Curtiss-Wright Corporation (NYSE: CW) reports financial results

for the third quarter ended September 30, 2024.

Third Quarter 2024 Highlights:

- Reported sales of $799 million, up 10%;

- Reported operating income of $145 million, operating margin of

18.1%, and diluted earnings per share (EPS) of $2.89;

- Adjusted operating income of $149 million, up 11%;

- Adjusted operating margin of 18.7%, up 20 basis points;

- Adjusted diluted EPS of $2.97, up 17%;

- New orders of $860 million, up 2%, reflected a book-to-bill of

1.1x driven by solid demand within our Aerospace & Defense

(A&D) markets;

- Backlog of $3.3 billion, up 16% year-to-date; and

- Free cash flow (FCF) of $163 million, generating 142% Adjusted

FCF conversion.

Raised Full-Year 2024 Adjusted Financial

Guidance:

- Sales increased to new range of 7% to 9% growth (previously 6%

to 8%), principally driven by strong growth in our A&D

markets;

- Operating income increased to new range of 7% to 10% growth

(previously 6% to 9%);

- Maintained operating margin range of 17.4% to 17.6%, flat to up

20 basis points compared with the prior year;

- Diluted EPS increased to new range of $10.55 to $10.75, up 12%

to 15% (previously $10.40 to $10.65, up 11% to 14%); and

- Free cash flow increased to new range of $430 to $450 million,

up 4% to 9% (previously $425 to $445 million, up 3% to 8%), and

continues to reflect greater than 105% FCF conversion.

"Curtiss-Wright achieved strong third quarter results,

highlighted by mid-teens revenue growth in our A&D end markets,

a better-than-expected operational performance in our Defense

Electronics segment and a 17% year-over-year increase in Adjusted

diluted EPS," said Lynn M. Bamford, Chair and CEO of Curtiss-Wright

Corporation. "We continue to demonstrate solid order activity,

yielding an overall book-to-bill of 1.1x in the quarter,

highlighted by record quarterly orders within our Defense

Electronics segment. We also delivered solid cash generation,

resulting in an exceptional free cash flow conversion of 142%.

Based on the strong year-to-date performance and our continued

momentum in executing on our Pivot to Growth strategy, we once

again raised our full-year 2024 outlook for sales, diluted EPS and

free cash flow."

“We continue to leverage our strong balance sheet in support of

our disciplined capital allocation strategy. This includes

delivering on our commitment to drive solid returns to our

shareholders as we completed the recently announced $100 million

expansion of our 2024 share repurchase program during the quarter.

Additionally, we remain focused on supplementing our organic growth

with high quality, strategic acquisitions that meet our stringent

financial criteria to drive long-term shareholder value.”

Third Quarter 2024 Operating

Results

(In millions)

Q3-2024

Q3-2023

Change

Reported

Sales

$

799

$

724

10

%

Operating income

$

145

$

133

9

%

Operating margin

18.1

%

18.3

%

(20 bps)

Adjusted (1)

Sales

$

799

$

724

10

%

Operating income

$

149

$

134

11

%

Operating margin

18.7

%

18.5

%

20 bps

(1) Reconciliations of Reported to

Adjusted operating results are available in the Appendix.

- Sales of $799 million increased 10% compared with the prior

year;

- Total A&D market sales increased 15%, as we experienced

strong growth in the defense markets principally driven by

increased demand for our defense electronics products and higher

submarine and aircraft carrier revenues in naval defense, as well

as higher OEM sales in the commercial aerospace market;

- Total Commercial market sales were flat, reflecting solid

growth in the power & process market, principally driven by

higher sales of our commercial nuclear products, which was offset

by lower sales in the general industrial market; and

- Adjusted operating income of $149 million increased 11%, while

Adjusted operating margin increased 20 basis points to 18.7%,

principally driven by favorable overhead absorption on higher

revenues in all three segments and partially offset by an

unfavorable mix of products.

Third Quarter 2024 Segment

Performance

Aerospace & Industrial

(In millions)

Q3-2024

Q3-2023

Change

Reported

Sales

$

229

$

220

4

%

Operating income

$

37

$

39

(4

%)

Operating margin

16.4

%

17.7

%

(130 bps)

Adjusted (1)

Sales

$

229

$

220

4

%

Operating income

$

39

$

39

1

%

Operating margin

17.2

%

17.7

%

(50 bps)

(1) Reconciliations of Reported to

Adjusted operating results are available in the Appendix.

- Sales of $229 million, up $8 million, or 4%;

- Commercial aerospace market revenue increases reflected strong

demand and higher OEM sales of sensors products and surface

treatment services on narrowbody and widebody platforms;

- Higher revenue in the aerospace defense market reflected the

timing of sales for our actuation equipment on various fighter jet

programs;

- Lower general industrial market revenue was principally driven

by reduced sales of industrial vehicle products to off-highway

vehicle platforms and lower sales of industrial automation and

services; and

- Adjusted operating income was $39 million, up 1% from the prior

year, while Adjusted operating margin decreased 50 basis points to

17.2%, as favorable absorption on higher sales as well as the

benefits of our restructuring initiatives were offset by

unfavorable mix of products.

Defense Electronics

(In millions)

Q3-2024

Q3-2023

Change

Reported

Sales

$

243

$

216

12

%

Operating income

$

64

$

56

13

%

Operating margin

26.2

%

26.0

%

20 bps

Adjusted (1)

Sales

$

243

$

216

12

%

Operating income

$

64

$

56

15

%

Operating margin

26.5

%

26.0

%

50 bps

(1) Reconciliations of Reported to

Adjusted operating results are available in the Appendix.

- Sales of $243 million, up $27 million, or 12%;

- Higher revenue in the aerospace defense market was principally

driven by increased sales of our embedded computing equipment on

various domestic and international helicopter programs, partially

offset by the timing of flight test equipment sales;

- Strong revenue growth in the ground defense market primarily

reflected higher sales of tactical battlefield communications

equipment;

- Higher commercial aerospace market revenue principally

reflected increased OEM sales of avionics and electronics on

various platforms; and

- Adjusted operating income was $64 million, up 15% from the

prior year, while Adjusted operating margin increased 50 basis

points to 26.5%, primarily due to favorable absorption on higher

A&D revenues.

Naval & Power

(In millions)

Q3-2024

Q3-2023

Change

Reported

Sales

$

327

$

288

14

%

Operating income

$

53

$

48

11

%

Operating margin

16.2

%

16.6

%

(40 bps)

Adjusted (1)

Sales

$

327

$

288

14

%

Operating income

$

54

$

49

10

%

Operating margin

16.4

%

17.0

%

(60 bps)

(1) Reconciliations of Reported to

Adjusted operating results are available in the Appendix.

- Sales of $327 million, up $39 million, or 14%;

- Strong revenue growth in the naval defense market principally

reflected higher demand on the Virginia-class submarine,

Columbia-class submarine and CVN-81 aircraft carrier programs, as

well as higher growth on various next-generation submarine

development programs;

- Higher power & process market revenues mainly reflected

increased commercial nuclear aftermarket sales supporting the

maintenance of U.S. operating reactors; and

- Adjusted operating income was $54 million, up 10% from the

prior year, while Adjusted operating margin decreased 60 basis

points to 16.4%, as favorable absorption on higher revenues was

partially offset by an unfavorable mix of products and the timing

of development programs.

Free Cash Flow

(In millions)

Q3-2024

Q3-2023

Change

Net cash provided by operating

activities

$

177

$

146

21

%

Capital expenditures

(15

)

(9

)

56

%

Reported free cash flow

$

163

$

137

19

%

Adjusted free cash flow (1)

$

163

$

137

19

%

(1) A reconciliation of Reported to

Adjusted free cash flow is available in the Appendix.

- Reported free cash flow of $163 million increased $26 million

year over year, primarily driven by higher cash earnings and lower

working capital;

- Adjusted free cash flow of $163 million; and

- Capital expenditures increased $5 million compared with the

prior year period, due to growth investments within the Aerospace

& Industrial and Defense Electronics segments.

New Orders and Backlog

- New orders of $860 million increased 2% compared with the prior

year and generated an overall book-to-bill of approximately 1.1x,

principally driven by continued strong demand for defense

electronics products within our A&D markets; and

- Backlog of $3.3 billion, up 16% from December 31, 2023,

reflecting higher demand in both our A&D and Commercial

markets.

Share Repurchase and Dividends

- During the third quarter, the Company repurchased 355,578

shares of its common stock for approximately $113 million and

remains on track to repurchase a total of $150 million in shares in

2024; and

- The Company declared a quarterly dividend of $0.21 a

share.

Full-Year 2024 Guidance

The Company is updating its full-year 2024 Adjusted financial

guidance(1) as follows:

($ in millions, except EPS)

2024 Adjusted Non-GAAP

Guidance (Prior)

2024 Adjusted Non-GAAP

Guidance (Current)

Change vs 2023 Adjusted

(Current)

Total Sales

$3,010 - $3,060

$3,050 - $3,095

Up 7% - 9%

Operating Income

$525 - $539

$531 - $545

Up 7% - 10%

Operating Margin

17.4% - 17.6%

17.4% - 17.6%

Up 0 - 20 bps

Diluted EPS

$10.40 - $10.65

$10.55 - $10.75

Up 12% - 15%

Free Cash Flow

$425 - $445

$430 - $450

Up 4% - 9%

(1) Reconciliations of Reported to

Adjusted 2023 operating results and 2024 financial guidance are

available in the Appendix.

**********

A more detailed breakdown of the Company’s 2024 financial

guidance by segment and by market, as well as all reconciliations

of Reported GAAP amounts to Adjusted Non-GAAP amounts, can be found

in the accompanying schedules. Historical financial results are

available in the Investor Relations section of Curtiss-Wright’s

website.

Conference Call & Webcast

Information

The Company will host a conference call to discuss its third

quarter 2024 financial results and updates to 2024 guidance at

10:00 a.m. ET on Thursday, October 31, 2024. A live webcast of the

call and the accompanying financial presentation, as well as a

webcast replay of the call, will be made available on the internet

by visiting the Investor Relations section of the Company’s website

at www.curtisswright.com.

(Tables to Follow)

CURTISS-WRIGHT CORPORATION and

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF EARNINGS (UNAUDITED)

($'s in thousands, except per

share data)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2024

2023

2024

2023

Product sales

$

684,216

$

613,915

$

1,941,327

$

1,721,832

Service sales

114,702

110,411

355,549

337,750

Total net sales

798,918

724,326

2,296,876

2,059,582

Cost of product sales

434,370

380,163

1,252,773

1,093,469

Cost of service sales

66,285

62,695

207,984

203,664

Total cost of sales

500,655

442,858

1,460,757

1,297,133

Gross profit

298,263

281,468

836,119

762,449

Research and development expenses

20,734

23,464

65,866

65,698

Selling expenses

37,311

34,084

109,202

100,782

General and administrative expenses

92,035

91,401

281,092

272,060

Restructuring expenses

3,280

—

6,198

—

Operating income

144,903

132,519

373,761

323,909

Interest expense

11,408

12,496

33,194

40,432

Other income, net

10,126

7,023

28,294

22,744

Earnings before income taxes

143,621

127,046

368,861

306,221

Provision for income taxes

(32,461

)

(30,268

)

(81,735

)

(71,598

)

Net earnings

$

111,160

$

96,778

$

287,126

$

234,623

Net earnings per share:

Basic earnings per share

$

2.91

$

2.53

$

7.51

$

6.13

Diluted earnings per share

$

2.89

$

2.51

$

7.47

$

6.09

Dividends per share

$

0.21

$

0.20

$

0.62

$

0.59

Weighted-average shares outstanding:

Basic

38,208

38,285

38,245

38,301

Diluted

38,451

38,558

38,451

38,538

CURTISS-WRIGHT CORPORATION and

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS (UNAUDITED)

($'s in thousands, except par

value)

September 30,

December 31,

2024

2023

Assets

Current assets:

Cash and cash equivalents

$

443,850

$

406,867

Receivables, net

857,614

732,678

Inventories, net

582,584

510,033

Other current assets

68,035

67,502

Total current assets

1,952,083

1,717,080

Property, plant, and equipment, net

330,292

332,796

Goodwill

1,583,448

1,558,826

Other intangible assets, net

532,397

557,612

Operating lease right-of-use assets,

net

156,613

141,435

Prepaid pension asset

279,212

261,869

Other assets

51,693

51,351

Total assets

$

4,885,738

$

4,620,969

Liabilities

Current liabilities:

Current portion of long-term debt

$

90,000

$

—

Accounts payable

222,542

243,833

Accrued expenses

194,414

188,039

Deferred revenue

392,330

303,872

Other current liabilities

87,369

70,800

Total current liabilities

986,655

806,544

Long-term debt

959,302

1,050,362

Deferred tax liabilities, net

124,186

132,319

Accrued pension and other postretirement

benefit costs

68,159

66,875

Long-term operating lease liability

134,866

118,611

Long-term portion of environmental

reserves

14,661

12,784

Other liabilities

107,490

105,061

Total liabilities

$

2,395,319

$

2,292,556

Stockholders' equity

Common stock, $1 par value

$

49,187

$

49,187

Additional paid in capital

144,394

140,182

Retained earnings

3,751,183

3,487,751

Accumulated other comprehensive loss

(203,428

)

(213,223

)

Less: cost of treasury stock

(1,250,917

)

(1,135,484

)

Total stockholders' equity

$

2,490,419

$

2,328,413

Total liabilities and stockholders'

equity

$

4,885,738

$

4,620,969

Use and Definitions of Non-GAAP Financial Information

(Unaudited)

The Corporation supplements its financial information determined

under U.S. generally accepted accounting principles (GAAP) with

certain non-GAAP financial information. Curtiss-Wright believes

that these Adjusted (non-GAAP) measures provide investors with

improved transparency in order to better measure Curtiss-Wright’s

ongoing operating and financial performance and better comparisons

of our key financial metrics to our peers. These non-GAAP measures

should not be considered in isolation or as a substitute for the

related GAAP measures, and other companies may define such measures

differently. Curtiss-Wright encourages investors to review its

financial statements and publicly filed reports in their entirety

and not to rely on any single financial measure. Reconciliations of

“Reported” GAAP amounts to “Adjusted” non-GAAP amounts are

furnished within this release.

The following definitions are provided:

Adjusted Operating Income, Operating

Margin, Net Earnings and Diluted EPS

These Adjusted financials are defined as Reported Operating

Income, Operating Margin, Net Earnings and Diluted Earnings per

Share under GAAP excluding: (i) the impact of first year purchase

accounting costs associated with acquisitions, specifically

one-time inventory step-up, backlog amortization, deferred revenue

adjustments and transaction costs; (ii) costs associated with the

Company's 2024 Restructuring Program; and (iii) the sale or

divestiture of a business or product line, as applicable.

CURTISS-WRIGHT CORPORATION and

SUBSIDIARIES

RECONCILIATION OF AS REPORTED

TO ADJUSTED (UNAUDITED)

($'s in thousands)

Three Months Ended

Three Months Ended

September 30, 2024

September 30, 2023

% Change

As Reported

Adjustments

Adjusted

As Reported

Adjustments

Adjusted

As Reported

Adjusted

Sales:

Aerospace & Industrial

$

228,659

$

—

$

228,659

$

220,297

$

—

$

220,297

4

%

4

%

Defense Electronics

243,029

—

243,029

216,285

—

216,285

12

%

12

%

Naval & Power

327,230

—

327,230

287,744

—

287,744

14

%

14

%

Total sales

$

798,918

$

—

$

798,918

$

724,326

$

—

$

724,326

10

%

10

%

Operating income

(expense):

Aerospace & Industrial(2)

$

37,435

$

1,926

$

39,361

$

39,014

$

—

$

39,014

(4

)%

1

%

Defense Electronics(2)

63,639

819

64,458

56,212

—

56,212

13

%

15

%

Naval & Power(1)(2)

53,039

759

53,798

47,663

1,333

48,996

11

%

10

%

Total segments

$

154,113

$

3,504

$

157,617

$

142,889

$

1,333

$

144,222

8

%

9

%

Corporate and other(2)

(9,210

)

660

(8,550

)

(10,370

)

—

(10,370

)

11

%

18

%

Total operating income

$

144,903

$

4,164

$

149,067

$

132,519

$

1,333

$

133,852

9

%

11

%

Operating

margins:

As Reported

Adjusted

As Reported

Adjusted

As Reported

Adjusted

Aerospace & Industrial

16.4

%

17.2

%

17.7

%

17.7

%

(130 bps)

(50 bps)

Defense Electronics

26.2

%

26.5

%

26.0

%

26.0

%

20 bps

50 bps

Naval & Power

16.2

%

16.4

%

16.6

%

17.0

%

(40 bps)

(60 bps)

Total Curtiss-Wright

18.1

%

18.7

%

18.3

%

18.5

%

(20 bps)

20 bps

Segment margins

19.3

%

19.7

%

19.7

%

19.9

%

(40 bps)

(20 bps)

(1) Excludes first year purchase

accounting adjustments in both the current and prior year

periods.

(2) Excludes costs associated with the

Company's 2024 Restructuring Program in the current period.

CURTISS-WRIGHT CORPORATION and

SUBSIDIARIES

RECONCILIATION OF AS REPORTED

TO ADJUSTED (UNAUDITED)

($'s in thousands)

Nine Months Ended

Nine Months Ended

September 30, 2024

September 30, 2023

% Change

As Reported

Adjustments

Adjusted

As Reported

Adjustments

Adjusted

As Reported

Adjusted

Sales:

Aerospace & Industrial

$

681,216

$

—

$

681,216

$

649,004

$

—

$

649,004

5

%

5

%

Defense Electronics

683,231

—

683,231

576,161

—

576,161

19

%

19

%

Naval & Power

932,429

—

932,429

834,417

—

834,417

12

%

12

%

Total sales

$

2,296,876

$

—

$

2,296,876

$

2,059,582

$

—

$

2,059,582

12

%

12

%

Operating income

(expense):

Aerospace & Industrial(2)

$

100,147

$

4,546

$

104,693

$

101,224

$

—

$

101,224

(1

)%

3

%

Defense Electronics(2)

169,964

1,342

171,306

122,760

—

122,760

38

%

40

%

Naval & Power (1)(2)

134,513

1,101

135,614

132,382

6,669

139,051

2

%

(2

)%

Total segments

$

404,624

$

6,989

$

411,613

$

356,366

$

6,669

$

363,035

14

%

13

%

Corporate and other(2)

(30,863

)

1,624

(29,239

)

(32,457

)

—

(32,457

)

5

%

10

%

Total operating income

$

373,761

$

8,613

$

382,374

$

323,909

$

6,669

$

330,578

15

%

16

%

Operating

margins:

As Reported

Adjusted

As Reported

Adjusted

As Reported

Adjusted

Aerospace & Industrial

14.7

%

15.4

%

15.6

%

15.6

%

(90 bps)

(20 bps)

Defense Electronics

24.9

%

25.1

%

21.3

%

21.3

%

360 bps

380 bps

Naval & Power

14.4

%

14.5

%

15.9

%

16.7

%

(150 bps)

(220 bps)

Total Curtiss-Wright

16.3

%

16.6

%

15.7

%

16.1

%

60 bps

50 bps

Segment margins

17.6

%

17.9

%

17.3

%

17.6

%

30 bps

30 bps

(1) Excludes first year purchase

accounting adjustments in both the current and prior year

periods.

(2) Excludes costs associated with the

Company's 2024 Restructuring Program in the current period.

CURTISS-WRIGHT CORPORATION and

SUBSIDIARIES

SALES BY END MARKET

(UNAUDITED)

($'s in thousands)

Three Months Ended

Three Months Ended

September 30, 2024

September 30, 2023

% Change

Aerospace & Defense

markets:

Aerospace Defense

$

158,980

$

148,023

7

%

Ground Defense

92,973

83,185

12

%

Naval Defense

217,510

179,862

21

%

Commercial Aerospace

96,677

79,703

21

%

Total Aerospace & Defense

$

566,140

$

490,773

15

%

Commercial markets:

Power & Process

$

131,376

$

122,118

8

%

General Industrial

101,402

111,435

(9

%)

Total Commercial

$

232,778

$

233,553

0

%

Total Curtiss-Wright

$

798,918

$

724,326

10

%

Nine Months Ended

Nine Months Ended

September 30, 2024

September 30, 2023

% Change

Aerospace & Defense

markets:

Aerospace Defense

$

445,158

$

380,095

17

%

Ground Defense

268,672

220,317

22

%

Naval Defense

605,004

532,773

14

%

Commercial Aerospace

279,768

232,226

20

%

Total Aerospace & Defense

$

1,598,602

$

1,365,411

17

%

Commercial markets:

Power & Process

$

394,016

$

373,457

6

%

General Industrial

304,258

320,714

(5

%)

Total Commercial

$

698,274

$

694,171

1

%

Total Curtiss-Wright

$

2,296,876

$

2,059,582

12

%

CURTISS-WRIGHT CORPORATION and

SUBSIDIARIES

RECONCILIATION OF AS REPORTED

TO ADJUSTED DILUTED EARNINGS PER SHARE (UNAUDITED)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2024

2023

2024

2023

Diluted earnings per share - As

Reported

$

2.89

$

2.51

$

7.47

$

6.09

First year purchase accounting

adjustments

0.02

0.03

0.02

0.13

Restructuring costs

0.06

—

0.15

—

Diluted earnings per share - Adjusted

(1)

$

2.97

$

2.54

$

7.64

$

6.22

(1) All adjustments are presented net of

income taxes.

Organic Sales and Organic Operating

Income

The Corporation discloses organic sales and organic operating

income because the Corporation believes it provides investors with

insight as to the Company’s ongoing business performance. Organic

sales and organic operating income are defined as sales and

operating income, excluding contributions from acquisitions and

results of operations from divested businesses or product lines

during the last twelve months, costs associated with the Company's

2024 Restructuring Program, and foreign currency fluctuations.

Three Months Ended

September 30,

2024 vs. 2023

Aerospace &

Industrial

Defense Electronics

Naval & Power

Total Curtiss-Wright

Sales

Operating income

Sales

Operating income

Sales

Operating income

Sales

Operating income

As Reported

4%

(4%)

12%

13%

14%

11%

10%

9%

Less: Acquisitions

0%

0%

0%

0%

(1%)

0%

0%

0%

Restructuring

0%

5%

0%

1%

0%

0%

0%

3%

Foreign Currency

(1%)

(2%)

0%

0%

0%

0%

0%

(1%)

Organic

3%

(1%)

12%

14%

13%

11%

10%

11%

Nine Months Ended

September 30,

2024 vs. 2023

Aerospace &

Industrial

Defense Electronics

Naval & Power

Total Curtiss-Wright

Sales

Operating income

Sales

Operating income

Sales

Operating income

Sales

Operating income

As Reported

5%

(1%)

19%

38%

12%

2%

12%

15%

Less: Acquisitions

0%

0%

0%

0%

(1%)

0%

0%

0%

Restructuring

0%

4%

0%

1%

0%

0%

0%

2%

Foreign Currency

0%

0%

(1%)

0%

0%

0%

(1%)

1%

Organic

5%

3%

18%

39%

11%

2%

11%

18%

Free Cash Flow and Free Cash Flow

Conversion

The Corporation discloses free cash flow because it measures

cash flow available for investing and financing activities. Free

cash flow represents cash available to repay outstanding debt,

invest in the business, acquire businesses, return capital to

shareholders and make other strategic investments. Free cash flow

is defined as net cash provided by operating activities less

capital expenditures. Adjusted free cash flow excludes payments

associated with the Westinghouse legal settlement in the prior year

period. The Corporation discloses adjusted free cash flow

conversion because it measures the proportion of net earnings

converted into free cash flow and is defined as adjusted free cash

flow divided by adjusted net earnings.

CURTISS-WRIGHT CORPORATION and

SUBSIDIARIES

NON-GAAP FINANCIAL DATA

(UNAUDITED)

($'s in thousands)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2024

2023

2024

2023

Net cash provided by operating

activities

$ 177,274

$ 146,364

$ 242,976

$ 165,717

Capital expenditures

(14,584

)

(9,373

)

(37,703

)

(32,037

)

Free cash flow

$ 162,690

$ 136,991

$ 205,273

$ 133,680

Westinghouse legal settlement

—

—

—

10,000

Adjusted free cash flow

$ 162,690

$ 136,991

$ 205,273

$ 143,680

Adjusted free cash flow conversion

142

%

140

%

70

%

60

%

CURTISS-WRIGHT

CORPORATION

2024 Guidance

As of October 30, 2024

($'s in millions, except per

share data)

2023 Reported

(GAAP)

2023 Adjustments

(Non- GAAP)(1,2)

2023 Adjusted

(Non- GAAP)(1,2)

2024 Reported

Guidance (GAAP)

2024 Adjustments

(Non-GAAP)(3)

2024 Adjusted

Guidance (Non-GAAP)(3)

Low

High

Low

High

2024 Chg

vs 2023

Adjusted

Sales:

Aerospace & Industrial

$

887

$

—

$

887

$

925

$

940

$

—

$

925

$

940

4 - 6%

Defense Electronics

816

—

816

892

907

—

892

907

9 - 11%

Naval & Power

1,142

—

1,142

1,233

1,248

—

1,233

1,248

8 - 9%

Total sales

$

2,845

$

—

$

2,845

$

3,050

$

3,095

$

—

$

3,050

$

3,095

7 - 9%

Operating income:

Aerospace & Industrial

$

145

$

—

$

145

$

148

$

152

$

9

$

157

$

161

8 - 11%

Defense Electronics

192

—

192

213

218

3

216

221

13 - 15%

Naval & Power

189

9

198

197

202

1

198

203

0 - 2%

Total segments

$

526

$

9

$

535

$

557

$

572

$

13

$

570

$

585

Corporate and other

(42

)

—

(42

)

(41

)

(42

)

2

(39

)

(40

)

Total operating income

$

485

$

9

$

494

$

516

$

530

$

15

$

531

$

545

7 - 10%

Interest expense

$

(51

)

$

—

$

(51

)

$

(44

)

$

(45

)

$

—

$

(44

)

$

(45

)

Other income, net

30

—

30

35

35

—

35

35

Earnings before income taxes

463

9

472

507

519

15

522

534

Provision for income taxes

(109

)

(2

)

(111

)

(114

)

(117

)

(3

)

(117

)

(120

)

Net earnings

$

355

$

6

$

361

$

393

$

401

$

12

$

405

$

413

Diluted earnings per share

$

9.20

$

0.18

$

9.38

$

10.23

$

10.44

$

0.32

$

10.55

$

10.75

12 - 15%

Diluted shares outstanding

38.5

38.5

38.4

38.4

38.4

38.4

Effective tax rate

23.4

%

23.4

%

22.5

%

22.5

%

22.5

%

22.5

%

Operating margins:

Aerospace & Industrial

16.4

%

16.4

%

16.0

%

16.2

%

16.9

%

17.1

%

50 - 70 bps

Defense Electronics

23.5

%

23.5

%

23.9

%

24.0

%

24.2

%

24.4

%

70 - 90 bps

Naval & Power

16.6

%

17.4

%

16.0

%

16.2

%

16.1

%

16.3

%

(110 - 130 bps)

Total operating margin

17.0

%

17.4

%

16.9

%

17.1

%

17.4

%

17.6

%

0 - 20 bps

Free cash flow

$

403

$

10

$

413

$

430

$

450

$

—

$

430

$

450

4 - 9%

Notes: Full year amounts may not add due

to rounding.

(1) 2023 Adjusted financials exclude the

impact of first year purchase accounting adjustments.

(2) Free Cash Flow is defined as cash flow

from operations less capital expenditures. 2023 Adjusted Free Cash

Flow excluded a legal settlement payment of $10 million.

(3) 2024 Adjusted financials are defined

as Reported Operating Income, Operating Margin, Net Income and

Diluted EPS under GAAP excluding costs associated with the

Company's 2024 Restructuring Program and the impact of first year

purchase accounting adjustments.

CURTISS-WRIGHT

CORPORATION

2024 Sales Growth Guidance by

End Market

As of October 30, 2024

2024 % Change vs. 2023

Adjusted

Prior

Current

% Total Sales

Aerospace &

Defense Markets

Aerospace Defense

7 - 9%

9 - 11%

20%

Ground Defense

10 - 12%

10 - 12%

11%

Naval Defense

5 - 7%

9 - 11%

26%

Commercial Aerospace

13 - 15%

16 - 18%

12%

Total Aerospace & Defense

8 - 10%

10 - 12%

69%

Commercial

Markets

Power & Process

4 - 6%

5 - 7%

18%

General Industrial

Flat

(2 - 4%)

14%

Total Commercial

1 - 3%

1 - 3%

31%

Total Curtiss-Wright Sales

6 - 8%

7 - 9%

100%

Note: Sales percentages may not add due to

rounding.

About Curtiss-Wright Corporation

Curtiss-Wright Corporation (NYSE:CW) is a global integrated

business that provides highly engineered products, solutions and

services mainly to Aerospace & Defense markets, as well as

critical technologies in demanding Commercial Power, Process and

Industrial markets. We leverage a workforce of approximately 8,600

highly skilled employees who develop, design and build what we

believe are the best engineered solutions to the markets we serve.

Building on the heritage of Glenn Curtiss and the Wright brothers,

Curtiss-Wright has a long tradition of providing innovative

solutions through trusted customer relationships. For more

information, visit www.curtisswright.com.

###

Certain statements made in this press release, including

statements about future revenue, financial performance guidance,

quarterly and annual revenue, net income, operating income growth,

future business opportunities, cost saving initiatives, the

successful integration of the Company’s acquisitions, and future

cash flow from operations, are forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These statements present management's expectations, beliefs,

plans and objectives regarding future financial performance, and

assumptions or judgments concerning such performance. Any

discussions contained in this press release, except to the extent

that they contain historical facts, are forward-looking and

accordingly involve estimates, assumptions, judgments and

uncertainties. Such forward-looking statements are subject to

certain risks and uncertainties that could cause actual results to

differ materially from those expressed or implied. Readers are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date hereof. Such risks and

uncertainties include, but are not limited to: a reduction in

anticipated orders; an economic downturn; changes in the

competitive marketplace and/or customer requirements; a change in

government spending; an inability to perform customer contracts at

anticipated cost levels; and other factors that generally affect

the business of aerospace, defense contracting, electronics,

marine, and industrial companies. Such factors are detailed in the

Company's Annual Report on Form 10-K for the fiscal year ended

December 31, 2023, and subsequent reports filed with the Securities

and Exchange Commission.

This press release and additional information are available at

www.curtisswright.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030622596/en/

Jim Ryan (704) 869-4621 Jim.Ryan@curtisswright.com

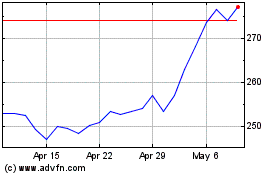

Curtiss Wright (NYSE:CW)

Historical Stock Chart

From Oct 2024 to Nov 2024

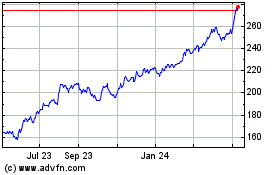

Curtiss Wright (NYSE:CW)

Historical Stock Chart

From Nov 2023 to Nov 2024