Equus II Incorporated Announces Increase in Net Assets for Third Quarter

November 10 2005 - 5:49PM

PR Newswire (US)

HOUSTON, Nov. 10 /PRNewswire-FirstCall/ -- Equus II Incorporated

(NYSE:EQS), a business development company, reports an increase in

net assets as of September 30, 2005, to $90.5 million. Comparative

data is summarized below: 9/30/05 6/30/05 12/31/04 9/30/04 Net

assets $90,493,296 $84,103,763 $68,599,657 $67,703,445 Shares

outstanding 7,376,592 7,376,592 6,506,692 6,289,018 Net assets per

share $12.27 $11.40 $10.54 $10.77 * Net assets increased in the

aggregate $6.4 million. The increase was primarily due to an

increase in valuation of $6.5 million for Doane Pet Care

Enterprises, Inc. ("Doane"). Doane, the largest manufacturer of

store brand pet food in the United States, completed a sales

transaction with Teachers' Private Capital, the private investment

arm of the Ontario Teachers' Pension Plan Fund. Equus II

Incorporated, which had been an investor in Doane since 1995, had

carried the Doane investment at zero portfolio value since December

31, 2004. Approximately 10% of the increase in value is

attributable to an escrow balance which will be distributed over

the next four to eighteen months; the Fund received a cash payment

of approximately $5.9 million in November 2005. * With the cash

received from the Doane transaction, Equus II Incorporated has

approximately $30 million in cash and has no outstanding debt.

Anthony R. Moore, Co-Chairman, CEO and President of Equus,

commented, "We are very pleased with the 8% increase in NAV per

share and will continue to explore opportunities which create and

maximize shareholder value. "To this end, we intend to bolster the

Fund's historic and successful LBO results with a new strategy to

take advantage of new millennium trends that we believe will offer

attractive investment opportunities now and in the future. We are

evaluating investments in real estate, healthcare, education,

family entertainment/leisure and alternative energy which will

compliment the existing portfolio core of service and manufacturing

sectors. In terms of non-US opportunities, we are preparing a

strategy for international investments, including China. "We are

excited about these new opportunities to enhance shareholder value

and hope this excitement is increasingly felt by our shareholders,

old and new." Equus II Incorporated seeks to generate current

distributions of net investment income and long-term capital gains

by managing equity-oriented investments in small to medium-sized

privately owned companies. More information on Equus II

Incorporated may be obtained from Equus' website at

http://www.equuscap.com/ This press release may contain certain

forward-looking statements regarding future circumstances. These

forward-looking statements are based upon the Company's current

expectations and assumptions and are subject to various risks and

uncertainties that could cause actual results to differ materially

from those contemplated in such forward-looking statements

including, in particular, the risks and uncertainties described in

the Company's filings with the Securities and Exchange Commission.

Actual results, events, and performance may differ. Readers are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date hereof. The Company

undertakes no obligation to release publicly any revisions to these

forward-looking statements that may be made to reflect events or

circumstances after the date hereof or to reflect the occurrence of

unanticipated events. The inclusion of any statement in this

release does not constitute an admission by the Company or any

other person that the events or circumstances described in such

statement are material. CONTACT: Sam Douglass (713) 529-0900

DATASOURCE: Equus II Incorporated CONTACT: Sam Douglass of Equus II

Incorporated, +1-713-529-0900 Web site: http://www.equuscap.com/

Copyright

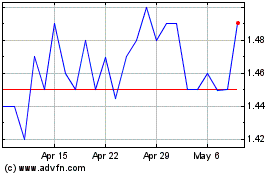

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Jun 2024 to Jul 2024

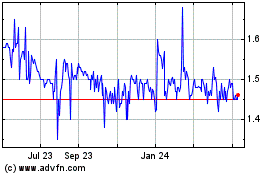

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Jul 2023 to Jul 2024