distribution companies form one of the nation's largest investor-owned electric systems, serving more than six million customers in Ohio, Pennsylvania, New Jersey, West Virginia, Maryland and New York. The company’s transmission subsidiaries operate approximately 24,000 miles of transmission lines that connect the Midwest and Mid-Atlantic regions. Follow FirstEnergy online at www.firstenergycorp.com and on X, formerly known as Twitter, @FirstEnergyCorp.

Forward-Looking Statements: This news release includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 based on information currently available to management. Such statements are subject to certain risks and uncertainties and readers are cautioned not to place undue reliance on these forward-looking statements. These statements include declarations regarding management's intents, beliefs and current expectations. These statements typically contain, but are not limited to, the terms “anticipate,” “potential,” “expect,” "forecast," "target," "will," "intend," “believe,” "project," “estimate," "plan" and similar words. Forward-looking statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements, which may include the following: the potential liabilities, increased costs and unanticipated developments resulting from government investigations and agreements, including those associated with compliance with or failure to comply with the Deferred Prosecution Agreement entered into July 21, 2021 with the U.S. Attorney’s Office for the Southern District of Ohio; the risks and uncertainties associated with government investigations and audits regarding Ohio House Bill 6, as passed by Ohio’s 133rd General Assembly (“HB 6”) and related matters, including potential adverse impacts on federal or state regulatory matters, including, but not limited to, matters relating to rates; the risks and uncertainties associated with litigation, arbitration, mediation, and similar proceedings, particularly regarding HB 6 related matters, including risks associated with obtaining

dismissal of the derivative shareholder lawsuits; changes in national and regional economic conditions, including recession, rising interest rates, inflationary pressure, supply chain disruptions, higher energy costs, and workforce impacts, affecting us and/or our customers and those vendors with which we do business; weather conditions, such as temperature variations and severe weather conditions, or other natural disasters affecting future operating results and associated regulatory actions or outcomes in response to such conditions; legislative and regulatory developments, including, but not limited to, matters related to rates, compliance and enforcement activity, cyber security, and climate change; the risks associated with physical attacks, such as acts of war, terrorism, sabotage or other acts of violence, and cyber-attacks and other disruptions to our, or our vendors’, information technology system, which may compromise our operations, and data security breaches of sensitive data, intellectual property and proprietary or personally identifiable information; the ability to meet our goals relating to employee, environmental, social and corporate governance opportunities, improvements, and efficiencies, including our greenhouse gas (“GHG”) reduction goals; the ability to accomplish or realize anticipated benefits through establishing a culture of continuous improvement and our other strategic and financial goals, including, but not limited to, overcoming current uncertainties and challenges associated with the ongoing government investigations, executing our Energize 365 transmission and distribution investment plan, executing on our rate filing strategy, controlling costs, improving our credit metrics, growing earnings, strengthening our balance sheet, and satisfying the conditions necessary to close the sale of additional membership interests of FirstEnergy Transmission, LLC; changing market conditions affecting the measurement of certain liabilities and the value of assets held in our pension trusts may negatively impact our forecasted growth rate, results of operations, and may also cause us to make contributions to our pension sooner or in amounts that are larger than currently anticipated; mitigating exposure for remedial activities associated with retired and formerly owned electric generation assets; changes to environmental laws and regulations, including but not limited to those related to climate change; changes in customers’ demand for power, including but not limited to, economic conditions, the impact of climate change , emerging technology, particularly with respect to electrification, energy storage and distributed sources of generation; the ability to access the public securities and other capital and credit markets in accordance with our financial plans, the cost of such capital and overall condition of the capital and credit markets affecting us, including the increasing number of financial institutions evaluating the impact of climate change on their investment decisions; future actions taken by credit rating agencies that could negatively affect either our access to or terms of financing or our financial condition and liquidity; changes in assumptions regarding factors such as economic conditions within our territories, the reliability of our transmission and distribution system, or the availability of capital or other resources supporting identified transmission and distribution investment opportunities; the potential of non-compliance with debt covenants in our credit facilities; the ability to comply with applicable reliability standards and energy efficiency and peak demand reduction mandates; human capital management challenges, including among other things, attracting and retaining appropriately trained and qualified employees and labor disruptions by our unionized workforce; changes to significant accounting policies; any changes in tax laws or regulations, including, but not limited to, the Inflation Reduction Act of 2022, or adverse tax audit results or rulings; and the risks and other factors discussed from time to time in our Securities and Exchange Commission (“SEC”) filings. Dividends declared from time to time on FirstEnergy Corp.’s common stock during any period may in the aggregate vary from prior periods due to circumstances considered by FirstEnergy Corp.’s Board of Directors at the time of the actual declarations. A security rating is not a recommendation to buy or hold securities and is subject to revision or withdrawal at any time by the assigning rating agency. Each rating should be evaluated independently of any other rating. These forward-looking statements are also qualified by, and should be read together with, the risk factors included in FirstEnergy Corp.’s (a) Item 1A. Risk Factors, (b) Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, and (c) other factors discussed herein and in FirstEnergy's other filings with the SEC. The foregoing review of factors also should not be construed as exhaustive. New factors emerge from time to time, and it is not possible for management to predict all such factors, nor assess the impact of any such factor on FirstEnergy Corp.’s business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statements. FirstEnergy Corp. expressly disclaims any obligation to update or revise, except as required by law, any forward-looking statements contained herein or in the information incorporated by reference as a result of new information, future events or otherwise.

(020824)

Focused on Our Future 4Q 2023 Strategic & Financial Highlights Published February 8, 2024

Forward-Looking Statements 2 This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 based on information currently available to management. Such statements are subject to certain risks and uncertainties and readers are cautioned not to place undue reliance on these forward-looking statements. These statements include declarations regarding management's intents, beliefs and current expectations. These statements typically contain, but are not limited to, the terms “anticipate,” “potential,” “expect,” "forecast," "target," "will," "intend," “believe,” "project," “estimate," "plan" and similar words. Forward-looking statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements, which may include the following: the potential liabilities, increased costs and unanticipated developments resulting from government investigations and agreements, including those associated with compliance with or failure to comply with the Deferred Prosecution Agreement entered into July 21, 2021 with the U.S. Attorney’s Office for the Southern District of Ohio; the risks and uncertainties associated with government investigations and audits regarding Ohio House Bill 6, as passed by Ohio’s 133rd General Assembly (“HB 6”) and related matters, including potential adverse impacts on federal or state regulatory matters, including, but not limited to, matters relating to rates; the risks and uncertainties associated with litigation, arbitration, mediation, and similar proceedings, particularly regarding HB 6 related matters, including risks associated with obtaining dismissal of the derivative shareholder lawsuits; changes in national and regional economic conditions, including recession, rising interest rates, inflationary pressure, supply chain disruptions, higher energy costs, and workforce impacts, affecting us and/or our customers and those vendors with which we do business; weather conditions, such as temperature variations and severe weather conditions, or other natural disasters affecting future operating results and associated regulatory actions or outcomes in response to such conditions; legislative and regulatory developments, including, but not limited to, matters related to rates, compliance and enforcement activity, cyber security, and climate change; the risks associated with physical attacks, such as acts of war, terrorism, sabotage or other acts of violence, and cyber-attacks and other disruptions to our, or our vendors’, information technology system, which may compromise our operations, and data security breaches of sensitive data, intellectual property and proprietary or personally identifiable information; the ability to meet our goals relating to employee, environmental, social and corporate governance opportunities, improvements, and efficiencies, including our greenhouse gas (“GHG”) reduction goals; the ability to accomplish or realize anticipated benefits through establishing a culture of continuous improvement and our other strategic and financial goals, including, but not limited to, overcoming current uncertainties and challenges associated with the ongoing government investigations, executing our Energize 365 transmission and distribution investment plan, executing on our rate filing strategy, controlling costs, improving our credit metrics, growing earnings, strengthening our balance sheet, and satisfying the conditions necessary to close the sale of additional membership interests of FirstEnergy Transmission, LLC; changing market conditions affecting the measurement of certain liabilities and the value of assets held in our pension trusts may negatively impact our forecasted growth rate, results of operations, and may also cause us to make contributions to our pension sooner or in amounts that are larger than currently anticipated; mitigating exposure for remedial activities associated with retired and formerly owned electric generation assets; changes to environmental laws and regulations, including but not limited to those related to climate change; changes in customers’ demand for power, including but not limited to, economic conditions, the impact of climate change , emerging technology, particularly with respect to electrification, energy storage and distributed sources of generation; the ability to access the public securities and other capital and credit markets in accordance with our financial plans, the cost of such capital and overall condition of the capital and credit markets affecting us, including the increasing number of financial institutions evaluating the impact of climate change on their investment decisions; future actions taken by credit rating agencies that could negatively affect either our access to or terms of financing or our financial condition and liquidity; changes in assumptions regarding factors such as economic conditions within our territories, the reliability of our transmission and distribution system, or the availability of capital or other resources supporting identified transmission and distribution investment opportunities; the potential of non-compliance with debt covenants in our credit facilities; the ability to comply with applicable reliability standards and energy efficiency and peak demand reduction mandates; human capital management challenges, including among other things, attracting and retaining appropriately trained and qualified employees and labor disruptions by our unionized workforce; changes to significant accounting policies; any changes in tax laws or regulations, including, but not limited to, the Inflation Reduction Act of 2022, or adverse tax audit results or rulings; and the risks and other factors discussed from time to time in our Securities and Exchange Commission (“SEC”) filings. Dividends declared from time to time on FirstEnergy Corp.’s common stock during any period may in the aggregate vary from prior periods due to circumstances considered by FirstEnergy Corp.’s Board of Directors at the time of the actual declarations. A security rating is not a recommendation to buy or hold securities and is subject to revision or withdrawal at any time by the assigning rating agency. Each rating should be evaluated independently of any other rating. These forward-looking statements are also qualified by, and should be read together with, the risk factors included in FirstEnergy Corp.’s (a) Item 1A. Risk Factors, (b) Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, and (c) other factors discussed herein and in FirstEnergy's other filings with the SEC. The foregoing review of factors also should not be construed as exhaustive. New factors emerge from time to time, and it is not possible for management to predict all such factors, nor assess the impact of any such factor on FirstEnergy Corp.’s business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statements. FirstEnergy Corp. expressly disclaims any obligation to update or revise, except as required by law, any forward-looking statements contained herein or in the information incorporated by reference as a result of new information, future events or otherwise. Strategic & Financial Highlights - Published February 8, 2024

Non-GAAP Financial Matters 1 Strategic & Financial Highlights - Published February 8, 2024 This presentation contains references to certain financial measures including, Operating earnings (loss) and Operating earnings (loss) per share (“EPS”), including by segment, and the impact of special items on the following measures, Total revenues, Total operating expenses, Total other expense, and Earnings (loss) attributable to FirstEnergy Corp. from continuing operations as “non-GAAP financial measures” which are not calculated in accordance with U.S. Generally Accepted Accounting Principals, (“GAAP”). Management uses these non-GAAP financial measures to evaluate the Company’s and its segments’ performance and manage its operations and frequently references these non-GAAP financial measures in its decision-making, using them to facilitate historical and ongoing performance comparisons. Management believes that the non-GAAP financial measures of Operating earnings (loss) and Operating EPS, including by segment, provide consistent and comparable measures of performance of its businesses on an ongoing basis. Management also believes that such measures are useful to shareholders and other interested parties to understand performance trends and evaluate the Company against its peer group by presenting period-over-period operating results without the effect of certain special items that may not be consistent or comparable across periods or across the Company’s peer group. These non-GAAP financial measures are intended to complement, and are not considered as alternatives to, the most directly comparable GAAP financial measures, which for Operating EPS is Continuing Operations EPS (GAAP), as reconciled in the above table. Also, the non-GAAP financial measures may not be comparable to similarly titled measures used by other entities. Special items represent charges incurred or benefits realized that management believes are not indicative of, or may obscure trends useful in evaluating the Company’s ongoing core activities and results of operations or otherwise warrant separate classification. Operating EPS is calculated by dividing Operating earnings (loss), which excludes special items as discussed above, for the periods presented by the weighted average number of common shares outstanding, which is 572 million shares for the fourth quarter of 2022, 571 million shares for full year 2022, 574 million shares for the fourth quarter of 2023, 573 million shares for the full year 2023, 575 million shares in the first quarter of 2024 and 576 million shares for the full year 2024. A reconciliation of forward-looking non-GAAP measures, including 2024 Operating EPS and long-term annual Operating EPS growth projections, to the most directly comparable GAAP measures is not provided because comparable GAAP measures for such measures are not reasonably accessible or reliable due to the inherent difficulty in forecasting and quantifying measures that would be necessary for such reconciliation. Specifically, management cannot, without reasonable effort, predict the impact of these special items in the context of operating EPS guidance and long-term annual operating EPS growth rate projections because these items, which could be significant, are difficult to predict and may be highly variable. In addition, the company believes such a reconciliation would imply a degree of precision and certainty that could be confusing to investors. These items are uncertain, depend on various factors and may have a material impact on our future GAAP results.

Focus of Today’s Call ■ Delivered on 2023 financial commitments and key accomplishments ■ Extending financial guidance through 2028 and affirming long-term annual Operating EPS growth rate of 6-8%(1) with significantly improved earnings quality ■ Building a strong regulatory track record ■ Providing updates on key strategic initiatives 4 Strategic & Financial Highlights - Published February 8, 2024 ■ Achieved strong 2023 financial results despite mild temperatures and pension headwind ■ Highlighting our financial guidance through 2028 – improved earnings quality, investment-grade credit metrics, and dividend growth in line with earnings growth ■ Initiating 2024 Operating Earnings Guidance of $2.61-$2.81/sh(1) reflecting robust regulated growth Brian X. Tierney – President and Chief Executive Officer K. Jon Taylor – Senior Vice President, Chief Financial Officer (1) The amount and timing of items impacting comparability makes a detailed reconciliation of forward-looking non-GAAP financial measures impracticable. Please see slide 3 for more information.

Strategic & Financial Highlights - Published February 8, 20245 $0.30 $0.62 -$0.71 $0.50 GAAP EPS Operating EPS Fourth Quarter $1.96 $2.56 $0.71 $2.41 GAAP EPS Operating EPS Full Year2023 2022 Financial Overview & Key Highlights Key Highlights 2023 vs 2022 Results Delivered 2023 Operating EPS of $2.56, +$0.02 above guidance midpoint $3.7B Investment Plan (16%> 2022, 9%> Budget) FET 30% Interest Sale ($3.5B, expected close in March) PA Consolidation (Effective 1/1/24) $1.5B Convertible Debt ($1.5B at a 4% coupon) ~$700M Pension Lift-out (~8% of total pension liability) Reinstated Dividend Growth (Targeting 60-70% payout) Initiating 2024 Operating EPS guidance range of $2.61-$2.81, +7% vs. 2023 midpoint Introducing Energize365, our new $26B, 5-yr investment plan (2024-2028) and 9% rate base growth Affirming 6-8% long-term annual Operating EPS growth with significant improvement in earnings quality (1) GAAP Earnings per Share from Continuing Operations (1) (1) 2023 Accomplishments We plan to file the Form 10-K the week of February 12th

2023 2024 Strategic & Financial Highlights - Published February 8, 20246 Executing on Our Regulatory Strategy WV (Settlement filed 1/23/24) Requested new rates effective 3/27/24, 9.8% ROE, $105M revenue increase O N D Base Rate Case Filings Additional Filings J F M A M J J A S O N D PA (April) OH (May) PA: Plan to file LTIIP in summer 2024 See Regulatory Calendar on slide 28 for additional regulatory details See the Regulatory Corner section of our IR website OH: Grid Mod II Hearings begin 4/16/24 OH: ESP V Requested approval effective 6/1/24, Reply briefs due 2/9/24 Effective 1/1/24 PA: FET 30% Interest Sale Settlement 11/29/23 NJ (Settlement filed 2/2/24) Requested new rates effective 6/1/24, 9.6% ROE, $85M revenue increase NJ: IIP Filed 11/9/23 Second triennium filed 12/1/23 WV: ENEC Settlement 11/29/23 MD (Order received 10/18/23) New rates 10/19/2023, 9.5% ROE, $29M revenue increase PA: Legal Entity Consolidation NJ: IIP Plan to submit revised filing on 2/29/24 NJ: EE&C

Strategic Updates Simplifying segments to align with new org. structure beginning with 1Q 2024 results Strategic & Financial Highlights - Published February 8, 20247 4.2M Customers *See FactBook slide 77 for 2023 Results recast to new segment view (1) Former PA utility companies merged with and into FE PA, however, FE PA continues to do business under the legacy utility company name and will continue to have separate rate districts until a future base rate case filing (2) FE Corp. holds a minority interest/share of MAIT (3) KATCo includes former utility transmission assets of WPP Cleveland Electric Illuminating Co. (CEI) Toledo Edison Co. (TE) FirstEnergy Pennsylvania Electric Company (FE PA) American Transmission Systems Inc. (ATSI) Mid-Atlantic Interstate Transmission, LLC (MAIT) (2) Trans-Allegheny Interstate Line Co. (TrAILCo) FirstEnergy Transmission, LLC (FET) Ohio Edison Co. (OE) Tx & Dx & Gx Monongahela Power Co. (MP) Tx & Dx Potomac Edison Co. (PE) Tx & Dx Jersey Central Power & Light Co. (JCP&L) Keystone Appalachian Transmission Co. (KATCo) (3) FE Parent Debt and Other Obligations • Holding company interest • Legacy investments • Former subsidiaries pension/OPEB Ohio Pennsylvania(1) New Jersey WV & MD Transmission Companies Stand-Alone Transmission Distribution Integrated Corp/Other % of 2024F Operating EPS: ~45% ~35% ~20% 2023A Rate Base: $10.9B $8.7B $7.7B 2M Customers 16.8K Tx Line Miles

Strategic Updates (Continued) 8 Strategic & Financial Highlights - Published February 8, 2024 Strengthening our Organization • Maintaining our aspirational goal of net carbon neutrality by 2050 • Eliminating our interim goal of reducing our Scope 1 emissions by 30% off the 2019 baseline by 2030 For more details, see the updated Climate Strategy published to our Corporate Responsibility website. Greenhouse Gas Emission Goal OOCIC • Continue to cooperate with commission We have made transformational strides to improve the financial strength of FirstEnergy and are singularly focused on regulated growth to improve reliability and the customer experience • In November, added Toby Thomas as Chief Operating Officer ‒ Responsible for system planning and protection, transmission and substation engineering, project and construction management, and system operations • In December, added Wade Smith as President of FE Utilities ‒ The presidents of our five operating businesses will report to Wade (OH, PA, NJ, WV & MD, and Stand-Alone Transmission) ‒ Actively reviewing internal and external candidates to run these businesses

Delivering Financial Results 4Q 2023 Earnings Summary Strategic & Financial Highlights - Published February 8, 20249 4Q23 GAAP Earnings from Continuing Operations $0.30 per share (vs. -$0.71 per share in 4Q22) – 4Q 2023 results include ($0.32) of special items, including Enhanced employee retirement and other related costs ($0.03), FE Forward cost to achieve ($0.01) Investigation and other related costs (0.03), Mark-to-market adjustments-Pension/OPEB actuarial assumptions ($0.12), Regulatory charges ($0.02), and Strategic transaction charges ($0.11) 4Q23 Operating Earnings $0.62 per share (vs. $0.50 per share in 4Q22) – 4Q 2023 results in the upper half of the 4Q guidance range of $0.55-$0.65/sh – Includes -$0.04/sh of lower earnings associated with weather-related distribution sales (-$0.04 vs normal) Quarter-over-Quarter Operating EPS Summary Note: Reconciliations between GAAP Earnings from Continuing Operations and Operating (non-GAAP) earnings and detailed information is available in the Earnings Supplement section of the Strategic & Financial Highlights RD Only: Weather:-$0.04 RD: +$0.04 RT: +$0.01 RD: +$0.09 Corp: +$0.03 Lower labor, vegetation mgmt, bad debt, non-deferred storms, and reg gen spend Other: RD: +$0.01 RT: +$0.04 Corp: +$0.03 Signal Peak: Higher EPS contribution ($0.06 4Q23 vs. $0.05 4Q22) RD: $0.32 RT: $0.25 Corp: $0.05 RD: $0.32 RT: $0.20 Corp: ($0.02) RD: -$0.03 Corp: -$0.01 Our focus on efficient operations and financial discipline allowed us to deliver operating results in the upper half of the 4Q guidance range Corp: lower Consolidated effective tax rate RD Only

Delivering Financial Results 2023 Earnings Summary 10 2023 GAAP Earnings from Continuing Operations $1.96 per share (vs. $0.71 per share in 22) – 2023 results include ($0.60) of special items, including Debt-related costs ($0.05), Enhanced employee retirement and other related costs ($0.13), Exit of generation ($0.02), FE Forward cost to achieve ($0.09), Investigation and other related costs ($0.10), Mark-to- market adjustments-Pension/OPEB actuarial assumptions ($0.05), Regulatory charges ($0.05), and Strategic transaction charges ($0.11) 2023 Operating Earnings $2.56 per share (vs. $2.41 per share in 22) – Operating results reflect continued focus on efficient operations and financial discipline – Includes -$0.28/sh share of lower earnings associated with weather-related distribution sales (-$0.22 vs normal) Year-over-Year Operating EPS Summary Note: Reconciliations between GAAP Earnings from Continuing Operations and Operating (non-GAAP) earnings and detailed information is available in the Earnings Supplement section of the Strategic & Financial Highlights RD: $1.78 RT: $0.83 Corp: ($0.20) RD: $1.60 RT: $0.91 Corp: $0.05 RD Only Weather: -$0.28 Weather-adj. sales: +$0.03 Rate Adj.:+$0.04 RD: +$0.11 RT: +$0.09 RD: +$0.27 Corp: +$0.05 Lower labor, vegetation mgmt, bad debt, and planned generation spend RD: -$0.26 Corp: -$0.04 RD: -$0.11 RT: -$0.05 Corp: +$0.04 Strategic & Financial Highlights - Published February 8, 2024 Other: RD: +$0.02 RT: +$0.04 Corp: +$0.06 Signal Peak: Higher EPS contribution ($0.24 FY23 vs. $0.23 FY22) Corp: Discrete income tax benefits, primarily from the use of state NOLs 2023 results reflect strong financial discipline and operational excellence with base O&M 14% below and capital deployment 16% above 2022 levels

L-T Annual EPS Target 6-8% Growth Attractive Total Shareholder Return Target Dividend Payout 60-70% Dividend growth in line with Operating earnings Rate Base 9% Growth $29B in 2024 to $41B in 2028 Sustainable Regulatory Growth Plan Robust Investment Plan $26B CapEx from $4.3B in 2024 to $6.2B in 2028 FFO/Debt: 14-15% Significant improvement from FET 30% sale & organic cash flow growth Strengthening Balance Sheet No Additional Equity Needs Excl. Employee Benefit programs of up to $100M/year Strategic & Financial Highlights - Published February 8, 202411 Pathway to Strong Financial Future 2024-2028 Financial Plan $4.3B Investment Plan $2.61-$2.81/sh Earnings Guidance 7% growth vs. 2023 Guidance Midpoint 16% increase vs. ‘23 Spend and 2024 *See FactBook for more details on 2024 Guidance $1.70/sh (Subject to Board Approval) Plan to declare four dividends of $0.425/sh in ‘24; 6.25% increase vs. $1.60/sh declared in ‘23 $0.48-$0.58/SH: 1Q 2024 Guidance Dividends Declared Improved earnings quality

Differentiating FirstEnergy through our transformation efforts ■ Significantly improved balance sheet positions FirstEnergy for accelerated growth without the need for equity – Closed or announced shareholder-friendly equity proceeds of $7B, equivalent to issuing common equity at $87/sh or 36x LTM P/E – Significant improvement in holding company leverage and utility capital structures ■ Building a strong regulatory track record with 3 approved/settled rate cases representing constructive outcomes totaling a $219M increase in annual revenue ■ Launching Energize365, a 5-year, $26B Investment plan representing a 44% increase over previous plan to strengthen and modernize distribution and transmission infrastructure ■ Affirming long-term annual Operating EPS growth of 6-8% with significant improvement in earnings quality – Signal Peak/pension earnings contribution reduced from ~27% in 2022 to 8% in 2024 of total earnings and de minimis thereafter Strategic & Financial Highlights - Published February 8, 202412 A significantly improved balance sheet and robust regulated investment opportunities funded with organic cash flow and traditional utility debt without the need for equity We are transforming FirstEnergy and accelerating our path to becoming a premier utility

Earnings Supplement to the Financial Community Strategic & Financial Highlights - Published February 8, 2024 14. 4Q Earnings Summary and Reconciliation 15. 4Q Earnings Drivers by Segment 16. Full Year Earnings Summary and Reconciliation 17. Full Year Earnings Drivers by Segment 18. Special Items Descriptions 19. 4Q 2023 Earnings Results 20. 4Q 2022 Earnings Results 21. Quarter-over-Quarter Earnings Comparison 22. Full Year 2023 Earnings Results 23. Full Year 2022 Earnings Results 24. Year-over-Year Earnings Comparison 25. Condensed Consolidated Balance Sheets (GAAP) 26. Condensed Consolidated Statements of Cash Flows (GAAP) TABLE OF CONTENTS (Slide) Irene M. Prezelj Vice President, IR & Communications prezelji@firstenergycorp.com 330.384.3859 Gina E. Caskey Director, IR & Corporate Responsibility caskeyg@firstenergycorp.com 330.761.4185 Jake M. Mackin Manager, IR mackinj@firstenergycorp.com 330.384.4829 13 Other sections within Highlights include: • Quarterly Support (slides 25-37)

FirstEnergy EPS Variance Analysis Regulated Regulated Corporate / Corp. (in millions, except per share amounts) Distribution Transmission Other Consolidated 4Q 2022 Earnings (Loss) Attributable to FirstEnergy Corp. from Continuing Operations - GAAP $129 $100 $(632) $(403) 4Q 2022 Basic Earnings (Loss) Attributable to FirstEnergy Corp. from Continuing Operations Per Share - GAAP (avg. shares outstanding 572M) $0.23 $0.18 $(1.12) $(0.71) Special Items - 2022 Debt-related costs — — 0.02 0.02 Exit of generation — — 0.01 0.01 FE Forward cost to achieve 0.01 — — 0.01 Investigation and other related costs — — 0.03 0.03 Mark-to-market adjustments - Pension/OPEB actuarial assumptions 0.06 — (0.19) (0.13) Regulatory charges 0.01 0.02 — 0.03 State tax legislative changes 0.01 — — 0.01 Strategic transaction charges — — 1.23 1.23 Total Special Items - 4Q 2022 0.09 0.02 1.10 1.21 4Q 2022 Operating Earnings (Loss) Per Share - Non-GAAP $0.32 $0.20 $(0.02) $0.50 Rates & Investments 0.04 0.01 — 0.05 Customer demand (0.04) — — (0.04) O&M 0.09 — 0.03 0.12 Pension/OPEB (0.07) — — (0.07) Financing Plan (0.03) — (0.01) (0.04) Income Taxes — — 0.02 0.02 Other 0.01 0.04 0.03 0.08 4Q 2023 Operating Earnings Per Share - Non-GAAP $0.32 $0.25 $0.05 $0.62 Special Items - 2023 Enhanced employee retirement and other related costs (0.03) — — (0.03) FE Forward cost to achieve (0.01) — — (0.01) Investigation and other related costs — — (0.03) (0.03) Mark-to-market adjustments - Pension/OPEB actuarial assumptions (0.17) — 0.05 (0.12) Regulatory charges (0.02) — — (0.02) Strategic transaction charges — — (0.11) (0.11) Total Special Items - 4Q 2023 (0.23) — (0.09) (0.32) 4Q 2023 Basic Earnings (Loss) Attributable to FirstEnergy Corp. from Continuing Operations Per Share - GAAP (avg. shares outstanding 574M) $0.09 $0.25 $(0.04) $0.30 4Q 2023 Earnings (Loss) Attributable to FirstEnergy Corp. from Continuing Operations - GAAP $52 $143 $(20) $175 Per share amounts for the special items and earnings drivers above and throughout this presentation are based on the after-tax effect of each item divided by the number of shares outstanding for the period. The current and deferred income tax effect was calculated by applying the subsidiaries' statutory tax rate to the pre-tax amount if deductible/taxable. The income tax rates range from 21% to 29% in the fourth quarter of 2023 and 2022. Quarterly Summary Quarterly Reconciliation 4Q 2023 4Q 2022 Change GAAP Earnings (Loss) from Continuing Operations Per Basic Share $0.30 $(0.71) $1.01 Special Items $0.32 $1.21 $(0.89) Operating (Non-GAAP) Earnings Per Share $0.62 $0.50 $0.12 Notes: Refer to slide 3 for information on Non-GAAP Financial Matters. Strategic & Financial Highlights - Published February 8, 2024 14

Earnings Drivers: 4Q 2023 vs. 4Q 2022 Regulated Distribution (RD) ▪ Rates & Investments +$0.04: Higher revenues from formula rate investment programs, lower Ohio rate credits, and the impact of new base rates in Maryland effective 10/19/23 ▪ Customer demand ($0.04): Due to lower weather-related demand, primarily in December; Weather-adjusted sales were flat to 2022 ▪ O&M +$0.09: Primarily due to lower vegetation management spend (in part due to accelerated work done in 2022), labor expense, bad debt expense, non-deferred storms, and regulated generation spend ▪ Pension/OPEB ($0.07): Primarily due to lower investment balances and higher interest costs ▪ Financing Plan ($0.03): Primarily due to increased long-term debt from new issuances ▪ Other $0.01: Primarily due to higher other investment and miscellaneous income, partially offset by higher depreciation ▪ Special Items: In 4Q23 and 4Q22, special items totaled $0.23 and $0.09 per share, respectively Regulated Transmission (RT) ▪ Rates & Investments +$0.01: Due to continued formula rate base growth from the ongoing investment program ▪ Other +$0.04: Due to an adjustment associated with recovery of certain costs ▪ Special Items: In 4Q23 and 4Q22, special items totaled $0.00 and $0.02 per share, respectively Corporate / Other (Corp) ▪ O&M +$0.03: Primarily due to lower sponsorships, advertising, and other corporate expenses ▪ Financing Plan ($0.01): Primarily due to the FE Corp. convertible debt issuance in May 2023, partially offset by lower short-term borrowings ▪ Income Taxes +$0.02: Primarily from a lower Consolidated effective tax rate of 13.5% in 4Q23 vs 16.5% in 4Q22 ▪ Other $0.03: Primarily due to higher earnings from 33% investment in Signal Peak and investment returns from corporate-owned life insurance policies ▪ Special Items: In 4Q23 and 4Q22, special items totaled $0.09 and $1.10 per share, respectively (0.4)% 2.0% 2.0% 1.1% Residential Commercial* Industrial Total (4.9)% (1.1)% 2.0% (1.3)% Residential Commercial* Industrial Total Q-o-Q Weather-Adjusted Distribution Deliveries Q-o-Q Actual Distribution Deliveries *Commercial includes street lighting Strategic & Financial Highlights - Published February 8, 202415

FirstEnergy EPS Variance Analysis Regulated Regulated Corporate / Corp. (in millions, except per share amounts) Distribution Transmission Other Consolidated 2022 Earnings (Loss) Attributable to FirstEnergy Corp. from Continuing Operations - GAAP $957 $361 $(912) $406 2022 Basic Earnings (Loss) Attributable to FirstEnergy Corp. from Continuing Operations Per Share (avg. shares outstanding 571M) $1.68 $0.63 $(1.60) $0.71 Special Items - 2022 Debt-related costs — — 0.25 0.25 Exit of generation — — 0.02 0.02 FE Forward cost to achieve 0.03 — — 0.03 Investigation and other related costs — — 0.08 0.08 Mark-to-market adjustments - Pension/OPEB actuarial assumptions 0.06 — (0.19) (0.13) Regulatory charges 0.01 0.20 — 0.21 State tax legislative changes — — 0.01 0.01 Strategic transaction charges — — 1.23 1.23 Total Special Items - 2022 0.10 0.20 1.40 1.70 2022 Operating Earnings (Loss) Per Share - Non-GAAP $1.78 $0.83 $(0.20) $2.41 Rates & Investments 0.11 0.09 — 0.20 Customer Demand (0.21) — — (0.21) O&M 0.27 — 0.05 0.32 Pension/OPEB (0.26) — (0.04) (0.30) Financing Plan (including dilution from FET 19.9% interest sale) (0.11) (0.05) 0.04 (0.12) Income Taxes — — 0.14 0.14 Other 0.02 0.04 0.06 0.12 2023 Operating Earnings Per Share - Non-GAAP $1.60 $0.91 $0.05 $2.56 Special Items - 2023 Debt-related costs — — (0.05) (0.05) Enhanced employee retirement and other related costs (0.13) — — (0.13) Exit of generation — — (0.02) (0.02) FE Forward cost to achieve (0.04) — (0.05) (0.09) Investigation and other related costs — — (0.10) (0.10) Mark-to-market adjustments - Pension/OPEB actuarial assumptions (0.10) — 0.05 (0.05) Regulatory charges (0.04) (0.01) — (0.05) Strategic transaction charges — — (0.11) (0.11) Total Special Items - 2023 (0.31) (0.01) (0.28) (0.60) 2023 Basic Earnings (Loss) Attributable to FirstEnergy Corp. from Continuing Operations Per Share (avg. shares outstanding 573M) $1.29 $0.90 $(0.23) $1.96 2023 Earnings (Loss) Attributable to FirstEnergy Corp. from Continuing Operations - GAAP $740 $514 $(131) $1,123 Per share amounts for the special items and earnings drivers above and throughout this presentation are based on the after-tax effect of each item divided by the number of shares outstanding for the period. The current and deferred income tax effect was calculated by applying the subsidiaries' statutory tax rate to the pre-tax amount if deductible/taxable. The income tax rates range from 21% to 29% in 2023 and 2022. Full Year Summary Full Year Reconciliation 2023 2022 Change GAAP Earnings from Continuing Operations Per Basic Share $1.96 $0.71 $1.25 Special Items $0.60 $1.70 $(1.10) Operating (Non-GAAP) Earnings Per Share $2.56 $2.41 $0.15 Notes: Refer to slide 3 for information on Non-GAAP Financial Matters. Strategic & Financial Highlights - Published February 8, 2024 16

Earnings Drivers: Full Year 2023 vs. Full Year 2022 Regulated Distribution (RD) ▪ Rates & Investments +$0.11: Higher revenues from formula rate investment programs, lower Ohio rate credits, and the impact of new base rates in Maryland effective 10/19/23 ▪ Customer Demand ($0.21): Primarily due to lower weather-related demand (-$0.28), partially offset by higher weather-adjusted sales (+$0.03) and certain rate adjustments associated with demand (+$0.04) ▪ O&M +$0.27: Primarily due to lower vegetation management spend (in part due to accelerated work done in 2022), labor expense, bad debt expense, and regulated generation spend ▪ Pension/OPEB ($0.26): Primarily due to lower investment balances and higher interest costs ▪ Financing Plan ($0.11): Due to higher long-term debt from new issuances as well as higher short-term borrowings and interest rates ▪ Other +$0.02: Primarily due to higher other investment and miscellaneous income, partially offset by higher depreciation ▪ Special Items: In 2023 and 2022, special items totaled $0.31 and $0.10 per share, respectively Regulated Transmission (RT) ▪ Rates & Investments +$0.09: Primarily due to continued formula rate base growth from the ongoing investment program ▪ Financing Plan ($0.05): Due to the impact of the FET 19.9% interest sale, which closed on 5/31/2022 ▪ Other +$0.04: Due to an adjustment associated with recovery of certain costs ▪ Special Items: In 2023 and 2022, special items totaled $0.01 and $0.20 per share, respectively Corporate / Other (Corp) ▪ O&M +$0.05: Primarily due to lower sponsorships, advertising, and other corporate expenses ▪ Pension/OPEB ($0.04): Primarily due to lower investment balances and higher interest costs ▪ Financing Plan +$0.04: Primarily due to lower interest expense from FE Corp. high coupon debt redemptions, partially offset by the FE Corp. low cost convertible debt issuance in May 2023 ▪ Income Taxes +$0.14: Primarily from a lower Consolidated effective tax rate of 16.2% in 2023 vs 20.9% in 2022 ▪ Other +$0.06: Primarily due to investment returns from corporate-owned life insurance policies and higher earnings from 33% investment in Signal Peak, partially offset by lower earnings from a legacy power off-take agreement (OVEC) ▪ Special Items: In 2023 and 2022, special items totaled $0.28 and $1.40 per share, respectively 1.5% 0.4% 0.7% 0.9% Residential Commercial* Industrial Total (6.7)% (3.9)% 0.7% (3.3)% Residential Commercial* Industrial Total Y-o-Y Weather-Adjusted Distribution Deliveries Y-o-Y Actual Distribution Deliveries *Commercial includes street lighting Strategic & Financial Highlights - Published February 8, 202417

Special Items Descriptions ▪ Debt-related costs: Primarily reflects costs associated with the redemption and early retirement of debt. ▪ Enhanced employee retirement and other related costs: Primarily reflects transition and benefit costs associated with the Company's voluntary retirement program and involuntary separations. ▪ Exit of generation: Primarily reflects charges resulting from the exit of competitive operations. ▪ FE Forward cost to achieve: Primarily reflects the termination charge associated with exiting certain sporting sponsorship agreements and certain advisory and other costs incurred to transform the Company for the future. ▪ Investigation and other related costs: Primarily reflects legal and advisory expenses related to the government investigations. ▪ Mark-to-market adjustments - Pension/OPEB actuarial assumptions: Reflects the change in fair value of plan assets and net actuarial gains and losses associated with the Company's pension and other post-employment benefit plans. ▪ Regulatory charges: Primarily reflects the impact of regulatory agreements, proceedings, audits, concessions or orders requiring certain commitments, refunds, and/or disallowing the recoverability of costs, net of related credits. ▪ State tax legislative changes: Primarily reflects charges resulting from 2022 state tax legislative changes. ▪ Strategic transaction charges: Primarily reflects the net tax charges associated with the FET interest sales. Note: Special items represent charges incurred or benefits realized that management believes are not indicative of, or may obscure trends useful in evaluating, the Company’s ongoing core activities and results of operations or otherwise warrant separate classification. Special items are not necessarily non-recurring. Strategic & Financial Highlights - Published February 8, 202418

4th Quarter 2023 (in millions, except for per share amounts) GAAP Special Items Operating (Non-GAAP) RD RT Corp FE RD RT Corp FE RD RT Corp FE (1) Electric sales $ 2,581 $ 563 $ (40) $ 3,104 $ — $ — $ (1) (d) $ (1) (2) Other 55 1 (14) 42 — — — — (3) Total Revenues 2,636 564 (54) 3,146 — — (1) (1) 2,636 564 (55) 3,145 (4) Fuel 99 — — 99 — — — — (5) Purchased power 930 — 5 935 — — — — (6) Other operating expenses 857 95 (56) 896 (36) (a)(b)(h) — (25) (b)-(d) (61) (7) Provision for depreciation 259 95 19 373 (1) (b) — — (1) (8) Deferral of regulatory assets, net (7) (1) — (8) — — — — (9) General taxes 205 67 11 283 — — — — (10) Total Operating Expenses 2,343 256 (21) 2,578 (37) — (25) (62) 2,306 256 (46) 2,516 (11) Operating Income (Loss) 293 308 (33) 568 37 — 24 61 330 308 (9) 629 (12) Debt redemption costs — — — — — — — — (13) Equity method investment earnings — — 41 41 — — — — (14) Miscellaneous income (expense), net 41 (2) 23 62 4 (a)(h) — — 4 (15) Pension and OPEB mark-to-market adjustment (135) (43) 41 (137) 135 (f) (2) (f) (41) (f) 92 (16) Interest expense (162) (71) (63) (296) 4 (a)(e) 1 (e) 1 (e) 6 (17) Capitalized financing costs 12 16 — 28 — — — — (18) Total Other Income (Expense) (244) (100) 42 (302) 143 (1) (40) 102 (101) (101) 2 (200) (19) Income taxes (benefits) (3) 48 29 74 47 (a)(b)(e)-(h) — (e)(f) (64) (b)-(g) (17) (20) Income attributable to noncontrolling interest — 17 — 17 — — — — (21) Earnings (Loss) Attributable to FirstEnergy Corp. from Continuing Operations $ 52 $ 143 $ (20) $ 175 $ 133 $ (1) $ 48 $ 180 $ 185 $ 142 $ 28 $ 355 (22) Average Shares Outstanding 574 574 574 (23) Earnings (Loss) per Share $ 0.09 $ 0.25 $ (0.04) $ 0.30 $ 0.23 $ — $ 0.09 $ 0.32 $ 0.32 $ 0.25 $ 0.05 $ 0.62 Special Items (after-tax impact): (a) Regulatory charges $ 11 $ — $ — $ 11 (b) FE Forward cost to achieve 6 — 1 7 (c) Investigation and other related costs — — 19 19 (d) Exit of generation — — 1 1 (e) Debt-related costs 1 — 1 2 (f) Mark-to-market - Pension/OPEB 98 (1) (33) 64 (g) Strategic transaction charges 2 — 59 61 (h) Enhanced employee retirement and other related charges 15 — — 15 Impact to Earnings $ 133 $ (1) $ 48 $ 180 Strategic & Financial Highlights - Published February 8, 202419

4th Quarter 2022 (in millions, except for per share amounts) GAAP Special Items Operating (Non-GAAP) RD RT Corp FE RD RT Corp FE RD RT Corp FE (1) Electric sales $ 2,718 $ 470 $ (44) $ 3,144 $ — $ 1 (a) $ — $ 1 (2) Other 45 1 (13) 33 — — — — (3) Total Revenues 2,763 471 (57) 3,177 — 1 — 1 2,763 472 (57) 3,178 (4) Fuel 191 — — 191 — — — — (5) Purchased power 1,071 — 6 1,077 — — — — (6) Other operating expenses 908 120 (38) 990 (12) (d) (16) (a) (27) (b)-(d) (55) (7) Provision for depreciation 248 90 17 355 — — — — (8) Deferral of regulatory assets, net (112) (1) — (113) — — — — (9) General taxes 205 64 9 278 — — — — (10) Total Operating Expenses 2,511 273 (6) 2,778 (12) (16) (27) (55) 2,499 257 (33) 2,723 (11) Operating Income (Loss) 252 198 (51) 399 12 17 27 56 264 215 (24) 455 (12) Debt redemption costs — — (16) (16) — — 16 (e) 16 (13) Equity method investment earnings — — 34 34 — — — — (14) Miscellaneous income, net 92 6 17 115 — 1 (a) — 1 (15) Pension and OPEB mark-to-market adjustment (50) (15) 137 72 50 (f) — (137) (f) (87) (16) Interest expense (137) (56) (58) (251) — — — — (17) Capitalized financing costs 10 15 — 25 — — — — (18) Total Other Income (Expense) (85) (50) 114 (21) 50 1 (121) (70) (35) (49) (7) (91) (19) Income taxes (benefits) 38 30 695 763 9 (a)(d)(f)(g) 7 (a)(g) (719) (b)-(h) (703) (20) Income attributable to noncontrolling interest — 18 — 18 — 1 (a)(g) — 1 (21) Earnings (Loss) Attributable to FirstEnergy Corp. from Continuing Operations $ 129 $ 100 $ (632) $ (403) $ 53 $ 10 $ 625 $ 688 $ 182 $ 110 $ (7) $ 285 (22) Average Shares Outstanding 572 572 572 (23) Earnings (Loss) per Share $ 0.23 $ 0.18 $ (1.12) $ (0.71) $ 0.09 $ 0.02 $ 1.10 $ 1.21 $ 0.32 $ 0.20 $ (0.02) $ 0.50 Special Items (after-tax impact): (a) Regulatory charges $ 5 $ 13 $ — $ 18 (b) Investigation and other related costs — — 18 18 (c) Exit of generation — — 3 3 (d) FE Forward cost to achieve 8 — 1 9 (e) Debt-related costs — — 13 13 (f) Mark-to-market - Pension/OPEB 35 — (108) (73) (g) State tax legislative changes 5 (3) — 2 (h) Strategic transaction charges — — 698 698 Impact to Earnings $ 53 $ 10 $ 625 $ 688 Strategic & Financial Highlights - Published February 8, 202420

4th Quarter 2023 vs 4th Quarter 2022 (in millions, except for per share amounts) GAAP Special Items Operating (Non-GAAP) RD RT Corp FE RD RT Corp FE RD RT Corp FE (1) Electric sales $ (137) $ 93 $ 4 $ (40) $ — $ (1) $ (1) $ (2) (2) Other 10 — (1) 9 — — — — (3) Total Revenues (127) 93 3 (31) — (1) (1) (2) (127) 92 2 (33) (4) Fuel (92) — — (92) — — — — (5) Purchased power (141) — (1) (142) — — — — (6) Other operating expenses (51) (25) (18) (94) (24) 16 2 (6) (7) Provision for depreciation 11 5 2 18 (1) — — (1) (8) Deferral of regulatory assets, net 105 — — 105 — — — — (9) General taxes — 3 2 5 — — — — (10) Total Operating Expenses (168) (17) (15) (200) (25) 16 2 (7) (193) (1) (13) (207) (11) Operating Income (Loss) 41 110 18 169 25 (17) (3) 5 66 93 15 174 (12) Debt redemption costs — — 16 16 — — (16) (16) (13) Equity method investment earnings — — 7 7 — — — — (14) Miscellaneous income, net (51) (8) 6 (53) 4 (1) — 3 (15) Pension and OPEB mark-to-market adjustment (85) (28) (96) (209) 85 (2) 96 179 (16) Interest expense (25) (15) (5) (45) 4 1 1 6 (17) Capitalized financing costs 2 1 — 3 — — — — (18) Total Other Expense (159) (50) (72) (281) 93 (2) 81 172 (66) (52) 9 (109) (19) Income taxes (benefits) (41) 18 (666) (689) 38 (7) 655 686 (20) Income attributable to noncontrolling interest — (1) — (1) — (1) — (1) (21) Earnings (Loss) Attributable to FirstEnergy Corp. from Continuing Operations $ (77) $ 43 $ 612 $ 578 $ 80 $ (11) $ (577) $ (508) $ 3 $ 32 $ 35 $ 70 (22) Average Shares Outstanding 2 2 2 (23) Earnings (Loss) per Share $ (0.43) $ 0.05 $ (0.09) $ 1.01 $ 0.14 $ (0.02) $ (1.01) $ (0.89) $ — $ 0.05 $ 0.07 $ 0.12 Strategic & Financial Highlights - Published February 8, 202421