– Q4 2023 Revenues of $244.1 million, Net Loss of $31.4 million

and Adjusted EBITDA of $156.8 million

– Full Year 2023 Revenues of $961.5 million, Net Loss of $91.7

million and Adjusted EBITDA of $618.0 million

– Identified potential medical cost savings of approximately

$5.9 billion in Q4 2023, up 2.3% from Q3 2023 and up 9.4% from Q4

2022

– In Full Year 2023, the Company deployed cash of $140.9 million

for the acquisition of Benefits Science LLC (“BST”), $165.8 million

toward open-market debt repurchases and repayment, and $15.2

million toward share repurchases

– Full Year 2024 Revenues guidance of $1,000 million to $1,030

million and FY 2024 Adjusted EBITDA guidance of $630 million to

$650 million

MultiPlan Corporation (“MultiPlan” or the “Company”) (NYSE:

MPLN), a leading value-added provider of data analytics and

technology-enabled end-to-end cost management, payment and revenue

integrity solutions to the U.S. healthcare industry, today reported

financial results for the fourth quarter and full year ended

December 31, 2023.

“As we close out 2023, I am very encouraged by the progress we

have made toward our long-term goal of transforming our business,”

said Dale White, CEO of MultiPlan. “Throughout the course of the

year, we successfully executed on each of the initiatives under our

new Growth Plan. We launched new products to enhance our core

services, we established our new Data and Decision Science service

line and accelerated the development of this line with the

acquisition of BST, and we partnered with ECHO Health, Inc. to

offer healthcare payment services. These and our other growth

initiatives will help us expand our presence in faster-growing

market segments, including Medicare Advantage, Medicaid,

third-party administrator, and direct-to-employer, and set us on a

path to diversify our revenues by market, customer and

product.”

“Further, in 2023 we took steps to put our business on stronger

footing by reducing our risk and improving our financial position,”

added Mr. White. “We delivered on our expectation to resume growth

in the second half and improved the visibility of our revenues,

following the renewal of our contracts with our larger customers

earlier in the year. We have also continued to reduce our debt,

repurchasing and repaying $222 million of face value during the

year, including $25 million of our 6.0% Senior Convertible PIK

Notes repurchased in the fourth quarter. Reducing our debt remains

among our highest priorities, and we expect to strengthen our

balance sheet and optimize our capital structure as we grow

revenues and cash flow over the next several years.”

“As we look forward to 2024,” Mr. White continued, “we are

excited to welcome our new CEO, Travis Dalton, to the Company.

Travis is precisely the right leader to guide us through the next

chapter of our transformation, and he shares our confidence that

our strategy for unlocking the value of our franchise through

product diversification and new markets penetration will drive

accelerated growth in 2024 and will amplify our growth trajectory

in 2025 and beyond.”

Mr. White concluded, “We remain incredibly proud of the critical

role MultiPlan plays in the U.S. healthcare system. During 2023, we

identified $22.9 billion of potential medical savings, and helped

lower out-of-pocket costs and reduce or eliminate balance billing

for millions of healthcare consumers. With the ongoing expansion

and enhancement of our services and products, the company has never

been better positioned to increase the value it delivers to more

than 700 customers, over 100,000 employers, over 60 million

consumers, and 1.4 million contracted providers.”

Business and Financial Highlights

- Revenues of $244.1 million for Q4 2023, an increase of 1.3%

over Q4 2022 revenues of $241.1 million.

- Net loss of $31.4 million for Q4 2023, compared to net loss of

$650.1 million for Q4 2022.

- Adjusted EBITDA of $156.8 million for Q4 2023, compared to

Adjusted EBITDA of $161.5 million for Q4 2022.

- Revenues of $961.5 million for full year 2023, a decrease of

10.9% over full year 2022 revenues of $1,079.7 million.

- Net loss for full year 2023 of $91.7 million, compared to net

loss of $572.9 million for full year 2022.

- Adjusted EBITDA of $618.0 million for full year 2023, compared

to Adjusted EBITDA of $768.7 million for full year 2022.

- Net cash provided by operating activities of $171.7 million for

full year 2023, compared to $372.4 million for full year 2022.

- Free Cash Flow of $62.9 million for full year 2023, compared to

$282.6 million for full year 2022.

- In Q4 2023, the Company used $17.6 million of cash to

repurchase $25 million face value of its 6.0% Senior Convertible

PIK Notes and used $2.0 million to repurchase shares of its common

stock in the open market. The Company ended Q4 2023 with $71.5

million of unrestricted cash and cash equivalents on the balance

sheet.

- The Company processed $43.4 billion in medical charges during

the fourth quarter 2023, identifying potential medical cost savings

of approximately $5.9 billion. For the year ended December 31,

2023, the Company processed approximately $168.6 billion in medical

charges and identified approximately $22.9 billion in potential

medical cost savings compared to $155.2 billion medical charges and

approximately $22.3 billion in potential medical cost savings for

the year ended December 31, 2022.

2024 Financial Guidance1

Financial Metric

Full Year 2024

Guidance

Revenues

$1,000 million to $1,030 million

Adjusted EBITDA1

$630 million to $650 million

Interest expense

$320 million to $330 million

Cash flow from operations

$170 million to $200 million

Capital expenditures

$120 million to $130 million

Depreciation

$80 million to $90 million

Amortization of intangible assets

$345 million to $350 million

Effective tax rate

25% to 28%

The Company anticipates Q1 2024 revenues between $235 million

and $250 million and Adjusted EBITDA between $150 million and $160

million.

Conference Call Information

The Company will host a conference call today, Thursday,

February 29, 2024 at 8:00 a.m. U.S. Eastern Time (ET) to discuss

its financial results. Investors and analysts are encouraged to

pre-register for the conference call by using the link below.

Participants who pre-register will receive access details via

email. Pre-registration may be completed at any time up to and

following the call start time.

To pre-register, go to:

https://www.netroadshow.com/events/login?show=e463e890&confId=59576

A live webcast of the conference call can be accessed through

the Investor Relations section of the Company’s website at

investors.multiplan.com/events-and-presentations. Participants

should join the webcast ten minutes prior to the start of the

conference call. The earnings release and supplemental slide deck

will also be available on this section of the Company’s

website.

For those unable to listen to the live conference call, a replay

will be available approximately two hours after the call through

the archived webcast on the Investor Relations section of the

Company’s website. For those requiring operator assistance please

dial (404) 975-4839 or (833) 470-1428. The access code is

925922.

______________

1 We have not reconciled the

forward-looking Adjusted EBITDA guidance included above to the most

directly comparable GAAP measure because this cannot be done

without unreasonable effort due to the variability and low

visibility with respect to certain costs, the most significant of

which are incentive compensation (including stock-based

compensation), transaction-related expenses (including expenses

relating to the business combination), certain fair value

measurements, which are potential adjustments to future earnings.

We expect the variability of these items to have a potentially

unpredictable, and a potentially significant, impact on our future

GAAP financial results.

About MultiPlan

MultiPlan is committed to delivering affordability, efficiency,

and fairness to the US healthcare system by helping healthcare

payors manage the cost of care, improve their competitiveness and

inspire positive change. Leveraging sophisticated technology, data

analytics and a team rich with industry experience, MultiPlan

interprets customers’ needs and customizes innovative solutions

that combine its payment and revenue integrity, network-based and

analytics-based, and data and decision science services. MultiPlan

is a trusted partner to over 700 healthcare payors, brokers,

employer groups, and supplemental carriers in the commercial

health, government, and property and casualty markets. For more

information, visit multiplan.com.

Forward Looking Statements

This press release includes statements that express our and our

subsidiaries’ opinions, expectations, beliefs, plans, objectives,

assumptions or projections regarding future events or future

results and therefore are, or may be deemed to be, “forward-looking

statements”. These forward-looking statements can generally be

identified by the use of forward-looking terminology, including the

terms “believes,” “estimates,” “anticipates,” “expects,” “seeks,”

“projects,” “forecasts,” “intends,” “plans,” “may,” “will” or

“should” or, in each case, their negative or other variations or

comparable terminology. These forward-looking statements include

all matters that are not historical facts. They appear in a number

of places throughout this press release, including the discussion

of 2024 outlook and guidance and the long-term prospects of the

Company. Such forward-looking statements are based on available

current market information and management’s expectations, beliefs

and forecasts concerning future events impacting the business.

Although we believe that these forward-looking statements are based

on reasonable assumptions at the time they are made, you should be

aware that these forward-looking statements involve a number of

risks, uncertainties (some of which are beyond our control) or

other assumptions that may cause actual results or performance to

be materially different from those expressed or implied by these

forward-looking statements. These factors include: loss of our

customers, particularly our largest customers; interruptions or

security breaches of our information technology systems and other

cybersecurity attacks; the ability to achieve the goals of our

strategic plans and recognize the anticipated strategic,

operational, growth and efficiency benefits when expected; our

ability to enter new lines of business and broaden the scope of our

services; the loss of key members of our management team or

inability to maintain sufficient qualified personnel; our ability

to continue to attract, motivate and retain a large number of

skilled employees, and adapt to the effects of inflationary

pressure on wages; trends in the U.S. healthcare system, including

recent trends of unknown duration of reduced healthcare utilization

and increased patient financial responsibility for services;

effects of competition; effects of pricing pressure; our ability to

identify, complete and successfully integrate acquisitions; the

inability of our customers to pay for our services; changes in our

industry and in industry standards and technology; our ability to

protect proprietary information, processes and applications; our

ability to maintain the licenses or right of use for the software

we use; our inability to expand our network infrastructure; our

ability to obtain additional financing; our ability to pay interest

and principal on our notes and other indebtedness; lowering or

withdrawal of our credit ratings; adverse outcomes related to

litigation or governmental proceedings; inability to preserve or

increase our existing market share or the size of our PPO networks;

decreases in discounts from providers; pressure to limit access to

preferred provider networks; changes in our regulatory environment,

including healthcare law and regulations; the expansion of privacy

and security laws; heightened enforcement activity by government

agencies; the possibility that we may be adversely affected by

other political, economic, business, and/or competitive factors;

changes in accounting principles or the incurrence of impairment

charges; our ability to remediate any material weaknesses or

maintain effective internal controls over financial reporting;

other factors disclosed in our Securities and Exchange Commission

(“SEC”) filings; and other factors beyond our control.

The forward-looking statements contained in this press release

are based on our current expectations and beliefs concerning future

developments and their potential effects on our business. There can

be no assurance that future developments affecting our business

will be those that we have anticipated. These forward-looking

statements involve a number of risks, uncertainties (some of which

are beyond our control) or other assumptions that may cause actual

results or performance to be materially different from those

expressed or implied by these forward-looking statements. These

risks and uncertainties include, but are not limited to, those

factors described in our Annual Report on Form 10-K for the fiscal

year ended December 31, 2022 and our Quarterly Report on Form 10-Q

for the fiscal quarter ended September 30, 2023, and other

documents filed or to be filed with the SEC by us. Should one or

more of these risks or uncertainties materialize, or should any of

the assumptions prove incorrect, actual results may vary in

material respects from those projected in these forward-looking

statements.

We do not undertake any obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as may be required under

applicable securities laws.

Non-GAAP Financial Measures

In addition to the financial measures prepared in accordance

with generally accepted accounting principles in the United States

(“GAAP”), this press release contains certain non-GAAP financial

measures, including EBITDA, Adjusted EBITDA, Free Cash Flow,

Unlevered Free Cash Flow and Adjusted cash conversion ratio. A

non-GAAP financial measure is generally defined as a numerical

measure of a company’s financial or operating performance that

excludes or includes amounts so as to be different than the most

directly comparable measure calculated and presented in accordance

with GAAP.

EBITDA, Adjusted EBITDA, Free Cash Flow, Unlevered Free Cash

Flow and Adjusted cash conversion ratio are supplemental measures

of MultiPlan’s performance that are not required by or presented in

accordance with GAAP. These measures are not measurements of our

financial or operating performance under GAAP, have limitations as

analytical tools and should not be considered in isolation or as an

alternative to net (loss) income, cash flows or any other measures

of performance prepared in accordance with GAAP.

EBITDA represents net (loss) income before interest expense,

interest income, income tax provision (benefit), depreciation,

amortization of intangible assets, and non-income taxes. Adjusted

EBITDA is EBITDA as further adjusted by certain items as described

in the table below.

In addition, in evaluating EBITDA and Adjusted EBITDA you should

be aware that in the future, we may incur expenses similar to the

adjustments in the presentation of EBITDA and Adjusted EBITDA. The

presentation of EBITDA and Adjusted EBITDA should not be construed

as an inference that our future results will be unaffected by

unusual or non-recurring items. The calculations of EBITDA and

Adjusted EBITDA may not be comparable to similarly titled measures

reported by other companies. Based on our industry and debt

financing experience, we believe that EBITDA and Adjusted EBITDA

are customarily used by investors, analysts and other interested

parties to provide useful information regarding a company’s ability

to service and/or incur indebtedness.

We also believe that Adjusted EBITDA is useful to investors and

analysts in assessing our operating performance during the periods

these charges were incurred on a consistent basis with the periods

during which these charges were not incurred. Both EBITDA and

Adjusted EBITDA have limitations as analytical tools, and you

should not consider either in isolation, or as a substitute for

analysis of our results as reported under GAAP. Some of the

limitations are:

- EBITDA and Adjusted EBITDA do not reflect changes in, or cash

requirements for, our working capital needs;

- EBITDA and Adjusted EBITDA do not reflect interest expense, or

the cash requirements necessary to service interest or principal

payments on our debt;

- EBITDA and Adjusted EBITDA do not reflect our tax expense or

the cash requirements to pay our taxes; and

- Although depreciation and amortization are non-cash charges,

the tangible assets being depreciated will often have to be

replaced in the future, and EBITDA and Adjusted EBITDA do not

reflect any cash requirements for such replacements.

MultiPlan’s presentation of Adjusted EBITDA should not be

construed as an inference that our future results and financial

position will be unaffected by unusual items.

Free Cash Flow is defined as net cash provided by operating

activities less capital expenditures, all as disclosed in the

Statements of Cash Flows. Unlevered Free Cash Flow is defined as

net cash provided by operating activities less capital

expenditures, plus cash interest paid, all as disclosed in the

Statements of Cash Flows. Free Cash Flow and Unlevered Free Cash

Flow are measures of our operational performance used by management

to evaluate our business after purchases of property and equipment

and, in the case of Unlevered Free Cash Flow, prior to the impact

of our capital structure. Free Cash Flow and Unlevered Free Cash

Flow should be considered in addition to, rather than as a

substitute for, consolidated net income as a measure of our

performance and net cash provided by operating activities as a

measure of our liquidity. Additionally, MultiPlan’s definitions of

Free Cash Flow and Unlevered Free Cash Flow are limited, in that

they do not represent residual cash flows available for

discretionary expenditures, due to the fact that the measures do

not deduct the payments required for debt service, in the case of

Unlevered Free Cash Flow, and other contractual obligations or

payments made for business acquisitions.

Adjusted cash conversion ratio is defined as Unlevered Free Cash

Flow divided by Adjusted EBITDA. MultiPlan believes that the

presentation of the Adjusted cash conversion ratio provides useful

information to investors because it is an financial performance

measure that shows how much of its Adjusted EBITDA MultiPlan

converts into Unlevered Free Cash Flow.

MULTIPLAN CORPORATION

Consolidated Balance

Sheets

(in thousands, except share and

per share data)

December 31,

2023

2022

Assets

Current assets:

Cash and cash equivalents

$

71,547

$

334,046

Restricted cash

9,947

6,513

Trade accounts receivable, net

76,558

78,907

Prepaid expenses

23,432

22,244

Prepaid taxes

1,364

1,351

Other current assets, net

10,745

3,676

Total current assets

193,593

446,737

Property and equipment, net

267,429

232,835

Operating lease right-of-use assets

19,680

24,237

Goodwill

3,829,002

3,705,199

Other intangibles, net

2,633,207

2,940,201

Other assets, net

21,776

21,895

Total assets

$

6,964,687

$

7,371,104

Liabilities and Shareholders’

Equity

Current liabilities:

Accounts payable

$

19,590

$

13,295

Accrued interest

56,827

57,982

Operating lease obligation, short-term

4,792

6,363

Current portion of long-term debt

13,250

13,250

Accrued compensation

44,720

34,568

Accrued legal contingencies

12,123

33,923

Other accrued expenses

15,437

16,463

Total current liabilities

166,739

175,844

Long-term debt

4,532,733

4,741,856

Operating lease obligation, long-term

17,124

20,894

Private Placement Warrants and Unvested

Founder Shares

477

2,442

Deferred income taxes

521,707

639,498

Other liabilities

16,783

28

Total liabilities

5,255,563

5,580,562

Commitments and contingencies (Note

13)

Shareholders’ equity:

Shareholder interests

Preferred stock, $0.0001 par value —

10,000,000 shares authorized; no shares issued

—

—

Common stock, $0.0001 par value —

1,500,000,000 shares authorized; 667,808,296 and 666,290,344

issued; 648,319,379 and 639,172,938 shares outstanding

67

67

Additional paid-in capital

2,348,505

2,330,444

Accumulated other comprehensive loss

(11,778

)

—

Retained deficit

(499,307

)

(347,800

)

Treasury stock — 19,488,917 and 27,117,406

shares

(128,363

)

(192,169

)

Total shareholders’ equity

1,709,124

1,790,542

Total liabilities and shareholders’

equity

$

6,964,687

$

7,371,104

MULTIPLAN CORPORATION

Consolidated Statements of

(Loss) Income and Comprehensive (Loss) Income

(in thousands, except share and

per share data)

Years Ended December

31,

2023

2022

2021

Revenues

$

961,524

$

1,079,716

$

1,117,602

Costs of services (exclusive of

depreciation and amortization of intangible assets shown below)

235,468

204,098

175,292

General and administrative expenses

144,057

166,837

151,095

Depreciation

77,323

68,756

64,885

Amortization of intangible assets

342,694

340,536

340,210

Loss on impairment of goodwill and

intangible assets

—

662,221

—

Total expenses

799,542

1,442,448

731,482

Operating income (loss)

161,982

(362,732

)

386,120

Interest expense

333,208

303,401

267,475

Interest income

(8,233

)

(3,500

)

(30

)

(Gain) loss on extinguishment of debt

(53,968

)

(34,551

)

15,843

Gain on investments

—

(289

)

(25

)

Gain on change in fair value of Private

Placement Warrants and Unvested Founder Shares

(1,965

)

(67,050

)

(32,596

)

Net (loss) income before taxes

(107,060

)

(560,743

)

135,453

(Benefit) provision for income taxes

(15,363

)

12,169

33,373

Net (loss) income

$

(91,697

)

$

(572,912

)

$

102,080

Weighted average shares outstanding –

Basic

645,134,657

638,925,689

651,006,567

Weighted average shares outstanding –

Diluted

645,134,657

638,925,689

651,525,791

Net (loss) income per share – Basic

$

(0.14

)

$

(0.90

)

$

0.16

Net (loss) income per share – Diluted

$

(0.14

)

$

(0.90

)

$

0.16

Net (loss) income

$

(91,697

)

$

(572,912

)

$

102,080

Other comprehensive income:

Unrealized loss on interest rate swap, net

of tax

(11,778

)

—

$

—

Comprehensive (loss) income

$

(103,475

)

$

(572,912

)

$

102,080

MULTIPLAN CORPORATION

Consolidated Statements of

Cash Flows

(in thousands)

Years Ended December

31,

2023

2022

2021

Operating activities:

Net (loss) income

$

(91,697

)

$

(572,912

)

$

102,080

Adjustments to reconcile net (loss) income

to net cash provided by operating activities:

Depreciation

77,323

68,756

64,885

Amortization of intangible assets

342,694

340,536

340,210

Amortization of the right-of-use asset

5,769

6,367

6,963

Loss on impairment of goodwill and

intangible assets

—

662,221

—

Stock-based compensation

18,018

16,739

18,010

Deferred income taxes

(114,060

)

(114,378

)

(81,929

)

Amortization of debt issuance costs and

discounts

10,663

10,539

12,259

(Gain) loss on extinguishment of debt

(53,968

)

(34,551

)

15,843

Gain on equity investments

—

(289

)

—

Loss on disposal of property and

equipment

851

1,051

2,991

Change in fair value of Private Placement

Warrants and Unvested Founder Shares

(1,965

)

(67,050

)

(32,596

)

Changes in assets and liabilities, net of

assets acquired and liabilities assumed from acquisitions:

Accounts receivable, net

4,402

20,998

(33,826

)

Prepaid expenses and other assets

(6,615

)

2,795

(6,952

)

Prepaid taxes

(13

)

3,713

(5,064

)

Operating lease obligation

(6,601

)

(6,520

)

(5,900

)

Accounts payable and accrued expenses and

other

(13,081

)

34,349

7,713

Net cash provided by operating

activities

171,720

372,364

404,687

Investing activities:

Purchases of property and equipment

(108,852

)

(89,735

)

(84,590

)

Proceeds from sale of investment

—

289

5,641

Purchase of equity investments

—

(15,000

)

—

BST Acquisition, net of cash acquired

(140,940

)

—

—

HST Acquisition, net of cash acquired

—

—

246

DHP Acquisition, net of cash acquired

—

—

(149,676

)

Net cash used in investing activities

(249,792

)

(104,446

)

(228,379

)

Financing activities:

Repayments of Term Loan G

—

—

(2,341,000

)

Repayments of Term Loan B

(13,250

)

(13,250

)

(3,313

)

Repurchase of 5.750% Notes

(134,975

)

(99,999

)

—

Repurchase of Senior Convertible PIK

Notes

(17,563

)

—

—

Issuance of Term Loan B

—

—

1,298,930

Issuance of 5.50% Senior Secured Notes

—

—

1,034,520

Taxes paid on settlement of vested share

awards

(465

)

(2,463

)

(3,789

)

MULTIPLAN CORPORATION

Consolidated Statements of

Cash Flows Continued

(in thousands)

Years Ended December

31,

2023

2022

2021

Purchase of treasury stock

(15,218

)

—

(100,000

)

Borrowings on finance leases, net

(30

)

(26

)

(32

)

Proceeds from issuance of common stock

under Employee Stock Purchase Plan

508

—

—

Net cash used in financing activities

(180,993

)

(115,738

)

(114,684

)

Net increase (decrease) in cash, cash

equivalents and restricted cash

(259,065

)

152,180

61,624

Cash, cash equivalents and restricted cash

at beginning of period

340,559

188,379

126,755

Cash, cash equivalents and restricted cash

at end of period

$

81,494

$

340,559

$

188,379

Cash and cash equivalents

$

71,547

$

334,046

$

185,328

Restricted cash

9,947

6,513

3,051

Cash, cash equivalents and restricted cash

at end of period

$

81,494

$

340,559

$

188,379

Noncash investing and financing

activities:

Purchases of property and equipment not

yet paid

$

8,649

$

4,784

$

5,930

Operating lease right-of-use assets

obtained in exchange for operating lease liabilities

$

1,304

$

3,631

$

6,880

Supplemental disclosure of cash flow

information:

Cash paid during the period for:

Interest

$

(323,396

)

$

(289,766

)

$

(231,049

)

Income taxes, net of refunds

$

(100,083

)

$

(124,082

)

$

(131,517

)

MULTIPLAN CORPORATION

Calculation of EBITDA and

Adjusted EBITDA

(in thousands)

Year Ended December

31,

2023

2022

2021

Net (loss) income

$

(91,697

)

$

(572,912

)

$

102,080

Adjustments:

Interest expense

333,208

303,401

267,475

Interest income

(8,233

)

(3,500

)

(30

)

Income tax provision (benefit)

(15,363

)

12,169

33,373

Depreciation

77,323

68,756

64,885

Amortization of intangible assets

342,694

340,536

340,210

Non-income taxes

2,283

1,653

1,698

EBITDA

$

640,215

$

150,103

$

809,691

Adjustments:

Other expenses, net (1)

4,323

4,477

8,295

Integration expenses

3,358

4,055

9,460

Change in fair value of Private Placement

Warrants and Unvested Founder Shares

(1,965

)

(67,050

)

(32,596

)

Transaction-related expenses

8,064

34,693

9,647

Gain on investments

—

(289

)

(25

)

(Gain) loss on extinguishment of debt

(53,968

)

(34,551

)

15,843

Loss on impairment of goodwill and

intangible assets

—

662,221

—

Stock-based compensation

18,018

15,083

18,010

Adjusted EBITDA

$

618,045

$

768,742

$

838,325

(1)

"Other expenses, net" represents

miscellaneous non-recurring income, miscellaneous non-recurring

expenses, gain or loss on disposal of assets, impairment of other

assets, gain or loss on disposal of leases, tax penalties, and

non-integration related severance costs.

Calculation of Free Cash Flow,

Unlevered Free Cash Flow and Adjusted Cash Conversion Ratio

(in thousands)

Year Ended December

31,

2023

2022

2021

Net cash provided by operating

activities

$

171,720

$

372,364

$

404,687

Purchases of property and equipment

(108,852

)

(89,735

)

(84,590

)

Free Cash Flow

62,868

282,629

320,097

Interest paid

323,396

289,766

231,049

Unlevered Free Cash Flow

$

386,264

$

572,395

$

551,146

Adjusted EBITDA

$

618,045

$

768,742

$

838,325

Adjusted Cash Conversion Ratio

62

%

74

%

66

%

Net cash used in investing activities

$

(249,792

)

$

(104,446

)

$

(228,379

)

Net cash used in financing activities

$

(180,993

)

$

(115,738

)

$

(114,684

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240229642362/en/

Investor Relations Contact Luke Montgomery, CFA SVP,

Finance & Investor Relations MultiPlan 866-909-7427

investor@multiplan.com Shawna Gasik AVP, Investor Relations

MultiPlan 866-909-7427 investor@multiplan.com

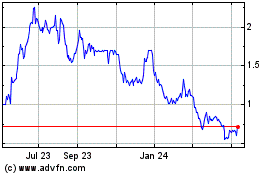

Churchill Capital Corp III (NYSE:MPLN)

Historical Stock Chart

From Dec 2024 to Jan 2025

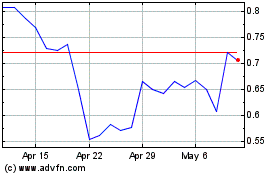

Churchill Capital Corp III (NYSE:MPLN)

Historical Stock Chart

From Jan 2024 to Jan 2025