Equus II Incorporated Announces Sale of Alenco

May 20 2004 - 10:00AM

PR Newswire (US)

Equus II Incorporated Announces Sale of Alenco HOUSTON, May 20

/PRNewswire-FirstCall/ -- Equus II Incorporated today announced the

completion of the sale of Alenco Holding Corporation for

approximately $11 million, with $9.7 million paid at closing and

$1.3 million deposited in an escrow account payable over the next

three years, pending certain representations and warranties. "The

Fund is pleased with its return from our investment in Alenco,"

stated Sam P. Douglass, Chairman and Chief Executive Officer of

Equus. "We are now adequately funded to pursue an aggressive

investment program over the next three years. As part of this

Fund's investment strategy, we will also continue to review

opportunistic sales of our existing portfolio to allow for new

investment opportunities." "The Alenco management team has done an

outstanding job in taking a difficult situation and bringing it to

maturity for the shareholders," continued Mr. Douglass. "We commend

them and wish them the best going forward." Alenco Holding

Corporation manufactures aluminum and vinyl windows in two plants,

one in Bryan, Texas and one in Peachtree City, Georgia, for single

and multi-family residential purposes. Alenco distributes its

products through a network of over 200 customers in twenty states.

Equus II is a business development company and seeks to generate

current distributions of net investment income and long-term

capital gains by making equity-oriented investments in small to

medium-sized privately owned companies. The current portfolio

consists of investments in 14 businesses in various industries and

two venture capital firms. Information on Equus II Incorporated and

other Equus entities may be obtained on the Internet. The company's

home page address is http://www.equuscap.com/ . "Safe Harbor"

Statement Under the Private Securities Litigation Reform Act of

1995: This press release contains certain forward-looking

statements which involve known and unknown risks, uncertainties or

other factors not under the Fund's control which may cause the

actual results, performance or achievement of the Fund to be

materially different from the results, performance or other

expectations implied by these forward-looking statements. These

factors include, but are not limited to, those disclosed in the

Fund's periodic filings with the Securities and Exchange

Commission. CONTACT: HANK NICODEMUS (713) 529-0900 DATASOURCE:

Equus II Incorporated CONTACT: Hank Nicodemus of Equus II

Incorporated, +1-713-529-0900 Web site: http://www.equuscap.com/

Copyright

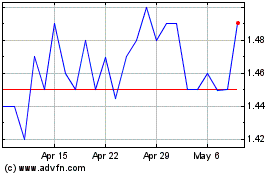

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Jun 2024 to Jul 2024

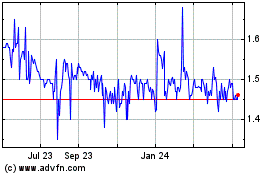

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Jul 2023 to Jul 2024