false000171129100017112912023-08-312023-08-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

_______________________________________________________________________

FORM 8-K

__________________________________________________________________________

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): August 31, 2023

________________________________________________________________________

CURO GROUP HOLDINGS CORP

(Exact Name of Registrant as Specified in Its Charter)

________________________________________________________________________

| | | | | | | | |

| Delaware | 001-38315 | 90-0934597 |

| (State or other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | |

200 W Hubbard Street, 8th Floor, Chicago, IL | 60654 |

| (Address of Principal Executive Offices) | (Zip Code) |

(312) 470-2000

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

________________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common stock | CURO | NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule12b-2of the Securities Exchange Act of 1934(§240.12b-2of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.01 Completion of Acquisition or Disposition of Assets

Completion of Sale of Flexiti Business

On August 31, 2023, CURO Intermediate Holdings Corp. (“Seller”), a wholly owned subsidiary of CURO Group Holdings Corp. (the “Company”), completed its previously announced sale (the “Disposition”) of all of the issued and outstanding equity interests of FLX Holdings Corp. (“Flexiti”), pursuant to that certain Share Purchase Agreement, dated as of August 2, 2023 (the “Purchase Agreement), with Questrade Financial Group Inc. (“Purchaser”). In connection with the Disposition, the Seller is providing the Purchaser with certain transition services for which the Seller will be paid certain variable fees.

In connection with the completion of the Disposition, Seller and Purchaser entered into that certain Amendment to Share Purchase Agreement, dated August 31, 2023 (the “Purchase Agreement Amendment”), with amends the Purchase Agreement to, among other things, specify the Closing Time (as such term is defined in the Purchase Agreement) and memorialize the parties’ agreement regarding certain tax elections.

The pro forma financial information required to be filed by Item 9.01(b) of Form 8-K is included in this Current Report.

The foregoing description of the Purchase Agreement, the Purchase Agreement Amendment and the transactions contemplated thereby do not purport to be complete and are subject to, and qualified in their entirety by, the full text of (i) the Purchase Agreement, which is filed as Exhibit 2.1 to the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on August 3, 2023, and is incorporated herein by reference and (ii) the Purchase Agreement Amendment, which is furnished as Exhibit 2.2 to this Current Report on Form 8-K and is incorporated into this Item 2.01 by reference.

ITEM 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

Appointment of New Independent Director

On September 5, 2023, the Board of Directors (the “Board”) of the Company announced the appointment of a new independent director effective September 1, 2023. Robert Hurzeler has been appointed to a newly-created position on the Board, with a term expiring at the Company’s annual meeting of stockholders to be held in 2024. Mr. Hurzeler will serve as a member of the Board’s Compensation Committee and Risk and Compliance Committee. The Board has determined that Mr. Hurzeler satisfies the director independence requirements of the New York Stock Exchange (“NYSE”).

In connection with his appointment to the Board, Mr. Hurzeler received an award of 48,543 restricted stock units under the Company’s 2017 Incentive Plan, in accordance with the Company’s 2023 compensation program for non-employee directors who serve on committees, which was described in the section entitled “2023 Non-Employee Director Compensation Program” in our definitive proxy statement for the 2023 annual meeting of stockholders filed with the Securities and Exchange Commission (“SEC”) on April 28, 2023, which description is incorporated by reference herein. The restricted stock units will vest on April 2, 2024, subject to his continued service on the Board through such date. The Company has entered into an indemnification agreement with Mr. Hurzeler on our standard form for directors filed as Exhibit 10.31 to the Registration Statement on Form S-1 (Amendment No. 1) filed with the SEC on November 1, 2017.

There is no arrangement or understanding between Mr. Hurzeler and any other person pursuant to which Mr. Hurzeler was selected as a director. There are no transactions involving Mr. Hurzeler or his immediate family members and the Company or any of its subsidiaries that would be required to be reported under Item 404(a) of Regulation S-K.

ITEM 7.01 Regulation FD Disclosure

On September 5, 2023, the Company issued a press release, which is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The Company also has prepared an updated outlook for the quarter ending September 30, 2023. The updated outlook is furnished as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated into this Item 7.01 by reference. A copy of the presentation is available at https://ir.curo.com/.

The information furnished in Item 7.01 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), is not subject to the liabilities of that section and is not deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act.

ITEM 8.01 Other Events

In connection with the appointment of Mr. Hurzeler to the Board as described above in Item 5.02, the Company has changed the composition of its Compensation Committee and the Risk and Compliance Committee. All committee members meet the independence requirements applicable to directors and the committees under SEC rules and NYSE Listing Standards.

Compensation Committee

Andrew Frawley, Chairperson

Robert Hurzeler

David Kirchheimer

Chris Masto

Risk and Compliance Committee

Gillian Van Schaick, Chairperson

Chad Faulkner

Robert Hurzeler

Issac Vaughn

ITEM 9.01 Financial Statements and Exhibits

(b) Pro Forma Financial Information

The unaudited pro forma condensed consolidated financial statements of the Company have been derived from the Company’s historical consolidated financial statements and are being presented to give effect to the Disposition. The unaudited pro forma condensed consolidated balance sheet of the Company as of June 30, 2023, the unaudited pro forma consolidated statement of operations of the Company for the six months ended June 30, 2023 and the unaudited pro forma condensed consolidated statements of operations of the Company for the years ended December 31, 2022 and 2021, and the related notes thereto, are furnished as Exhibit 99.3 to this Current Report on Form 8-K.

(d). Exhibits

| | | | | |

| Exhibit Number | Description |

| 2.1 | |

2.2 | |

| 99.1 | |

| 99.2 | |

| 99.3 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

*Schedules and exhibits have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Company agrees to furnish supplementally to the SEC a copy of any omitted schedule or exhibit upon request by the SEC.

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized on this 5th day of September, 2023.

CURO Group Holdings Corp.

By: /s/ Rebecca Fox______

Rebecca Fox

Secretary

AMENDMENT TO SHARE PURCHASE AGREEMENT

THIS AMENDING AGREEMENT (this "Agreement") is made effective as of the 31st day of August, 2023

BETWEEN:

QUESTRADE FINANCIAL GROUP INC., a corporation formed under the laws of the Province of Ontario (the "Purchaser")

- and -

CURO INTERMEDIATE HOLDINGS CORP., a corporation formed under the laws of the State of Delaware (the "Seller", and together with the Purchaser, the "Parties")

WHEREAS:

A.The Purchaser and the Seller entered into a share purchase agreement dated August 2, 2023 (the "SPA"), pursuant to which the Purchaser will purchase all of the issued and outstanding shares in the capital of the FLX Holding Corporation from the Seller on the Closing Date (as defined in the SPA);

B.Pursuant to Section 11.4 of the SPA, the SPA may be amended by written agreement of the Seller and the Purchaser; and

C.The Parties wish to amend the SPA as set forth herein.

NOW THEREFORE for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged by each of the Parties, the Parties hereby agree as follows:

1.INTERPRETATION

All capitalized terms used in this Agreement (including the recitals to this Agreement) have the same meaning as in the SPA, unless such terms are otherwise defined herein.

2.AMENDMENT

The Parties hereby agree that, effective as of the date of this Agreement, the SPA is amended as follows:

(a)The definition of "Closing Time" set out in Section 1.1 is deleted in its entirety and replaced with the following:

""Closing Time" means the time on the Closing Date at which Closing occurs, being the last moment of the day on the Closing Date.";

(b)The reference to "Section 3.25" in the definition of "Material Contracts" set out in Section 1.1 is deleted and replaced with reference to "Section 3.26";

(c)Section 3.32 is amended by deleting the word "the" which incorrectly appears between the words "no" and "Group Company" in the first line of the paragraph, such that Section 3.32 will read as follows:

"Except as set forth in Section 3.32 of the Seller Disclosure Letter, no Group Company has given…"; and

(d)Subsection 6.1(f) of the SPA is deleted in its entirety and replaced with the following:

"If applicable, the Parties agree that elections under subsection 256(9) of the Tax Act shall be made in respect of the Group Companies' income Tax Returns for taxation years ending by virtue of the Closing.";

(a)The reference to "paragraph C of Schedule 5.13" in Section 10.2 is deleted and replaced with reference to " paragraph D of Schedule 5.13".

3.GENERAL PROVISIONS

(a)Severability. If any one or more of the provisions contained in this Agreement should be invalid, illegal or unenforceable in any respect under any applicable Law, the validity, legality and enforceability of the remaining provisions hereof shall not in any way be affected or impaired thereby. Each of the provisions of this Agreement is hereby declared to be separate and distinct.

(b)Entire Agreement. The SPA and this Agreement will be read and construed together as one document. The Parties ratify and affirm the SPA as amended hereby (the "Amended SPA"), and agree that the Amended SPA contains the entire understanding of the Parties hereto with respect to the subject matter hereof. The Amended SPA supersedes all prior agreements, understandings, negotiations and discussions relating to the subject matter hereof, whether oral or written.

(c)Time. Time is of the essence in this Agreement.

(d)Governing Law. This Agreement is governed by and is to be interpreted and enforced in accordance with the laws of the Province of Ontario and the federal laws of Canada applicable therein. Each of the Parties irrevocably attorns and submits to the exclusive jurisdiction of the courts of Ontario in any action or proceeding arising out of, or relating to, this Agreement. Each of the Parties waives objection to the venue of any action or proceeding in such court or any argument that such court provides an inconvenient forum. Each of the Parties irrevocably waives any and all rights to trial by jury in any legal proceeding arising out of, or related to, this Agreement or any other Transaction Document.

(e)Amendments. This Agreement may only be amended, supplemented or otherwise modified by written agreement of the Seller and the Purchaser.

(f)Further Assurances. From time to time, each Party shall, at the request of the other Party, execute and deliver such additional conveyances, transfers and other assurances and perform or cause to be performed such further and other acts or things as may be reasonably required to give effect to, and carry out the intent of, this Agreement.

(g)Execution and Delivery. This Agreement may be executed in any number of separate counterparts, each of which shall be deemed to be an original. All such signed counterparts, taken together, shall constitute one and the same agreement. Delivery of an executed signature page to this Agreement by electronic means (including in PDF format) shall be as valid and effective as delivery of an originally or manually executed copy of this Agreement.

[Signature page follows]

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the date first written above.

| | | | | | | | | | | |

|

| QUESTRADE FINANCIAL GROUP INC. |

By: | /s/ Edward Kholodenko |

| Authorized Signing Officer |

| |

CURO INTERMEDIATE HOLDINGS CORP. |

By: | /s/ Douglas Clark |

| Authorized Signing Officer |

CURO Announces Addition of New Independent Director Bob Hurzeler to CURO’s Board and Completion of Flexiti Sale

Chicago, Illinois—September 5, 2023 -- (BUSINESS WIRE) -- CURO Group Holdings Corp. (NYSE: CURO) (“CURO”), an omni-channel consumer finance company serving consumers in the U.S. and Canada, today announced Bob Hurzeler, Chief Executive Officer of Flagship Credit Acceptance, has been appointed to CURO’s Board of Directors effective September 1, 2023. In addition, CURO also announced it has completed the sale of its Canadian point-of-sale business, FLX Holding Corp. (“Flexiti”), to Questrade Financial Group Inc. After deal and transaction costs, approximately C$39 million of net proceeds were received at closing, inclusive of adjustments for escrow and holdbacks. CURO also expects to receive C$25-30 million in late 2023 and up to C$4 million in subsequent periods, subject to adjustments, in accordance with the terms of the definitive agreement.

“We are excited to welcome Bob to the CURO Board. Bob’s extensive executive and operational finance experience will provide CURO and its Board with a wealth of relevant knowledge and guidance as we continue to execute our long-term strategy to grow responsibly, execute with excellence and strengthen our foundation.” said Doug Clark, Chief Executive Officer of CURO.

Mr. Hurzeler has served as the Chief Executive Officer of Flagship Credit Acceptance, an auto lender, since 2019. Prior to joining Flagship, Mr. Hurzeler served as Chief Operating Officer of OneMain Financial, a non-prime lender, from 2014 to 2019. Earlier in his career, Mr. Hurzeler was Chief Operating Officer of Global Lending Services, an auto lender, from 2012 to 2014, and served in various roles of increasing responsibility at Wells Fargo & Company (NYSE: WFC) from 1986 to 2012, including serving as President of Auto Finance from 2008 to 2012. Mr. Hurzeler holds a B.A. in Business from Concordia University-Wisconsin.

“I am incredibly honored to join the CURO Board at this very important time as CURO continues to execute on its strategic plan,” said Mr. Hurzeler. “I look forward to bringing my consumer finance experience to bear on behalf of CURO and its mission of providing affordable credit solutions for consumers across North America.”

The Company’s Form 8-K filed with the Securities and Exchange Commission today includes an updated 2023 outlook for the quarter ending September 30, 2023, which replaces the outlook provided in the Company’s earnings presentation for the quarter ended June 30, 2023. The updated outlook has no material changes from the prior published outlook other than reflecting the removal of the Canada POS Lending (Flexiti) segment.

About CURO

CURO Group Holdings Corp. (NYSE: CURO) is a leading consumer credit lender serving U.S. and Canadian customers for over 25 years. Our roots in the consumer finance market run deep. We’ve worked diligently to provide customers a variety of convenient, easily accessible financial services. Our decades of diversified data power a hard-to-replicate underwriting and scoring engine, mitigating risk across the full spectrum of credit products. We operate a number of brands including Cash Money®, LendDirect®, Heights Finance, Southern Finance, Covington Credit, Quick Credit and First Heritage Credit.

(CURO-NWS)

Investor Relations: Email: IR@curo.com

Source: CURO Group Holdings Corp.

Updated 3Q 2023 Outlook Ex-Flexiti Strengthen our Foundation Execute with Excellence Grow Responsibly Continue to maintain adequate liquidity and capacity for growth EOP Receivables: $1.23-1.28B Revenue: $165-170MM Net Charge-off: 17.0-19.5% Operating Expenses: $90-100M Note: There have been no material changes vs our prior published targets other than the removal of Flexiti from our 3Q 2023 outlook Updated 3Q 2023 targets to reflect the removal of Flexiti, our Canada POS Lending Segment, on August 31, 2023

Exhibit 99.3

UNAUDITED PRO FORMA COMBINED FINANCIAL INFORMATION

Curo Intermediate Holdings Corp. (“Seller”), a wholly owned subsidiary of CURO Group Holdings Corp. (the “Company”), entered into a Share Purchase Agreement dated August 2, 2023 and an Amendment to Share Purchase Agreement dated August 31, 2023 (collectively the “Purchase Agreement”), with Questrade Financial Group Inc. (“Purchaser”) pursuant to which Purchaser agreed to purchase from Seller all of the issued and outstanding equity interests of FLX Holding Corp. (“Flexiti”), which constitutes the entirety of the Company’s Canada point-of-sale lending segment, for a purchase price of approximately C$55 million, subject to an adjustment based on Flexiti’s tangible book value and certain other adjustments (the “Divestiture”). The Disposition closed on August 31, 2023. In connection with the Flexiti Divestiture, Seller has agreed to provide Purchaser with certain transition services for which the Seller will be paid certain variable fees (“Transition Services Agreement”).

The accompanying unaudited pro forma combined financial information should be read together with:

•The accompanying notes to the unaudited pro forma combined financial information;

•The Company’s historical consolidated financial statements and the accompanying notes included in the Quarterly Report on Form 10-Q for the three and six months ended June 30, 2023 filed with the Securities and Exchange Commission (the “SEC”) on August 3, 2023;

•The Company’s audited historical consolidated financial statements and the accompanying notes included in the Annual Report on Form 10-K as of and for the year ended December 31, 2022 filed with the SEC on March 10, 2023;

The preparation of the unaudited pro forma combined statement of operations for the years ended December 31, 2022 and 2021 and the unaudited pro forma financial information as of and for the six month period ended June 30, 2023 and related adjustments required management to make certain assumptions and estimates. The unaudited pro forma combined financial information is based upon available information and certain assumptions that the Company and management believes are reasonable under the circumstances. The accompanying unaudited pro forma combined statements of operations for the years ended December 31, 2022 and 2021 and the six month period ended June 30, 2023 have been prepared giving effect to the Divestiture as if the Divestiture had occurred on March 10, 2021, the date the Company acquired Flexiti. The accompanying unaudited pro forma combined balance sheet as of June 30, 2023 has been prepared giving effect to the Divestiture as if the Divestiture occurred on June 30, 2023.

An unaudited pro forma condensed combined statement of operations for the year ended December 31, 2020 is not presented here because the Company did not acquire Flexiti until March 10, 2021 and, therefore, they are not included in our consolidated results for the year ended December 31, 2020.

The unaudited pro forma combined financial statements are prepared in accordance with Article 11 of Regulation S-X. The pro forma adjustments are described in the accompanying notes and are based upon and derived from information and assumptions available at the time of the filing of the Current Report on Form 8-K to which these unaudited pro forma combined financial statements are attached.

The unaudited pro forma financial information is provided for illustrative purposes only and does not purport to represent what the actual consolidated results of operations of the Company would have been had the Divestiture occurred on the dates assumed, nor are they necessarily indicative of future consolidated results of operations. The unaudited pro forma combined statements of operations does not reflect the costs of any disintegration activities or benefits that may result from realization of future cost savings from the Divestiture.

Exhibit 99.3

UNAUDITED PRO FORMA COMBINED FINANCIAL INFORMATION

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

UNAUDITED PRO FORMA COMBINED BALANCE SHEET

AS OF June 30, 2023

(in thousands)

| | | | | | | | | | | | | | | | | |

| CURO Group Holdings Corp. Historical | | Transaction Accounting Adjustments

(Note 2a) | | CURO Group Holdings Corp. Pro Forma Combined |

| | |

| ASSETS | | | | | |

| Cash and cash equivalents | $ | 112,531 | | | $ | 16,435 | | Note 2b | $ | 128,966 | |

| Restricted cash | 109,484 | | | (33,109) | | | 76,375 | |

| Gross loans receivable | 2,139,865 | | | (912,250) | | | 1,227,615 | |

| Less: Allowance for loan losses | (272,615) | | | 62,323 | | | (210,292) | |

Loans receivable, net | 1,867,250 | | | (849,927) | | | 1,017,323 | |

| Income taxes receivable | 20,854 | | | 1,242 | | | 22,096 | |

| Prepaid expenses and other | 44,518 | | | 12,104 | | Note 2b | 56,622 | |

| Property and equipment, net | 28,418 | | | (2,592) | | | 25,826 | |

| Investment in Katapult | 18,368 | | | — | | | 18,368 | |

| Right of use asset - operating leases | 56,021 | | | (2,979) | | | 53,042 | |

| Deferred tax assets | 54,102 | | | (38,798) | | | 15,304 | |

| Goodwill | 277,069 | | | — | | | 277,069 | |

| Intangibles, net | 133,947 | | | (59,940) | | | 74,007 | |

| Other assets | 22,275 | | | (12,496) | | Note 2b | 9,779 | |

| Total Assets | $ | 2,744,837 | | | $ | (970,062) | | | $ | 1,774,775 | |

| LIABILITIES AND STOCKHOLDERS' (DEFICIT) EQUITY | | | | | |

| Liabilities | | | | | |

| Accounts payable and accrued liabilities | $ | 78,343 | | | $ | (24,174) | | | $ | 54,169 | |

| Deferred revenue | 36,793 | | | (33,423) | | | 3,370 | |

| Lease liability - operating leases | 56,585 | | | (3,403) | | | 53,182 | |

| Contingent consideration related to acquisition | 18,499 | | | (512) | | | 17,987 | |

| Income taxes payable | 788 | | | (788) | | | — | |

| Accrued interest | 39,306 | | | — | | | 39,306 | |

| Debt | 2,772,872 | | | (784,699) | | | 1,988,173 | |

| Other long-term liabilities | 10,016 | | | — | | | 10,016 | |

| Deferred tax liabilities | 8 | | | (7) | | | 1 | |

| Total Liabilities | 3,013,210 | | | (847,006) | | | 2,166,204 | |

| Commitments and contingencies | | | | | |

| Stockholders' (Deficit) Equity | | | | | |

| Preferred stock | — | | | — | | | — | |

| Common stock | 23 | | | — | | | 23 | |

| Treasury stock | (136,832) | | | — | | | (136,832) | |

| Paid-in capital | 127,939 | | | (270,627) | | | (142,688) | |

| Retained earnings | (227,900) | | | 159,645 | | | (68,255) | |

| Accumulated other comprehensive loss | (31,603) | | | (12,072) | | | (43,675) | |

| Total Stockholders' (Deficit) Equity | (268,373) | | | (123,054) | | | (391,427) | |

| Total Liabilities and Stockholders' (Deficit) Equity | $ | 2,744,837 | | | $ | (970,062) | | | $ | 1,774,775 | |

The accompanying notes are an integral part of the unaudited pro forma combined balance sheet.

Exhibit 99.3

UNAUDITED PRO FORMA COMBINED FINANCIAL INFORMATION

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

UNAUDITED PRO FORMA COMBINED STATEMENT OF OPERATIONS

FOR THE SIX MONTHS ENDED JUNE 30, 2023

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | |

| CURO Group Holdings Corp. Historical | | Transaction Accounting Adjustments

(Note 2c) | | CURO Group Holdings Corp. Pro Forma Combined |

| Revenue | | | | | |

| Interest and fees revenue | $ | 358,423 | | | $ | (72,353) | | | $ | 286,070 | |

| Insurance premiums and other income | 60,293 | | | (9,979) | | | 50,314 | |

| Total revenue | 418,716 | | | (82,332) | | | 336,384 | |

| Provision for losses | 142,530 | | | (30,411) | | | 112,119 | |

| Net revenue | 276,186 | | | (51,921) | | | 224,265 | |

| Operating expenses | | | | | |

| Salaries and benefits | 126,151 | | | (16,388) | | | 109,763 | |

| Occupancy | 22,939 | | | (710) | | | 22,229 | |

| Advertising | 4,306 | | | (340) | | | 3,966 | |

| Direct operations | 28,558 | | | (6,781) | | | 21,777 | |

| Depreciation and amortization | 18,162 | | | (7,433) | | | 10,729 | |

| Other operating expense | 26,229 | | | (257) | | | 25,972 | |

| Total operating expenses | 226,345 | | | (31,909) | | | 194,436 | |

| Other expense | | | | | |

| Interest expense | 125,044 | | | (30,539) | | | 94,505 | |

| Extinguishment or modification of debt costs | 8,864 | | | — | | | 8,864 | |

| Loss (gain) on equity investment | 5,547 | | | — | | | 5,547 | |

| | | | | |

| | | | | |

| Loss on change in fair value of contingent consideration | 2,728 | | | (2,728) | | | — | |

| Gain on sale | 2,027 | | | — | | | 2,027 | |

| Lease termination | 1,435 | | | — | | | 1,435 | |

| Total other expense | 145,645 | | | (33,267) | | | 112,378 | |

| Loss before income taxes | (95,804) | | | 13,255 | | | (82,549) | |

| Provision for income taxes | 22,994 | | | 3,513 | | Note 2e | 26,507 | |

| Net loss | $ | (118,798) | | | $ | 9,742 | | | $ | (109,056) | |

| | | | | |

| Basic loss per share: | $ | (2.91) | | | | Note 3 | $ | (2.67) | |

| Diluted loss per share: | $ | (2.91) | | | | Note 3 | $ | (2.67) | |

The accompanying notes are an integral part of the unaudited pro forma combined statement of operations.

Exhibit 99.3

UNAUDITED PRO FORMA COMBINED FINANCIAL INFORMATION

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

UNAUDITED PRO FORMA COMBINED STATEMENT OF OPERATIONS

FOR THE YEAR ENDED December 31, 2022

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | |

| CURO Group Holdings Corp Historical | | Transaction Accounting Adjustments (Note 2c) | | CURO Group Holdings Corp. Pro Forma Combined |

| Revenue | | | | | |

| Interest and fees revenue | $ | 905,407 | | | $ | (95,332) | | | $ | 810,075 | |

| Insurance and other income | 88,490 | | | (2,335) | | | 86,155 | |

| Other revenue | 32,021 | | | (8,779) | | | 23,242 | |

| Total revenue | 1,025,918 | | | (106,446) | | | 919,472 | |

| Provision for losses | 400,325 | | | (45,180) | | | 355,145 | |

| Net revenue | 625,593 | | | (61,266) | | | 564,327 | |

| Operating expenses | | | | | |

| Salaries and benefits | 281,636 | | | (25,365) | | | 256,271 | |

| Occupancy | 59,485 | | | (1,258) | | | 58,227 | |

| Advertising | 32,143 | | | (1,420) | | | 30,723 | |

| Direct operations | 64,128 | | | (14,768) | | | 49,360 | |

| Depreciation and amortization | 36,322 | | | (13,923) | | | 22,399 | |

| Other operating expense | 82,811 | | | (3,392) | | | 79,419 | |

| Total operating expenses | 556,525 | | | (60,126) | | | 496,399 | |

| Other expense (income) | | | | | |

| Interest expense | 185,661 | | | (40,641) | | | 145,020 | |

| Income from equity method investment | 3,985 | | | — | | | 3,985 | |

| | | | | |

| Goodwill impairment | 145,241 | | | (37,414) | | | 107,827 | |

| Loss on extinguishment of debt | 4,391 | | | (665) | | | 3,726 | |

| Gain on change in fair value of contingent consideration | (7,605) | | | 7,605 | | | — | |

| Gain on divestiture | (68,443) | | | — | | | (68,443) | |

| Total other expense | 263,230 | | | (71,115) | | | 192,115 | |

| Loss before income taxes | (194,162) | | | 69,975 | | | (124,187) | |

| (Benefit) provision for income taxes | (8,678) | | | 18,543 | | Note 2e | 9,865 | |

| Net loss | $ | (185,484) | | | $ | 51,432 | | | $ | (134,052) | |

| | | | | |

| Basic loss per share: | $ | (4.59) | | | | Note 3 | $ | (3.32) | |

| Diluted loss per share: | $ | (4.59) | | | | Note 3 | $ | (3.32) | |

The accompanying notes are an integral part of the unaudited pro forma combined statement of operations.

Exhibit 99.3

UNAUDITED PRO FORMA COMBINED FINANCIAL INFORMATION

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

UNAUDITED PRO FORMA COMBINED STATEMENT OF OPERATIONS

FOR THE YEAR ENDED December 31, 2021

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | |

| CURO Group Holdings Corp. Historical | | Transaction Accounting Adjustments

(Note 2c) | | CURO Group Holdings Corp. Pro Forma Combined |

| Revenue | | | | | |

| Interest and fees revenue | $ | 743,735 | | | $ | (32,289) | | | $ | 711,446 | |

| Insurance and other income | 49,411 | | | (421) | | | 48,990 | |

| Other revenue | 24,697 | | | (2,132) | | | 22,565 | |

| Total revenue | 817,843 | | | (34,842) | | | 783,001 | |

| Provision for losses | 245,668 | | | (24,638) | | | 221,030 | |

| Net revenue | 572,175 | | | (10,204) | | | 561,971 | |

| Operating expenses | | | | | |

| Salaries and benefits | 237,109 | | | (14,147) | | Note 2d | 222,962 | |

| Occupancy | 55,559 | | | (512) | | | 55,047 | |

| Advertising | 38,762 | | | (1,272) | | | 37,490 | |

| Direct operations | 60,056 | | | (14,380) | | | 45,676 | |

| Depreciation and amortization | 26,955 | | | (10,445) | | | 16,510 | |

| Other operating expense | 68,473 | | | (3,601) | | | 64,872 | |

| Total operating expenses | 486,914 | | | (44,357) | | | 442,557 | |

| Other expense (income) | | | | | |

| Interest expense | 97,334 | | | (14,993) | | | 82,341 | |

| Income from equity method investment | (3,658) | | | — | | | (3,658) | |

| Gain from equity method investment | (135,387) | | | — | | | (135,387) | |

| Loss on extinguishment of debt | 40,206 | | | — | | | 40,206 | |

| Loss on change in fair value of contingent consideration | 6,209 | | | — | | | 6,209 | |

| Total other (income) expense | 4,704 | | | (14,993) | | | (10,289) | |

| Income before income taxes | 80,557 | | | 49,146 | | | 129,703 | |

| Provision for income taxes | 21,223 | | | 13,024 | | Note 2e | 34,247 | |

| Net income | $ | 59,334 | | | $ | 36,122 | | | $ | 95,456 | |

| | | | | |

| Basic earnings per share: | $ | 1.44 | | | | Note 3 | $ | 2.32 | |

| Diluted earnings per share: | $ | 1.38 | | | | Note 3 | $ | 2.21 | |

The accompanying notes are an integral part of the unaudited pro forma combined statement of operations.

Exhibit 99.3

UNAUDITED PRO FORMA COMBINED FINANCIAL INFORMATION

Note 1 - Basis of Pro Forma Presentation

The unaudited pro forma combined financial statements are prepared in accordance with Article 11 of SEC Regulation S-X. The pro forma adjustments are described in the accompanying notes and are based upon and derived from information and assumptions available at the time of this filing on Form 8-K.

The unaudited pro forma financial information is based on financial statements prepared in accordance with U.S. generally accepted accounting principles, which are subject to change and interpretation. The unaudited pro forma combined financial statements were based on and derived from our historical consolidated financial statements, adjusted for certain transaction accounting adjustments. Actual adjustments, however, may differ materially from the information presented. Pro forma adjustments do not include allocations of corporate costs, as those are not directly attributable to the Divestiture. In addition, the unaudited pro forma financial information is based upon available information and assumptions that management considers to be reasonable, and such assumptions have been made solely for purposes of developing such unaudited pro forma financial information for illustrative purposes in compliance with the disclosure requirements of the SEC. The unaudited pro forma financial information is not necessarily indicative of what the financial position or statements of operations results would have actually been had the Divestiture occurred on the dates indicated. In addition, these unaudited pro forma combined financial statements should not be considered to be indicative of our future consolidated financial performance and statement of operations results. Further, the unaudited pro forma combined statement of operations does not reflect the costs of separation activities or benefits from the realization of future cost savings due to corporate cost savings expected to result from the Divestiture.

The accompanying unaudited pro forma combined statement of operations for six month period ended June 30, 2023 and unaudited pro forma combined statements of operations for the years ended December 31, 2022 and 2021 give effect to the Divestiture March 10, 2021, the date the Company acquired Flexiti. The accompanying unaudited pro forma combined balance sheet as of June 30, 2023 has been prepared giving effect to the Divestiture as having occurred on June 30, 2023.

Note 2 - Divestiture Accounting Adjustments

(a) Reflects the elimination of the assets, liability, and historical equity balances sold as part of the Divestiture, as of June 30, 2023. The amount of the actual loss will be calculated based on the net book value of the sold entities as of the closing of the Divestiture on August 31, 2023 and, therefore, would differ from the current estimate, as of June 30, 2023.

(b) Reflects the addition of (i) $41.7 million of cash related to purchase price received at closing, (ii) $16.2 million estimated closing tangible book value true up, and (iii) $0.1 million of cash received for excess unrestricted cash retained by Flexiti offset by (i) $11.5 million unrestricted cash retained by Flexiti, (ii) $10.6 million of deferred estimated closing tangible book value true up, (iii) $7.0 million other escrowed closing amounts and (iv) $12.5 million estimated transaction costs. The $10.6 million of deferred estimated closing tangible book value true up and $7.0 million other escrowed closing amounts are included in the unaudited pro forma financial information as a $14.5 million increase to Prepaid expenses and other and a $3.1 million increase to Other assets.

(c) Reflects the elimination of revenue and expenses associated with the Divestiture for the years ended December 31, 2022 and 2021 and the six months ended June 30, 2023.

(d) Includes a decrease of $0.3 million related to reimbursement of costs incurred associated with the Transition Services Agreement received from the Purchaser entered into as part of the Divestiture.

(e) Applies a 26.5% estimated blended tax rate to Transaction Accounting Adjustments for the Divestiture. The estimated blended tax rate consists of the Canadian federal income tax rate and an estimated combined provincial income tax rate driven by the apportionment factors applicable to each province.

Exhibit 99.3

UNAUDITED PRO FORMA COMBINED FINANCIAL INFORMATION

Note 3 - EPS

Pro forma basic and diluted earnings per share (in thousands, except per share data):

| | | | | | | | | | | |

| For the six months ended June 30, 2023 | For the year ended December 31, 2022 | For the year ended December 31, 2021 |

| Basic EPS | | | |

Combined pro forma net (loss) income | $ | (109,056) | | $ | (134,052) | | 95,456 | |

| CURO historical basic weighted average common shares outstanding | 40,893 | | 40,428 | | 41,155 | |

| Basic EPS | $ | (2.67) | | $ | (3.32) | | $ | 2.32 | |

| | | |

| Diluted EPS | | | |

| Combined pro forma net (loss) income | $ | (109,056) | | $ | (134,052) | | 95,456 | |

| CURO historical diluted weighted average common shares outstanding | — | | — | | 1,988 | |

| Pro forma weighted average common shares outstanding | 40,893 | | 40,428 | | 43,143 | |

| Diluted EPS | $ | (2.67) | | $ | (3.32) | | $ | 2.21 | |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

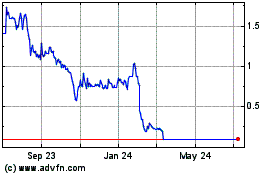

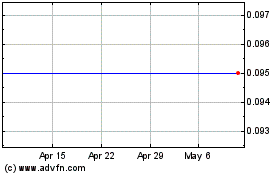

CURO (NYSE:CURO)

Historical Stock Chart

From Apr 2024 to May 2024

CURO (NYSE:CURO)

Historical Stock Chart

From May 2023 to May 2024