EPR Properties (NYSE:EPR) today announced operating results for

the third quarter and nine months ended September 30, 2020 (dollars

in thousands, except per share data):

Three Months Ended September

30,

Nine Months Ended September

30,

2020 (1

)

2019 (2

)

2020 (1

)

2019 (2

)

Total revenue from continuing

operations

$

63,877

$

169,356

$

321,249

$

481,623

Net (loss) income available to common

shareholders

(91,938

)

27,969

(129,853

)

147,844

Net (loss) income available to common

shareholders per diluted common share

(1.23

)

0.36

(1.70

)

1.94

Funds From Operations as adjusted (FFOAA)

(a non-GAAP financial measure)

(11,699

)

115,309

95,645

323,519

FFOAA per diluted common share (a non-GAAP

financial measure)

(0.16

)

1.46

1.25

4.19

Adjusted Funds From Operations (AFFO) (a

non-GAAP financial measure)

2,698

113,647

126,078

323,567

AFFO per diluted common share (a non-GAAP

financial measure)

0.04

1.44

1.65

4.19

(1) The operating results for the three and nine months ended

September 30, 2020, include $49.8 million of straight-line and

other receivable write-offs, or $0.67 per share, related to moving

two customers to cash basis for revenue recognition purposes at the

end of the third quarter. These write-offs are reflected in all

metrics in these columns except that AFFO per diluted share for the

three and nine months ended September 30, 2020 excludes the impact

of the straight-line portion of these write-offs totaling $23.9

million.

(2) The operating results of the Company's public charter school

portfolio for the three and nine months ended September 30, 2019,

include $11.3 million and $22.9 million in termination fees,

respectively, and are included in all metrics in these columns

except for total revenue from continuing operations. The remaining

public charter school portfolio was sold subsequent to September

30, 2019.

Third Quarter Company Headlines

- Collections Ramping Up - For July, August and September,

cash collections from customers continued to improve and were

approximately 35%, 40% and 48% of contractual cash revenue,

respectively.

- Property Openings Increase - Approximately 93% of

non-theatre properties and 63% of theatre properties were open as

of November 3, 2020. In addition, New York and California are

making progress in reopening theatres.

- Strong Liquidity Position - The Company had minimal cash

burn during the quarter and with nearly $1.0 billion of cash on

hand at quarter-end, the Company believes it has sufficient

liquidity to navigate through the impact of the pandemic.

- Extension of Covenant Waivers - Waivers of certain

covenants related to the Company’s bank credit facilities have been

extended through December 31, 2021, providing additional

flexibility to work through issues with customers as needed. The

Company is currently negotiating a similar covenant waiver

extension relating to its private placement notes.

- Two Customers Placed on Cash Basis – At the end of the

quarter, two customers were placed on cash basis for revenue

recognition purposes and, as a result, all of the associated

receivables related to these two customers were written-off.

CEO Comments

“As the impact of the COVID-19 pandemic persists, we continue to

focus on ensuring our strong liquidity position and helping to

facilitate on-going property openings and tenant recovery,” stated

Greg Silvers, Company President and CEO. “We limited our cash burn

during the quarter and reached rent resolution with the vast

majority of our customers and have seen an improvement in cash

collections. We have also extended our debt covenant waivers on our

bank credit facilities to provide additional flexibility through

the end of next year. While uncertainty remains, particularly

around the timing of a widespread reopening of theatres, we are

encouraged by the return to business of the rest of our customers

and our stable balance sheet position.”

COVID-19 Response and Update

Collections and Property Openings

Approximately 93% of the Company's non-theatre and 63% of the

Company's theatre locations were open for business as of November

3, 2020. Cash collections from tenants and borrowers during the

third quarter continued to improve and were 35%, 40% and 48% for

July, August and September, respectively. The Company has reached

resolution with customers representing approximately 90% of its

annualized pre-COVID contractual cash rent and interest payments,

however, additional deferral agreements related to certain theatre

tenants are currently being negotiated as discussed below. Based on

the Company's current agreements and ongoing negotiations with

customers, permanent rent and interest payment adjustments are

currently expected to lower annualized pre-COVID contractual cash

rent and interest payments by approximately 5% to 7%. However,

there can be no assurance that additional permanent rent or

interest payment reductions or other term modifications will not

occur in future periods in light of the continued adverse impact of

the pandemic, particularly ongoing uncertainty in the theatre

industry.

Theatre Update

The customers occupying the Company's theatre properties are

facing several challenges as they diligently try to reopen. As a

result of the impact of the COVID-19 pandemic, some of our theatre

locations remain closed due to state and local restrictions,

including key markets in New York and California. Other theatres

are currently closed by operator choice, including 52 of our

theatres operated by Regal Cinemas ("Regal"), a subsidiary of

Cineworld Group, as movie studios continue to delay the release of

blockbuster movies in hopes that larger audiences will be available

as additional markets open. The delay of these movie releases has

had a significant negative impact on current and expected box

office performance. Although the Company previously completed

deferral agreements with respect to substantially all of its

theatre properties, the Company is currently working on additional

deferral agreements with certain of its theatre customers as a

result of these continuing challenges.

Due to the challenges facing theatres and the continued

uncertainty caused by the pandemic, at the end of the third

quarter, the Company determined it was appropriate to begin

recognizing revenue from Regal on a cash basis. Accordingly, the

Company recorded write-offs of accounts receivable of approximately

$49.8 million, or $0.67 per share, at the end of the quarter ended

September 30, 2020 related to Regal as well as one attraction

tenant where a similar assessment was made that cash accounting is

appropriate. The write-offs were recorded primarily as a reduction

in rental revenue and consisted of $23.9 million in straight line

rent receivables and $25.9 million of other receivables.

Below provides an update of classification of customers as of

September 30, 2020:

Classification of

Customers

($ in millions)

Annualized Revenue (1)

No Payment Deferral

$

107

17

%

Payments Deferred and Recognized as

Revenue During Deferral Period

233

37

%

Payments Deferred But Not Recognized as

Revenue During Deferral Period

29

5

%

Cash Basis/Lease Restructurings (2)

245

39

%

New Vacancies

10

2

%

Total

$

624

100

%

(1) Represents annualized pre-COVID

contractual revenue which includes cash rent (including tenant

reimbursements) and interest payments.

(2) Includes leases for tenants accounted

for on a cash basis and/or leases for tenants that have been or are

expected to be restructured. This category includes AMC and

Regal.

Strong Liquidity Position

The Company remains focused on maintaining strong liquidity and

financial flexibility through the pandemic. The Company’s cash

provided by operations (which includes interest payments) of $2.0

million, less preferred dividends paid of $6.0 million, resulted in

an outflow of $4.0 million during the quarter. The Company has no

scheduled debt maturities until 2022 and had over $985.0 million of

cash on hand at quarter-end. As discussed in more detail below, the

Company amended the agreement governing its bank credit facilities

to, among other things, extend the waiver of the Company's

obligations to comply with certain covenants through the earlier of

December 31, 2021, or when the Company provides notice that it

elects to terminate the covenant relief period, subject to certain

conditions.

Other Charges

As a result of the COVID-19 pandemic, the Company reassessed the

expected holding periods of two Eat & Play properties during

the third quarter, and determined that the estimated cash flows

were not sufficient to recover the carrying values. Accordingly,

during the three months ended September 30, 2020, the Company

recognized non-cash impairment charges on real estate investments

of $11.6 million for these two properties. Also during the third

quarter, the Company recognized credit loss expense totaling $5.7

million that primarily related to reserving the outstanding

principal balance of one note receivable due to recent changes in

the borrower's financial status as a result of the COVID-19

pandemic.

During the third quarter, the Company recognized $18.4 million

in income tax expense that primarily related to recognizing a full

valuation allowance of $18.0 million on deferred tax assets related

to the Company's taxable REIT subsidiary and Canadian tax paying

entity as a result of the uncertainty of realization created by the

COVID-19 pandemic.

Portfolio Update

The Company's total investments (a non-GAAP financial measure)

were approximately $6.7 billion at September 30, 2020 with

Experiential totaling $5.9 billion, or 89%, and Education totaling

$0.8 billion, or 11%.

The Company's Experiential portfolio (excluding property under

development) consisted of the following property types (owned or

financed) at September 30, 2020:

- 180 theatre properties;

- 56 eat & play properties (including seven theatres located

in entertainment districts);

- 18 attraction properties;

- 13 ski properties;

- six experiential lodging properties;

- one gaming property;

- three cultural properties; and

- seven fitness & wellness properties.

As of September 30, 2020, the Company's owned Experiential

portfolio consisted of approximately 19.5 million square feet,

which was 96.4% leased and included $44.1 million in property under

development and $22.8 million in undeveloped land inventory.

The Company's Education portfolio consisted of the following

property types (owned or financed) at September 30, 2020:

- 69 early childhood education center properties; and

- 16 private school properties.

As of September 30, 2020, the Company's owned Education

portfolio consisted of approximately 1.9 million square feet, which

was 100% leased and included $3.0 million in undeveloped land

inventory.

The combined owned portfolio consisted of 21.4 million square

feet and was 96.7% leased.

Investment Update

The Company's investment spending for the three months ended

September 30, 2020 totaled $8.7 million (bringing the year-to-date

investment spending to $62.3 million), and included spending on

Experiential build-to-suit development and redevelopment

projects.

Balance Sheet and Liquidity Update

At September 30, 2020, the Company's net debt to gross assets

ratio (a non-GAAP Financial Measure) was 42%.

At September 30, 2020, the Company had $985.4 million of

unrestricted cash on hand and $750.0 million outstanding under its

$1.0 billion unsecured revolving credit facility. The Company has

no scheduled debt maturities until 2022 when its unsecured

revolving credit facility comes due.

During the quarter ended September 30, 2020, Moody's downgraded

the credit rating for the Company's unsecured debt to Baa3. As a

result, the interest rate spreads on the Company's outstanding

borrowings under its bank credit facilities increased by 0.25%.

Subsequent to September 30, 2020, Fitch and Standard and Poor's

downgraded the credit ratings for the Company's unsecured debt to

BB+. As a result, the interest rate payable on the Company's

outstanding private placement notes increased by 0.60%. In

addition, as a result of these downgrades, the Company is in the

process of causing certain of its key subsidiaries to guarantee the

Company's obligations under its bank credit facilities, private

placement notes and other outstanding senior unsecured notes in

accordance with existing agreements with the holders of such

indebtedness.

On November 3, 2020, the Company amended the agreement governing

its bank credit facilities (including its revolving credit facility

and $400.0 million term loan). The amendment modified certain

provisions and extended the waiver of the Company's obligation to

comply with certain covenants under these facilities through

December 31, 2021 in light of the continuing financial and

operational impacts of the COVID-19 pandemic on the Company and its

tenants and borrowers. The Company can elect to terminate the

covenant relief period early, subject to certain conditions. The

loans subject to the modifications continue to bear interest at the

same higher rates during the covenant relief period as specified in

the previous waiver, and will return to the original pre-waiver

levels at the end of such period, subject to certain conditions.

The rates during and after the covenant relief period continue to

be subject to change based on long-term unsecured debt ratings, as

defined in the agreements.

The amendment to the agreement governing the Company's bank

credit facilities continues to impose additional restrictions on

the Company during the covenant relief period, including

limitations on certain investments, incurrences of indebtedness,

capital expenditures, payment of dividends or other distributions,

minimum liquidity and share repurchases, in each case subject to

certain exceptions. The Company is currently negotiating a similar

covenant waiver extension relating to its $340.0 million of private

placement notes.

Dividend Information

The monthly cash dividend to common shareholders was suspended

following the common share dividend paid on May 15, 2020 to

shareholders of record as of April 30, 2020. The Company is

restricted from paying dividends on its common shares during the

covenant relief period, subject to certain limited exceptions, and

there can be no assurances as to the Company's ability to

reinstitute cash dividend payments to common shareholders or the

timing thereof.

The Board declared its regular quarterly dividends to preferred

shareholders of $0.359375 per share on its 5.75% Series C

cumulative convertible preferred shares, $0.5625 per share on its

9.00% Series E cumulative convertible preferred shares and

$0.359375 per share on its 5.75% Series G cumulative redeemable

preferred shares.

Conference Call Information

Management will host a conference call to discuss the Company's

financial results on November 5, 2020 at 8:30 a.m. Eastern Time.

The call may also include discussion of Company developments, and

forward-looking and other material information about business and

financial matters. The conference will be webcast and can be

accessed via the Webcasts page in the Investor Center on the

Company's website located at http://investors.eprkc.com/webcasts.

To access the call, audio only, dial (866) 587-2930 and when

prompted, provide the passcode 1372156.

You may watch a replay of the webcast by visiting the Webcasts

page at http://investors.eprkc.com/webcasts.

Quarterly Supplemental

The Company's supplemental information package for the third

quarter and nine months ended September 30, 2020 is available in

the Investor Center on the Company's website located at

http://investors.eprkc.com/earnings-supplementals.

EPR Properties

Consolidated Statements of

(Loss) Income

(Unaudited, dollars in

thousands except per share data)

Three Months Ended September

30,

Nine Months Ended September

30,

2020

2019

2020

2019

Rental revenue

$

55,591

$

150,962

$

288,165

$

438,257

Other income

182

11,464

8,171

17,534

Mortgage and other financing income

8,104

6,930

24,913

25,832

Total revenue

63,877

169,356

321,249

481,623

Property operating expense

13,759

14,494

42,181

44,642

Other expense

2,680

11,403

15,012

19,494

General and administrative expense

10,034

11,600

31,454

35,540

Severance expense

—

1,521

—

1,941

Costs associated with loan refinancing or

payoff

—

38,269

820

38,269

Interest expense, net

41,744

36,667

114,837

107,088

Transaction costs

2,776

5,959

4,622

18,005

Credit loss expense

5,707

—

10,383

—

Impairment charges

11,561

—

62,825

—

Depreciation and amortization

42,059

41,644

128,319

116,436

(Loss) income before equity in (loss)

income from joint ventures, other items and discontinued

operations

(66,443

)

7,799

(89,204

)

100,208

Equity in (loss) income from joint

ventures

(1,044

)

(435

)

(3,188

)

524

Impairment charges on joint ventures

—

—

(3,247

)

—

Gain on sale of real estate

—

845

242

457

(Loss) income before income taxes

(67,487

)

8,209

(95,397

)

101,189

Income tax (expense) benefit

(18,417

)

600

(16,354

)

2,505

(Loss) income from continuing

operations

$

(85,904

)

$

8,809

$

(111,751

)

$

103,694

Discontinued operations:

Income from discontinued operations before

other items

—

11,736

—

32,304

Gain on sale of real estate from

discontinued operations

—

13,458

—

29,948

Income from discontinued operations

—

25,194

—

62,252

Net (loss) income

(85,904

)

34,003

(111,751

)

165,946

Preferred dividend requirements

(6,034

)

(6,034

)

(18,102

)

(18,102

)

Net (loss) income available to common

shareholders of EPR Properties

$

(91,938

)

$

27,969

$

(129,853

)

$

147,844

Net (loss) income available to common

shareholders of EPR Properties per share:

Continuing operations

$

(1.23

)

$

0.04

$

(1.70

)

$

1.12

Discontinued operations

—

0.32

—

0.82

Basic

$

(1.23

)

$

0.36

$

(1.70

)

$

1.94

Continuing operations

$

(1.23

)

$

0.04

$

(1.70

)

$

1.12

Discontinued operations

—

0.32

—

0.82

Diluted

$

(1.23

)

$

0.36

$

(1.70

)

$

1.94

Shares used for computation (in

thousands):

Basic

74,613

77,632

76,456

76,169

Diluted

74,613

77,664

76,456

76,207

EPR Properties

Condensed Consolidated Balance

Sheets

(Unaudited, dollars in

thousands)

September 30, 2020

December 31, 2019

Assets

Real estate investments, net of

accumulated depreciation of $1,072,201 and $989,254 at September

30, 2020 and December 31, 2019, respectively

$

5,067,657

$

5,197,308

Land held for development

25,846

28,080

Property under development

44,103

36,756

Operating lease right-of-use assets

185,459

211,187

Mortgage notes and related accrued

interest receivable

362,011

357,391

Investment in joint ventures

29,571

34,317

Cash and cash equivalents

985,372

528,763

Restricted cash

2,424

2,677

Accounts receivable

129,714

86,858

Other assets

75,053

94,174

Total assets

$

6,907,210

$

6,577,511

Liabilities and Equity

Accounts payable and accrued

liabilities

$

95,429

$

122,939

Operating lease liabilities

225,379

235,650

Dividends payable

6,063

35,458

Unearned rents and interest

75,415

74,829

Debt

3,854,855

3,102,830

Total liabilities

4,257,141

3,571,706

Total equity

$

2,650,069

$

3,005,805

Total liabilities and equity

$

6,907,210

$

6,577,511

The historical financial results of the public charter schools

sold by the Company in 2019 are reflected in the Company's

consolidated statements of income as discontinued operations for

the three and nine months ended September 30, 2019. The operating

results relating to discontinued operations are as follows

(unaudited, dollars in thousands):

Three Months Ended September

30, 2019

Nine Months Ended September

30, 2019

Rental revenue

$

10,300

$

31,058

Mortgage and other financing income

5,206

12,421

Total revenue

15,506

43,479

Property operating expense

169

585

Costs associated with loan refinancing or

payoff

138

138

Interest expense, net

(27

)

(344

)

Depreciation and amortization

3,490

10,796

Income from discontinued operations before

other items

11,736

32,304

Gain on sale of real estate

13,458

29,948

Income from discontinued operations

$

25,194

$

62,252

Non-GAAP Financial Measures

Funds From Operations (FFO), Funds From Operations As

Adjusted (FFOAA) and Adjusted Funds From Operations (AFFO)

The National Association of Real Estate Investment Trusts

(“NAREIT”) developed FFO as a relative non-GAAP financial measure

of performance of an equity REIT in order to recognize that

income-producing real estate historically has not depreciated on

the basis determined under GAAP. Pursuant to the definition of FFO

by the Board of Governors of NAREIT, the Company calculates FFO as

net income available to common shareholders, computed in accordance

with GAAP, excluding gains and losses from disposition of real

estate and impairment losses on real estate, plus real estate

related depreciation and amortization, and after adjustments for

unconsolidated partnerships, joint ventures and other affiliates.

Adjustments for unconsolidated partnerships, joint ventures and

other affiliates are calculated to reflect FFO on the same basis.

The Company has calculated FFO for all periods presented in

accordance with this definition.

In addition to FFO, the Company presents FFOAA and AFFO. FFOAA

is presented by adding to FFO costs associated with loan

refinancing or payoff, transaction costs, severance expense,

preferred share redemption costs, impairment of operating lease

right-of-use assets, termination fees associated with tenants'

exercises of public charter school buy-out options and credit loss

expense and subtracting deferred income tax (benefit) expense. AFFO

is presented by adding to FFOAA non-real estate depreciation and

amortization, deferred financing fees amortization, share-based

compensation expense to management and Trustees and amortization of

above and below market leases, net and tenant allowances; and

subtracting maintenance capital expenditures (including second

generation tenant improvements and leasing commissions),

straight-lined rental revenue (removing impact of straight-lined

ground sublease expense), and the non-cash portion of mortgage and

other financing income.

FFO, FFOAA and AFFO are widely used measures of the operating

performance of real estate companies and are provided here as a

supplemental measure to GAAP net income available to common

shareholders and earnings per share, and management provides FFO,

FFOAA and AFFO herein because it believes this information is

useful to investors in this regard. FFO, FFOAA and AFFO are

non-GAAP financial measures. FFO, FFOAA and AFFO do not represent

cash flows from operations as defined by GAAP and are not

indicative that cash flows are adequate to fund all cash needs and

are not to be considered alternatives to net income or any other

GAAP measure as a measurement of the results of our operations or

our cash flows or liquidity as defined by GAAP. It should also be

noted that not all REITs calculate FFO, FFOAA and AFFO the same way

so comparisons with other REITs may not be meaningful.

The following table summarizes FFO, FFOAA and AFFO for the three

and nine months ended September 30, 2020 and 2019 and reconciles

such measures to net income available to common shareholders, the

most directly comparable GAAP measure:

EPR Properties

Reconciliation of Non-GAAP

Financial Measures

(Unaudited, dollars in

thousands except per share data)

Three Months Ended September

30,

Nine Months Ended September

30,

2020

2019

2020

2019

FFO:

Net (loss) income available to common

shareholders of EPR Properties

$

(91,938

)

$

27,969

$

(129,853

)

$

147,844

Gain on sale of real estate

—

(14,303

)

(242

)

(30,405

)

Impairment of real estate investments, net

(1)

11,561

—

47,816

—

Real estate depreciation and

amortization

41,791

44,863

127,467

126,475

Allocated share of joint venture

depreciation

369

553

1,130

1,662

Impairment charges on joint ventures

—

—

3,247

—

FFO available to common shareholders of

EPR Properties

$

(38,217

)

$

59,082

$

49,565

$

245,576

FFO available to common shareholders of

EPR Properties

$

(38,217

)

$

59,082

$

49,565

$

245,576

Add: Preferred dividends for Series C

preferred shares

—

—

—

5,817

Add: Preferred dividends for Series E

preferred shares

—

—

—

5,817

Diluted FFO available to common

shareholders of EPR Properties

$

(38,217

)

$

59,082

$

49,565

$

257,210

FFOAA:

FFO available to common shareholders of

EPR Properties

$

(38,217

)

$

59,082

49,565

$

245,576

Costs associated with loan refinancing or

payoff

—

38,407

820

38,407

Transaction costs

2,776

5,959

4,622

18,005

Severance expense

—

1,521

—

1,941

Termination fees included in gain on

sale

—

11,324

—

22,858

Impairment of operating lease right-of-use

assets (1)

—

—

15,009

—

Credit loss expense

5,707

—

10,383

—

Deferred income tax expense (benefit)

18,035

(984

)

15,246

(3,268

)

FFOAA available to common shareholders of

EPR Properties

$

(11,699

)

$

115,309

$

95,645

$

323,519

FFOAA available to common shareholders of

EPR Properties

$

(11,699

)

$

115,309

$

95,645

$

323,519

Add: Preferred dividends for Series C

preferred shares

—

1,939

—

5,817

Add: Preferred dividends for Series E

preferred shares

—

1,939

—

5,817

Diluted FFOAA available to common

shareholders of EPR Properties

$

(11,699

)

$

119,187

$

95,645

$

335,153

AFFO:

FFOAA available to common shareholders of

EPR Properties

$

(11,699

)

$

115,309

$

95,645

$

323,519

Non-real estate depreciation and

amortization

268

271

852

757

Deferred financing fees amortization

1,498

1,552

4,783

4,571

Share-based compensation expense to

management and trustees

3,410

3,372

10,382

9,832

Amortization of above and below market

leases, net and tenant allowances

(124

)

(107

)

(384

)

(224

)

Maintenance capital expenditures (2)

(8,911

)

(2,370

)

(11,130

)

(3,177

)

Straight-lined rental revenue

17,969

(4,399

)

25,448

(10,036

)

Straight-lined ground sublease expense

216

256

599

645

Non-cash portion of mortgage and other

financing income

71

(237

)

(117

)

(2,320

)

AFFO available to common shareholders of

EPR Properties

$

2,698

$

113,647

$

126,078

$

323,567

AFFO available to common shareholders of

EPR Properties

$

2,698

$

113,647

$

126,078

$

323,567

Add: Preferred dividends for Series C

preferred shares

—

1,939

—

5,817

Add: Preferred dividends for Series E

preferred shares

—

1,939

—

5,817

Diluted AFFO available to common

shareholders of EPR Properties

$

2,698

$

117,525

$

126,078

$

335,201

FFO per common share:

Basic

$

(0.51

)

$

0.76

$

0.65

$

3.22

Diluted

(0.51

)

0.76

0.65

3.21

FFOAA per common share:

Basic

$

(0.16

)

$

1.49

$

1.25

$

4.25

Diluted

(0.16

)

1.46

1.25

4.19

AFFO per common share:

Basic

$

0.04

$

1.46

$

1.65

$

4.25

Diluted

0.04

1.44

1.65

4.19

Shares used for computation (in

thousands):

Basic

74,613

77,632

76,456

76,169

Diluted

74,613

77,664

76,456

76,207

Weighted average shares

outstanding-diluted EPS

74,613

77,664

76,456

76,207

Effect of dilutive Series C preferred

shares

—

2,170

—

2,158

Effect of dilutive Series E preferred

shares

—

1,634

—

1,628

Adjusted weighted average shares

outstanding-diluted Series C and Series E

74,613

81,468

76,456

79,993

Other financial information:

Dividends per common share

$

—

$

1.1250

$

1.5150

$

3.3750

Amounts above include the impact of discontinued operations,

which are separately classified in the consolidated statements of

income for all periods.

(1) Impairment charges recognized during the nine months ended

September 30, 2020 totaled $62.8 million, which was comprised of

$47.8 million of impairments of real estate investments and $15.0

million of impairments of operating lease right-of-use assets.

(2) Includes maintenance capital expenditures and certain second

generation tenant improvements and leasing commissions.

The conversion of the 5.75% Series C cumulative convertible

preferred shares and the 9.00% Series E cumulative convertible

preferred shares would be dilutive to FFO per share for the nine

months ended September 30, 2019 and FFOAA per share for the three

and nine months ended September 30, 2019. Therefore, the additional

common shares that would result from the conversion and the

corresponding add-back of the preferred dividends declared on those

shares are included in the calculation of diluted FFO and FFOAA per

share for these periods.

Net Debt

Net Debt represents debt (reported in accordance with GAAP)

adjusted to exclude deferred financing costs, net and reduced for

cash and cash equivalents. By excluding deferred financing costs,

net and reducing debt for cash and cash equivalents on hand, the

result provides an estimate of the contractual amount of borrowed

capital to be repaid, net of cash available to repay it. The

Company believes this calculation constitutes a beneficial

supplemental non-GAAP financial disclosure to investors in

understanding our financial condition. The Company's method of

calculating Net Debt may be different from methods used by other

REITs and, accordingly, may not be comparable to such other

REITs.

Gross Assets

Gross Assets represents total assets (reported in accordance

with GAAP) adjusted to exclude accumulated depreciation and reduced

for cash and cash equivalents. By excluding accumulated

depreciation and reducing cash and cash equivalents, the result

provides an estimate of the investment made by the Company. The

Company believes that investors commonly use versions of this

calculation in a similar manner. The Company's method of

calculating Gross Assets may be different from methods used by

other REITs and, accordingly, may not be comparable to such other

REITs.

Net Debt to Gross Assets

Net Debt to Gross Assets is a supplemental measure derived from

non-GAAP financial measures that the Company uses to evaluate

capital structure and the magnitude of debt to gross assets. The

Company believes that investors commonly use versions of this ratio

in a similar manner. The Company's method of calculating Net Debt

to Gross Assets may be different from methods used by other REITs

and, accordingly, may not be comparable to such other REITs.

EBITDAre

NAREIT developed EBITDAre as a relative non-GAAP financial

measure of REITs, independent of a company's capital structure, to

provide a uniform basis to measure the enterprise value of a

company. Pursuant to the definition of EBITDAre by the Board of

Governors of NAREIT, the Company calculates EBITDAre as net income,

computed in accordance with GAAP, excluding interest expense (net),

income tax (benefit) expense, depreciation and amortization, gains

and losses from disposition of real estate, impairment losses on

real estate, costs associated with loan refinancing or payoff and

adjustments for unconsolidated partnerships, joint ventures and

other affiliates.

Management provides EBITDAre herein because it believes this

information is useful to investors as a supplemental performance

measure as it can help facilitate comparisons of operating

performance between periods and with other REITs. The Company's

method of calculating EBITDAre may be different from methods used

by other REITs and, accordingly, may not be comparable to such

other REITs. EBITDAre is not a measure of performance under GAAP,

does not represent cash generated from operations as defined by

GAAP and is not indicative of cash available to fund all cash

needs, including distributions. This measure should not be

considered an alternative to net income or any other GAAP measure

as a measurement of the results of the Company's operations or cash

flows or liquidity as defined by GAAP.

Adjusted EBITDA

Management uses Adjusted EBITDA in its analysis of the

performance of the business and operations of the Company.

Management believes Adjusted EBITDA is useful to investors because

it excludes various items that management believes are not

indicative of operating performance, and that it is an informative

measure to use in computing various financial ratios to evaluate

the Company. The Company defines Adjusted EBITDA as EBITDAre

(defined above) for the quarter excluding severance expense, credit

loss expense, transaction costs, impairment losses on operating

lease right-of-use assets and prepayment fees. For the three months

ended September 30, 2020, Adjusted EBITDA was further adjusted to

reflect Adjusted EBITDA on a cash basis related to Regal and one

attraction tenant.

The Company's method of calculating Adjusted EBITDA may be

different from methods used by other REITs and, accordingly, may

not be comparable to such other REITs. Adjusted EBITDA is not a

measure of performance under GAAP, does not represent cash

generated from operations as defined by GAAP and is not indicative

of cash available to fund all cash needs, including distributions.

This measure should not be considered as an alternative to net

income or any other GAAP measure as a measurement of the results of

the Company's operations or cash flows or liquidity as defined by

GAAP.

Reconciliations of debt and total assets (all reported in

accordance with GAAP) to Net Debt, Gross Assets, Net Debt to Gross

Assets, EBITDAre and Adjusted EBITDA (each of which is a non-GAAP

financial measure) are included in the following tables (unaudited,

in thousands):

September 30,

2020

2019

Net Debt:

Debt

$

3,854,855

$

3,101,611

Deferred financing costs, net

35,140

38,384

Cash and cash equivalents

(985,372

)

(115,839

)

Net Debt

$

2,904,623

$

3,024,156

Gross Assets:

Total Assets

$

6,907,210

$

6,633,290

Accumulated depreciation

1,072,201

989,480

Cash and cash equivalents

(985,372

)

(115,839

)

Gross Assets

$

6,994,039

$

7,506,931

Net Debt to Gross Assets

42

%

40

%

Three Months Ended September

30,

2020

2019

EBITDAre and Adjusted EBITDA:

Net (loss) income

$

(85,904

)

$

34,003

Interest expense, net

41,744

36,640

Income tax expense (benefit)

18,417

(600

)

Depreciation and amortization

42,059

45,134

Gain on sale of real estate

—

(14,303

)

Impairment of real estate investments,

net

11,561

—

Costs associated with loan refinancing or

payoff

—

38,407

Allocated share of joint venture

depreciation

369

553

Allocated share of joint venture interest

expense

741

739

EBITDAre

$

28,987

$

140,573

Severance expense

—

1,521

Transaction costs

2,776

5,959

Credit loss expense

5,707

—

Accounts receivable write-offs from prior

periods (1)

13,533

—

Straight-line receivable write-offs from

prior periods (1)

19,927

—

Prepayment fees

—

(1,760

)

Adjusted EBITDA

$

70,930

$

146,293

Amounts above include the impact of

discontinued operations, which are separately classified in the

consolidated statements of (loss) income and comprehensive (loss)

income.

(1) Included in rental revenue from

continuing operations in the accompanying consolidated statements

of income. Rental revenue includes the following:

Three Months Ended September

30,

2020

2019

Minimum rent

$

83,230

$

139,844

Accounts receivable write-offs from prior

periods

(13,533

)

—

Tenant reimbursements

2,413

5,129

Percentage rent

1,303

3,032

Straight-line rental revenue

1,958

2,866

Straight-line receivable write-offs from

prior periods

(19,927

)

—

Other rental revenue

147

91

Rental revenue

$

55,591

$

150,962

Total Investments

Total investments is a non-GAAP financial measure defined as the

sum of the carrying values of real estate investments (before

accumulated depreciation), land held for development, property

under development, mortgage notes receivable (including related

accrued interest receivable), investment in joint ventures,

intangible assets, gross (before accumulated amortization and

included in other assets) and notes receivable and related accrued

interest receivable, net (included in other assets). Total

investments is a useful measure for management and investors as it

illustrates across which asset categories the Company's funds have

been invested. Our method of calculating total investments may be

different from methods used by other REITs and, accordingly, may

not be comparable to such other REITs. A reconciliation of total

investments to total assets (computed in accordance with GAAP) is

included in the following table (unaudited, in thousands):

September 30, 2020

December 31, 2019

Total Investments:

Real estate investments, net of

accumulated depreciation

$

5,067,657

$

5,197,308

Add back accumulated depreciation on real

estate investments

1,072,201

989,254

Land held for development

25,846

28,080

Property under development

44,103

36,756

Mortgage notes and related accrued

interest receivable

362,011

357,391

Investment in joint ventures

29,571

34,317

Intangible assets, gross (1)

58,402

57,385

Notes receivable and related accrued

interest receivable, net (1)

7,373

14,026

Total investments

$

6,667,164

$

6,714,517

Total investments

$

6,667,164

$

6,714,517

Operating lease right-of-use assets

185,459

211,187

Cash and cash equivalents

985,372

528,763

Restricted cash

2,424

2,677

Accounts receivable

129,714

86,858

Less: accumulated depreciation on real

estate investments

(1,072,201

)

(989,254

)

Less: accumulated amortization on

intangible assets

(15,385

)

(12,693

)

Prepaid expenses and other current

assets

24,663

35,456

Total assets

$

6,907,210

$

6,577,511

(1) Included in other assets in the

accompanying consolidated balance sheet. Other assets include the

following:

September 30, 2020

December 31, 2019

Intangible assets, gross

$

58,402

$

57,385

Less: accumulated amortization on

intangible assets

(15,385

)

(12,693

)

Notes receivable and related accrued

interest receivable, net

7,373

14,026

Prepaid expenses and other current

assets

24,663

35,456

Total other assets

$

75,053

$

94,174

About EPR Properties

EPR Properties is a leading experiential net lease real estate

investment trust (REIT), specializing in select enduring

experiential properties in the real estate industry. We focus on

real estate venues which create value by facilitating out of home

leisure and recreation experiences where consumers choose to spend

their discretionary time and money. We have nearly $6.7 billion in

total investments across 44 states. We adhere to rigorous

underwriting and investing criteria centered on key industry,

property and tenant level cash flow standards. We believe our

focused approach provides a competitive advantage and the potential

for stable and attractive returns. Further information is available

at www.eprkc.com.

CAUTIONARY STATEMENT CONCERNING

FORWARD-LOOKING STATEMENTS

The financial results in this press release reflect preliminary,

unaudited results, which are not final until the Company's

Quarterly Report on Form 10-Q is filed. With the exception of

historical information, certain statements contained or

incorporated by reference herein may contain forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended (the “Securities Act”), and Section 21E of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”),

such as those pertaining to the uncertain financial impact of

COVID-19, our capital resources and liquidity, expected waivers of

financial covenants related to our private placement notes,

expected liquidity and performance of our customers, including AMC

and Regal, our expected revenue and customer deferral agreements,

our expected dividend payments and share repurchases and our

results of operations and financial condition. The estimates

presented herein are based on the Company's current expectations

and, given the current economic uncertainty, there can be no

assurances that the Company will be able to continue to comply with

other applicable covenants under its debt agreements, which could

materially impact actual performance. Forward-looking statements

involve numerous risks and uncertainties and you should not rely on

them as predictions of actual events. There is no assurance the

events or circumstances reflected in the forward-looking statements

will occur. You can identify forward-looking statements by use of

words such as “will be,” “intend,” “continue,” “believe,” “may,”

“expect,” “hope,” “anticipate,” “goal,” “forecast,” “pipeline,”

“estimates,” “offers,” “plans,” “would” or other similar

expressions or other comparable terms or discussions of strategy,

plans or intentions contained or incorporated by reference herein.

While references to commitments for investment spending are based

on present commitments and agreements of the Company, we cannot

provide assurance that these transactions will be completed on

satisfactory terms. Forward-looking statements necessarily are

dependent on assumptions, data or methods that may be incorrect or

imprecise. These forward-looking statements represent our

intentions, plans, expectations and beliefs and are subject to

numerous assumptions, risks and uncertainties. Many of the factors

that will determine these items are beyond our ability to control

or predict. For further discussion of these factors see “Item 1A.

Risk Factors” in our Quarterly Report on Form 10-Q for the quarter

ended March 31, 2020 filed with the Securities and Exchange

Commission ("SEC") on May 11, 2020.

For these statements, we claim the protection of the safe harbor

for forward-looking statements contained in the Private Securities

Litigation Reform Act of 1995. You are cautioned not to place undue

reliance on our forward-looking statements, which speak only as of

the date hereof or the date of any document incorporated by

reference herein. All subsequent written and oral forward-looking

statements attributable to us or any person acting on our behalf

are expressly qualified in their entirety by the cautionary

statements contained or referred to in this section. Except as

required by law, we do not undertake any obligation to release

publicly any revisions to our forward-looking statements to reflect

events or circumstances after the date hereof.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201104005706/en/

EPR Properties Brian Moriarty, 888-EPR-REIT

www.eprkc.com

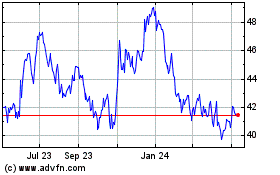

EPR Properties (NYSE:EPR)

Historical Stock Chart

From Mar 2024 to Apr 2024

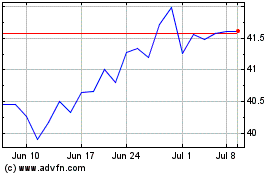

EPR Properties (NYSE:EPR)

Historical Stock Chart

From Apr 2023 to Apr 2024