Equus Total Return, Inc. Announces $10 Million Credit Agreement With Regions Bank

August 22 2006 - 7:17PM

PR Newswire (US)

HOUSTON, Aug. 22 /PRNewswire-FirstCall/ -- Equus Total Return, Inc.

(NYSE:EQS) ("Equus" or the "Fund") announces a new revolving line

of credit agreement with Regions Bank for $10 million. The initial

term of the agreement is through December 31, 2007 and the loan is

secured by the Fund's investments. "This credit facility

strengthens the investment flexibility and liquidity position of

the Fund. We are pleased to continue our relationship with Regions

Bank and we look forward to developing opportunities together well

into the future," commented Sam P. Douglass, Co-Chairman of Equus.

"Regions Bank Private Banking is pleased to support the activities

of Equus with this new line of credit. Regions Management in

Houston has known Equus for many years and the association should

provide the basis for an expansion of the relationship for years to

come," said Terry Pruden, Private Banking Sales Manager for Regions

Bank. Equus is a business development company that trades as a

closed-end fund on the New York Stock Exchange, under the symbol

"EQS". Additional information on Equus may be obtained from the

website at http://www.equuscap.com/ . Regions Financial Corporation

(NYSE:RF), headquartered in Birmingham, Ala., is a full-service

provider of retail and commercial banking, trust, securities

brokerage, mortgage and insurance products and services. Regions

had $84.8 billion in assets as of December 31, 2005, making it one

of the nation's Top 15 banks. Regions' banking subsidiary, Regions

Bank, operates some 1,300 offices and a 1,600-ATM network across a

16-state geographic footprint in the South, Midwest and Texas. Its

investment and securities brokerage, trust and asset management

division, Morgan Keegan & Company Inc., provides services from

over 280 offices. This press release may contain certain

forward-looking statements regarding future circumstances. These

forward-looking statements are based upon the Fund's current

expectations and assumptions and are subject to various risks and

uncertainties that could cause actual results to differ materially

from those contemplated in such forward-looking statements

including, in particular, the risks and uncertainties described in

the Fund's filings with the Securities and Exchange Commission.

Actual results, events, and performance may differ. Readers are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as to the date hereof. The Fund

undertakes no obligation to release publicly any revisions to these

forward-looking statements that may be made to reflect events or

circumstances after the date hereof or to reflect the occurrence of

unanticipated events. The inclusion of any statement in this

release does not constitute an admission by the Fund or any other

person that the events or circumstances described in such

statements are material. CONTACT: Brett Chiles (713) 529-0900

DATASOURCE: Equus Total Return, Inc. CONTACT: Brett Chiles of Equus

Total Return, Inc., +1-713-529-0900 Web site:

http://www.equuscap.com/

Copyright

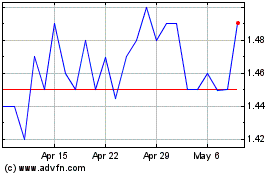

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Jun 2024 to Jul 2024

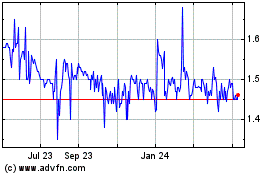

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Jul 2023 to Jul 2024