Equus II Incorporated Shareholders Approve New Investment Adviser

July 05 2005 - 7:08PM

PR Newswire (US)

Equus II Incorporated Shareholders Approve New Investment Adviser

HOUSTON, July 5 /PRNewswire-FirstCall/ -- At their annual

shareholder meeting, the shareholders of Equus II Incorporated

(NYSE:EQS) (the "Fund") approved Moore Clayton Capital Advisers,

Inc. as the Fund's new investment adviser. The new advisory firm is

an affiliate of Moore Clayton Co., Inc., an international private

equity investment and advisory firm with offices in Los Angeles,

San Francisco, New York, London, Cape Town and Johannesburg. The

Fund's shareholders also elected ten directors, six of whom are new

to the Board. The change in investment advisers was made in

connection with the sale of Equus Capital Management Company

("ECMC"), the Fund's prior adviser, to the Moore Clayton group.

Certain ECMC executives will continue with the new Moore Clayton

adviser, including Sam P. Douglass, prior Chairman and CEO of the

Fund and ECMC, who will continue as President of the new adviser

and Co-Chairman of the Fund's Board. Anthony R. Moore, of Moore

Clayton, has become Co-Chairman of the Board and CEO of the Fund,

and will carry the same title with Moore Clayton Capital Advisers,

Inc. Nolan Lehmann has retired as a Fund officer and director. The

Moore Clayton group has committed to purchase, or arrange for the

purchase of, at least 27.5% of the Fund's outstanding shares within

the next 90 days. As of July 1, 2005, Moore Clayton interests had

purchased 1,111,205 common shares, representing 15.1% of the Fund's

total outstanding common stock. Anthony Moore commented, "We at

Moore Clayton are committed to building shareholder value and are

excited about the opportunity of using our skills and experience to

benefit the Equus shareholders." Speaking of the change, Mr.

Douglass said, "I'm delighted with the people, experience and

commitment Moore Clayton is bringing to the Fund and looking

forward to serving with them in their efforts on behalf of the Fund

and its shareholders." The Fund -- Equus II Incorporated -- is an

investment company that trades as a closed-end fund, business

development company on the New York Stock Exchange. The Fund seeks

to generate current distributions of net investment income and

long-term capital gains by making equity oriented investments in

small to medium-sized, privately owned companies. This press

release may contain certain forward-looking statements regarding

future circumstances. These forward-looking statements are based

upon the Fund's current expectations and assumptions and are

subject to various risks and uncertainties that could cause actual

results to differ materially from those contemplated in such

forward-looking statements including, in particular, the risks and

uncertainties described in the Fund's filings with the SEC. Actual

results, events, and performance may differ. Readers are cautioned

not to place undue reliance on these forward-looking statements,

which speak only as of the date hereof. The Fund undertakes no

obligation to release publicly any revisions to these

forward-looking statements that may be made to reflect events or

circumstances after the date hereof or to reflect the occurrence of

unanticipated events. The inclusion of any statement in this

release does not constitute an admission by the Fund or any other

person that the events or circumstances described in such statement

are material. For Information Contact: Sam P. Douglass 713-529-0900

Kenneth Denos 801-816-2511 DATASOURCE: Equus II Incorporated

CONTACT: Sam P. Douglass, +1-713-529-0900, or Kenneth Denos,

+1-801-816-2511, both of Equus II Incorporated Web site:

http://www.equuscap.com/

Copyright

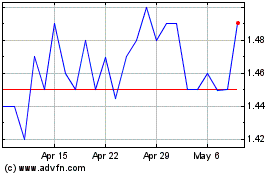

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Jun 2024 to Jul 2024

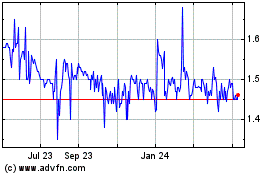

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Jul 2023 to Jul 2024