Current Report Filing (8-k)

September 12 2022 - 7:01AM

Edgar (US Regulatory)

0001764046

false

00-0000000

0001764046

2022-09-09

2022-09-09

0001764046

us-gaap:CommonStockMember

2022-09-09

2022-09-09

0001764046

us-gaap:SeriesAPreferredStockMember

2022-09-09

2022-09-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (date of earliest event

reported): September 12, 2022 (September 9,

2022)

CLARIVATE PLC

(Exact name of registrant as specified in

its charter)

Jersey, Channel Islands

(State

or other jurisdiction of incorporation)

001-38911

(Commission File Number)

N/A

(IRS Employer Identification No.)

30 St. Mary Axe

London

EC3A

8BE

United

Kingdom

(Address of principal executive offices)

Not applicable

(Zip Code)

(44)

207 433 4000

Registrant’s telephone

number, including area code

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

| Title of Each Class |

Trading Symbol |

Name of Each Exchange on Which

Registered |

| Ordinary

shares, no par value |

CLVT |

New York Stock Exchange |

| 5.25% Series A Mandatory Convertible Preferred Shares, no par value |

CLVT PR A |

New York Stock Exchange |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01. |

Regulation FD Disclosure. |

On

September 12, 2022, Clarivate Plc (the “Company” or “Clarivate”) issued a press release announcing

the transaction described under Item 8.01 below, which is furnished as Exhibit 99.1 hereto and shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

and shall not be incorporated by reference into any registration statement or other document pursuant to

the Securities Act of 1933, as amended, or the Exchange Act, except as otherwise expressly stated in such filing.

On

September 9, 2022, Camelot UK Bidco Limited, a wholly owned indirect subsidiary of the Company, entered into a definitive agreement with

Newfold Digital, Inc. (the “Buyer”) to sell the Company’s MarkMonitor domain management business to the Buyer for an

aggregate purchase price of approximately $302.5 million. The agreement contemplates delayed closings in China and Japan pending

completion of certain country-specific closing conditions. Of the purchase price, $292.5 million will be

payable at the initial closing, subject to certain adjustments, and $10 million will be payable upon the completion of all deferred closings.

The initial closing is expected to occur in the fourth quarter of 2022, subject to the receipt of required regulatory approvals

and the satisfaction of other customary closing conditions.

Forward-Looking Statements

This report

contains “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking

statements are neither historical facts nor assurances of future performance. Instead, they are based only on management’s current

beliefs, expectations, and assumptions regarding our ability to close the transaction and to realize the expected synergies of the transaction,

as well as the future of our business, future plans and strategies, projections, anticipated events and trends, the economy, and other

future conditions. Because forward-looking statements relate to the future, they are difficult to predict and many are outside of our

control. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the

forward-looking statements are discussed under the caption “Risk Factors” in our 2021 Annual Report on Form 10-K, along with

our other filings with the Securities and Exchange Commission (“SEC”). However, those factors should not be considered to

be a complete statement of all potential risks and uncertainties. Additional risks and uncertainties not known to us or that we currently

deem immaterial may also impair our business operations. Forward-looking statements are based only on information currently available

to our management and speak only as of the date of this report. We do not assume any obligation to publicly provide revisions or updates

to any forward-looking statements, whether as a result of new information, future developments or otherwise, should circumstances change,

except as otherwise required by securities and other applicable laws. Please consult our public filings with the SEC or our website at

www.clarivate.com.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

CLARIVATE PLC |

| |

|

| Date: September 12, 2022 |

By: |

/s/ Jonathan Collins |

| |

Name: |

Jonathan Collins |

| |

Title: |

Executive Vice President and Chief Financial Officer |

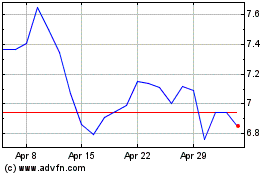

Clarivate (NYSE:CLVT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Clarivate (NYSE:CLVT)

Historical Stock Chart

From Apr 2023 to Apr 2024