FAST Acquisition Corp. II (the "Company" or "FAST II"), a

special purpose acquisition company, today reminded stockholders to

vote “FOR” the business combination with Falcon’s Beyond Global,

LLC (“Falcon’s Beyond”) at the special meeting of stockholders

scheduled for September 26, 2023 (the “Special Meeting”). The

Company also noted the pending voluntary delisting of its units,

Class A common stock, and warrants from the New York Stock Exchange

(“NYSE”) in connection with the anticipated closing of the business

combination.

Following the closing of the business combination, shares and

warrants of Falcon’s Beyond Global, Inc. are expected to trade on

Nasdaq. Following the closing, and no earlier than October 5, 2023,

the units, Class A common stock, and warrants of FAST II will cease

trading on NYSE and be delisted.

The closing of FAST II’s business combination transaction with

Falcon’s Beyond is subject to final stockholder approval at the

Special Meeting and satisfaction of other customary closing

conditions.

As previously announced, the Company will hold the Special

Meeting via live webcast at

https://www.cstproxy.com/fastacqii/sm2023 on September 26, 2023 at

10:00 a.m. Eastern Time for its stockholders of record at the close

of business on August 21, 2023 to vote on the proposed business

combination, among other things. The definitive joint proxy

statement/prospectus with respect to the business combination,

together with a proxy card for voting, has been mailed to the

Company’s stockholders. Stockholders are encouraged to attend the

Special Meeting and to vote as soon as possible by signing, dating

and returning the proxy card enclosed with the definitive joint

proxy statement/prospectus. If you have any questions, please

contact Morrow Sodali LLC, the Company’s proxy solicitor, at (800)

662-5200.

About FAST Acquisition Corp. II

FAST II is a hospitality and consumer entertainment focused

blank check company whose business purpose is to effect a merger,

capital stock exchange, asset acquisition, stock purchase,

reorganization or similar business combination with one or more

businesses. FAST II was as founded by Doug Jacob and headed by

Sandy Beall as Chief Executive Officer. FAST II is listed on NYSE

under the ticker symbol “FZT.” For more information, visit

https://www.fastacqii.com/.

Additional Information

In connection with the proposed transaction, Falcon’s Beyond

Global, Inc. (“Pubco”) filed with the U.S. Securities and Exchange

Commission (the “SEC”) a registration statement on Form S-4 (the

“Registration Statement”), which includes a document that serves as

a joint prospectus of Pubco and proxy statement of FAST II,

referred to as a proxy statement/prospectus. A proxy

statement/prospectus has been sent to all FAST II stockholders. No

offering of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities

Act of 1933, as amended, or an exemption therefrom. FAST II and

Pubco will also file other documents regarding the proposed

business combination with the SEC. BEFORE MAKING ANY VOTING

DECISION, INVESTORS AND SECURITY HOLDERS OF FAST II ARE URGED TO

READ THE REGISTRATION STATEMENT, THE PROXY STATEMENT/PROSPECTUS AND

ALL OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE

SEC IN CONNECTION WITH THE PROPOSED BUSINESS COMBINATION AS THEY

BECOME AVAILABLE BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT

THE PROPOSED BUSINESS COMBINATION. Investors and security holders

will be able to obtain free copies of the registration statement,

the proxy statement/prospectus and all other relevant documents

filed or that will be filed with the SEC by FAST II or Pubco

through the website maintained by the SEC at www.sec.gov. The

documents filed by FAST II with the SEC also may be obtained free

of charge upon written request to 109 Old Branchville Road,

Ridgefield, CT 06877. The documents filed by Pubco with the SEC may

also be obtained free of charge upon written request to 6996 Piazza

Grande Avenue, Suite 301, Orlando, FL 32835.

Participants in the Solicitation

FAST II and its directors and executive officers may be deemed

participants in the solicitation of proxies from FAST II’s

stockholders with respect to the proposed business combination. A

list of the names of those directors and executive officers and a

description of their interests in FAST II is contained in the

Registration Statement, which was filed with the SEC and is

available free of charge at the SEC’s website at www.sec.gov.

The Company and its directors and executive officers may also be

deemed to be participants in the solicitation of proxies from the

stockholders of FAST II in connection with the proposed business

combination. A list of the names of such directors and executive

officers and information regarding their interests in the proposed

business combination is included in the Registration Statement,

which was filed with the SEC and is available free of charge at the

SEC’s website at www.sec.gov.

No Offer or Solicitation

This press release is for informational purposes only and shall

not constitute a solicitation of a proxy, consent or authorization

with respect to any securities or in respect of the proposed

business combination and shall not constitute an offer to sell or a

solicitation of an offer to buy any securities, nor shall there be

any sale of securities in any state or jurisdiction in which such

offer, solicitation, or sale would be unlawful prior to

registration or qualification under the securities laws of such

state or jurisdiction. No offering of securities shall be made

except by means of a prospectus meeting the requirements of Section

10 the Securities Act of 1933, as amended, or an exemption

therefrom.

Caution About Forward-Looking Statements

This press release includes certain statements that are not

historical facts but are forward-looking statements for purposes of

the safe harbor provisions under the United States Private

Securities Litigation Reform Act of 1995. Forward-looking

statements generally are accompanied by words such as “believe,”

“may,” “will,” “estimate,” “continue,” “anticipate,” “intend,”

“expect,” “should,” “would,” “plan,” “predict,” “potential,”

“seem,” “seek,” “future,” “outlook,” and similar expressions that

predict or indicate future events or trends or that are not

statements of historical matters.

These forward-looking statements include, but are not limited

to, the expectation that the proposed transaction will occur and

Pubco will be listed on Nasdaq. These statements are based on

various assumptions and on the current expectations of the Company,

Pubco and FAST II and are not predictions of actual performance.

These forward-looking statements are provided for illustrative

purposes only and are not intended to serve as and should not be

relied on by an investor or others as, a guarantee, an assurance, a

prediction, or a definitive statement of fact or probability.

Actual events and circumstances are difficult or impossible to

predict and will differ from assumptions. Many actual events and

circumstances are beyond the control of Falcon’s Beyond and FAST

II. These forward-looking statements are subject to a number of

risks and uncertainties, including, but not limited to, the

likelihood of which could be adversely affected by (1) changes in

domestic and foreign business, market, financial, political, and

legal conditions in general and in the entertainment industry in

particular; (2) the outcome of any legal proceedings that may be

instituted against FAST II, Falcon’s Beyond or Pubco following the

announcement of the proposed business combination; (3) the

inability of the parties to successfully or timely consummate the

proposed business combination, including the risk that any

regulatory approvals are not obtained, are delayed or are subject

to unanticipated conditions that could adversely affect Falcon’s

Beyond or the expected benefits of the proposed transaction or that

the approval of the requisite equity holders of FAST II is not

obtained; (4) the occurrence of any event, change or other

circumstance that could give rise to the termination of the merger

agreement; (5) volatility in the price of FAST II’s or Falcon’s

Beyond’s securities; (6) the risk that the proposed business

combination disrupts current plans and operations as a result of

the announcement and consummation of the business combination; (7)

the enforceability of Falcon’s Beyond’s intellectual property,

including its patents, and the potential infringement on the

intellectual property rights of others, cyber security risks or

potential breaches of data security; (8) any failure to realize the

anticipated benefits of the proposed transaction; (9) risks

relating to the uncertainty of the projected financial information

with respect to Falcon’s Beyond; (10) risks related to the rollout

of Falcon’s Beyond's business and the timing of expected business

milestones; (11) the effects of competition on Falcon’s Beyond's

business; (12) the risk that the proposed business combination may

not be completed by FAST II’s business combination deadline; (13)

the amount of redemption requests made by FAST II's stockholders;

(14) the ability of FAST II or Falcon’s Beyond to issue equity or

equity-linked securities or obtain debt financing in connection

with the proposed transaction or in the future; (15) and those

factors discussed in the Registration Statement and FAST II's

Annual Report on Form 10-K for the year ended December 31, 2022

under the heading "Risk Factors" and other documents FAST II or

Pubco has filed, or will file, with the SEC. If any of these risks

materialize or our assumptions prove incorrect, actual results

could differ materially from the results implied by these

forward-looking statements. There may be additional risks that

neither FAST II nor Falcon’s Beyond presently know, or that FAST II

or Falcon’s Beyond currently believe are immaterial, that could

also cause actual results to differ from those contained in the

forward-looking statements. In addition, the forward-looking

statements reflect FAST II's and Falcon’s Beyond's expectations,

plans, or forecasts of future events and views as of the date of

this communication. FAST II and Falcon’s Beyond anticipate that

subsequent events and developments will cause FAST II's and

Falcon’s Beyond's assessments to change. However, while FAST II and

Falcon’s Beyond may elect to update these forward-looking

statements at some point in the future, FAST II and Falcon’s Beyond

specifically disclaim any obligation to do so. These

forward-looking statements should not be relied upon as a

representation of FAST II's and Falcon’s Beyond's assessments as of

any date subsequent to the date of this communication. Accordingly,

undue reliance should not be placed upon the forward-looking

statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230925025230/en/

Investor Relations: Brett Milotte, ICR

FalconsBeyondIR@icrinc.com

Media: Keil Decker, ICR FalconsBeyondPR@icrinc.com

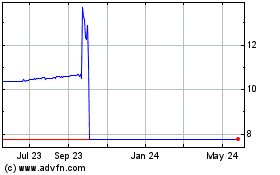

FAST Acquisition Corp II (NYSE:FZT)

Historical Stock Chart

From Oct 2024 to Nov 2024

FAST Acquisition Corp II (NYSE:FZT)

Historical Stock Chart

From Nov 2023 to Nov 2024