Equus Total Return, Inc. Implements a Managed Distribution Policy and Declares a Quarterly Dividend of $.125 Per Share

October 23 2006 - 9:00AM

PR Newswire (US)

HOUSTON, Oct. 23 /PRNewswire-FirstCall/ -- Equus Total Return, Inc.

(NYSE:EQS) ("Equus" or the "Fund") today announced its Board of

Directors has approved a managed distribution policy for the Fund

to pay quarterly dividends to shareholders at an annual rate of a

minimum of $0.50 per share. The Fund is managed with a goal of

generating as much of the dividend as possible from ordinary income

(net investment income and short-term capital gains). The balance

of the dividend then comes from long-term capital gains and, if

necessary, a return of capital. In accordance with the new managed

distribution policy, the Board has approved a dividend of $0.125

per share that will be paid for the fourth quarter. The dividend

will be payable on December 7, 2006, to shareholders of record as

of the close of business on November 7, 2006. Shares of EQS will

trade ex-dividend beginning November 3, 2006. The dividend will be

payable in shares of common stock or in cash by specific election.

Such election must be made by shareholders no later than November

28, 2006. If no election is made, shareholders will receive stock.

The stock issued in the dividend will be valued at the average

closing market price of EQS for the ten trading days ending

November 28, 2006. Cash will be paid in lieu of issuing any

fractional shares. Anthony R. Moore, the Fund's Co-Chairman, CEO

and President, commented, "The dividend policy is consistent with

the Fund's total return objective approved earlier this year by our

shareholders. Going forward, our focus will be on targeting

strategic investments with debt and capital appreciation

components. It is our belief this approach will provide

shareholders with a current income feature in the form of a

quarterly dividend. The structure of the Fund also allows for

capital gains distributions contemporaneous with extraordinary

events, which in such cases could exceed $0.50 per share per

annum." Equus is a business development company that trades as a

closed-end fund on the New York Stock Exchange, under the symbol

"EQS". Additional information on Equus may be obtained from the

website at http://www.equuscap.com/. This press release may contain

certain forward-looking statements regarding future circumstances.

These forward-looking statements are based upon the Fund's current

expectations and assumptions and are subject to various risks and

uncertainties that could cause actual results to differ materially

from those contemplated in such forward-looking statements

including, in particular, the risks and uncertainties described in

the Fund's filings with the Securities and Exchange Commission.

Actual results, events, and performance may differ. Readers are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as to the date hereof. The Fund

undertakes no obligation to release publicly any revisions to these

forward-looking statements that may be made to reflect events or

circumstances after the date hereof or to reflect the occurrence of

unanticipated events. The inclusion of any statement in this

release does not constitute an admission by the Fund or any other

person that the events or circumstances described in such

statements are material. CONTACT: Brett Chiles (713) 529-0900

DATASOURCE: Equus Total Return, Inc. CONTACT: Brett Chiles,

+1-713-529-0900, for Equus Total Return, Inc. Web site:

http://www.equuscap.com/

Copyright

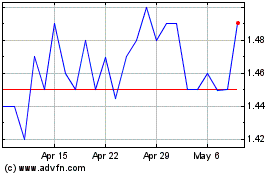

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Jun 2024 to Jul 2024

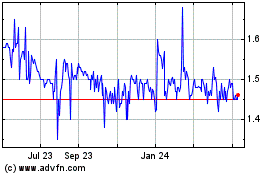

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Jul 2023 to Jul 2024