Form 8-K - Current report

November 08 2024 - 4:26PM

Edgar (US Regulatory)

00010478620000023632false00010478622024-11-082024-11-080001047862ed:ConsolidatedEdisonCompanyofNewYorkInc.Member2024-11-082024-11-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 8, 2024

Consolidated Edison, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| New York | | 1-14514 | | 13-3965100 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | | | | | | | |

| 4 Irving Place, | New York, | New York | | 10003 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (212) 460-4600

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities Registered Pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Consolidated Edison, Inc., | | ED | | New York Stock Exchange |

| Common Shares ($.10 par value) | | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

In November 2024, a subsidiary of Consolidated Edison, Inc., Orange and Rockland Utilities, Inc. (O&R), the New York State Department of Public Service (NYSDPS) and other parties entered into a joint proposal for new electric and gas rate plans for the three-year period January 2025 through December 2027 (the Joint Proposal). The Joint Proposal is subject to approval by the New York State Public Service Commission (NYSPSC). The following tables contain a summary of the Joint Proposal.

| | | | | |

| O&R New York – Electric | |

| Effective period | January 2025 – December 2027 |

| Base rate changes | Yr. 1 – $(13.1) million (a)

Yr. 2 – $24.8 million (a)

Yr. 3 – $44.1 million (a) |

Amortizations to income of net

regulatory (assets) and liabilities | Yr. 1 – $(4.5) million

Yr. 2 – $(5.4) million

Yr. 3 – $(6.4) million |

| Other revenue sources | Potential earnings adjustment mechanism incentives for energy efficiency and other potential incentives of up to:

Yr. 1 – $3.9 million

Yr. 2 – $4.7 million

Yr. 3 – $5.8 million

|

| Revenue decoupling mechanisms | Continuation of reconciliation of actual to authorized electric delivery revenues. |

| Recoverable energy costs | Continuation of current rate recovery of purchased power and fuel costs. |

| Negative revenue adjustments | Potential charges if certain performance targets relating to service, reliability, safety and other matters are not met:

Yr. 1 – $7.6 million

Yr. 2 – $8.5 million

Yr. 3 – $11.5 million |

Regulatory reconciliations | Reconciliation of expenses for pension and other postretirement benefits, environmental remediation costs, property taxes (b), energy efficiency program (c), major storms, low-income bill credits, uncollectible expenses (d), late payment charges (d), and certain other costs to amounts reflected in rates. |

| Net utility plant reconciliations | Target levels reflected in rates: Electric average net plant target Yr. 1 – $1,398 million Yr. 2 – $1,471 million Yr. 3 – $1,737 million |

| Average rate base | Yr. 1 – $1,293 million Yr. 2 – $1,393 million Yr. 3 – $1,646 million |

| Capital Investments | Yr. 1 – $311 million Yr. 2 – $349 million Yr. 3 – $315 million |

| Weighted average cost of capital (after-tax) | Yr. 1 – 7.25 percent

Yr. 2 – 7.28 percent

Yr. 3 – 7.31 percent |

| Authorized return on common equity | 9.75 percent |

| Earnings sharing | Most earnings above an annual earnings threshold of 10.25 percent are to be applied to reduce regulatory assets for environmental remediation and other costs accumulated in the rate year.

|

| Cost of long-term debt | Yr. 1 – 4.95 percent

Yr. 2 – 5.01 percent

Yr. 3 – 5.08 percent |

| Common equity ratio | 48 percent |

(a) The Joint Proposal recommends that these base rate changes may be implemented with no change in Yr. 1 and increases of $17.7 million in each of Yr. 2 and Yr. 3.

(b) Deferrals for property taxes are limited to 90 percent of the difference from amounts reflected in rates, subject to an annual maximum for the remaining difference of not more than a maximum number of basis points impact on return on common equity: Yr. 1 - 10.0 basis points; Yr. 2 - 7.5 basis points; and Yr. 3 - 5.0 basis points.

(c) Energy efficiency costs are deferred as regulatory assets and amortized over a 15-year period. Balances are reconciled to the revenue requirement effect of actual level of cost incurred to the rate plan targets. If the NYSPSC authorizes modified energy efficiency spending budgets over the course of the rate plan, O&R will defer the impact of any variance between the level in rates and the authorized budgets for collection or refund to customers in the next base rate case.

(d) Reconciliation of uncollectible expenses and late payment charges are subject to a combined annual threshold of $0.9 million. Once the threshold is met, O&R will defer the variance between actual uncollectible expense and late payment charge, and the level set forth in rates that is above the threshold. Recovery/refunds will be made via surcharge/sur-credit. Surcharge recovery is subject to an annual cap that produces no more than a 0.5 percent total customer bill impact.

| | | | | |

| O&R New York – Gas | |

| Effective period | January 2025 – December 2027 |

| Base rate changes | Yr. 1 – $3.6 million (a)

Yr. 2 – $18.0 million (a)

Yr. 3 – $16.5 million (a) |

| Amortization to income of net regulatory liabilities | Yr. 1 – $8.4 million

Yr. 2 – $8.2 million

Yr. 3 – $8 million |

| Other revenue sources | Potential positive rate adjustment for gas safety and performance of up to:

Yr. 1 – $1 million

Yr. 2 – $1.1 million

Yr. 3 – $1.2 million |

| Revenue decoupling mechanisms | Continuation of reconciliation of actual to authorized gas delivery revenues.

|

| Recoverable energy costs | Continuation of current rate recovery of purchased gas costs. |

| Negative revenue adjustments | Potential charges if performance targets relating to service, safety and other matters are not met:

Yr. 1 – $8.4 million

Yr. 2 – $9.4 million

Yr. 3 – $11.1 million |

Regulatory reconciliations | Reconciliation of expenses for pension and other postretirement benefits, environmental remediation costs, property taxes (b), energy efficiency program (c), low-income bill credits, uncollectible expenses (d), late payment charges (d), and certain other costs to amounts reflected in rates. |

| Net utility plant reconciliations | Target levels reflected in rates: Gas average net plant target Yr. 1 – $877 million Yr. 2 – $934 million Yr. 3 – $1,010 million |

| Average rate base | Yr. 1 – $720 million

Yr. 2 – $791 million

Yr. 3 – $863 million |

| Capital Investments | Yr. 1 – $121 million

Yr. 2 – $127 million

Yr. 3 – $110 million |

| Weighted average cost of capital (after-tax) | Yr. 1 – 7.25 percent

Yr. 2 – 7.28 percent

Yr. 3 – 7.31 percent |

| Authorized return on common equity | 9.75 percent |

| Earnings sharing | Most earnings above an annual earnings threshold of 10.25 percent are to be applied to reduce regulatory assets for environmental remediation and other costs accumulated in the rate year. |

| Cost of long-term debt | Yr. 1 – 4.95 percent

Yr. 2 – 5.01 percent

Yr. 3 – 5.08 percent |

| Common equity ratio | 48 percent |

(a) The Joint Proposal recommends that these base rate changes may be implemented with increases of: Yr. 1 – $10.4 million; Yr. 2 - $10.4 million; and Yr. 3 -$10.4 million.

(b) Deferrals for property taxes are limited to 90 percent of the difference from amounts reflected in rates, subject to an annual maximum for the remaining difference of not more than a maximum number of basis points impact on return on common equity: Yr. 1 - 10.0 basis points; Yr. 2 - 7.5 basis points; and Yr. 3 - 5.0 basis points.

(c) Energy efficiency costs are deferred as regulatory assets and amortized over a 15-year period. Balances are reconciled to the revenue requirement effect of actual level of cost incurred to the rate plan targets. If the NYSPSC authorizes modified energy efficiency spending budgets over the course of the rate plan, O&R will defer the impact of any variance between the level in rates and the authorized budgets for collection or refund to customers in the next base rate case.

(d) Reconciliation of uncollectible expenses and late payment charges are subject to a combined annual threshold of $0.5 million. Once the threshold is met, O&R will defer the variance between actual uncollectible expense and late payment charge, and the level set forth in rates that is above the threshold. Recovery/refunds will be made via surcharge/sur-credit. Surcharge recovery is subject to an annual cap that produces no more than a 0.5 percent total customer bill impact.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, each registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| CONSOLIDATED EDISON, INC. |

|

| CONSOLIDATED EDISON COMPANY OF NEW YORK, INC. |

| |

| By | | /s/ Joseph Miller |

| | Joseph Miller |

| | Vice President, Controller and Chief Accounting Officer |

Date: November 8, 2024

v3.24.3

Cover Page

|

Nov. 08, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 08, 2024

|

| Entity Registrant Name |

Consolidated Edison, Inc

|

| Entity Central Index Key |

0001047862

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

NY

|

| Entity File Number |

1-14514

|

| Entity Tax Identification Number |

13-3965100

|

| Entity Address, Address Line One |

4 Irving Place,

|

| Entity Address, City or Town |

New York,

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10003

|

| City Area Code |

212

|

| Local Phone Number |

460-4600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Shares ($.10 par value)

|

| Trading Symbol |

ED

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| CECONY |

|

| Entity Information [Line Items] |

|

| Entity Central Index Key |

0000023632

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_LegalEntityAxis=ed_ConsolidatedEdisonCompanyofNewYorkInc.Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

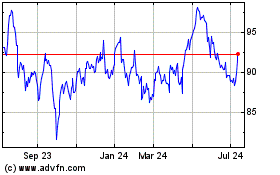

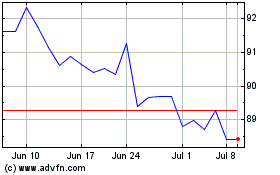

Consolidated Edison (NYSE:ED)

Historical Stock Chart

From Nov 2024 to Dec 2024

Consolidated Edison (NYSE:ED)

Historical Stock Chart

From Dec 2023 to Dec 2024