false000003123500000312352024-11-202024-11-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 20, 2024 |

Eastman Kodak Company

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

New Jersey |

1-00087 |

16-0417150 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

343 State Street |

|

Rochester, New York |

|

14650 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 800 356-3259 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common stock, par value $0.01 per share |

|

KODK |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On November 20, 2024, the Kodak Retirement Income Plan Trust (the “Trust”), in its capacity as holder of assets for the benefit of the Kodak Retirement Income Plan (“KRIP”), entered into a Purchase and Sale Agreement (the “Agreement”) with Mastercard Foundation (the “Buyer”). Pursuant to the Agreement, the Trust agreed to sell and the Buyer agreed to purchase certain private equity ownership interests and other illiquid assets held by the Trust for the benefit of KRIP (collectively, “KRIP Illiquid Assets”) having an aggregate net asset value as of March 31, 2024 (the “Reference Date”) of $764.4 million for a purchase price of $550.6 million payable in cash at closing. The closing is scheduled to occur as of December 31, 2024, but a portion of the KRIP Illiquid Assets subject to the Agreement may be sold at one or more subsequent closings in accordance with the terms of the Agreement. The Agreement contains representations, warranties, covenants, conditions and other provisions customary for secondary sales of private equity investments.

Item 8.01 Other Events.

Subsequent to the entry into the Agreement, the Trust entered into or expects to enter into in the near term Purchase and Sale Agreements similar to the Agreement (collectively, the “Other Agreements” and, together with the Agreement, the “Sale Agreements”) with four other investors pursuant to which the Trust agreed or will agree to sell and such investors agreed or will agree to purchase certain KRIP Illiquid Assets having an aggregate net asset value as of the Reference Date of $87.3 million for a purchase price of $61.7 million payable in cash at closing, except for $15.3 million of cash proceeds which are payable on a deferred basis on December 31, 2025. The Sale Agreements were entered into as a result of the previously announced secondary sale process with respect to the KRIP Illiquid Assets being conducted by a third-party broker.

Assuming the consummation of the transactions contemplated by the Sale Agreements, the Trust will continue to hold KRIP Illiquid Assets having a net asset value of $161.3 million as of September 30, 2024. KRIP also owns interests in hedge funds having a net asset value of $917.2 million as of September 30, 2024 (“Hedge Fund Assets”) which are not included in the KRIP Illiquid Assets. As previously reported, redemption notices have been given with respect to a substantial majority of Hedge Fund Assets and KRIP expects to receive proceeds from the redemption of those Hedge Fund Assets in accordance with the agreements governing the relevant Hedge Fund Assets.

The Board of Directors of Eastman Kodak Company (“Kodak”), the settlor of KRIP, is reviewing options with respect to KRIP, including the possible termination of KRIP, and has instructed the committee with authority to manage KRIP’s assets to take actions appropriate to position KRIP for a potential termination. At this time, the Board has not yet made a formal determination to terminate KRIP. The following disclosure summarizes what Kodak expects and projects to occur in the event of a termination of KRIP assuming the transactions under the Sale Agreements are consummated as contemplated and the Board determines to terminate KRIP. A termination of KRIP would not impair the accrued benefits of any participant under KRIP; rather, the first step in the termination process would be the satisfaction of KRIP’s liabilities to all participants in a manner complying with applicable laws. It is anticipated that KRIP’s liabilities would be satisfied through a combination of lump sum distributions to active and terminated vested participants who elect a lump sum distribution and the purchase of an annuity from an insurance company with respect to existing KRIP annuity obligations for current retirees and beneficiaries and annuity obligations arising from the termination to active and terminated vested participants who do not elect to receive lump sum distributions. The cost to satisfy KRIP’s liabilities will be affected by a variety of factors including interest rate fluctuations, the portion of active and terminated vested participants who elect lump-sum distributions, the premium payable to purchase the annuity, and other actuarial factors used to calculate the value of KRIP’s ongoing annuity obligations.

After KRIP’s liabilities and applicable legal requirements have been satisfied, KRIP’s surplus assets would revert to Kodak as the settlor of KRIP subject to an excise tax. Based on current assumptions, Kodak estimates KRIP would have surplus assets of between $885 million and $975 million after the satisfaction of KRIP’s liabilities. The actual amount of surplus assets available after the satisfaction of KRIP’s liabilities will be affected by the actual amount paid to satisfy KRIP’s liabilities, the return on KRIP’s assets during the period over which KRIP’s assets are liquidated and its liabilities satisfied (the “Liquidation Period”), the degree to which KRIP’s hedging strategy is effective in hedging fluctuations in the amount of KRIP’s liabilities during the Liquidation Period, the amounts realized from Hedge Fund Assets in the course of their redemption during the Liquidation Period, the amounts realized from distributions from or any sale of remaining KRIP Illiquid Assets during the Liquidation Period, the value of Hedge Fund Assets or KRIP Illiquid Assets held in the portfolio at the time of reversion, actuarial experience on plan liabilities during the Liquidation Period, the duration of the Liquidation Period, and the costs associated with the termination and liquidation process. While KRIP has hedging arrangements in place designed to hedge interest rates for practically all of KRIP’s liabilities, a significant portion of those arrangements are linked to fluctuations in US treasury rates and would not hedge against changes to the difference between the discount rates used to value KRIP’s liabilities and US treasury rates (i.e., the credit spread) or non-interest rate factors that may influence the amount of KRIP’s liabilities.

In order to reduce the amount of the surplus assets subject to excise tax and to reduce the rate of the excise tax from 50% to 20%, Kodak expects that it would direct the transfer of or otherwise contribute 25% of the surplus assets (which may include all or a significant portion of remaining non-cash assets) to one or more qualified replacement plans for the benefit of current employees (collectively, the “Replacement Plan”). After the capitalization of the Replacement Plan and the payment of the 20% excise tax on the remaining surplus, Kodak projects it would receive proceeds from KRIP having a value of between $530 million and $585 million. Kodak believes no material amount of income tax would be owed on this amount due to available tax attributes. In addition to the proceeds received by Kodak from KRIP, the Replacement Plan is projected to have assets having a value of between $220 million and $245 million which would allow Kodak to provide valuable benefits to its current employee base for the foreseeable future without additional cash cost to Kodak.

Under the terms of the Amended and Restated Credit Agreement to which Kodak is a party (the “Credit Agreement”), Kodak is obligated to use 100% of the net cash proceeds of any reversion from KRIP (“Reversion Proceeds”) to prepay term loans outstanding under the Credit Agreement (“Term Loans”) until the amount of the Term Loans is reduced to $300 million and, thereafter, to use 50% of the Reversion Proceeds to prepay Term Loans until the amount of the Term Loans is reduced to $200 million, in each case plus a 1% prepayment fee. Reversion Proceeds not used to prepay Term Loans would be included in the calculation of Excess Cash Flow as defined in the Credit Agreement and could thereby trigger additional prepayment obligations under the Credit Agreement which cannot be estimated at this time. Assuming these obligations are not amended, waived or otherwise modified in the interim, no other prepayments are made in the interim, and Kodak uses the Reversion Proceeds to prepay only the minimum amount required under the Credit Agreement, Kodak expects it would use approximately $315 million of the Reversion Proceeds to satisfy these obligations, leaving a Term Loan balance of $200 million and yielding an annual interest cost savings of approximately $40 million. Based on all of the foregoing projections and after the projected prepayment of Term Loans, Kodak projects that it would receive cash or other assets from the KRIP surplus having a value of between $215 million and $270 million that it would be able to use for strategic growth or general corporate purposes.

Kodak estimates that from the date a formal determination is made to terminate KRIP, it will take between 12 and 18 months to determine and satisfy KRIP’s liabilities and between 18 and 24 months before Kodak receives any Reversion Proceeds; however, these time frames are subject to factors beyond Kodak’s control including (i) the availability of an annuity product to satisfy KRIP’s annuity obligations at an acceptable cost and on acceptable terms, (ii) the continued conversion of investments into cash or other liquid assets at the pace currently anticipated, and (iii) regulatory review and approval of various aspects of the terms of the KRIP plan, KRIP’s activities, and the termination and liquidation process.

CAUTIONARY STATEMENT PURSUANT TO SAFE HARBOR PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

This report on Form 8-K includes “forward–looking statements” as that term is defined under the Private Securities Litigation Reform Act of 1995. Forward–looking statements include statements concerning Kodak’s or KRIP’s plans, objectives, intentions, future events, liquidity, asset or liability values, investments and other information that is not historical information. When used in this document, the words “estimates,” “expects,” “anticipates,” “projects,” “plans,” “intends,” “believes,” “predicts,” “forecasts,” “continues,” “goals,” “targets” or future or conditional verbs, such as “will,” “should,” “could,” or “may,” and similar words and expressions, as well as statements that do not relate strictly to historical or current facts, are intended to identify forward–looking statements. All forward–looking statements are based upon Kodak’s or KRIP’s current expectations and assumptions, some of which are based on forecasts provided by professional advisors. Forward-looking statements are subject to risks, uncertainties and other factors that could cause actual results to differ materially from historical results or those expressed in or implied by such forward-looking statements. Important factors that could cause actual events or results to differ materially from the forward-looking statements include, among others, the risks, uncertainties, variables, factors and influences described in the foregoing disclosure as well as the following:

•the Trust’s inability to consummate the transactions contemplated by the Sale Agreements due to the failure of closing conditions to be satisfied, inability to obtain general partner consents, counterparty risks or other impediments;

•Kodak’s Board making the determinations necessary for it to be appropriate for KRIP to be terminated;

•possible changes in laws, regulations or processes relating to any termination of KRIP, monetization of assets, satisfaction of liabilities, substitution of annuity providers, reversion of excess assets, taxation of such reversion, treatment of non-cash assets upon liquidation, prepayment of Term Loans, use of excess proceeds or associated fiduciary duty obligations, and any claims or lawsuits with respect to such matters or seeking to impede contemplated actions;

•the potential inability to obtain necessary regulatory approvals or satisfy regulatory audits;

•counterparty risks associated with general partners of private investment funds, hedge fund managers and liability hedge providers;

•differences between actual results and experience and the assumptions used to generate forecasts, which differences could be material;

•adverse changes to debt and/or equity markets, general economic conditions or the insurance industry or markets, including the occurrence of force majeure events such as wars, terrorist activities, pandemics and similar circumstances; and

•delays or increased costs associated with any of the foregoing.

There is no guarantee Kodak will receive any proceeds from a reversion of KRIP’s assets or with respect to the amount or timing of any such potential reversion. Future events and other factors may cause the realization and use of KRIP’s assets to differ materially from the forward–looking statements. All forward–looking statements attributable to Kodak or persons acting on its behalf apply only as of the date of this report on Form 8-K and are expressly qualified in their entirety by the cautionary statements included in this document. Kodak undertakes no obligation to update or revise forward–looking statements to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events, except as required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

EASTMAN KODAK COMPANY |

|

|

|

|

Date: |

November 25, 2024 |

By: |

/s/ David E. Bullwinkle |

|

|

|

David E. Bullwinkle

Chief Executive Officer and Senior Vice President

|

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

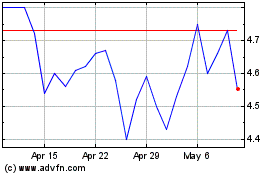

Eastman Kodak (NYSE:KODK)

Historical Stock Chart

From Nov 2024 to Dec 2024

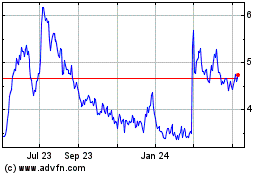

Eastman Kodak (NYSE:KODK)

Historical Stock Chart

From Dec 2023 to Dec 2024