Equus Total Return, Inc. Announces Year-End Total Net Asset Increase

April 02 2007 - 6:17PM

PR Newswire (US)

HOUSTON, April 2 /PRNewswire-FirstCall/ -- Equus Total Return, Inc.

(NYSE:EQS) (the "Fund") today reported total net assets of $93.2

million, representing an increase of $0.63 million in 2006. Due to

two dividend payments in the amounts of $2.50 and $0.125, total net

assets per share decreased by 9%. Comparative data is summarized

below: December 31, 2006 December 31, 2005 -----------------

----------------- Net assets $93,235,863 $92,602,338 Shares

outstanding 8,164,249 7,376,592 Dividend per share $2.625 $0.00 Net

assets per share $11.42 $12.55 The increase in net assets was the

result of improved portfolio performance. Spectrum Management, LLC,

Sovereign Business Forms, Inc., ConGlobal Industries, Inc. and The

Drilltec Corporation, four of the Fund's largest portfolio

holdings, have increased valuations in the aggregate amount of

approximately $9.8 million or 52% from year-end 2005. These

investments represent 67% of the Fund's investments in portfolio

securities at fair value. Significant dividend payments were made,

resulting principally from the sale of Champion Window Holdings,

Inc. and the recently adopted managed distribution policy. The Fund

also completed two new investments in 2006. A commitment of up to

$11.1 million was made to RP&C International Investments LLC,

for preferred equity or subordinated debt in entities to acquire

nursing and residential care homes in the United Kingdom and/or

Germany. An investment was also made in HealthSPAC, LLC, a

California-based company in the business of incubating Special

Purpose Acquisition Companies focused on healthcare opportunities.

The Fund also made nine follow-on investments in existing portfolio

companies. Interests in Jones Industrial Holdings, Inc., and

Equicom, Inc. were sold. The Fund had no outstanding debt and $51

million in cash and short-term investments at year-end. Of this

amount, $35 million has been identified for potential future

investments under consideration. Anthony Moore, Co-Chairman, Chief

Executive Officer and President of Equus, commented, "We are

pleased with the overall performance of the Fund for the year."

"The Fund's performance for the year is demonstrative of the

ongoing strategy to provide enhanced value with current income

realization," commented Sam P. Douglass, Co-Chairman of Equus. "We

believe the Fund is in an excellent position for continued growth."

Equus Total Return, Inc. is a business development company that

trades as a closed-end fund on the New York Stock Exchange, under

the symbol "EQS". Additional information on Equus Total Return,

Inc. may be obtained from Equus' website at

http://www.equuscap.com/ . This press release may contain certain

forward-looking statements regarding future circumstances. These

forward-looking statements are based upon the Company's current

expectations and assumptions and are subject to various risks and

uncertainties that could cause actual results to differ materially

from those contemplated in such forward-looking statements

including, in particular, the risks and uncertainties described in

the Company's filings with the Securities and Exchange Commission.

Actual results, events, and performance may differ. Readers are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as to the date hereof. The Company

undertakes no obligation to release publicly any revisions to these

forward-looking statements that may be made to reflect events or

circumstances after the date hereof or to reflect the occurrence of

unanticipated events. The inclusion of any statement in this

release does not constitute an admission by the Company or any

other person that the events or circumstances described in such

statements are material. CONTACT: Brett Chiles (713) 529-0900

DATASOURCE: Equus Total Return, Inc. CONTACT: Brett Chiles of Equus

Total Return, Inc., +1-713-529-0900 Web site:

http://www.equuscap.com/

Copyright

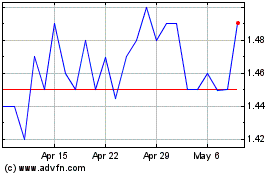

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Jun 2024 to Jul 2024

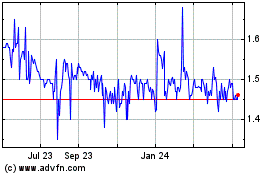

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Jul 2023 to Jul 2024