Current Report Filing (8-k)

February 11 2019 - 6:13AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

8-K

CURRENT REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): February 11, 2019

CURO GROUP HOLDINGS CORP.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

Delaware

|

|

001-38315

|

|

90-0934597

|

|

(State or Other Jurisdiction of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

|

|

|

3527 North Ridge Road, Wichita, Kansas

|

|

67205

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(316)

425-1410

(Registrant’s telephone number, including area code)

N/A

(Former Name or

Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions:

|

|

|

|

|

☐

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR

§230.425)

|

|

|

|

|

☐

|

|

Soliciting material pursuant to Rule

14a-12

under the

Exchange Act (17 CFR

§240.14a-12)

|

|

|

|

|

☐

|

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

§240.14d-2(b))

|

|

|

|

|

☐

|

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

§240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of

1933 (17 CFR §230.405) or Rule

12b-2

of the Securities Exchange Act of 1934 (17 CFR

§240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Consent Solicitation

As previously announced on the

Company’s Current Report on Form

8-K,

filed with the Securities and Exchange Commission on February 1, 2019 (incorporated herein by reference), on February 1, 2019, CURO Group Holdings Corp.

(the “Company”) launched a consent solicitation of the holders (“Holders”) of all of its 8.250% Senior Secured Notes due 2025 (the “Notes”) requesting consent to implement one or more of the “Proposed

Transactions” and to provide a

one-time

waiver with respect to certain provisions contained in the indenture governing the Notes to permit the implementation of any of the “Proposed

Transactions” (the “Proposed Waiver/Consent”). For a description of the “Proposed Transactions,” please see the Company’s Current Report on Form

8-K,

filed with the Securities and

Exchange Commission on January 31, 2019, which description is incorporated herein by reference. On February 8, 2019, the Company received consents to the Proposed Waiver/Consent from Holders holding a majority in aggregate principal amount of

the outstanding Notes and the Proposed Waiver/Consent became effective.

In connection with the consummation of the consent solicitation, Holders of

$680,578,000 aggregate principal amount of Notes delivered valid consents at or prior to the expiration of the consent solicitation, and a cash payment of $10.00 per $1,000 in aggregate principal amount of Notes will be paid to such consenting

Holders.

About CURO

CURO Group Holdings Corp.

(NYSE: CURO), operating in three countries and powered by its fully integrated technology platform, is a market leader by revenues in providing short-term credit to underbanked consumers. In 1997, the Company was founded in Riverside, California by

three Wichita, Kansas childhood friends to meet the growing consumer need for short-term loans. Their success led to opening stores across the United States and expanding to offer online loans and financial services across three countries. Today,

CURO combines its market expertise with a fully integrated technology platform, omni-channel approach and advanced credit decisioning to provide an array of short-term credit products across all mediums. CURO operates under a number of brands

including Speedy Cash, Rapid Cash, Cash Money, LendDirect, Avío Credit, WageDayAdvance, Juo Loans, and Opt+. With over 20 years of operating experience, CURO provides financial freedom to the underbanked.

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized on this 11

th

day of February, 2019.

|

|

|

|

|

CURO Group Holdings Corp.

|

|

|

|

|

By:

|

|

/s/ Vin Thomas

|

|

Name:

|

|

Vin Thomas

|

|

Title:

|

|

Chief Legal Officer

|

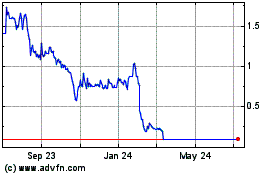

CURO (NYSE:CURO)

Historical Stock Chart

From Aug 2024 to Sep 2024

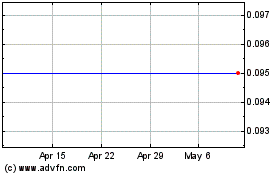

CURO (NYSE:CURO)

Historical Stock Chart

From Sep 2023 to Sep 2024