Equus Total Return, Inc. Announces $7.5 Million Credit Agreement with Amegy Bank of Texas

August 26 2008 - 4:56PM

PR Newswire (US)

HOUSTON, Aug. 26 /PRNewswire-FirstCall/ -- Equus Total Return, Inc.

(NYSE:EQS) ("Equus" or the "Fund") announces that it has entered

into a new revolving line of credit agreement with Amegy Bank of

Texas ("Amegy") for $7.5 million. The initial term of the agreement

is through February 2010 and the loan is secured by the Fund's

investments. "We are pleased to establish a new credit line for

Equus Total Return and a new relationship with Amegy Bank as we

look to build the resources of the Fund. We believe this facility

will enable the Fund to more effectively capitalize on new

investment opportunities, as well as existing follow-on

opportunities within the Equus portfolio" commented Kenneth Denos,

CEO and President of Equus. "Amegy Bank is pleased to support the

activities of Equus with this new line of credit. Amegy is eager to

work with Equus, and the association should provide the basis for

the development of a long lasting business relationship," said Bill

Pyle, Senior Vice President of Amegy. Equus is a business

development company that trades as a closed-end fund on the New

York Stock Exchange, under the symbol "EQS". Additional information

on Equus Total Return, Inc. may be obtained from the Equus website

at http://www.equuscap.com/. Amegy Bank of Texas is one of the

fastest growing banks in Texas. With assets of more than $11

billion, local decision making and a history of relationship

banking, Amegy has the resources to serve leading Texas companies

as a source of capital as well as provide efficient and effective

treasury management, international and investment services. Amegy,

with more than 85 locations in the state, specializes in commercial

banking as well as private financial management and trust services

for families and individuals, and retail and mortgage banking

services. Amegy is a part of the Zions Bancorporation

(NASDAQ:ZION). This press release may contain certain

forward-looking statements regarding future circumstances. These

forward-looking statements are based upon the Fund's current

expectations and assumptions and are subject to various risks and

uncertainties that could cause actual results to differ materially

from those contemplated in such forward-looking statements

including, in particular, the risks and uncertainties described in

the Fund's filings with the Securities and Exchange Commission.

Actual results, events and performance may differ. Readers are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as to the date hereof. The Fund

undertakes no obligation to release publicly any revisions to these

forward-looking statements that may be made to reflect events or

circumstances after the date hereof or to reflect the occurrence of

unanticipated events. The inclusion of any statement in this

release does not constitute an admission by the fund or any other

person that the events or circumstances described in such

statements are material. CONTACT: Brett Chiles (713) 529-0900

DATASOURCE: Equus Total Return, Inc. CONTACT: Brett Chiles of Equus

Total Return, Inc., +1-713-529-0900 Web site:

http://www.equuscap.com/

Copyright

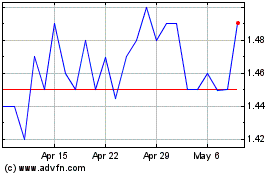

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Jun 2024 to Jul 2024

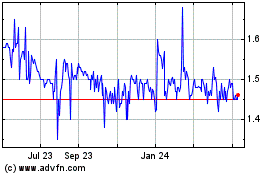

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Jul 2023 to Jul 2024