Equus II Incorporated Announces Increase in Net Assets for Second Quarter

August 11 2006 - 6:29PM

PR Newswire (US)

HOUSTON, Aug. 11 /PRNewswire-FirstCall/ -- Equus II Incorporated

(NYSE:EQS) ("Equus" or the "Fund") reports net assets as of June

30, 2006, of $84.3 million, equivalent to $10.40 per share or a 5%

increase from the first quarter of 2006 and a 4% increase from the

end of 2005 after the effect of the $2.50 per share dividend

declared on February 2, 2006. Comparative data is summarized below:

6/30/06 3/31/06 12/31/05 6/30/05 Net assets $84,307,330 $80,065,212

$92,602,338 $84,103,763 Shares outstanding 8,106,365 8,106,365

7,376,592 7,376,592 Net assets per share $10.40 $9.88 $12.55 $11.40

Significant events for the second quarter, 2006 are as follows: *

Portfolio Company Increase. Drilltec Corporation, Jones Industrial

Holdings, Inc., PalletOne, Inc. and Sovereign Business Forms, Inc.

collectively increased approximately $5 million in value due to

improved operating performance. These portfolio companies comprise

approximately 46% of the Fund. Of the $5 million increase, Drilltec

Corporation represented an increase of approximately $2.5 million

or 31 cents per share due to continued improving operating

performance. * Financial Advisor. The Fund has engaged AG Edwards,

Inc. to provide strategic financial advisory services to the Fund.

"We are pleased with the results of the first year under the new

management company of Moore Clayton Capital Advisors," commented

Anthony R. Moore, Co-Chairman, CEO and President of Equus.

"Investments have been made in the real estate and family

entertainment and leisure sectors, which are representative of the

Fund's new millennium investment strategy. We continue to realize

value from some of the Fund's historical investments which is

reflected in the increase of net assets. As our primary focus

remains on enhancing shareholder value, we will seek to provide the

highest total return consisting of capital appreciation and current

income. We are excited about the future." Equus is a business

development company that trades as a closed-end fund on the New

York Stock Exchange, under the symbol "EQS". Additional information

on Equus may be obtained from the website at

http://www.equuscap.com/ . This press release may contain certain

forward-looking statements regarding future circumstances. These

forward-looking statements are based upon the Company's current

expectations and assumptions and are subject to various risks and

uncertainties that could cause actual results to differ materially

from those contemplated in such forward-looking statements

including, in particular, the risks and uncertainties described in

the Company's filings with the Securities and Exchange Commission.

Actual results, events, and performance may differ. Readers are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as to the date hereof. The Company

undertakes no obligation to release publicly any revisions to these

forward-looking statements that may be made to reflect events or

circumstances after the date hereof or to reflect the occurrence of

unanticipated events. The inclusion of any statement in this

release does not constitute an admission by the Company or any

other person that the events or circumstances described in such

statements are material. CONTACT: Brett Chiles (713) 529-0900

DATASOURCE: Equus II Incorporated CONTACT: Brett Chiles of Equus II

Incorporated, +1-713-529-0900 Web site: http://www.equuscap.com/

Copyright

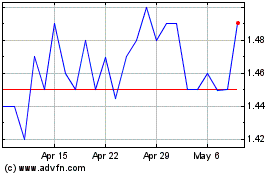

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Jun 2024 to Jul 2024

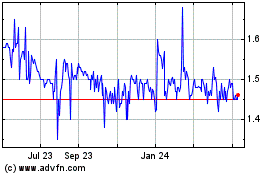

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Jul 2023 to Jul 2024