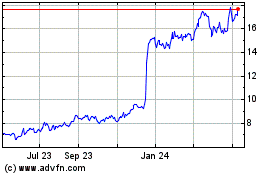

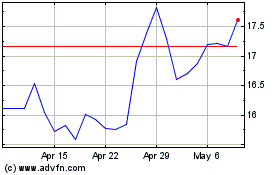

Compañia de Minas Buenaventura S.A.A. (“Buenaventura” or

“the Company”) (NYSE: BVN; Lima Stock Exchange: BUE.LM), Peru’s

largest publicly-traded precious metals mining company, today

announced results for the third quarter (3Q23) and nine-month

period ended September 30, 2023 (9M23). All figures have been

prepared in accordance with IFRS (International Financial Reporting

Standards) on a non-GAAP basis and are stated in U.S. dollars

(US$).

Third Quarter and Nine-Month 2023 Highlights:

- 3Q23 EBITDA from direct operations was US$ 53.3 million,

compared to US$ 22.2 million reported in 3Q22. 9M23 EBITDA from

direct operations reached US$ 121.9 million, compared to US$ 96.3

million reported in 9M22. 2022 EBITDA does not include US$ 300

million resulting from the sale of Buenaventura's 43.65% stake in

Yanacocha.

- 3Q23 net loss from direct operations reached US$ 24.3 million,

compared to a US$ 22.6 million net loss for the same period in

2022. 9M23 net income from direct operations was US$ 42.5 million,

compared to US$ 67.7 million net income for the 9M22.

- Buenaventura recorded US$ 51.3 million in Depreciation and

Amortization for the 3Q23: US$ 17.6 million was due to deferred

stripping related to the final open pit expansion works, which was

completely mined in September 2023, when mining activities at

Colquijirca’s Tajo Norte mine were suspended.

- Buenaventura's 9M23 consolidated copper production increased

35% YoY. Zinc production decreased by 65% YoY, lead decreased by

61% YoY, silver decreased by 19% YoY, and gold decreased by 17%

YoY.

- Buenaventura's cash position reached US$ 221.8 million and net

debt decreased to US$ 493.7 million with an average maturity of 2.7

years by quarter’s end, September 30, 2023.

- 3Q23 capital expenditures were US$ 59.8 million, compared to

US$ 37.2 million for the same period in 2022. 9M23 capital

expenditures reached US$ 145.7 million, compared to US$ 93.2

million in 9M22, and includes US$ 46.5 million related to the San

Gabriel Project and US$ 31.4 million related to the Yumpag

Project.

- The Yumpag project’s Environmental Impact Assessment (EIA) was

approved on September 7, 2023. The Company promptly submitted a

request to the Peruvian Ministry of Energy and Mines to obtain the

necessary authorizations to initiate the deposit’s exploitation.

However, 4Q23 targeted production initiation remains unchanged, as

resumed activities at the Uchucchacua processing plant also enables

Buenaventura to perform metallurgical tests for up to 124,600 tons

of ore from the Yumpag project’s pilot stope.

- Cerro Verde paid a total dividend of US$ 250 million on August

3, 2023. Buenaventura received US$ 49.0 million relative to its

stake in Cerro Verde.

Financial Highlights (in millions of US$, except EPS

figures):

3Q23

3Q22

Var %

9M23

9M22

Var %

Total Revenues

211.3

195.4

8%

570.0

578.4

-1%

Operating Income

-29.5

-20.0

48%

-39.0

-52.0

-25%

EBITDA Direct Operations (1)

53.3

22.2

N.A.

121.9

96.3

27%

EBITDA Including Affiliates (1)

152.7

78.2

95%

418.5

369.8

13%

Net Income (2)

-28.0

-19.8

42%

29.6

548.5

-95%

EPS (3)

-0.11

-0.08

42%

0.12

2.16

-95%

(1)

Does not include US$ 300 million from the

sale of Buenaventura’s stake in Yanacocha.

(2)

Net Income attributable to owners of the

parent

(3)

As of September 30, 2023, Buenaventura had

a weighted average number of shares outstanding of 253,986,867.

Operating Revenues

3Q23 net sales were US$ 211.3 million, compared to US$ 195.4

million in 3Q22; a year-on-year increase resulting from improved

copper volume sold.

The Company recorded a negative US$ 15.3 million provisional

price adjustment for the accumulated first nine months of 2023.

This is comprised of US$ 13.7 million in fair value of accounts

receivables and US$ 1.5 million in adjustments to prior period

liquidations. This compares to a negative US$ 40.4 million

adjustment for the accumulated first nine months of 2022.

Operating Highlights

3Q23

3Q22

Var %

9M23

9M22

Var %

Net Sales (millions of US$)

211.3

195.4

8%

570.0

577.1

-1%

Average Gold Price (US$/oz.) Direct

Operations (1) (2)

1,921

1,678

14%

1,927

1,794

7%

Average Gold Price (US$/oz.) incl.

Associated (2) (3)

1,917

1,677

14%

1,925

1,794

7%

Average Silver Price (US$/oz.)

(2)

25.67

17.33

48%

24.30

21.32

14%

Average Lead Price (US$/MT) (2)

2,225

1,713

30%

2,030

2,093

-3%

Average Zinc Price (US$/MT) (2)

1,762

3,412

-48%

2,152

3,983

-46%

Average Copper Price (US$/MT)

(2)

8,291

7,261

14%

8,689

8,685

0%

Volume Sold

3Q23

3Q22

Var %

9M23

9M22

Var %

Gold Oz Direct Operations (1)

33,265

45,807

-27%

102,700

123,692

-17%

Gold Oz incl. Associated (3)

41,780

54,399

-23%

117,239

148,778

-21%

Silver Oz

1,743,629

1,954,000

-11%

4,666,199

5,655,367

-17%

Lead MT

1,269

4,129

-69%

4,799

12,530

-62%

Zinc MT

3,029

8,061

-62%

8,324

24,871

-67%

Copper MT

17,802

11,449

55%

41,940

31,512

33%

(1)

Buenaventura Consolidated figure includes

100% of Buenaventura’s operating units, 100% of La Zanja and 100%

of El Brocal.

(2)

The realized price takes into account the

adjustments of quotational periods.

(3)

Considers 100% of Buenaventura’s operating

units, 100% of La Zanja, 100% of El Brocal and 40.095% of

Coimolache.

Production and Operating Costs

Buenaventura’s 3Q23 equity gold production was 43,449 ounces,

compared to 55,837 ounces produced in 3Q22, primarily due to

decreased production at Tambomayo and La Zanja. 3Q23 silver

production decreased by 12% primarily due to Julcani and Tambomayo

performance. 3Q23 lead and zinc production decreased by 66% and

62%, respectively, due to decreased production at Tambomayo and El

Brocal. The Company’s 3Q23 equity copper production was 34,168 MT,

compared to 28,909 MT produced in 3Q22, due to increased production

at El Brocal and Cerro Verde.

Equity Production

3Q23

3Q22

Var %

9M23

9M22

Var %

Gold Oz Direct Operations(1)

33,978

47,057

-28%

105,930

128,131

-17%

Gold Oz including Associated(2)

Companies

43,449

55,837

-22%

121,884

152,726

-20%

Silver Oz Direct Operations(1)

1,472,907

1,664,600

-12%

3,984,040

5,034,531

-21%

Lead MT Direct Operations(1)

1,279

3,738

-66%

4,575

11,628

-61%

Zinc MT Direct Operations(1)

2,663

6,937

-62%

7,706

22,336

-66%

Copper MT Direct Operations(1)

11,565

7,438

55%

27,200

20,152

35%

Copper MT including Associated

Companies(3)

34,168

28,909

18%

94,336

84,065

12%

Consolidated

Production

3Q23

3Q22

Var %

9M23

9M22

Var %

Gold Oz(4)

36,228

49,789

-27%

111,574

134,261

-17%

Silver Oz(4)

1,933,025

1,906,679

1%

4,857,709

5,996,245

-19%

Lead MT(4)

1,620

4,340

-63%

5,408

13,698

-61%

Zinc MT(4)

3,762

9,129

-59%

10,275

29,511

-65%

Copper MT(4)

18,826

12,108

55%

44,277

32,805

35%

(1)

Buenaventura’s Direct Operations includes

100% of Buenaventura’s operating units, 100% of La Zanja and 61.43%

of El Brocal.

(2)

Based on 100% of Buenaventura´s operating

units, 100% of La Zanja, 61.43% of El Brocal and 40.095% of

Coimolache.

(3)

Based on 100% of Buenaventura´s operating

units, 61.43% of El Brocal and 19.58% of Cerro Verde.

(4)

Based on 100% of Buenaventura’s operating

units, 100% of La Zanja and 100% of El Brocal

Tambomayo (100% owned by Buenaventura)

Production

3Q23

3Q22

Var %

9M23

9M22

Var %

Gold

Oz

8,127

13,755

-41%

29,623

41,973

-29%

Silver

Oz

301,963

546,256

-45%

1,237,001

1,399,472

-12%

Cost Applicable to

Sales

3Q23

3Q22

Var %

9M23

9M22

Var %

Gold

US$/Oz

1,891

982

93%

1,357

978

39%

Tambomayo 3Q23 gold production decreased 41% year on year

aligned with the Company’s mine plan for this asset, while silver

production decreased 45% year on year and by 12% for the first nine

months of 2023 compared to the same period of 2022 due to lower

than planned mining rate within the mine's upper zone, which

required more extensive rehabilitation to enable access to

high-grade ore. Cost Applicable to Sales (CAS) increased to 1,891

US$/Oz in 3Q23 from 982 US$/Oz in 3Q22. This increase was primarily

due to decreased volume sold in 3Q23.

Orcopampa (100% owned by Buenaventura)

Production

3Q23

3Q22

Var %

9M23

9M22

Var %

Gold

Oz

20,576

20,164

2%

60,547

56,944

6%

Silver

Oz

7,168

8,247

-13%

22,028

23,437

-6%

Cost Applicable to

Sales

3Q23

3Q22

Var %

9M23

9M22

Var %

Gold

US$/Oz

970

803

21%

973

911

7%

3Q23 gold production was in line with 3Q22 and with the planned

mining sequence. Cost Applicable to Sales (CAS) increased to 970

US$/Oz in 3Q23, compared to 803 US$/Oz in 3Q22, primarily due to

lower gold grades in 2023 compared to 2022.

La Zanja (100% owned by Buenaventura)

Production

3Q23

3Q22

Var %

9M23

9M22

Var %

Gold

Oz

1,692

8,786

-81%

6,772

19,452

-65%

Silver

Oz

3,681

31,665

-88%

15,633

85,347

-82%

Cost Applicable to

Sales

3Q23

3Q22

Var %

9M23

9M22

Var %

Gold

US$/Oz

1,140

1,892

-40%

1,679

1,914

-12%

3Q23 gold production decreased by 81% year on year, in line with

2023 estimates, as mining and ore stockpiling was suspended in

4Q22. 3Q23 Cost Applicable to Sales (CAS) was 1,140 US$/Oz, a

decrease from 1,892 US$/Oz gold production in 3Q22 as only pad

leaching and water treatment are being performed at the property,

as well as exploration.

Coimolache (40.10% owned by Buenaventura)

Production

3Q23

3Q22

Var %

9M23

9M22

Var %

Gold

Oz

23,621

21,899

8%

39,789

61,341

-35%

Silver

Oz

87,185

76,133

15%

176,755

228,832

-23%

Cost Applicable to

Sales

3Q23

3Q22

Var %

9M23

9M22

Var %

Gold

US$/Oz

1,083

1,710

-37%

1,711

1,288

33%

Coimolache 3Q23 gold production increased by 8% year-over-year,

due to increased treated ore, higher gold grades and accelerated

gold extraction from the leach pad. Cost Applicable to Sales (CAS)

therefore decreased to 1,083 US$/Oz in 3Q23, from 1,710 US$/Oz in

3Q22.

Uchucchacua (100% owned by Buenaventura)

Production

3Q23

3Q22

Var %

9M23

9M22

Var %

Silver

Oz

N.A.

N.A.

N.A.

N.A.

N.A.

N.A.

Zinc

MT

N.A.

N.A.

N.A.

N.A.

N.A.

N.A.

Lead

MT

N.A.

N.A.

N.A.

N.A.

N.A.

N.A.

Cost Applicable to

Sales

3Q23

3Q22

Var %

9M23

9M22

Var %

Silver

US$/Oz

N.A.

N.A.

N.A.

N.A.

N.A.

N.A.

Buenaventura submitted Uchucchacua’s updated mine plan to the

Peruvian Ministry of Energy and Mines on August 28, 2023.

Buenaventura initiated a short ore processing campaign at the

processing plant, ensuring plant operational readiness to process

ore from Uchucchacua and Yumpag during the 4Q23. Exploration and

mine development progressed as scheduled during 3Q23.

The Yumpag project’s Environmental Impact Assessment (EIA) was

approved on September 7, 2023. The Company promptly submitted a

request to the Peruvian Ministry of Energy and Mines to obtain the

necessary authorizations to initiate the deposit’s exploitation.

4Q23 targeted production initiation remains unchanged, as resumed

activities at the Uchucchacua processing plant also enables

Buenaventura to perform metallurgical tests for up to 124,600 tons

of ore from the Yumpag project’s pilot stope.

Yumpag’s ore concentrates will be processed at the Rio Seco

plant to reduce manganese content. The Rio Seco plant is scheduled

to resume operations in November 2023.

Julcani (100% owned by Buenaventura)

Production

3Q23

3Q22

Var %

9M23

9M22

Var %

Silver

Oz

427,269

692,876

-38%

1,317,895

1,994,565

-34%

Cost Applicable to

Sales

3Q23

3Q22

Var %

9M23

9M22

Var %

Silver

US$/Oz

26.09

13.80

89%

22.40

14.55

54%

3Q23 silver production decreased 38% year on year primarily due

to a negative geology reconciliation with decreased treated ore.

3Q23 Cost Applicable to Sales (CAS) was 26.09 US$/Oz, compared to

13.80 US$/Oz in 2Q22; an 89% year on year increase due to decreased

volume sold.

Exploration and development of Julcani’s Rosario sector at 610

level began during 3Q23. This new zone includes gold and copper

which Buenaventura will begin processing during the fourth quarter

2023. The Company will also submit a related reserves and resources

analysis by year end 2023.

El Brocal (61.43% owned by Buenaventura)

Production

3Q23

3Q22

Var %

9M23

9M22

Var %

Copper

MT

18,826

12,108

55%

44,277

32,805

35%

Zinc

MT

2,849

5,683

-50%

6,661

18,601

-64%

Silver

Oz

1,192,944

627,635

90%

2,265,152

2,493,424

-9%

Cost Applicable to

Sales

3Q23

3Q22

Var %

9M23

9M22

Var %

Copper

US$/MT

6,029

6,690

-10%

6,290

6,676

-6%

Zinc

US$/MT

1,924

2,698

-29%

1,859

2,931

-37%

El Brocal 3Q23 copper production increased by 55% year on year

as underground mine production ramp-up continued ahead of

expectations during the quarter. Transitional ore from the open pit

also had a higher than estimated copper content with improved

metallurgical recovery. Buenaventura maintains its targeted

underground mine 10,000 tpd exploitation rate for 4Q23.

3Q23 silver production increased by 90% year on year in line

with the 2023 planned mining sequence.

3Q23 zinc production decreased by 50% year on year as part as

the planned transition to copper from polymetallic ore. On October

3, 2023, Buenaventura submitted a notice to the Peruvian Ministry

of Energy and Mines (MINEM) for the temporary suspension of mining

activities at Colquijirca’s Tajo Norte mine for up to three years

due to approval delay of Colquijirca’s Modification of

Environmental Impact Assessment. Buenaventura expects to now

process 100% of the El Brocal lead and zinc inventories by year end

2023 with the remaining open pit copper inventories expected in

1Q24. In the 4Q23, the company will recognize the deferred

stripping costs associated with lead and zinc inventories, which

are expected to be in line with the amortization reported in the

3Q23.

2Q23 Copper Cost Applicable to Sales (CAS) decreased by 10% year

on year due to increased volume sold.

Share in Associated Companies

Buenaventura’s share in associated companies was US$ 46.4

million in 3Q23, compared with US$ 20.4 million in 3Q22, comprised

of:

Share in Associates’ Results (in US$

millions)

3Q23

3Q22

Var %

9M23

9M22

Var %

Cerro Verde

44.4

20.7

N.A.

122.3

120.1

2%

Coimolache

2.5

-0.2

N.A.

-7.7

0.3

N.A.

Other minor

-0.5

0.0

N.A.

-1.2

-2.2

-45%

Total

46.4

20.4

N.A.

113.4

118.1

-4%

CERRO VERDE (19.58% owned by Buenaventura)

3Q23 copper production was 115,441 MT, 22,603 MT of which is

attributable to Buenaventura; a 5% increase as compared to 109,655

MT produced in 3Q22, 21,471 MT of which was attributable to

Buenaventura.

Cerro Verde reported US$ 225.5 million net income in 3Q23,

compared to US$ 105.5 million net income in 3Q22. This is primarily

due to a 40% year on year net sales increase, primarily due to a

higher average realized copper price of US$ 3.77 per pound in the

third quarter of 2023, compared to US$ 3.14 per pound in the third

quarter of 2022, as well as an 11% increase in volume of copper

sold. This increase was partially offset by a year-on-year cost of

sales increase due to an inventory variation, and higher tax paid

during the quarter.

3Q23 Cerro Verde capital expenditures were US$ 70.8 million.

COIMOLACHE (40.10% owned by Buenaventura)

Coimolache reported US$ 6.6 million in 3Q23 net income, compared

to US$ 1.0 million net loss in 3Q22.

SAN GABRIEL Project

3Q23 and 9M23 capital expenditures was US$ 22.4 million and US$

46.5 million, respectively, primarily related to earthworks and

construction-related water dam excavation. The Company has also

invested an additional US$ 40.0 million in the project as advance

payment for equipment manufacturing, primarily related to the

processing plant. This amount is reported within Buenaventura’s

financial statements as accounts receivable and will be

reclassified as CAPEX once the equipment arrives at the

project.

The underground mining tender process was completed during 3Q23.

Personnel hiring and mobilization is in progress, and contractors

will begin field works during 4Q23.

Item

Description

Progress as of:

1Q23

2Q23

3Q23

1

Engineering

66%

81%

90%

2

Procurement

85%

85%

89%

3

Construction

3%

7%

14%

4

Commissioning

0%

0%

0%

Total

15%

23%

28%

Company Description

Compañía de Minas Buenaventura S.A.A. is Peru’s largest,

publicly traded precious and base metals Company and a major holder

of mining rights in Peru. The Company is engaged in the

exploration, mining development, processing and trade of gold,

silver and other base metals via wholly-owned mines and through its

participation in joint venture projects. Buenaventura currently

operates several mines in Peru (Orcopampa*, Uchucchacua*, Julcani*,

Tambomayo*, La Zanja*, El Brocal and Coimolache).

The Company owns 19.58% of Sociedad Minera Cerro Verde, an

important Peruvian copper producer (a partnership with

Freeport-McMorRan Inc. and Sumitomo Corporation).

For a printed version of the Company’s 2022 Form 20-F, please

contact the investor relations contacts on page 1 of this report or

download the PDF format file from the Company’s web site at

www.buenaventura.com.

(*) Operations wholly owned by Buenaventura

Note on Forward-Looking Statements

This press release and related conference call contain, in

addition to historical information, forward-looking statements

including statements related to the Company’s ability to manage its

business and liquidity during and after the COVID-19 pandemic, the

impact of the COVID-19 pandemic on the Company’s results of

operations, including net revenues, earnings and cash flows, the

Company’s ability to reduce costs and capital spending in response

to the COVID-19 pandemic if needed, the Company’s balance sheet,

liquidity and inventory position throughout and following the

COVID-19 pandemic, the Company’s prospects for financial

performance, growth and achievement of its long-term growth

algorithm following the COVID-19 pandemic, future dividends and

share repurchases.

This press release may also contain forward-looking information

(as defined in the U.S. Private Securities Litigation Reform Act of

1995) that involve risks and uncertainties, including those

concerning the Company’s, Cerro Verde’s costs and expenses, results

of exploration, the continued improving efficiency of operations,

prevailing market prices of gold, silver, copper and other metals

mined, the success of joint ventures, estimates of future

explorations, development and production, subsidiaries’ plans for

capital expenditures, estimates of reserves and Peruvian political,

economic, social and legal developments. These forward-looking

statements reflect the Company’s view with respect to the

Company’s, Cerro Verde’s future financial performance. Actual

results could differ materially from those projected in the

forward-looking statements as a result of a variety of factors

discussed elsewhere in this Press Release.

**Tables to follow**

APPENDIX 1

Equity Participation in

Subsidiaries and Associates (as of September 30, 2023)

BVN

Operating

Equity %

Mines / Business

El Molle Verde S.A.C*

100.00

Trapiche Project

Minera La Zanja S.A*

100.00

La Zanja

Sociedad Minera El Brocal S.A.A*

61.43

Colquijirca and Marcapunta

Compañía Minera Coimolache S.A**

40.10

Tantahuatay

Sociedad Minera Cerro Verde S.A.A**

19.58

Cerro Verde

Processadora Industrial Rio Seco S.A*

100.00

Rio Seco chemical plant

Consorcio Energético de Huancavelica

S.A*

100.00

Energy – Huanza Hydroelectrical

plant

(*) Consolidated (**) Equity

Accounting

APPENDIX 2

Gold Production

Mining Unit

Operating Results

Unit

3Q23

3Q22

△%

9M23

9M22

△ %

Underground

Tambomayo

Ore Milled

DMT

143,469

161,764

-11%

435,103

468,323

-7%

Ore Grade

Gr/MT

2.22

3.00

-26%

2.57

3.17

-19%

Recovery Rate

%

79.35

88.26

-10%

82.08

87.97

-7%

Ounces Produced

Oz

8,127

13,755

-41%

29,623

41,973

-29%

Orcopampa

Ore Milled

DMT

74,026

63,736

16%

213,474

180,342

18%

Ore Grade

Gr/MT

8.96

10.16

-12%

9.19

10.00

-8%

Recovery Rate

%

96.48

96.90

0%

96.01

98.17

-2%

Ounces Produced*

Oz

20,576

20,164

2%

60,547

56,944

6%

Marcapunta

Ore Milled

DMT

776,985

794,447

-2%

2,465,994

2,174,456

13%

Ore Grade

Gr/MT

0.88

0.70

25%

0.64

0.65

-2%

Recovery Rate

%

24.86

38.72

-36%

28.09

34.02

-17%

Ounces Produced*

Oz

5,431

7,085

-23%

13,970

15,711

-11%

Open Pit

La Zanja

Ounces Produced

Oz

1,692

8,786

-81%

6,772

19,452

-65%

Tajo Norte Cu - Ag

Ounces Produced

Oz

402

-

N.A.

661

181

N.A.

Coimolache

Ounces Produced

Oz

23,621

21,899

8%

39,789

61,341

-35%

Silver Production

Mining Unit

Operating Results

Unit

3Q23

3Q22

△%

9M23

9M22

△ %

Underground

Tambomayo

Ore Milled

DMT

143,469

161,764

-11%

435,103

468,323

-7%

Ore Grade

Oz/MT

2.55

3.54

-28%

3.29

3.13

5%

Recovery Rate

%

82.04

96.43

-15%

85.84

95.54

-10%

Ounces Produced

Oz

301,963

546,256

-45%

1,237,001

1,399,472

-12%

Orcopampa

Ore Milled

DMT

74,026

63,736

16%

213,474

180,342

18%

Ore Grade

Oz/MT

0.13

0.17

-27%

0.14

0.18

-23%

Recovery Rate

%

75.79

73.54

3%

74.27

72.54

2%

Ounces Produced

Oz

7,168

8,247

-13%

22,028

23,437

-6%

Uchucchacua

Ore Milled

DMT

-

-

N.A.

-

-

N.A.

Ore Grade

Oz/MT

-

-

N.A.

-

-

N.A.

Recovery Rate

%

-

-

N.A.

-

-

N.A.

Ounces Produced

Oz

-

-

N.A.

-

-

N.A.

Julcani

Ore Milled

DMT

31,268

34,691

-10%

87,663

98,294

-11%

Ore Grade

Oz/MT

14.25

20.36

-30%

15.63

20.66

-24%

Recovery Rate

%

95.81

98.10

-2%

96.04

98.22

-2%

Ounces Produced*

Oz

427,269

692,876

-38%

1,317,895

1,994,565

-34%

Marcapunta

Ore Milled

DMT

776,985

794,447

-2%

2,465,994

2,174,456

13%

Ore Grade

Oz/MT

0.94

0.98

-4%

0.91

0.88

3%

Recovery Rate

%

58.70

55.65

5%

56.15

53.28

5%

Ounces Produced

Oz

428,293

442,811

-3%

1,259,899

1,036,547

22%

Open Pit

Tajo Norte Cu - Ag

Ore Milled

DMT

354,994

-

N.A.

478,455

156,342

N.A.

Ore Grade

Oz/MT

2.58

-

N.A.

2.24

2.15

4%

Recovery Rate

%

56.71

-

N.A.

55.51

53.45

4%

Ounces Produced

Oz

601,473

-

N.A.

682,291

178,769

N.A.

Tajo Norte Pb - Zn

Ore Milled

DMT

162,367

425,835

-62%

366,699

1,486,286

-75%

Ore Grade

Oz/MT

1.97

0.84

N.A.

1.56

1.61

-3%

Recovery Rate

%

51.94

69.56

-25%

58.92

58.29

1%

Ounces Produced

Oz

163,178

370,460

-56%

322,962

1,463,744

-78%

La Zanja

Ounces Produced

Oz

3,681

31,665

-88%

15,633

85,347

-82%

Coimolache

Ounces Produced

Oz

87,185

76,133

15%

176,755

228,832

-23%

Lead Production

Mining Unit

Operating Results

Unit

3Q23

3Q22

△%

9M23

9M22

△ %

Underground

Tambomayo

Ore Milled

DMT

143,469

161,764

-11%

435,103

468,323

-7%

Ore Grade

%

0.57

1.81

-69%

0.77

1.87

-59%

Recovery Rate

%

75.05

90.25

-17%

83.41

90.82

-8%

MT Produced

MT

603

2,639

-77%

2,851

7,970

-64%

Uchucchacua

Ore Milled

DMT

-

-

N.A.

-

-

N.A.

Ore Grade

%

-

-

N.A.

-

-

N.A.

Recovery Rate

%

-

-

N.A.

-

-

N.A.

MT Produced

MT

-

-

N.A.

-

-

N.A.

Julcani

Ore Milled

DMT

31,268

34,691

-10%

87,663

98,294

-11%

Ore Grade

%

0.48

0.44

8%

0.51

0.40

26%

Recovery Rate

%

88.79

91.04

-2%

88.95

91.46

-3%

Ounces Produced*

MT

132

140

-5%

398

363

9%

Open Pit

Tajo Norte Pb - Zn

Ore Milled

DMT

162,367

425,835

-62%

366,699

1,486,286

-75%

Ore Grade

%

1.63

1.04

57%

1.49

0.96

55%

Recovery Rate

%

34.08

41.61

-18%

40.22

39.51

2%

MT Produced

MT

885

1,781

-50%

2,160

5,584

-61%

Zinc Production

Mining Unit

Operating Results

Unit

3Q23

3Q22

△%

9M23

9M22

△ %

Underground

Tambomayo

Ore Milled

DMT

143,469

161,764

-11%

435,103

468,323

-7%

Ore Grade

%

0.87

2.44

-64%

1.06

2.61

-59%

Recovery Rate

%

71.98

87.43

-18%

77.50

89.41

-13%

MT Produced

MT

913

3,446

-74%

3,614

10,910

-67%

Uchucchacua

Ore Milled

DMT

-

-

N.A.

-

-

N.A.

Ore Grade

%

-

-

N.A.

-

-

N.A.

Recovery Rate

%

-

-

N.A.

-

-

N.A.

MT Produced

MT

-

-

N.A.

-

-

N.A.

Open Pit

Tajo Norte Pb - Zn

Ore Milled

DMT

162,367

425,835

-62%

366,699

1,486,286

-75%

Ore Grade

%

4.09

2.66

54%

3.61

2.44

48%

Recovery Rate

%

42.97

59.70

-28%

51.87

53.20

-2%

MT Produced

MT

2,849

6,403

-56%

6,661

19,321

-66%

Copper Production

Mining Unit

Operating Results

Unit

3Q23

3Q22

△%

9M23

9M22

△ %

Underground

Marcapunta

Ore Milled

DMT

776,985

794,447

-2%

2,465,994

2,174,456

13%

Ore Grade

%

1.75

1.78

-2%

1.70

1.72

-1%

Recovery Rate

%

84.71

85.60

-1%

85.57

84.99

1%

MT Produced

MT

11,501

12,108

-5%

35,891

31,709

13%

Tajo Norte Cu - Ag

Ore Milled

DMT

354,994

-

N.A.

478,455

156,342

N.A.

Ore Grade

%

2.86

-

N.A.

2.49

1.13

N.A.

Recovery Rate

%

59.71

-

N.A.

59.89

61.97

-3%

MT Produced

MT

7,325

-

N.A.

8,387

1,096

N.A.

APPENDIX 3: Adjusted EBITDA Reconciliation (in thousand

US$)

3Q23

3Q22

9M23

9M22

Net Income

-24,498

-22,487

42,953

547,593

Add / Subtract:

77,758

44,733

78,961

-151,322

Income from sale of investment in

Yanacocha

0

0

-

300,000

Depreciation and Amortization in cost of

sales

51,264

41,477

121,816

131,531

Provision (credit) for income tax, net

-1,264

-16,296

-2,070

-35,198

Interest expense

13,381

12,641

43,455

42,092

Loss (gain) on currency exchange

difference

31,176

27,961

-3,450

3,086

Provision of bonuses and compensations

4,447

7,260

10,391

11,964

Loss (gain) from discontinued

operations

167

-62

-439

-479,869

Workers' participation provision

2,899

-2,666

4,691

271

Depreciation and amortization in

administration expenses

651

600

1,943

1,816

Depreciation and Amortization in other,

net

30

25

79

76

Provision (reversal) for contingencies

-240

1,960

-5,534

3,805

Share in associated companies by the

equity method, net

-46,375

-20,442

-113,368

-118,149

Write-off of fixed assets

632

4

870

322

Impairment (reversal) of inventories

23,112

-6,392

26,650

-1,508

Interest income

-2,122

-1,337

-6,073

-11,561

EBITDA Buenaventura Direct

Operations

53,260

22,246

121,914

396,271

EBITDA Cerro Verde (19.58%)

95,953

52,321

296,566

261,100

EBITDA Coimolache (40.095%)

3,528

3,667

-3

12,392

EBITDA Buenaventura + All

Associates

152,741

78,235

418,477

669,763

*Cerro Verde’s EBITDA accounts for D&A related to the

capitalization of the stripping.

Note:

EBITDA (Buenaventura Direct Operations) consists of earnings

before net interest, taxes, depreciation and amortization, share in

associated companies, net, loss on currency exchange difference,

other, net, provision for workers’ profit sharing and provision for

long-term officers’ compensation.

EBITDA (including associated companies) consists of EBITDA

(Buenaventura Direct Operations), plus (1) Buenaventura’s equity

share of EBITDA (Cerro Verde), plus (2) Buenaventura’s equity share

of EBITDA (Coimolache). All EBITDA mentioned were similarly

calculated using financial information provided to Buenaventura by

the associated companies.

Buenaventura presents EBITDA (Buenaventura Direct Operations)

and EBITDA (including affiliates) to provide further information

with respect to its operating performance and the operating

performance of its equity investees, the affiliates. EBITDA

(Buenaventura Direct Operations) and EBITDA (including affiliates)

are not a measure of financial performance under IFRS and may not

be comparable to similarly titled measures of other companies. You

should not consider EBITDA (Buenaventura Direct Operations) and

EBITDA (including affiliates) as alternatives to operating income

or net income determined in accordance with IFRS, as an indicator

of Buenaventura’s, affiliates operating performance, or as an

alternative to cash flows from operating activities.

APPENDIX 4: COST APPLICABLE TO SALES RECONCILIATION

Reconciliation of Costs Applicable to Sales and Cost

Applicable to Sales per Unit Sold

Cost applicable to sales consists of cost of sales, excluding

depreciation and amortization, plus selling expenses. Cost

applicable to sales per unit sold for each mine consists of cost

applicable to sales for a particular metal produced at a given mine

divided by the volume of such metal produced at such mine in the

specified period. We note that cost applicable to sales is not

directly comparable to the cash operating cost figures disclosed in

previously furnished earnings releases.

Cost applicable to sales and Cost applicable to sales per unit

of mineral sold are not measures of financial performance under

IFRS and may not be comparable to similarly titled measures of

other companies. We consider Cost applicable to sales and Cost

applicable to sales per unit of mineral sold to be key measures in

managing and evaluating our operating performance. These measures

are widely reported in the precious metals industry as a benchmark

for performance, but do not have standardized meanings. You should

not consider Cost applicable to sales or Cost applicable to sales

per unit of mineral sold as alternatives to cost of sales

determined in accordance with IFRS, as indicators of our operating

performance. Cost applicable to sales and Cost applicable to sales

per unit of mineral sold are calculated without adjusting for

by-product revenue amounts.

Operations’ Cost applicable to sales does not include operating

cost for those months during which Buenaventura’s operations were

suspended due to COVID-19, as these have been classified as

“Unabsorbed costs due to production stoppage” within the financial

statements.

The tables below set forth (i) a reconciliation of consolidated

Cost of sales, excluding depreciation and amortization to

consolidated Cost applicable to sales, (ii) reconciliations of the

components of Cost applicable to sales (by mine and mineral) to the

corresponding consolidated line items set forth on our consolidated

statements of profit or loss for the three and twelve months ended

December 31, 2022 and 2021 and (iii) reconciliations of Cost of

sales, excluding depreciation and amortization to Cost applicable

to sales for each of our mining units. The amounts set forth in

Cost applicable to sales and Cost applicable to sales per unit sold

for each mine and mineral indicated in the tables below can be

reconciled to the amounts set forth on our consolidated statements

of profit or loss for the three and twelve months ended December

31, 2021 and 2022 by reference to the reconciliations of Cost of

sales, excluding depreciation and amortization (by mine and

mineral), Selling Expenses (by mine and metal) expenses and

Exploration in units in operations (by mine and mineral) to

consolidated Cost of sales, excluding depreciation and

amortization, consolidated Selling Expenses and consolidated

Exploration in units in operations expenses, respectively, set

forth below.

Set forth below is a reconciliation of consolidated Cost of sales,

excluding depreciation and amortization, to consolidated Cost

applicable to sales:

For the 3 months ended September 30

For the 9 months ended September 30

2023

2022

2023

2022

(in thousands of US$)

Consolidated Cost of sales excluding depreciation and amortization

136,195

118,419

342,171

337,503

Add:

Consolidated Exploration in units in operation

12,418

20,708

39,051

53,629

Consolidated Commercial deductions

51,260

42,039

134,651

137,887

Consolidated Selling expenses

4,277

5,854

12,745

15,490

Consolidated Cost applicable to sales

204,150

187,020

528,618

544,509

Set forth below is a reconciliation of Cost of sales, excluding

depreciation and amortization (by mine and mineral) to consolidated

Cost of sales:

For the 3 months ended September 30 For

the 9 months ended September 30

2023

2022

2023

2022

Cost of sales by mine and

mineral (in thousands of US$) Julcani, Gold

71

43

123

12

Julcani, Silver

7,761

6,843

21,670

20,965

Julcani, Lead

181

130

513

302

Julcani, Copper

99

68

296

211

Orcopampa, Gold

17,987

12,207

52,819

41,227

Orcopampa, Silver

69

51

195

233

Orcopampa, Copper

0

0

0

0

Uchucchacua, Gold

0

0

0

0

Uchucchacua, Silver

0

0

0

0

Uchucchacua, Lead

0

0

0

0

Uchucchacua, Zinc

0

0

0

0

Tambomayo, Gold

11,899

8,430

29,626

25,782

Tambomayo, Silver

5,758

3,434

15,406

9,584

Tambomayo, Zinc

1,020

1,757

2,982

14,353

Tambomayo, Lead

0

4,578

2,979

6,034

La Zanja, Gold

1,909

14,961

11,009

33,201

La Zanja, Silver

112

647

597

1,771

El Brocal, Gold

3,367

5,089

7,489

8,531

El Brocal, Silver

10,936

6,818

19,045

21,345

El Brocal, Lead

610

1,523

1,654

4,541

El Brocal, Zinc

2,485

9,404

5,428

27,179

El Brocal, Copper

66,626

47,037

153,802

119,290

Non Mining Units

5,305

-4,601

16,538

2,942

Consolidated Cost of sales, excluding depreciation and

amortization

136,195

118,419

342,171

337,503

Set forth below is a reconciliation of Exploration expenses in

units in operation (by mine and mineral) to consolidated

Exploration expenses in mining units:

For the 3 months ended

September 30 For the 9 months ended September 30

2023

2022

2023

2022

Exploration expenses in units in operation

by mine and mineral (in thousands of US$)

Julcani, Gold

16

11

28

3

Julcani, Silver

1,793

1,716

4,937

4,781

Julcani, Lead

42

33

117

69

Julcani, Copper

23

17

67

48

Orcopampa, Gold

1,434

3,328

4,697

9,499

Orcopampa, Silver

6

14

17

54

Orcopampa, Copper

0

0

0

0

Uchucchacua, Gold

0

0

0

0

Uchucchacua, Silver

6,661

6,536

20,592

15,531

Uchucchacua, Lead

0

0

0

-182

Uchucchacua, Zinc

0

0

0

0

Tambomayo, Gold

459

1,424

1,304

3,694

Tambomayo, Silver

222

580

678

1,373

Tambomayo, Lead

39

297

131

865

Tambomayo, Zinc

0

774

131

2,057

La Zanja, Gold

103

1,056

415

2,454

La Zanja, Silver

6

46

23

131

El Brocal, Gold

65

355

236

625

El Brocal, Silver

210

476

601

1,564

El Brocal, Lead

12

106

52

333

El Brocal, Zinc

48

656

171

1,991

El Brocal, Copper

1,280

3,282

4,853

8,739

Non Mining Units

0

0

0

0

Consolidated Exploration expenses in units in operation

12,418

20,708

39,051

53,629

Set forth below is a reconciliation of Commercial Deductions in

units in operation (by mine and mineral) to consolidated Commercial

deductions:

For the 3 months ended September 30 For the 9

months ended September 30

2023

2022

2023

2022

Commercial Deductions in units in

operation by mine and mineral (in thousands of

US$) Julcani, Gold

4

2

7

-6

Julcani, Silver

549

352

1,273

1,496

Julcani, Lead

12

6

29

22

Julcani, Copper

6

4

16

13

Orcopampa, Gold

215

217

826

608

Orcopampa, Silver

1

0

0

13

Orcopampa, Copper

0

0

0

0

Uchucchacua, Gold

0

0

0

0

Uchucchacua, Silver

753

1,340

3,299

1,837

Uchucchacua, Lead

0

12

0

7

Uchucchacua, Zinc

0

0

0

272

Tambomayo, Gold

1,274

1,414

4,071

4,998

Tambomayo, Silver

685

738

2,355

2,439

Tambomayo, Lead

70

285

351

1,128

Tambomayo, Zinc

301

3,027

1,756

11,282

La Zanja, Gold

6

131

86

211

La Zanja, Silver

3

23

9

28

El Brocal, Gold

2,114

2,607

5,025

5,561

El Brocal, Silver

5,888

3,229

11,634

12,325

El Brocal, Lead

193

719

608

2,328

El Brocal, Zinc

1,906

3,672

4,379

16,214

El Brocal, Copper

37,280

24,260

98,928

77,110

Non Mining Units

0

0

0

0

Consolidated Commercial deductions in units in operation

51,260

42,039

134,651

137,887

Set forth below is a reconciliation of Selling expenses (by mine

and mineral) to consolidated Selling expenses:

For the 3 months

ended September 30 For the 9 months ended September 30

2023

2022

2023

2022

Selling expenses by mine and

mineral

(in thousands of US$)

Julcani, Gold

0

0

1

0

Julcani, Silver

43

71

156

307

Julcani, Lead

1

1

4

4

Julcani, Copper

1

1

2

3

Orcopampa, Gold

202

150

512

443

Orcopampa, Silver

1

1

2

3

Orcopampa, Copper

0

0

0

0

Uchucchacua, Gold

0

0

0

0

Uchucchacua, Silver

600

1,084

2,203

2,472

Uchucchacua, Lead

0

0

0

-29

Uchucchacua, Zinc

0

0

0

0

Tambomayo, Gold

400

665

1,175

1,966

Tambomayo, Silver

194

271

611

731

Tambomayo, Lead

34

139

118

460

Tambomayo, Zinc

0

361

118

1,095

La Zanja, Gold

11

74

46

126

La Zanja, Silver

1

3

3

7

El Brocal, Gold

103

205

286

339

El Brocal, Silver

336

274

728

849

El Brocal, Lead

19

61

63

181

El Brocal, Zinc

76

378

208

1,082

El Brocal, Copper

2,045

1,892

5,882

4,747

Non Mining Units

210

222

626

703

Consolidated Selling expenses

4,277

5,854

12,745

15,490

JULCANI JULCANI

3Q 2023

3Q 2022

9M 2023

9M 2022

GOLD (OZ) SILVER (OZ) LEAD (MT) ZINC

(MT) COPPER (MT) TOTAL GOLD (OZ) SILVER

(OZ) LEAD (MT) ZINC (MT) COPPER (MT)

TOTAL GOLD (OZ) SILVER (OZ) LEAD (MT)

ZINC (MT) COPPER (MT) TOTAL GOLD (OZ)

SILVER (OZ) LEAD (MT) ZINC (MT) COPPER

(MT) TOTAL Cost of Sales (without D&A) (US$000)

71

7,761

181

-

99

8,112

43

6,843

130

-

68

7,084

Cost of Sales (without D&A) (US$000)

123

21,670

513

-

296

22,602

12

20,965

302

-

211

21,490

Add: Add: Exploration Expenses (US$000)

16

1,793

42

-

23

1,874

11

1,716

33

-

17

1,777

Exploration Expenses (US$000)

28

4,937

117

-

67

5,149

3

4,781

69

-

48

4,901

Commercial Deductions (US$000)

4

549

12

-

6

571

2

352

6

-

4

364

Commercial Deductions (US$000)

7

1,273

29

-

16

1,325

-6

1,496

22

-

13

1,526

Selling Expenses (US$000)

0

43.05

1.00

-

1

45

0

71

1

-

1

74

Selling Expenses (US$000)

1

156

4

-

2

163

0

307

4

-

3

315

Cost Applicable to Sales (US$000)

92

10,145

236

-

129

10,602

57

8,983

170

-

89

9,299

Cost Applicable to Sales (US$000)

158

28,036

663

-

382

29,239

9

27,550

397

-

275

28,232

Divide: Divide: Volume Sold

51

388,854

107

-

16

Not Applicable

39

651,077

112

-

18

Not Applicable Volume Sold

90

1,251,585

339

-

50

Not Applicable

79

1,893,014

280

-

48

No Aplicable

CAS

1,791

26.09

2,196

-

8,019

Not Applicable

1,457

13.80

1,521

-

5,024

Not Applicable CAS

1,759

22.40

1,955

-

7,637

No Applicable

120

14.55

1,417

-

5,737

No Applicable ORCOPAMPA ORCOPAMPA

3Q 2023

3Q 2022

9M 2023

9M 2022

GOLD (OZ) SILVER (OZ) LEAD (MT) ZINC

(MT) COPPER (MT) TOTAL GOLD (OZ) SILVER

(OZ) LEAD (MT) ZINC (MT) COPPER (MT)

TOTAL GOLD (OZ) SILVER (OZ) LEAD (MT)

ZINC (MT) COPPER (MT) TOTAL GOLD (OZ)

SILVER (OZ) LEAD (MT) ZINC (MT) COPPER

(MT) TOTAL Cost of Sales (without D&A) (US$000)

17,987

69

-

-

-

18,056

12,207

51

-

-

-

12,258

Cost of Sales (without D&A) (US$000)

52,819

195

-

-

-

53,014

41,227

233

-

-

-

41,460

Add:

-

Add: Exploration Expenses (US$000)

1,434

6

-

-

-

1,440

3,328

14

-

-

-

3,342

Exploration Expenses (US$000)

4,697

17

-

-

-

4,714

9,499

54

-

-

-

9,553

Commercial Deductions (US$000)

215

1

-

-

-

216

217

0

-

-

-

217

Commercial Deductions (US$000)

826

0

-

-

-

826

608

13

-

-

-

621

Selling Expenses (US$000)

202

1

-

-

-

203

150

1

-

-

-

151

Selling Expenses (US$000)

512

2

-

-

-

514

443

3

-

-

-

446

Cost Applicable to Sales (US$000)

19,839

76

-

-

-

19,915

15,903

65

-

-

-

15,968

Cost Applicable to Sales (US$000)

58,854

214

-

-

-

59,068

51,777

303

-

-

-

52,080

Divide: Divide: Volume Sold

20,460

6,710

-

-

-

Not Applicable

19,814

7,715

-

-

-

Not Applicable Volume Sold

60,504

19,432

-

-

-

Not Applicable

56,840

27,054

-

-

-

Not Applicable

CAS

970

11.34

-

-

-

Not Applicable

803

8.48

-

-

-

Not Applicable CAS

973

11.01

-

-

-

No Applicable

911

11.19

-

-

-

No Applicable UCHUCCHACUA UCHUCCHACUA

3Q 2023

3Q 2022

9M 2023

9M 2022

GOLD (OZ) SILVER (OZ) LEAD (MT) ZINC

(MT) COPPER (MT) TOTAL GOLD (OZ) SILVER

(OZ) LEAD (MT) ZINC (MT) COPPER (MT)

TOTAL GOLD (OZ) SILVER (OZ) LEAD (MT)

ZINC (MT) COPPER (MT) TOTAL GOLD (OZ)

SILVER (OZ) LEAD (MT) ZINC (MT) COPPER

(MT) TOTAL Cost of Sales (without D&A) (US$000)

-

-

-

-

-

-

-

-

-

-

-

-

Cost of Sales (without D&A) (US$000)

-

-

-

-

-

-

-

-

-

-

-

-

Add: Add: Exploration Expenses (US$000)

-

6,661

-

-

-

6,661

-

6,536

-

-

-

6,536

Exploration Expenses (US$000)

-

20,592

-

-

-

20,592

-

15,531

-182

-

-

15,349

Commercial Deductions (US$000)

-

753

-

-

-

753

-

1,340

12

-

-

1,352

Commercial Deductions (US$000)

-

3,299

-

-

-

3,299

-

1,837

7

272

-

2,116

Selling Expenses (US$000)

-

600

-

-

-

600

-

1,084

-

-

-

1,084

Selling Expenses (US$000)

-

2,203

-

-

-

2,203

-

2,472

-29

-

-

2,443

Cost Applicable to Sales (US$000)

-

8,014

-

-

-

8,014

-

8,960

12

-

-

8,972

Cost Applicable to Sales (US$000)

-

26,094

-

-

-

26,094

-

19,840

-204

272

-

19,908

Divide:

-

-

Divide: Volume Sold

85,499

-

-

-

Not Applicable

-

150,426

-

-

-

Not Applicable Volume Sold

-

366,778

-

-

-

Not Applicable

-

308,844

18

-

-

Not Applicable

CAS

-

93.74

-

-

-

No Applicable

-

59.56

-

-

-

No Applicable CAS

-

71.15

-

-

-

No Applicable

-

64.24

-

-

-

No Applicable TAMBOMAYO TAMBOMAYO

3Q 2023

3Q 2022

9M 2023

9M 2022

GOLD (OZ) SILVER (OZ) LEAD (MT) ZINC

(MT) COPPER (MT) TOTAL GOLD (OZ) SILVER

(OZ) LEAD (MT) ZINC (MT) COPPER (MT)

TOTAL GOLD (OZ) SILVER (OZ) LEAD (MT)

ZINC (MT) COPPER (MT) TOTAL GOLD (OZ)

SILVER (OZ) LEAD (MT) ZINC (MT) COPPER

(MT) TOTAL Cost of Sales (without D&A) (US$000)

11,899

5,758

1,020

-

-

18,677

8,430

3,434

1,757

4,578

-

18,198

Cost of Sales (without D&A) (US$000)

29,626

15,406

2,979

2,982

-

50,993

25,782

9,584

6,034

14,353

-

55,753

Add: Add: Exploration Expenses (US$000)

459

222

39

-

-

720

1,424

580

297

774

-

3,075

Exploration Expenses (US$000)

1,304

678

131

131

-

2,244

3,694

1,373

865

2,057

-

7,989

Commercial Deductions (US$000)

1,274

685

70

301

-

2,330

1,414

738

285

3,027

-

5,464

Commercial Deductions (US$000)

4,071

2,355

351

1,756

-

8,532

4,998

2,439

1,128

11,282

-

19,847

Selling Expenses (US$000)

400

194

34

-

-

628

665

271

139

361

-

1,436

Selling Expenses (US$000)

1,175

611

118

118

-

2,023

1,966

731

460

1,095

-

4,252

Cost Applicable to Sales (US$000)

14,031

6,858

1,164

301

-

22,355

11,933

5,023

2,477

8,739

-

28,173

Cost Applicable to Sales (US$000)

36,176

19,050

3,578

4,988

-

63,792

36,440

14,128

8,487

28,786

-

87,841

Divide: Divide: Volume Sold

7,421

269,542

525

682

-

Not Applicable

12,150

468,076

2,449

2,832

-

Not Applicable Volume Sold

26,649

1,125,434

2,521

2,846

-

Not Applicable

37,248

1,195,466

7,353

9,016

-

Not Applicable

CAS

1,891

25.44

2,218

441

-

No Applicable

982

10.73

1,012

3,086

-

No Applicable CAS

1,357

16.93

1,419

1,753

-

No Applicable

978

11.82

1,154

3,193

-

Not Applicable LA ZANJA LA ZANJA

3Q 2023

3Q 2022

9M 2023

9M 2022

GOLD (OZ) SILVER (OZ) LEAD (MT) ZINC

(MT) COPPER (MT) TOTAL GOLD (OZ) SILVER

(OZ) LEAD (MT) ZINC (MT) COPPER (MT)

TOTAL GOLD (OZ) SILVER (OZ) LEAD (MT)

ZINC (MT) COPPER (MT) TOTAL GOLD (OZ)

SILVER (OZ) LEAD (MT) ZINC (MT) COPPER

(MT) TOTAL Cost of Sales (without D&A) (US$000)

1,909

112

-

-

-

2,021

14,961

647

-

-

-

15,608

Cost of Sales (without D&A) (US$000)

11,009

597

-

-

-

11,606

33,201

1,771

-

-

-

34,972

Add: Add: Exploration Expenses (US$000)

103

6

-

-

-

109

1,056

46

-

-

-

1,102

Exploration Expenses (US$000)

415

23

-

-

-

438

2,454

131

-

-

-

2,585

Commercial Deductions (US$000)

6

3

-

-

-

8

131

23

-

-

-

154

Commercial Deductions (US$000)

86

9

-

-

-

96

211

28

-

-

-

239

Selling Expenses (US$000)

11

1

-

-

-

12

74

3

-

-

-

77

Selling Expenses (US$000)

46

3

-

-

-

49

126

7

-

-

-

133

Cost Applicable to Sales (US$000)

2,029

122

-

-

-

2,150

16,221

720

-

-

-

16,941

Cost Applicable to Sales (US$000)

11,557

632

-

-

-

12,189

35,992

1,937

-

-

-

37,929

Divide: Divide: Volume Sold

1,780

6,442

-

-

-

Not Applicable

8,575

34,147

-

-

-

Not Applicable Volume Sold

6,883

28,973

-

-

-

Not Applicable

18,800

85,237

-

-

-

Not Applicable

CAS

1,140

18.91

-

-

-

Not Applicable

1,892

21.07

-

-

-

Not Applicable CAS

1,679

21.80

-

-

-

No Applicable

1,914

22.72

-

-

-

Not Applicable BROCAL BROCAL

3Q 2023

3Q 2022

9M 2023

9M 2022

GOLD (OZ) SILVER (OZ) LEAD (MT) ZINC

(MT) COPPER (MT) TOTAL GOLD (OZ) SILVER

(OZ) LEAD (MT) ZINC (MT) COPPER (MT)

TOTAL GOLD (OZ) SILVER (OZ) LEAD (MT)

ZINC (MT) COPPER (MT) TOTAL GOLD (OZ)

SILVER (OZ) LEAD (MT) ZINC (MT) COPPER

(MT) TOTAL Cost of Sales (without D&A) (US$000)

3,367

10,936

610

2,485

66,626

84,024

5,089

6,818

1,523

9,404

47,037

69,872

Cost of Sales (without D&A) (US$000)

7,489

19,045

1,654

5,428

153,802

187,418

8,531

21,345

4,541

27,179

119,290

180,886

Add: Add: Exploration Expenses (US$000)

65

210

12

48

1,280

1,614

355

476

106

656

3,282

4,876

Exploration Expenses (US$000)

236

601

52

171

4,853

5,914

625

1,564

333

1,991

8,739.38

13,252

Commercial Deductions (US$000)

2,114

5,888

193

1,906

37,280

47,382

2,607

3,229

719

3,672

24,260

34,487

Commercial Deductions (US$000)

5,025

11,634

608

4,379

98,928

120,572

5,561

12,325

2,328

16,214

77,110

113,539

Selling Expenses (US$000)

103

336

19

76

2,045

2,579

205

274

61

378

1,892

2,810

Selling Expenses (US$000)

286

728

63

208

5,882

7,167

339

849

181

1,082

4,747

7,198

Cost Applicable to Sales (US$000)

5,649

17,370

833

4,516

107,231

135,599

8,256

10,797

2,409

14,111

76,472

112,045

Cost Applicable to Sales (US$000)

13,036

32,008

2,377

10,185

263,465

321,071

15,057

36,083

7,383

46,465

209,887

314,875

Divide: Divide: Volume Sold

3,553

986,583

636

2,347

17,786

Not Applicable

5,229

642,558

1,568

5,229

11,431

Not Applicable Volume Sold

8,575

1,873,998

1,939

5,478

41,889

Not Applicable

10,725

2,145,751

4,878

15,855

31,439

Not Applicable

CAS

1,590

17.61

1,309

1,924

6,029

Not Applicable

1,579

16.80

1,536

2,698

6,690

Not Applicable CAS

1,520

17.08

1,226

1,859

6,290

No Applicable

1,404

16.82

1,513

2,931

6,676

Not Applicable NON MINING COMPANIES NON

MINING COMPANIES

3Q 2023

3Q 2022

9M 2023

9M 2022

GOLD (OZ) SILVER (OZ) LEAD (MT) ZINC

(MT) COPPER (MT) TOTAL GOLD (OZ) SILVER

(OZ) LEAD (MT) ZINC (MT) COPPER (MT)

TOTAL GOLD (OZ) SILVER (OZ) LEAD (MT)

ZINC (MT) COPPER (MT) TOTAL GOLD (OZ)

SILVER (OZ) LEAD (MT) ZINC (MT) COPPER

(MT) TOTAL Cost of Sales (without D&A) (US$000)

-

-

-

-

-

5,305

-

-

-

-

-

-4,601

Cost of Sales (without D&A) (US$000)

-

-

-

-

-

16,538

-

-

-

-

-

2,942

Add: Add:

-

-

Selling Expenses (US$000)

-

-

-

-

-

210

-

-

-

-

-

222

Selling Expenses (US$000)

-

-

-

-

-

626

-

-

-

-

-

703

Total (US$000)

-

-

-

-

-

5,515

-

-

-

-

-

-4,379

Total (US$000)

-

-

-

-

-

17,164

-

-

-

-

-

3,645

BUENAVENTURA CONSOLIDATED BUENAVENTURA

CONSOLIDATED

3Q 2023

3Q 2022

9M 2023

9M 2022

GOLD (OZ) SILVER (OZ) LEAD (MT) ZINC

(MT) COPPER (MT) TOTAL GOLD (OZ) SILVER

(OZ) LEAD (MT) ZINC (MT) COPPER (MT)

TOTAL GOLD (OZ) SILVER (OZ) LEAD (MT)

ZINC (MT) COPPER (MT) TOTAL GOLD (OZ)

SILVER (OZ) LEAD (MT) ZINC (MT) COPPER

(MT) TOTAL Cost of Sales (without D&A) (US$000)

35,233

24,636

1,811

2,485

66,725

136,195

40,730

17,793

3,410

13,982

47,105

118,419

Cost of Sales (without D&A) (US$000)

101,066

56,913

5,145

8,410

154,099

342,171

108,753

53,899

10,877

41,532

119,501

337,503

Add: Add: Exploration Expenses (US$000)

2,077

8,897

93

48

1,303

12,418

6,175

9,368

436

1,430

3,299

20,708

Exploration Expenses (US$000)

6,680

26,847

300

302

4,921

39,051

16,275

23,434

1,084

4,048

8,787

53,629

Commercial Deductions (US$000)

3,613

7,879

275

2,207

37,287

51,260

4,372

5,683

1,023

6,699

24,264

42,039

Commercial Deductions (US$000)

10,014

18,571

987

6,135

98,944

134,651

11,372

18,139

3,486

27,768

77,123

137,887

Selling Expenses (US$000)

717

1,174

54

76

2,046

4,277

1,094

1,704

201

739

1,892

5,854

Selling Expenses (US$000)

2,021

3,703

185

326

5,884

12,745

2,876

4,369

616

2,176

4,750

15,490

Cost Applicable to Sales (US$000)

41,640

42,586

2,233

4,816

107,360

204,150

52,371

34,549

5,069

22,850

76,561

187,020

Cost Applicable to Sales (US$000)

119,781

106,034

6,618

15,173

263,847

528,618

139,276

99,840

16,063

75,523

210,162

544,509

Divide: Divide: Volume Sold

33,265

1,743,629

1,269

3,029

17,802

Not Applicable

45,807

1,954,000

4,129

8,061

11,449

Not Applicable Volume Sold

102,700

4,666,199

4,799

8,324

41,940

Not Applicable

123,692

5,655,367

12,530

24,871

31,487

Not Applicable

CAS

1,252

24.42

1,760

1,590

6,031

Not Applicable

1,143

17.68

1,228

2,835

6,687

Not Applicable CAS

1,166

22.72

1,379

1,823

6,291

Not Applicable

1,126

17.65

1,282

3,037

6,675

Not Applicable COIMOLACHE COIMOLACHE

3Q 2023

3Q 2022

9M 2023

9M 2022

GOLD (OZ) SILVER (OZ) LEAD (MT) ZINC

(MT) COPPER (MT) TOTAL GOLD (OZ) SILVER

(OZ) LEAD (MT) ZINC (MT) COPPER (MT)

TOTAL GOLD (OZ) SILVER (OZ) LEAD (MT)

ZINC (MT) COPPER (MT) TOTAL GOLD (OZ)

SILVER (OZ) LEAD (MT) ZINC (MT) COPPER

(MT) TOTAL Cost of Sales (without D&A) (US$000)

18,044

866

-

-

-

18,910

33,976.00

1,285

-

-

-

35,261

Cost of Sales (without D&A) (US$000)

51,805

2,881

-

-

-

54,686

73,723

3,529

-

-

-

77,252

Add: Add: Exploration Expenses (US$000)

4,530

217

-

-

-

4,747

2,292.30

87

-

-

-

2,379

Exploration Expenses (US$000)

9,485

527

-

-

-

10,012

5,768

276

-

-

-

6,044

Commercial Deductions (US$000)

181

40

-

-

-

221

111

2

-

-

-

113

Commercial Deductions (US$000)

293

48

-

-

-

342

436

40

-

-

-

477

Selling Expenses (US$000)

234

11

-

-

-

245

276

10

-

-

-

286

Selling Expenses (US$000)

468

26

-

-

-

494

684

33

-

-

-

717

Cost Applicable to Sales (US$000)

22,989

1,134

-

-

-

24,123

36,655

1,384

-

-

-

38,039

Cost Applicable to Sales (US$000)

62,051

3,483

-

-

-

65,534

80,611

3,879

-

-

-

84,490

Divide: Divide: Volume Sold

21,237

82,379

-

-

-

Not Applicable

21,431

78,028

-

-

-

Not Applicable Volume Sold

36,261

164,895

-

-

-

Not Applicable

62,568

259,521

-

-

-

Not Applicable

CAS

1,083

13.77

-

-

-

Not Applicable

1,710

17.74

-

-

-

Not Applicable CAS

1,711

21.12

-

-

-

No Applicable

1,288

14.95

-

-

-

Not Applicable

APPENDIX 5: All-in Sustaining Cost

All-in Sustaining Cost for 3Q23 Buenaventura1

La Zanja Tantahuatay Attributable 2

3Q23

3Q23

3Q23

3Q23

Au Ounces Sold Net

27,932

1,780

21,237

38,227

3Q23

3Q23

3Q23

3Q23

Income Statement & Cash Flow US$ 000' US$/Oz

Au US$ 000' US$/Oz Au US$ 000' US$/Oz

Au US$ 000' US$/Oz Au Cost of Sales

44,648

1,598

5,656

3,178

18,910

890

57,886

1,514

Exploration in Operating Units

10,695

383

109

61

4,747

224

12,707

332

Royalties

3,235

116

0

0

0

0

3,235

85

Comercial Deductions3

3,870

139

8

5

221

10

3,967

104

Selling Expenses

1,476

53

12

7

245

12

1,586

41

Administrative Expenses

9,740

349

812

456

1,002

47

10,954

287

Other, net

2,378

85

255

143

-110

-5

2,589

68

Sustaining Capex4

2,364

85

1,732

973

719

34

4,385

115

By-product Credit

-21,851

-782

-166

-93

-1,938

-91

-22,794

-596

All-in Sustaining Cost

56,555

2,025

8,419

4,731

23,796

1,121

74,515

1,949

*All-in Sustaining Cost does not include: Depreciation and

Amortization, Stoppage of mining units, Exploration in

non-operating areas.

Notes: 1.

Non-consolidated financial statements for Compañia De Minas

Buenaventura S.A.A. 2. Considers 100% from Compañia De Minas

Buenaventura S.A.A., 100% from La Zanja and 40.095% from

Tantahuatay. 3. For all metals produced. 4. Sustaining Capex +

Growth Capex equals Acquisitions of mining concessions, development

costs, property, plant and equipment.

All-in Sustaining Cost for

3Q22 Buenaventura1 La Zanja

Tantahuatay Attributable 2

3Q22

3Q22

3Q22

3Q22

Au Ounces Sold Net

32,003

8,575

21,431

49,170

3Q22

3Q22

3Q22

3Q22

Income Statement & Cash Flow US$ 000' US$/Oz

Au US$ 000' US$/Oz Au US$ 000' US$/Oz

Au US$ 000' US$/Oz Au Cost of Sales

39,582

1,237

11,214

1,308

26,671

1,245

61,490

1,251

Exploration in Operating Units

14,729

460

1,103

129

1,994

93

16,631

338

Royalties

2,789

87

0

0

0

0

2,789

57

Comercial Deductions3

7,398

231

154

18

113

5

7,598

155

Selling Expenses

2,875

90

77

9

217

10

3,039

62

Administrative Expenses

9,175

287

692

81

916

43

10,234

208

Other, net

-249

-8

-107

-12

-338

-16

-492

-10

Sustaining Capex4

2,921

91

548

64

3,099

145

4,712

96

By-product Credit

-36,603

-1,144

-621

-72

-1,355

-63

-37,767

-768

All-in Sustaining Cost

42,618

1,332

13,060

1,523

31,316

1,461

68,234

1,388

*All-in Sustaining Cost does not include: Depreciation and

Amortization, Stoppage of mining units, Exploration in

non-operating areas.

Notes: 1.

Non-consolidated financial statements for Compañia De Minas

Buenaventura S.A.A. 2. Considers 100% from Compañia De Minas

Buenaventura S.A.A., 100% from La Zanja and 40.095% from

Tantahuatay. 3. For all metals produced. 4. Sustaining Capex +

Growth Capex equals Acquisitions of mining concessions, development

costs, property, plant and equipment.

All-in Sustaining Cost for

9M23 Buenaventura1 La Zanja

Tantahuatay Attributable 2

9M23

9M23

9M23

9M23

Au Ounces Sold Net

87,243

6,883

36,261

108,665

9M23

9M23

9M23

9M23

Income Statement & Cash Flow US$ 000' US$/Oz

Au US$ 000' US$/Oz Au US$ 000' US$/Oz

Au US$ 000' US$/Oz Au Cost of Sales

129,229

1,481

24,261

3,525

54,686

1,508

175,416

1,614

Exploration in Operating Units

32,699

375

438

64

10,012

276

37,151

342

Royalties

9,446

108

0

0

0

0

9,446

87

Comercial Deductions3

13,983

160

96

14

342

9

14,216

131

Selling Expenses

4,903

56

49

7

494

14

5,150

47

Administrative Expenses

31,765

364

2,206

321

3,053

84

35,195

324

Other, net

2,446

28

518

75

-751

-21

2,663

25

Sustaining Capex4

5,532

63

2,087

303

4,121

114

9,272

85

By-product Credit