Equus II Incorporated Announces Year-End Increase in Net Asset Value

March 29 2006 - 8:41PM

PR Newswire (US)

HOUSTON, March 29 /PRNewswire-FirstCall/ -- Equus II Incorporated

(NYSE:EQS) (the "Fund") today reported net assets as of December

31, 2005, of $92.6 million, an increase of $24 million for the

year. Net assets per share increased $2.01 from $10.54 per share at

December 31, 2004, to $12.55 per share at December 31, 2005. This

represents an annual increase of 19.1% per share. Comparative data

is summarized below: December 31, 2005 December 31, 2004 Net assets

$92,602,338 $68,599,657 Shares outstanding 7,376,592 6,506,692 Net

assets per share $12.55 $10.54 The increase in net assets was the

result of significant increases in the valuation of the portfolio

in 2005. Doane PetCare Enterprises, Inc., which at December 31,

2004 was carried at zero portfolio value, was sold in November of

2005 for $5.9 million. In addition, Champion Window Holdings, Inc.,

the Fund's largest portfolio holding, was valued at $28.1 million

at December 31, 2005, and was sold in January of 2006, representing

an increase in valuation of $12.7 million or 83% from December 31,

2004. Spectrum Management, LLC, Sovereign Business Forms, Inc.,

PalletOne, Inc. and Jones Industrial Services, Inc., the Fund's

largest portfolio holdings excluding Champion Window Holdings,

Inc., also had increased valuations as of December 31, 2005, in the

aggregate amount of approximately $4 million or 18% from year-end

2004. Significant decreases in value of the Fund include Equicom,

Inc., an owner and operator of small radio stations in Texas, which

was written down $0.9 million, and ConGlobal, a shipping container

repair and storage company, which was written down $1.3 million.

During 2005, the Fund completed three new investments. These

included Creekstone Florida Holdings, Inc., a condominium

development project in Panama City, Florida, Cedar Lodge Holdings,

Inc., a condominium conversion project in Baton Rouge, Louisiana

and Riptide Entertainment LLC, a developer and operator of Ripley's

Believe It or Not! museums. In addition, the Fund sold its

interests in Sternhill Partners I, L.P. and Vanguard Ventures VII,

L.P., the Fund's two venture capital investments. At year-end, the

Fund had no outstanding debt and $26 million in cash and short-term

investments. Approximately $6.7 million of cash was received from

the exercise of 869,900 stock options by officers and directors of

the Fund. Anthony Moore, Co-Chairman, Chief Executive Officer and

President of Equus, commented, "The year 2005 was an exciting year

for the Fund. The Fund completed the transition to a new investment

adviser and its new investment strategy, sold its interest in its

largest portfolio holding and completed three new investments in

the real estate and family entertainment and leisure sectors. We

feel the Fund is well positioned for future investments in other

areas that are also representative of the Fund's strategy to invest

in attractive millennium growth trends such as energy renewables,

healthcare and education." Sam P. Douglass, Co-Chairman of Equus,

commented, "We are very pleased with the new management company of

Moore Clayton Capital Advisors and the position of the Fund at

year-end. We look forward to 2006 which we feel will present

significant opportunities to enhance shareholder value." Equus II

Incorporated is a business development company that trades as a

closed-end fund on the New York Stock Exchange, under the symbol

"EQS". Additional information on Equus II Incorporated may be

obtained from Equus' website at http://www.equuscap.com/ . This

press release may contain certain forward-looking statements

regarding future circumstances. These forward-looking statements

are based upon the Company's current expectations and assumptions

and are subject to various risks and uncertainties that could cause

actual results to differ materially from those contemplated in such

forward-looking statements including, in particular, the risks and

uncertainties described in the Company's filings with the

Securities and Exchange Commission. Actual results, events, and

performance may differ. Readers are cautioned not to place undue

reliance on these forward-looking statements, which speak only as

to the date hereof. The Company undertakes no obligation to release

publicly any revisions to these forward-looking statements that may

be made to reflect events or circumstances after the date hereof or

to reflect the occurrence of unanticipated events. The inclusion of

any statement in this release does not constitute an admission by

the Company or any other person that the events or circumstances

described in such statements are material. CONTACT: Brett Chiles

(713) 529-0900 DATASOURCE: Equus II Incorporated CONTACT: Brett

Chiles of Equus II Incorporated, +1-713-529-0900 Web site:

http://www.equuscap.com/

Copyright

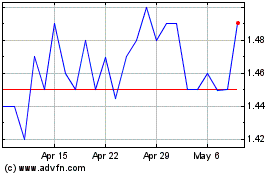

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Jun 2024 to Jul 2024

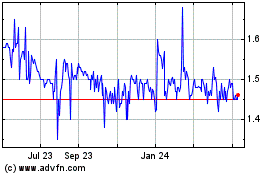

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Jul 2023 to Jul 2024