UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For August 2024

Commission File Number: 1-34513

CENOVUS ENERGY INC.

(Translation of registrant’s name into English)

4100, 225 6 Avenue S.W.

Calgary, Alberta, Canada T2P 1N2

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

DOCUMENTS FILED AS PART OF THIS FORM 6-K

See the Exhibit Index to this Form 6-K.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: August 1, 2024

| | | | | | | | | | | | | | | | | |

| | | CENOVUS ENERGY INC. | | |

| | | (Registrant) | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | By: | | /s/ Christine D. Lee | | |

| | | | Name: | | Christine D. Lee | | |

| | | | Title: | | Assistant Corporate Secretary | | |

Form 6-K Exhibit Index

| | | | | | | | |

| Exhibit No. | | |

| | |

| | News Release dated August 1, 2024 |

| | |

| | Management’s Discussion and Analysis dated July 31, 2024 for the period ended June 30, 2024 |

| | |

| | Interim Consolidated Financial Statement (unaudited) for the period ended June 30, 2024 |

| | |

| | Form 52-109F2 Full Certificate, dated August 1, 2024, of Jonathan M. McKenzie, President & Chief Executive Officer |

| | |

| | Form 52-109F2 Full Certificate, dated August 1, 2024, of Karamjit S. Sandhar, Executive Vice-President & Chief Financial Officer |

| | |

| | |

Cenovus announces second quarter 2024 results

Calgary, Alberta (August 1, 2024) – Cenovus Energy Inc. (TSX: CVE) (NYSE: CVE) delivered strong operational performance across its portfolio in the second quarter of 2024, with solid production from its upstream assets and improved crude throughput at the company’s U.S. refineries, which operated at an overall utilization rate of 93%. Net debt was $4.26 billion at June 30, 2024, and in July the company achieved its net debt target of $4.0 billion. As a result, beginning in the third quarter, Cenovus will begin returning 100% of excess free funds flow (EFFF) to shareholders, as per the company’s shareholder returns framework.

“With the achievement of this significant financial milestone, we are now in a position to substantially increase our shareholder returns,” said Jon McKenzie, Cenovus President & Chief Executive Officer. “We will continue our focus on safely delivering profitable and predictable operations, while progressing our growth projects to further improve the resiliency of the company.”

Recent highlights

•Achieved net debt target of $4.0 billion in July, immediately shifting to returning 100% excess free funds flow to shareholders.

•As a result of strong first half performance, increased the midpoint of Upstream production guidance to 797,500 barrels of oil equivalent per day (BOE/d)1 and the midpoint of Downstream throughput guidance to 655,000 barrels per day (bbls/d). Capital investment range is unchanged.

•The Narrows Lake tie-back pipeline to Christina Lake is expected to achieve mechanical completion by the end of the year, and remains on schedule to deliver first oil mid-2025.

•At Sunrise, the company began steaming two well pads which will be brought on production in the third and fourth quarters of this year.

•Achieved significant milestones on the West White Rose project as the concrete gravity structure reached its final height and topsides were structurally completed.

•Safely completed the largest turnaround in the Lloydminster Upgrader’s history, with the facility now returned to full operations.

| | | | | | | | | | | | | |

| Financial, production & throughput summary |

| For the period ended June 30 | 2024 Q2 | 2024 Q1 | 2023 Q2 | | |

| Financial ($ millions, except per share amounts) |

| Cash from (used in) operating activities | 2,807 | 1,925 | 1,990 | | |

Adjusted funds flow2 | 2,361 | 2,242 | 1,899 | | |

Per share (diluted)2 | 1.26 | 1.19 | 0.98 | | |

| Capital investment | 1,155 | 1,036 | 1,002 | | |

Free funds flow2 | 1,206 | 1,206 | 897 | | |

Excess free funds flow2 | 735 | 832 | 505 | | |

| Net earnings (loss) | 1,000 | 1,176 | 866 | | |

| Per share (diluted) | 0.53 | 0.62 | 0.44 | | |

| Long-term debt, including current portion | 7,275 | 7,227 | 8,534 | | |

| Net debt | 4,258 | 4,827 | 6,367 | | |

| Production and throughput (before royalties, net to Cenovus) |

Oil and NGLs (bbls/d)1 | 656,300 | 658,200 | 608,400 | | |

| Conventional natural gas (MMcf/d) | 867.2 | 855.8 | 729.4 | | |

1 See Advisory for production by product type.

2 Non-GAAP financial measure or contains a non-GAAP financial measure. See Advisory.

CENOVUS ENERGY NEWS RELEASE | 1

| | | | | | | | | | | | | |

Total upstream production (BOE/d)1 | 800,800 | 800,900 | 729,900 | | |

Total downstream throughput (bbls/d) | 622,700 | 655,200 | 537,800 | | |

Second-quarter results

Operating results1

Cenovus’s total revenues were approximately $14.9 billion in the second quarter of 2024, up from $13.4 billion in the first quarter, driven primarily by improved benchmark oil prices, including a narrower light-heavy crude oil differential, combined with strong operating results. Upstream revenues were about $7.9 billion, an increase from $7.1 billion in the first quarter, while downstream revenues were approximately $9.1 billion, up from $8.6 billion in the first quarter. Total operating margin3 was about $2.9 billion, compared with $3.2 billion in the previous quarter. Upstream operating margin4 was approximately $3.1 billion, up from $2.6 billion in the first quarter. The company had a downstream operating margin4 shortfall of $153 million in the second quarter, compared with an operating margin of $560 million in the previous quarter as the Lloydminster Upgrader underwent a major planned turnaround. The turnaround was impacted by weather-related delays which resulted in additional costs due to lost productivity. The turnaround is now complete and the Upgrader has ramped up to full rates. Downstream operating margin was further impacted by narrower light-heavy crude oil differentials in addition to planned and unplanned outages. In the second quarter, operating margin in U.S. Refining benefited from approximately $80 million of first in, first out (FIFO) gains.

Total upstream production was 800,800 BOE/d in the second quarter, in line with the first quarter. Foster Creek volumes were 195,000 bbls/d compared with 196,000 bbls/d in the first quarter and Christina Lake production was 237,100 bbls/d, in line with the first quarter. Christina Lake will commence planned turnaround activity in September, which is expected to reduce third-quarter production volumes by approximately 45,000 bbls/d. Sunrise production was 46,100 bbls/d in the second quarter, a slight decline from the previous quarter, reflecting a planned outage. Lloydminster thermal production was 113,500 bbls/d, which reflects a successful redevelopment program and base well optimization. Lloydminster conventional heavy oil production was 18,100 bbls/d, in line with the first quarter. In the second quarter, Cenovus loaded its first vessels at the Westridge Marine Terminal following the successful startup of the Trans Mountain pipeline expansion.

Production in the Conventional segment was 123,100 BOE/d in the second quarter, an increase from 120,700 BOE/d in the prior quarter. Conventional operating costs declined approximately 14% from the first quarter of 2024, to $11.25/BOE4, reflecting lower repair and maintenance expenses, the divestment of higher-cost assets and the company’s commitment to cost discipline.

In the Offshore segment, production was 66,200 BOE/d compared with 64,900 BOE/d in the first quarter. In Asia Pacific, sales volumes were 57,800 BOE/d, reflecting strong natural gas demand in the region. In the Atlantic, production was 8,400 bbls/d, up from 7,200 bbls/d in the prior quarter as the non-operated Terra Nova field continues to ramp up to full rates. Sales volumes in the Atlantic region in the second quarter were 14,800 bbls/d, compared with 3,900 bbls/d in the first quarter. Planned maintenance work on the SeaRose floating production, storage and offloading (FPSO) vessel is nearing completion and the company anticipates the return of the vessel to the White Rose field late in the third quarter of this year.

Refining throughput in the second quarter was 622,700 bbls/d, a decrease from 655,200 bbls/d in the first quarter, due to planned maintenance activities in Canadian Refining as well as both planned and minor unplanned outages in U.S. Refining. Crude throughput in the Canadian Refining segment was 53,800 bbls/d in the second quarter, compared with 104,100 bbls/d in the first quarter, with the decrease due to the

1 See Advisory for production by product type.

3 Non-GAAP financial measure. Total operating margin is the total of Upstream operating margin plus Downstream operating margin. See Advisory.

4 Specified financial measure. See Advisory.

CENOVUS ENERGY NEWS RELEASE | 2

turnaround at the Lloydminster Upgrader. The turnaround was safely and successfully completed, and the Upgrader has now ramped up to normal rates. Weather-related delays impacting the turnaround resulted in cost increases due to lost productivity and extended the scheduled timeline.

In U.S. Refining, crude throughput was 568,900 bbls/d in the second quarter, compared with 551,100 bbls/d in the first quarter. Throughput in the quarter increased primarily due to improved operating performance and availability across the company's operated and non-operated refining assets and lower levels of planned maintenance when compared with the prior quarter. In addition, the company has optimized planned turnaround activity at the Lima Refinery in the second half of the year, leveraging the integration of the company’s expanded refinery network. This, combined with the deferral of some planned turnaround activities into 2025, is now reflected in the planned maintenance summary below and in the company’s updated guidance range for crude throughput.

1 See Advisory for production by product type.

3 Non-GAAP financial measure. Total operating margin is the total of Upstream operating margin plus Downstream operating margin. See Advisory.

4 Specified financial measure. See Advisory.

CENOVUS ENERGY NEWS RELEASE | 3

Financial results

Second-quarter cash from operating activities, which includes changes in non-cash working capital, was about $2.8 billion, compared with $1.9 billion in the first quarter of 2024. Adjusted funds flow was approximately $2.4 billion, compared with $2.2 billion in the prior period and free funds flow was $1.2 billion, in line with the previous quarter. Second-quarter financial results were positively impacted by higher benchmark crude oil prices and a narrowing of the light-heavy crude oil differential, partially offset by higher feedstock costs in the company’s Downstream business and increased condensate prices. Net earnings in the second quarter were $1.0 billion, a slight decline from $1.2 billion in the previous quarter, primarily as a result of higher purchased product, and transportation and blending costs.

Long-term debt, including the current portion, was $7.3 billion at June 30, 2024, in line with the previous quarter. Net debt was approximately $4.26 billion at June 30, 2024, a decrease from $4.8 billion at March 31, 2024, primarily due to free funds flow of $1.2 billion and a release of non-cash working capital. These factors were partially offset by shareholder returns of $1.0 billion. In July, the company achieved its net debt target of $4.0 billion, and will now return 100% of EFFF to shareholders in accordance with its financial framework.

Growth projects and capital investments

In the Oil Sands segment, the company continues to progress the tie-back of Narrows Lake, building a 17-kilometre pipeline connecting the reservoir to the Christina Lake processing facility, which will add between 20,000 bbls/d and 30,000 bbls/d of production starting in late 2025. The project is now 88% constructed, with the first two pads drilled, and hydro testing of the first segment of the line was completed in the second quarter of 2024. At Sunrise, the company began steaming two well pads which will be brought on production in the third and fourth quarters of this year, and one additional well pad will come online in early 2025. Additionally, the optimization project at Foster Creek remains on schedule for startup by the middle of 2026, with most modules and major pieces of equipment in place and pipe installation underway. At the Conventional Heavy Oil assets, the rig fleet has ramped up to four rigs. The company expects to see increased drilling activity in the second half of the year and a higher exit production rate for the asset.

Capital in the Conventional business was directed towards drilling, completion, tie-in and infrastructure projects. The West White Rose project reached a significant milestone with the completion of major construction on two key components of the platform, with the concrete gravity structure reaching its final height and the topsides structurally completed. The West White Rose project is now approximately 80% complete and progressing on-schedule, with first production expected from the field in 2026. In the Downstream, capital was primarily directed to sustaining activities and reliability initiatives at the company’s operated and non-operated assets.

2024 guidance update

Cenovus has revised its 2024 corporate guidance to reflect the company’s updated outlook for the remainder of the year. It is available on Cenovus.com under Investors.

Changes to the company’s 2024 guidance include:

•Total upstream production of 785,000 BOE/d to 810,000 BOE/d, an increase of 7,500 BOE/d at the midpoint as a result of strong year-to-date performance and asset reliability.

•Total downstream throughput of 640,000 bbls/d to 670,000 bbls/d, an increase of 5,000 bbls/d at the midpoint as a result of strong year-to-date performance and optimization of the

1 See Advisory for production by product type.

3 Non-GAAP financial measure. Total operating margin is the total of Upstream operating margin plus Downstream operating margin. See Advisory.

4 Specified financial measure. See Advisory.

CENOVUS ENERGY NEWS RELEASE | 4

company’s turnaround activities in the second half of the year, including turnaround activity that was deferred to 2025.

•Oil Sands operating costs of $10.50/bbl to $12.50/bbl representing a decrease of 12% at the midpoint, and Asia Pacific operating costs of $9.50/BOE to $10.50/BOE, representing a decrease of $2.00/BOE at the midpoint.

•Updated Canadian Refining operating costs per barrel range to $20.25/bbl to $22.25/bbl to reflect cost increases associated with the Lloydminster Upgrader turnaround which were incurred in the first half of the year.

•G&A expenses of $625 million to $675 million, a reduction of $25 million at the midpoint

The company has also updated its commodity price assumptions, guidance range for cash taxes, and operating cost guidance for the Atlantic and U.S. Downstream segments. The company continues to execute its capital program and there has been no change to Cenovus’s expected capital investment range of $4.5 billion to $5.0 billion.

Dividend declarations and share purchases

The Board of Directors has declared a quarterly base dividend of $0.180 per common share, payable on September 27, 2024 to shareholders of record as of September 13, 2024.

In addition, the Board has declared a quarterly dividend on each of the Cumulative Redeemable First Preferred Shares – Series 1, Series 2, Series 3, Series 5 and Series 7 – payable on October 1, 2024 to shareholders of record as of September 13, 2024 as follows:

| | | | | | | | |

| Preferred shares dividend summary |

| Share series | Rate (%) | Amount ($/share) |

| Series 1 | 2.577 | 0.16106 |

| Series 2 | 6.602 | 0.41488 |

| Series 3 | 4.689 | 0.29306 |

| Series 5 | 4.591 | 0.28694 |

| Series 7 | 3.935 | 0.24594 |

All dividends paid on Cenovus’s common and preferred shares will be designated as “eligible dividends” for Canadian federal income tax purposes. Declaration of dividends is at the sole discretion of the Board and will continue to be evaluated on a quarterly basis.

In the second quarter, the company returned approximately $1.0 billion to common shareholders. This was composed of $440 million through its normal course issuer bid, $334 million through base dividends and $251 million of variable dividends paid.

2024 planned maintenance

The following table provides details on planned maintenance activities at Cenovus assets through 2024 and anticipated production or throughput impacts.

| | | | | | | | | | | |

2024 planned maintenance |

Potential quarterly production/throughput impact (Mbbls/d or MBOE/d) |

| Q3 | Q4 | Annualized impact |

Upstream | | | |

Oil Sands | 42-47 | 6-10 | 13-16 |

CENOVUS ENERGY NEWS RELEASE | 5

| | | | | | | | | | | |

2024 planned maintenance |

Atlantic | 8-10 | — | 5-7 |

Conventional | 6-8 | — | 2-4 |

| Downstream | | | |

Canadian Refining | 2-5 | — | 12-14 |

| U.S. Refining | 10-15 | 15-20 | 12-15 |

Organizational updates

Drew Zieglgansberger, Executive Vice-President & Chief Commercial Officer, has announced his retirement from Cenovus effective August 31, 2024. The current duties of the chief commercial officer will be reassigned to other members of the company’s senior leadership team.

“Drew has made significant contributions in multiple roles during his impressive 25-year career with Cenovus and its predecessor companies,” said McKenzie. “As Chief Commercial Officer, Drew has led the successful integration of the commercial aspects of our business with our operations, which we will continue to build on as we demonstrate the value of our larger, integrated company. I would like to thank Drew for his many contributions over the years and wish him the very best.”

Sustainability

Cenovus’s 2023 Environmental, Social & Governance report was originally scheduled to be published at the end of June. However, due to significant uncertainty created by recent changes to Canada’s Competition Act involving environmental and climate disclosure standards, Cenovus will be issuing an interim Corporate Social Responsibility report in late August, addressing safety, Indigenous reconciliation, inclusion & diversity and governance. The extent to which the Competition Bureau can provide clarity regarding its new environmental disclosure standards will help guide Cenovus’s future communications about the environmental work the company continues to advance.

| | |

Conference call today

8 a.m. Mountain Time (10 a.m. Eastern Time) Cenovus will host a conference call today, August 1, 2024, starting at 8 a.m. MT (10 a.m. ET). To join the conference call without operator assistance, please register here approximately 5 minutes in advance to receive an automated call-back when the session begins. Alternatively, you can dial 888-664-6383 (toll-free in North America) or 416-764-8650 to reach a live operator who will join you into the call. A live audio webcast will also be available and archived for approximately 90 days. |

Advisory

Basis of Presentation

Cenovus reports financial results in Canadian dollars and presents production volumes on a net to Cenovus before royalties basis, unless otherwise stated. Cenovus prepares its financial statements in accordance with International Financial Reporting Standards (IFRS) Accounting Standards.

Barrels of Oil Equivalent

Natural gas volumes have been converted to barrels of oil equivalent (BOE) on the basis of six thousand cubic feet (Mcf) to one barrel (bbl). BOE may be misleading, particularly if used in isolation. A conversion ratio of one bbl to six Mcf is based on an energy equivalency conversion method primarily applicable at

CENOVUS ENERGY NEWS RELEASE | 6

the burner tip and does not represent value equivalency at the wellhead. Given that the value ratio based on the current price of crude oil compared with natural gas is significantly different from the energy equivalency conversion ratio of 6:1, utilizing a conversion on a 6:1 basis is not an accurate reflection of value.

Product types

| | | | | |

| Product type by operating segment |

| Three months ended June 30, 2024 |

| Oil Sands |

| Bitumen (Mbbls/d) | 591.7 |

| Heavy crude oil (Mbbls/d) | 18.1 |

| Conventional natural gas (MMcf/d) | 10.5 |

| Total Oil Sands segment production (MBOE/d) | 611.5 |

| Conventional | |

| Light crude oil (Mbbls/d) | 5.1 |

| Natural gas liquids (Mbbls/d) | 21.4 |

| Conventional natural gas (MMcf/d) | 579.4 |

| Total Conventional segment production (MBOE/d) | 123.1 |

| Offshore | |

| Light crude oil (Mbbls/d) | 8.4 |

| Natural gas liquids (Mbbls/d) | 11.6 |

| Conventional natural gas (MMcf/d) | 277.3 |

| Total Offshore segment production (MBOE/d) | 66.2 |

| Total upstream production (MBOE/d) | 800.8 |

Forward‐looking Information

This news release contains certain forward‐looking statements and forward‐looking information (collectively referred to as “forward‐looking information”) within the meaning of applicable securities legislation about Cenovus’s current expectations, estimates and projections about the future of the company, based on certain assumptions made in light of the company’s experiences and perceptions of historical trends. Although Cenovus believes that the expectations represented by such forward‐looking information are reasonable, there can be no assurance that such expectations will prove to be correct.

Forward‐looking information in this document is identified by words such as “anticipate”, “continue”, “deliver”, “expect”, “focus”, “progress”, “target” and “will” or similar expressions and includes suggestions of future outcomes, including, but not limited to, statements about: returning Excess Free Funds Flow to shareholders; shareholder returns; safety; profitable and predictable operations; growth projects; resiliency; Net Debt; production guidance; the optimization project at Foster Creek; production at Sunrise; drilling activity and production at the Conventional Heavy Oil assets; turnaround activity at Christina Lake; planned maintenance on the SeaRose FPSO; return of the SeaRose FPSO to the White Rose Field; first production from the West White Rose project; optimizing planned turnaround activity for U.S. Refining; allocation of Excess Free Funds Flow; 2024 planned maintenance; dividend payments; and Cenovus’s 2024 corporate guidance available on cenovus.com.

Developing forward‐looking information involves reliance on a number of assumptions and consideration of certain risks and uncertainties, some of which are specific to Cenovus and others that apply to the industry generally. The factors or assumptions on which the forward‐looking information in this news release are based include, but are not limited to: the allocation of free funds flow to reducing net debt; commodity prices, inflation and supply chain constraints; Cenovus’s ability to produce on an

CENOVUS ENERGY NEWS RELEASE | 7

unconstrained basis; Cenovus’s ability to access sufficient insurance coverage to pursue development plans; Cenovus’s ability to deliver safe and reliable operations and demonstrate strong governance; and the assumptions inherent in Cenovus’s 2024 corporate guidance available on cenovus.com.

The risk factors and uncertainties that could cause actual results to differ materially from the forward‐looking information in this news release include, but are not limited to: the accuracy of estimates regarding commodity production and operating expenses, inflation, taxes, royalties, capital costs and currency and interest rates; risks inherent in the operation of Cenovus’s business; and risks associated with climate change and Cenovus’s assumptions relating thereto and other risks identified under “Risk Management and Risk Factors” and “Advisory” in Cenovus’s Management’s Discussion and Analysis (MD&A) for the year ended December 31, 2023.

Except as required by applicable securities laws, Cenovus disclaims any intention or obligation to publicly update or revise any forward‐looking statements, whether as a result of new information, future events or otherwise. Readers are cautioned that the foregoing lists are not exhaustive and are made as at the date hereof. Events or circumstances could cause actual results to differ materially from those estimated or projected and expressed in, or implied by, the forward‐looking information. For additional information regarding Cenovus’s material risk factors, the assumptions made, and risks and uncertainties which could cause actual results to differ from the anticipated results, refer to “Risk Management and Risk Factors” and “Advisory” in Cenovus’s MD&A for the periods ended December 31, 2023 and June 30, 2024, and to the risk factors, assumptions and uncertainties described in other documents Cenovus files from time to time with securities regulatory authorities in Canada (available on SEDAR+ at sedarplus.ca, on EDGAR at sec.gov and Cenovus’s website at cenovus.com.

Specified Financial Measures

This news release contains references to certain specified financial measures that do not have standardized meanings prescribed by IFRS Accounting Standards. Readers should not consider these measures in isolation or as a substitute for analysis of the company’s results as reported under IFRS Accounting Standards. These measures are defined differently by different companies and, therefore, might not be comparable to similar measures presented by other issuers. For information on the composition of these measures, as well as an explanation of how the company uses these measures, refer to the Specified Financial Measures Advisory located in Cenovus’s MD&A for the period ended June 30, 2024 (available on SEDAR+ at sedarplus.ca, on EDGAR at sec.gov and on Cenovus's website at cenovus.com) which is incorporated by reference into this news release.

Upstream Operating Margin and Downstream Operating Margin

Upstream Operating Margin and Downstream Operating Margin, and the individual components thereof, are included in Note 1 to the interim Consolidated Financial Statements.

Total Operating Margin

Total Operating Margin is the total of Upstream Operating Margin plus Downstream Operating Margin.

CENOVUS ENERGY NEWS RELEASE | 8

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Upstream (1) | | Downstream (1) | | Total |

| ($ millions) | Q2 2024 | | Q1 2024 | | Q2 2023 | | Q2 2024 | | Q1 2024 | | Q2 2023 | | Q2 2024 | | Q1 2024 | | Q2 2023 |

| Revenues | | | | | | | | | | | | | | | | | |

| Gross Sales | 8,715 | | | 7,864 | | | 7,285 | | | 9,053 | | | 8,567 | | | 7,427 | | | 17,768 | | | 16,431 | | | 14,712 | |

| Less: Royalties | (859) | | | (747) | | | (637) | | | — | | | — | | | — | | | (859) | | | (747) | | | (637) | |

| 7,856 | | | 7,117 | | | 6,648 | | | 9,053 | | | 8,567 | | | 7,427 | | | 16,909 | | | 15,684 | | | 14,075 | |

| Expenses | | | | | | | | | | | | | | | | | |

| Purchased Product | 815 | | | 771 | | | 751 | | | 8,099 | | | 7,219 | | | 6,447 | | | 8,914 | | | 7,990 | | | 7,198 | |

| Transportation and Blending | 3,043 | | | 2,811 | | | 2,770 | | | — | | | — | | | — | | | 3,043 | | | 2,811 | | | 2,770 | |

| Operating | 889 | | | 898 | | | 883 | | | 1,099 | | | 787 | | | 843 | | | 1,988 | | | 1,685 | | | 1,726 | |

| Realized (Gain) Loss on Risk Management | 20 | | | 6 | | | (13) | | | 8 | | | 1 | | | (6) | | | 28 | | | 7 | | | (19) | |

| Operating Margin | 3,089 | | | 2,631 | | | 2,257 | | | (153) | | | 560 | | | 143 | | | 2,936 | | | 3,191 | | | 2,400 | |

(1) Found in the June 30, 2024, or the March 31, 2024, interim Consolidated Financial Statements.

Adjusted Funds Flow, Free Funds Flow and Excess Free Funds Flow

The following table provides a reconciliation of cash from (used in) operating activities found in Cenovus’s Consolidated Financial Statements to Adjusted Funds Flow, Free Funds Flow and Excess Free Funds Flow. Adjusted Funds Flow per Share – Basic and Adjusted Funds Flow per Share – Diluted are calculated by dividing Adjusted Funds Flow by the respective basic or diluted weighted average number of common shares outstanding during the period and may be useful to evaluate a company’s ability to generate cash.

| | | | | | | | | | | | | | |

| Three Months Ended | | |

| ($ millions) | Jun. 30, 2024 | Mar. 31, 2024 | Jun. 30, 2023 | | | |

Cash From (Used in) Operating Activities (1) | 2,807 | | 1,925 | | 1,990 | | | | |

| (Add) Deduct: | | | | | | |

| Settlement of Decommissioning Liabilities | (48) | | (48) | | (41) | | | | |

| Net Change in Non-Cash Working Capital | 494 | | (269) | | 132 | | | | |

| Adjusted Funds Flow | 2,361 | | 2,242 | | 1,899 | | | | |

| Capital Investment | 1,155 | | 1,036 | | 1,002 | | | | |

| Free Funds Flow | 1,206 | | 1,206 | | 897 | | | | |

| Add (Deduct): | | | | | | |

| Base Dividends Paid on Common Shares | (334) | | (262) | | (265) | | | | |

| Dividends Paid on Preferred Shares | (9) | | (9) | | (9) | | | | |

| Settlement of Decommissioning Liabilities | (48) | | (48) | | (41) | | | | |

| Principal Repayment of Leases | (75) | | (70) | | (76) | | | | |

| Acquisitions, Net of Cash Acquired | (5) | | (10) | | (4) | | | | |

| Proceeds From Divestitures | — | | 25 | | 3 | | | | |

| | | | | | |

| Excess Free Funds Flow | 735 | | 832 | | 505 | | | | |

(1) Found in the June 30, 2024, or the March 31, 2024, interim Consolidated Financial Statements.

Cenovus Energy Inc.

Cenovus Energy Inc. is an integrated energy company with oil and natural gas production operations in Canada and the Asia Pacific region, and upgrading, refining and marketing operations in Canada and the United States. The company is focused on managing its assets in a safe, innovative and cost-efficient manner, integrating environmental, social and governance considerations into its business plans.

CENOVUS ENERGY NEWS RELEASE | 9

Cenovus common shares and warrants are listed on the Toronto and New York stock exchanges, and the company’s preferred shares are listed on the Toronto Stock Exchange. For more information, visit cenovus.com.

Find Cenovus on Facebook, X, LinkedIn, YouTube and Instagram.

Cenovus contacts | | | | | |

| Investors | Media |

| Investor Relations general line 403-766-7711 | Media Relations general line 403-766-7751 |

CENOVUS ENERGY NEWS RELEASE | 10

Exhibit 99.2

Cenovus Energy Inc.

Management’s Discussion and Analysis (unaudited)

For the Periods Ended June 30, 2024

(Canadian Dollars)

MANAGEMENT’S DISCUSSION AND ANALYSIS

| | |

For the periods ended June 30, 2024 |

This Management’s Discussion and Analysis (“MD&A”) for Cenovus Energy Inc. (which includes references to “we”, “our”, “us”, “its”, the “Company”, or “Cenovus”, and means Cenovus Energy Inc., the subsidiaries of, joint arrangements, and partnership interests held directly or indirectly by, Cenovus Energy Inc.) dated July 31, 2024, should be read in conjunction with our June 30, 2024 unaudited interim Consolidated Financial Statements and accompanying notes (“interim Consolidated Financial Statements”), the December 31, 2023 audited Consolidated Financial Statements and accompanying notes (“Consolidated Financial Statements”) and the December 31, 2023 MD&A (“annual MD&A”). All of the information and statements contained in this MD&A are made as at July 31, 2024, unless otherwise indicated. This MD&A contains forward-looking information about our current expectations, estimates, projections and assumptions. See the Advisory for information on the risk factors that could cause actual results to differ materially and the assumptions underlying our forward-looking information. Cenovus management (“Management”) prepared the MD&A. The Audit Committee of the Cenovus Board of Directors (“the Board”), reviewed and recommended the MD&A for approval by the Board, which occurred on July 31, 2024. Additional information about Cenovus, including our quarterly and annual reports, Annual Information Form (“AIF”) and Form 40-F, is available on SEDAR+ at sedarplus.ca, on EDGAR at sec.gov, and on our website at cenovus.com. Information on or connected to our website, even if referred to in this MD&A, do not constitute part of this MD&A. Basis of Presentation

This MD&A and the interim Consolidated Financial Statements were prepared in Canadian dollars, (which includes references to “dollar” or “$”), except where another currency is indicated, and in accordance with International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board (“IASB”) (the “IFRS Accounting Standards”). Production volumes are presented on a before royalties basis. Refer to the Abbreviations and Definitions section for commonly used oil and gas terms.

| | | | | |

| Cenovus Energy Inc. – Q2 2024 Management's Discussion and Analysis | 2 |

We are a Canadian-based integrated energy company headquartered in Calgary, Alberta. We are one of the largest Canadian-based crude oil and natural gas producers, with upstream operations in Canada and the Asia Pacific region, and one of the largest Canadian-based refiners and upgraders, with downstream operations in Canada and the United States (“U.S.”).

Our upstream operations include oil sands projects in northern Alberta; thermal and conventional crude oil, natural gas and natural gas liquids (“NGLs”) projects across Western Canada; crude oil production offshore Newfoundland and Labrador; and natural gas and NGLs production offshore China and Indonesia. Our downstream operations include upgrading and refining operations in Canada and the U.S., and commercial fuel operations across Canada.

Our operations involve activities across the full value chain to develop, produce, refine, transport and market crude oil, natural gas and refined petroleum products in Canada and internationally. Our physically and economically integrated upstream and downstream operations help us mitigate the impact of volatility in light-heavy crude oil differentials and contribute to our net earnings by capturing value from crude oil, natural gas and NGLs production through to the sale of finished products such as transportation fuels.

Our Strategy

At Cenovus, our purpose is to energize the world to make people’s lives better. Our strategy is focused on maximizing shareholder value over the long-term through sustainable, low-cost, diversified and integrated energy leadership. Our five strategic objectives include: delivering top tier safety performance; maximizing value through competitive cost structures and optimizing margins; a focus on financial discipline, including reaching and maintaining targeted debt levels while positioning Cenovus for resiliency through commodity price cycles; a disciplined approach to allocating capital to projects that generate returns at the bottom of the commodity price cycle; and the prioritization of Free Funds Flow generation through all price cycles to manage our balance sheet, increase shareholder returns through dividend growth and common share purchases, reinvest in our business, and diversify our portfolio.

On December 14, 2023, we released our 2024 budget focused on disciplined capital investment and balancing growth of our base business with meaningful shareholder returns. We will remain focused on safe operations, reducing costs, capital discipline and realizing the full value of our integrated business. Our 2024 corporate guidance was updated on July 31, 2024, and is available on our website at cenovus.com. For further details, see the Outlook section of this MD&A.

Our Operations

The Company operates through the following reportable segments:

Upstream Segments

•Oil Sands, includes the development and production of bitumen and heavy oil in northern Alberta and Saskatchewan. Cenovus’s oil sands assets include Foster Creek, Christina Lake, Sunrise, Lloydminster thermal and Lloydminster conventional heavy oil assets. Cenovus jointly owns and operates pipeline gathering systems and terminals through the equity-accounted investment in Husky Midstream Limited Partnership (“HMLP”). The sale and transportation of Cenovus’s production and third-party commodity trading volumes are managed and marketed through access to capacity on third-party pipelines and storage facilities in both Canada and the U.S. to optimize product mix, delivery points, transportation commitments and customer diversification.

•Conventional, includes assets rich in NGLs and natural gas within the Elmworth-Wapiti, Kaybob‑Edson, Clearwater and Rainbow Lake operating areas in Alberta and British Columbia and interests in numerous natural gas processing facilities. Cenovus’s NGLs and natural gas production is marketed and transported, with additional third-party commodity trading volumes, through access to capacity on third-party pipelines, export terminals and storage facilities. These provide flexibility for market access to optimize product mix, delivery points, transportation commitments and customer diversification.

•Offshore, includes offshore operations, exploration and development activities in China and the east coast of Canada, as well as the equity-accounted investment in Husky-CNOOC Madura Ltd. (“HCML”), which is engaged in the exploration for and production of NGLs and natural gas in offshore Indonesia.

Downstream Segments

•Canadian Refining, includes the owned and operated Lloydminster upgrading and asphalt refining complex, which converts heavy oil and bitumen into synthetic crude oil, diesel, asphalt and other ancillary products. Cenovus also owns and operates the Bruderheim crude-by-rail terminal and two ethanol plants. The Company’s commercial fuels business across Canada is included in this segment. Cenovus markets its production and third-party commodity trading volumes in an effort to use its integrated network of assets to maximize value.

| | | | | |

| Cenovus Energy Inc. – Q2 2024 Management's Discussion and Analysis | 3 |

•U.S. Refining, includes the refining of crude oil to produce gasoline, diesel, jet fuel, asphalt and other products at the wholly-owned Lima, Superior and Toledo refineries, and the jointly-owned Wood River and Borger refineries, held through WRB Refining LP (“WRB”), a jointly owned entity with operator Phillips 66. Cenovus markets some of its own and third-party refined products including gasoline, diesel, jet fuel and asphalt.

Corporate and Eliminations

Corporate and Eliminations, includes Cenovus-wide costs for general and administrative, financing activities, gains and losses on risk management for corporate related derivative instruments and foreign exchange. Eliminations include adjustments for feedstock and internal usage of crude oil, natural gas, condensate, other NGLs and refined products between segments; transloading services provided to the Oil Sands segment by the Company’s crude-by-rail terminal; the sale of condensate extracted from blended crude oil production in the Canadian Refining segment and sold to the Oil Sands segment; and unrealized profits in inventory. Eliminations are recorded based on market prices.

| | |

|

| QUARTERLY RESULTS OVERVIEW |

The second quarter’s financial and operational results reflect strong operational performance and constructive crude oil prices at our Oil Sands assets, the impact that the execution of the turnaround at the Lloydminster Upgrader (the “Upgrader”) had on our Canadian Refining segment, and increased crude oil unit throughput (“throughput”) at our U.S. Refineries, offset by the impact of the narrowing WTI-WCS differential at Hardisty and volatile market crack spreads.

•Continued focus on safety. We maintained safe operations throughout our business, and are continually striving to improve our safety record. Safety continues to be a key priority for 2024.

•Achieved our Net Debt target in July. As at June 30, 2024, our Net Debt position was $4.3 billion and in July, we reached our Net Debt target of $4.0 billion. As such, in the third quarter of 2024, we will target to allocate 100 percent of Excess Free Funds Flow to shareholder returns, adjusted for the amount Net Debt exceeded $4.0 billion, which was $258 million at June 30, 2024.

•Strong upstream production. Upstream production averaged 800.8 thousand barrels of oil equivalent per day in the second quarter, consistent with 800.9 thousand barrels of oil equivalent per day in the first quarter of 2024.

•Safely executed the Lloydminster Upgrader turnaround. From May 8 to July 4, 2024, we completed the largest turnaround in the history of the Upgrader. As a result, throughput in the Canadian Refining segment decreased 50.3 thousand barrels per day from the first quarter of 2024 to 53.8 thousand barrels per day. Total Canadian Refining operating expenses of $415 million included $211 million related to the turnaround. The Upgrader has returned to full operations.

•Improved U.S. Refining throughput. Crude throughput at our U.S. refineries was 568.9 thousand barrels per day in the quarter, an increase of 17.8 thousand barrels per day from the first quarter of 2024, due to improved crude unit reliability at our operated and non-operated refineries.

•Drove improvements to our cost structures. Per-Unit Operating Expenses at our Oil Sands and Conventional assets decreased from the first quarter of 2024. We continue to focus on reducing operating, capital and general and administrative costs.

•Progressed key Atlantic projects. The West White Rose project reached a significant milestone with the completion of major construction on two key components of the platform. The concrete gravity structure reached its final height and the last crane was installed, completing the topsides structurally. The SeaRose asset life extension (“ALE”) project continues to progress the refit work that commenced in the first quarter of 2024. The floating production, storage and offloading unit (“FPSO”) is expected to return to the White Rose field late in the third quarter of 2024, with production resuming in the fourth quarter.

•Advanced our Oil Sands growth projects. The Narrows Lake tie-back pipeline to Christina Lake is approximately 88 percent constructed and is expected to achieve mechanical completion by the end of the year. At our Sunrise asset, we began steaming two well pads, which we expect to be brought on production in the third and fourth quarters of 2024. Our Foster Creek optimization project is approximately 26 percent complete and is expected to be operational in 2026. At our Lloydminster conventional heavy oil assets, we have progressed our planned drilling program and currently have four rigs in operation.

•Loaded our first vessels at the Westridge Marine Terminal. With the successful start-up of the Trans Mountain Pipeline expansion project (“TMX”), we loaded our first vessels at the Westridge Marine Terminal and continue to ramp up our position.

| | | | | |

| Cenovus Energy Inc. – Q2 2024 Management's Discussion and Analysis | 4 |

•Reported solid financial results. Adjusted funds flow increased to $2.4 billion from $2.2 billion in the first quarter of 2024, mainly due to improved benchmark prices and strong operating results. Cash flow from operating activities was $2.8 billion, an increase from $1.9 billion in the first quarter of 2024, as lower Operating Margin in the second quarter was more than offset by changes in non-cash working capital. Net earnings were $1.0 billion, a decrease of $176 million from the first quarter of 2024.

•Delivered significant cash returns to common shareholders. We returned $1.0 billion to common shareholders, composed of the purchase of 15.4 million common shares for $440 million through our normal course issuer bid (“NCIB”), $334 million through common share base dividends and $251 million through common share variable dividends. On July 31, 2024, our Board of Directors declared a third quarter base dividend of $0.180 per common share.

Summary of Quarterly Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six Months

Ended

June 30, | | | | 2024 | | 2023 | | 2022 |

| ($ millions, except where indicated) | 2024 | | 2023 | | | | Q2 | | Q1 | | Q4 | | Q3 | | Q2 | | Q1 | | Q4 | | Q3 | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Upstream Production Volumes (1) (MBOE/d) | 800.9 | | | 754.4 | | | | | 800.8 | | | 800.9 | | | 808.6 | | | 797.0 | | | 729.9 | | | 779.0 | | | 806.9 | | | 777.9 | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Downstream Total Processed Inputs (2) (3) (Mbbls/d) | 668.3 | | | 524.1 | | | | | 652.9 | | | 683.8 | | | 605.7 | | | 691.3 | | | 566.9 | | | 480.7 | | | 491.3 | | | 563.4 | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Crude Oil Unit Throughput (2) (Mbbls/d) | 639.0 | | | 498.1 | | | | | 622.7 | | | 655.2 | | | 579.1 | | | 664.3 | | | 537.8 | | | 457.9 | | | 473.3 | | | 533.5 | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Downstream Production Volumes (1) (2) (Mbbls/d) | 680.8 | | | 530.0 | | | | | 659.5 | | | 702.1 | | | 627.4 | | | 706.0 | | | 571.9 | | | 487.7 | | | 506.3 | | | 572.6 | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Revenues | 28,282 | | | 24,493 | | | | | 14,885 | | | 13,397 | | | 13,134 | | | 14,577 | | | 12,231 | | | 12,262 | | | 14,063 | | | 17,471 | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Operating Margin (4) | 6,127 | | | 4,502 | | | | | 2,936 | | | 3,191 | | | 2,151 | | | 4,369 | | | 2,400 | | | 2,102 | | | 2,782 | | | 3,339 | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Cash From (Used In) Operating Activities | 4,732 | | | 1,704 | | | | | 2,807 | | | 1,925 | | | 2,946 | | | 2,738 | | | 1,990 | | | (286) | | | 2,970 | | | 4,089 | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Adjusted Funds Flow (4) | 4,603 | | | 3,294 | | | | | 2,361 | | | 2,242 | | | 2,062 | | | 3,447 | | | 1,899 | | | 1,395 | | | 2,346 | | | 2,951 | | | |

Per Share - Basic (4) ($) | 2.47 | | | 1.73 | | | | | 1.27 | | | 1.20 | | | 1.10 | | | 1.82 | | | 1.00 | | | 0.73 | | | 1.22 | | | 1.53 | | | |

Per Share - Diluted (4) ($) | 2.45 | | | 1.69 | | | | | 1.26 | | | 1.19 | | | 1.09 | | | 1.81 | | | 0.98 | | | 0.71 | | | 1.19 | | | 1.49 | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Capital Investment | 2,191 | | | 2,103 | | | | | 1,155 | | | 1,036 | | | 1,170 | | | 1,025 | | | 1,002 | | | 1,101 | | | 1,274 | | | 866 | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Free Funds Flow (4) | 2,412 | | | 1,191 | | | | | 1,206 | | | 1,206 | | | 892 | | | 2,422 | | | 897 | | | 294 | | | 1,072 | | | 2,085 | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Excess Free Funds Flow (4) | n/a | | n/a | | | | 735 | | | 832 | | | 471 | | | 1,989 | | | 505 | | | (499) | | | 786 | | | 1,756 | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Net Earnings (Loss) | 2,176 | | | 1,502 | | | | | 1,000 | | | 1,176 | | | 743 | | | 1,864 | | | 866 | | | 636 | | | 784 | | | 1,609 | | | |

Per Share - Basic ($) | 1.16 | | | 0.78 | | | | | 0.53 | | | 0.62 | | | 0.39 | | | 0.98 | | | 0.45 | | | 0.33 | | | 0.40 | | | 0.83 | | | |

Per Share - Diluted ($) | 1.15 | | | 0.76 | | | | | 0.53 | | | 0.62 | | | 0.39 | | | 0.97 | | | 0.44 | | | 0.32 | | | 0.39 | | | 0.81 | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Total Assets | 56,000 | | | 53,747 | | | | | 56,000 | | | 54,994 | | | 53,915 | | | 54,427 | | | 53,747 | | | 54,000 | | | 55,869 | | | 55,086 | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Total Long-Term Liabilities | 18,945 | | | 19,831 | | | | | 18,945 | | | 18,884 | | | 18,993 | | | 18,395 | | | 19,831 | | | 19,917 | | | 20,259 | | | 19,378 | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Long-Term Debt, Including Current Portion | 7,275 | | | 8,534 | | | | | 7,275 | | | 7,227 | | | 7,108 | | | 7,224 | | | 8,534 | | | 8,681 | | | 8,691 | | | 8,774 | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Net Debt | 4,258 | | | 6,367 | | | | | 4,258 | | | 4,827 | | | 5,060 | | | 5,976 | | | 6,367 | | | 6,632 | | | 4,282 | | | 5,280 | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Cash Returns to Common Shareholders | 1,452 | | | 815 | | | | | 1,025 | | | 427 | | | 722 | | | 1,225 | | | 575 | | | 240 | | | 807 | | | 864 | | | |

| Common Shares – Base Dividends | 596 | | | 465 | | | | | 334 | | | 262 | | | 261 | | | 264 | | | 265 | | | 200 | | | 201 | | | 205 | | | |

Base Dividends Per Common Share ($) | 0.320 | | | 0.245 | | | | | 0.180 | | | 0.140 | | | 0.140 | | | 0.140 | | | 0.140 | | | 0.105 | | | 0.105 | | | 0.105 | | | |

| Common Shares – Variable Dividends | 251 | | | — | | | | | 251 | | | — | | | — | | | — | | | — | | | — | | | 219 | | | — | | | |

Variable Dividends Per Common Share ($) | 0.135 | | | — | | | | | 0.135 | | | — | | | — | | | — | | | — | | | — | | | 0.114 | | | — | | | |

| Purchase of Common Shares Under NCIB | 605 | | | 350 | | | | | 440 | | | 165 | | | 350 | | | 361 | | | 310 | | | 40 | | | 387 | | | 659 | | | |

| Payment for Purchase of Warrants | — | | | — | | | | | — | | | — | | | 111 | | | 600 | | | — | | | — | | | — | | | — | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Preferred Share Dividends | 18 | | | 27 | | | | | 9 | | | 9 | | | 9 | | | — | | | 9 | | | 18 | | | — | | | 9 | | | |

(1)Refer to the Operating and Financial Results section of this MD&A for a summary of total production by product type.

(2)Represents Cenovus’s net interest in refining operations.

(3)Total processed inputs include crude oil and other feedstocks. Blending is excluded.

(4)Non-GAAP financial measure or contains a non-GAAP financial measure. See the Specified Financial Measures Advisory of this MD&A.

| | | | | |

| Cenovus Energy Inc. – Q2 2024 Management's Discussion and Analysis | 5 |

| | |

|

| OPERATING AND FINANCIAL RESULTS |

Selected Operating and Financial Results — Upstream

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, | | | | |

| | | Percent Change | | | | | | Percent Change | | | | | | |

| 2024 | | | 2023 | | 2024 | | | 2023 | | | |

Production Volumes by Segment (1) (MBOE/d) | | | | | | | | | | | | | | | |

Oil Sands | 611.5 | | 7 | | | 573.8 | | 613.4 | | 5 | | | 581.6 | | | | |

Conventional | 123.1 | | 18 | | | 104.6 | | 121.9 | | 7 | | | 114.2 | | | | |

Offshore | 66.2 | | 29 | | | 51.5 | | 65.6 | | 12 | | | 58.6 | | | | |

Total Production Volumes | 800.8 | | 10 | | | 729.9 | | 800.9 | | 6 | | | 754.4 | | | | |

| | | | | | | | | | | | | | | |

Production Volumes by Product | | | | | | | | | | | | | | | |

Bitumen (Mbbls/d) | 591.7 | | 7 | | | 554.6 | | 593.5 | | 6 | | | 562.5 | | | | |

Heavy Crude Oil (Mbbls/d) | 18.1 | | 6 | | | 17.0 | | 18.0 | | 7 | | | 16.9 | | | | |

Light Crude Oil (Mbbls/d) | 13.5 | | 34 | | | 10.1 | | 13.0 | | 2 | | | 12.7 | | | | |

NGLs (Mbbls/d) | 33.0 | | 24 | | | 26.7 | | 32.8 | | 9 | | | 30.0 | | | | |

Conventional Natural Gas (MMcf/d) | 867.2 | | 19 | | | 729.4 | | 861.5 | | 9 | | | 793.1 | | | | |

Total Production Volumes (MBOE/d) | 800.8 | | 10 | | | 729.9 | | 800.9 | | 6 | | | 754.4 | | | | |

| | | | | | | | | | | | | | | |

Per-Unit Operating Expenses by Segment (2) ($/BOE) | | | | | | | | | | | | | | | |

Oil Sands | 11.47 | | | (10) | | | 12.72 | | 11.67 | | (13) | | | 13.37 | | | | |

Conventional | 11.25 | | (23) | | | 14.59 | | 12.14 | | (12) | | | 13.77 | | | | |

Offshore (3) | 22.34 | | 15 | | | 19.48 | | 20.03 | | 6 | | | 18.88 | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

(1)Refer to the Oil Sands, Conventional or Offshore Reportable Segments section of this MD&A for a summary of production by product type by segment.

(2)Specified financial measure. See the Specified Financial Measures Advisory of this MD&A.

(3)Reflects Cenovus’s 40 percent interest in HCML. Expenses related to the HCML joint venture are accounted for using the equity method in the interim Consolidated Financial Statements.

Total upstream production increased compared with 2023 due to:

•Three new well pads brought online throughout 2023 and one in the first quarter of 2024 at Foster Creek.

•Successful results from the 2023 redevelopment programs, new wells brought online during the year and base well optimizations at our Lloydminster thermal assets.

•The successful restart of operations in the Conventional segment following the temporary shut-in of a significant portion of production in response to wildfire activity in the second quarter of 2023.

•The temporary unplanned outage in China related to the disconnection of the umbilical by a third-party vessel in April 2023.

•Turnarounds that were completed at our Foster Creek and Atlantic operations in the second quarter of 2023.

•The completion of maintenance activity at the Terra Nova FPSO and returning to the field in August 2023. Production resumed in late November 2023.

The increases were partially offset by:

•The suspended production on the SeaRose FPSO for the planned ALE project in late December 2023. The FPSO is expected to return to the White Rose field late in the third quarter of 2024, with production resuming in the fourth quarter.

Per-Unit Operating Expenses decreased in the Oil Sands segment reflecting the benefit of lower fuel operating costs as a result of significant declines in AECO benchmark prices, as well as efforts made to manage operating expenses by securing long-term contracts, working with vendors and purchasing long-lead items to mitigate future cost escalations. Per-Unit Operating Expenses decreased in our Conventional segment primarily due to the divestiture of assets.

| | | | | |

| Cenovus Energy Inc. – Q2 2024 Management's Discussion and Analysis | 6 |

Selected Operating and Financial Results — Downstream

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, | | | | |

| | | Percent Change | | | | | | Percent Change | | | | | | |

| 2024 | | | 2023 | | 2024 | | | 2023 | | | |

Crude Oil Unit Throughput by Segment (Mbbls/d) | | | | | | | | | | | | | | | |

Canadian Refining | 53.8 | | (44) | | | 95.3 | | 79.0 | | (19) | | | 97.0 | | | | |

U.S. Refining | 568.9 | | 29 | | | 442.5 | | 560.0 | | 40 | | | 401.1 | | | | |

Total Crude Oil Unit Throughput | 622.7 | | 16 | | | 537.8 | | 639.0 | | 28 | | | 498.1 | | | | | |

| | | | | | | | | | | | | | | |

Production Volumes by Product (1) (Mbbls/d) | | | | | | | | | | | | | | | |

Gasoline | 278.3 | | 40 | | | 199.4 | | 280.1 | | 45 | | | 193.2 | | | | |

Distillates (2) | 221.5 | | 28 | | | 173.3 | | 217.2 | | 34 | | | 162.0 | | | | |

Synthetic Crude Oil | 20.7 | | (54) | | | 44.8 | | 33.9 | | (25) | | | 45.2 | | | | |

Asphalt | 40.2 | | 7 | | | 37.4 | | 41.0 | | 28 | | | 32.0 | | | | |

Ethanol | 4.4 | | 13 | | | 3.9 | | 4.9 | | 9 | | | 4.5 | | | | |

Other | 94.4 | | (17) | | | 113.1 | | 103.7 | | 11 | | | 93.1 | | | | |

Total Production Volumes | 659.5 | | 15 | | | 571.9 | | 680.8 | | 28 | | | 530.0 | | | | |

| | | | | | | | | | | | | | | |

Per-Unit Operating Expenses by Segment (3) ($/bbl) | | | | | | | | | | | | | | | |

Canadian Refining (4) | 70.44 | | 401 | | | 14.05 | | 34.36 | | 153 | | | 13.59 | | | | |

U.S. Refining | 12.66 | | (21) | | | 16.09 | | 12.17 | | (28) | | | 16.86 | | | | |

(1)Refer to the Canadian Refining and U.S. Refining Reportable Segments section of this MD&A for a summary of production by product by segment.

(2)Includes diesel and jet fuel.

(3)Specified financial measure. The definition of Per-Unit Operating Expense has been revised to operating expenses divided by total processed inputs. Prior periods have been re-presented. See the Specified Financial Measures Advisory of this MD&A.

(4)Represents operating expenses associated with the Lloydminster Upgrader, the Lloydminster Refinery and the commercial fuels business.

Total downstream throughput and total downstream production increased compared with 2023 due to:

•Increased throughput in the U.S. Refining segment as we realized the benefit from the purchase of the Toledo Refinery on February 28, 2023 (the “Toledo Acquisition”), which has allowed us to better use existing resources across our U.S. portfolio to improve our product mix.

•Obtaining the benefit of a full period of throughput and production at the Toledo and Superior refineries.

•Improved crude unit reliability at our operated and non-operated refineries.

The increases were partially offset by:

•The turnaround completed at the Upgrader, which significantly impacted throughput in our Canadian Refining segment.

•Planned and unplanned outages at our operated and non-operated refineries.

Canadian Refining Per-Unit Operating Expenses increased compared with 2023, primarily due to increased turnaround costs at the Upgrader and lower total processed inputs.

U.S. Refining Per-Unit Operating Expenses decreased compared with 2023, primarily due to increased total processed inputs at the Toledo and Superior refineries discussed above and total operating expenses remaining relatively consistent.

Selected Consolidated Financial Results

Revenues

Revenues increased 22 percent to $14.9 billion in the three months ended June 30, 2024, compared with 2023. Year-to-date, revenues increased 15 percent to $28.3 billion, compared with 2023. The increases for both periods were primarily due to increased total upstream production and higher crude oil benchmark pricing, combined with increased total downstream production due to obtaining the benefit of a full period of production at the Toledo and Superior refineries, offset by decreased production in the Canadian Refining segment. The increase was partially offset by lower natural gas and refined product pricing in the three and six months ended June 30, 2024, compared with the same periods in 2023.

| | | | | |

| Cenovus Energy Inc. – Q2 2024 Management's Discussion and Analysis | 7 |

Operating Margin

Operating Margin is a non-GAAP financial measure and is used to provide a consistent measure of the cash generating performance of our assets for comparability of our underlying financial performance between periods.

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, | | |

| ($ millions) | 2024 | | 2023 | | 2024 | | 2023 | | |

Gross Sales (1) | | | | | | | | | |

External Sales | 15,744 | | | 12,868 | | | 29,888 | | | 25,726 | | | |

Intersegment Sales | 2,024 | | | 1,844 | | | 4,311 | | | 3,340 | | | |

| 17,768 | | | 14,712 | | | 34,199 | | | 29,066 | | | |

| Royalties | (859) | | | (637) | | | (1,606) | | | (1,233) | | | |

Revenues | 16,909 | | | 14,075 | | | 32,593 | | | 27,833 | | | |

| Expenses | | | | | | | | | |

Purchased Product (1) | 8,914 | | | 7,198 | | | 16,904 | | | 14,027 | | | |

Transportation and Blending (1) | 3,043 | | | 2,770 | | | 5,854 | | | 5,797 | | | |

| Operating Expenses | 1,988 | | | 1,726 | | | 3,673 | | | 3,509 | | | |

| Realized (Gain) Loss on Risk Management Activities | 28 | | | (19) | | | 35 | | | (2) | | | |

Operating Margin | 2,936 | | | 2,400 | | | 6,127 | | | 4,502 | | | |

(1)Comparative periods reflect certain revisions. See Note 24 of the interim Consolidated Financial Statements and Prior Period Revisions found in the Advisory section of this MD&A for further details.

Operating Margin by Segment

Three Months Ended June 30, 2024 and 2023

Operating Margin increased $536 million to $2.9 billion in the three months ended June 30, 2024, compared with 2023, primarily due to:

•Higher crude oil benchmark pricing and higher sales volumes impacting our Oil Sands segment.

•Increased sales volumes and higher realized sales prices from our Offshore segment.

•Obtaining the benefit of a full period of production at the Toledo and Superior refineries.

| | | | | |

| Cenovus Energy Inc. – Q2 2024 Management's Discussion and Analysis | 8 |

These increases were partially offset by:

•Lower Operating Margin in the Canadian Refining segment due to turnaround activity.

•Increased royalties in our Oil Sands segment due to higher realized prices combined with higher Alberta sliding scale oil sands royalty rates.

•Lower market crack spreads and narrower light-heavy differentials impacting our U.S. Refining segment.

•Increased transportation expenses as we ramp up our use of TMX.

Operating Margin in the Conventional segment decreased compared to 2023, primarily due to lower realized natural gas prices. The decrease was offset by reduced fuel operating costs in the Oil Sands segment on natural gas purchased from the Conventional segment.

Six Months Ended June 30, 2024 and 2023

Operating Margin increased $1.6 billion to $6.1 billion in the six months ended June 30, 2024, compared with 2023, primarily due to the reasons discussed above.

Cash From (Used in) Operating Activities and Adjusted Funds Flow

Adjusted Funds Flow is a non-GAAP financial measure commonly used in the oil and gas industry to assist in measuring a company’s ability to finance its capital programs and meet its financial obligations.

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, | |

| ($ millions) | 2024 | | 2023 | | 2024 | | 2023 | | |

| Cash From (Used in) Operating Activities | 2,807 | | | 1,990 | | | 4,732 | | | 1,704 | | | |

| (Add) Deduct: | | | | | | | | | |

Settlement of Decommissioning Liabilities | (48) | | | (41) | | | (96) | | | (89) | | | |

| Net Change in Non-Cash Working Capital | 494 | | | 132 | | | 225 | | | (1,501) | | | |

Adjusted Funds Flow | 2,361 | | | 1,899 | | | 4,603 | | | 3,294 | | | |

Cash from operating activities increased in the second quarter of 2024, compared with the same period in 2023. The increase was primarily due to higher Operating Margin combined with changes in non-cash working capital. Changes in non-cash working capital increased cash from operating activities by $494 million in the quarter, primarily due to higher accounts payable, partially offset by higher inventory.

Cash from operating activities was $4.7 billion in the first six months of 2024, compared with $1.7 billion in 2023. The increase was primarily due to changes in non-cash working capital and higher Operating Margin. In the first half of 2023, changes in non-cash working capital decreased cash from operating activities by $1.5 billion, primarily driven by an income tax payment of $1.2 billion that occurred during the period.

| | | | | |

| Cenovus Energy Inc. – Q2 2024 Management's Discussion and Analysis | 9 |

Adjusted Funds Flow was higher in the three and six months ended June 30, 2024, compared with the same periods in 2023. The quarter-over-quarter increase was primarily due to higher Operating Margin, as discussed above, partially offset by higher current income tax expense. The year-over-year increase was primarily due to higher Operating Margin, partially offset by higher current income tax expense and long-term incentive costs paid.

Net Earnings (Loss)

Net earnings in the three and six months ended June 30, 2024, was $1.0 billion and $2.2 billion, respectively, compared with $866 million and $1.5 billion, respectively, in 2023. The increase for both periods was due to higher Operating Margin, as discussed above, partially offset by higher income tax expense, increased DD&A and foreign exchange losses in 2024 compared with gains in 2023.

Net Debt

| | | | | | | | | | | | | | | | | |

As at ($ millions) | June 30, 2024 | | | | December 31, 2023 | | | | |

| Short-Term Borrowings | 137 | | | | | 179 | | | | | |

| | | | | | | | | |

| Long-Term Portion of Long-Term Debt | 7,275 | | | | | 7,108 | | | | | |

| Total Debt | 7,412 | | | | | 7,287 | | | | | |

| Cash and Cash Equivalents | (3,154) | | | | | (2,227) | | | | | |

Net Debt | 4,258 | | | | | 5,060 | | | | | |

Net Debt decreased by $802 million from December 31, 2023, mainly due to cash from operating activities of $4.7 billion, partially offset by capital investment of $2.2 billion, cash returns to common shareholders of $1.5 billion and the weakening of the Canadian dollar, which impacted our U.S. denominated debt. For further details, see the Liquidity and Capital Resources section of this MD&A.

Capital Investment (1)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | | | Six Months Ended June 30, | | |

| ($ millions) | 2024 | 2023 | | | | 2024 | | 2023 | | |

| Upstream | | | | | | | | | | | |

| Oil Sands | 613 | | | 539 | | | | | 1,260 | | | 1,174 | | | |

| Conventional | 68 | | | 82 | | | | | 194 | | | 223 | | | |

| Offshore | 295 | | | 184 | | | | | 454 | | | 284 | | | |

| Total Upstream | 976 | | | 805 | | | | | 1,908 | | | 1,681 | | | |

| Downstream | | | | | | | | | | | |

| Canadian Refining | 70 | | | 34 | | | | | 101 | | | 61 | | | |

| U.S. Refining | 100 | | | 153 | | | | | 167 | | | 347 | | | |

| Total Downstream | 170 | | | 187 | | | | | 268 | | | 408 | | | |

| Corporate and Eliminations | 9 | | | 10 | | | | | 15 | | | 14 | | | |

| Total Capital Investment | 1,155 | | | 1,002 | | | | | 2,191 | | | 2,103 | | | |

(1)Includes expenditures on property, plant and equipment (“PP&E”), exploration and evaluation (“E&E”) assets and capitalized interest. Excludes capital expenditures related to the HCML joint venture.

Capital investment in the first six months of 2024 was mainly related to:

•Sustaining activities in the Oil Sands segment, including the drilling of stratigraphic test wells as part of our integrated winter program.

•The progression of the West White Rose project and the SeaRose ALE.

•Growth projects in our Oil Sands segment, including the tie-back of Narrows Lake to Christina Lake, optimization projects at Foster Creek and Sunrise, and the progression of the planned drilling program at our Lloydminster conventional heavy oil assets.

•Drilling, completion, tie-in and infrastructure projects in the Conventional segment.

•Sustaining activities at our operated Canadian and U.S. refining assets, and refining reliability projects at our non-operated Wood River and Borger refineries.

•The drilling of an exploration well in China.

| | | | | |

| Cenovus Energy Inc. – Q2 2024 Management's Discussion and Analysis | 10 |

Drilling Activity

| | | | | | | | | | | | | | | | | | | | | | | |

| Net Stratigraphic Test Wells and Observation Wells | | Net Production Wells (1) |

| Six Months Ended June 30, | 2024 | | 2023 | | 2024 | | 2023 |

Foster Creek | 82 | | | 87 | | | 7 | | | 10 | |

| Christina Lake | 58 | | | 53 | | | 9 | | | 11 | |

| Sunrise | 40 | | | 38 | | | — | | | 7 | |

Lloydminster Thermal | — | | | 1 | | | 4 | | | — | |

| Lloydminster Conventional Heavy Oil | — | | | 1 | | | 3 | | | 5 | |

Other | — | | | 3 | | | — | | | — | |

| 180 | | | 183 | | | 23 | | | 33 | |

(1)Steam-assisted gravity drainage (“SAGD”) well pairs in the Oil Sands segment are counted as a single producing well.

Stratigraphic test wells were drilled to help identify future well pad locations and to further progress the evaluation of other assets. Observation wells were drilled to gather information and monitor reservoir conditions.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, 2024 | | Six Months Ended June 30, 2023 |

| (net wells) | Drilled | | Completed | | Tied-in | | Drilled | | Completed | | Tied-in |

| Conventional | 18 | | | 14 | | | 14 | | | 17 | | | 21 | | | 22 | |

In the Offshore segment, we commenced drilling one well in China in the second quarter of 2024. No wells were completed in the Offshore segment in the first six months of 2024 (2023 – drilled and completed one (0.4 net) development well at the MAC field in Indonesia).

| | |

|

| COMMODITY PRICES UNDERLYING OUR FINANCIAL RESULTS |

Key performance drivers for our financial results include commodity prices, quality and location price differentials, refined product prices and refining crack spreads, as well as the U.S./Canadian dollar and Chinese Yuan (“RMB”)/Canadian dollar exchange rates. The following table shows selected market benchmark prices and average exchange rates to assist in understanding our financial results.

Selected Benchmark Prices and Exchange Rates (1)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| Six Months Ended June 30, | | | | | | | | | | | | | | | |

| (Average US$/bbl, unless otherwise indicated) | 2024 | | Percent Change | | 2023 | | | | Q2 2024 | | | | Q1 2024 | | | | | | Q2 2023 | |

Dated Brent | 84.09 | | | 5 | | | 79.83 | | | | | 84.94 | | | | | 83.24 | | | | | | | 78.39 | | |

| WTI | 78.77 | | | 5 | | | 74.96 | | | | | 80.57 | | | | | 76.96 | | | | | | | 73.78 | | |

| Differential Dated Brent - WTI | 5.32 | | | 9 | | | 4.87 | | | | | 4.37 | | | | | 6.28 | | | | | | | 4.61 | | |

| WCS at Hardisty | 62.30 | | | 13 | | | 55.05 | | | | | 66.96 | | | | | 57.65 | | | | | | | 58.74 | | |

| Differential WTI - WCS at Hardisty | 16.47 | | | (17) | | | 19.91 | | | | | 13.61 | | | | | 19.31 | | | | | | | 15.04 | | |

WCS at Hardisty (C$/bbl) | 84.70 | | | 14 | | | 74.17 | | | | | 91.63 | | | | | 77.77 | | | | | | | 78.90 | | |

| WCS at Nederland | 72.29 | | | 12 | | | 64.73 | | | | | 74.69 | | | | | 69.89 | | | | | | | 66.98 | | |

| Differential WTI - WCS at Nederland | 6.48 | | | (37) | | | 10.23 | | | | | 5.88 | | | | | 7.07 | | | | | | | 6.80 | | |

| Condensate (C5 at Edmonton) | 74.96 | | | (2) | | | 76.13 | | | | | 77.14 | | | | | 72.78 | | | | | | | 72.39 | | |

| Differential Condensate - WTI Premium/(Discount) | (3.81) | | | (426) | | | 1.17 | | | | | (3.43) | | | | | (4.18) | | | | | | | (1.39) | | |

Differential Condensate - WCS at Hardisty Premium/(Discount) | 12.66 | | | (40) | | | 21.08 | | | | | 10.18 | | | | | 15.13 | | | | | | | 13.65 | | |

Condensate (C$/bbl) | 101.87 | | | (1) | | | 102.61 | | | | | 105.55 | | | | | 98.18 | | | | | | | 97.25 | | |

| Synthetic at Edmonton | 76.37 | | | (1) | | | 77.42 | | | | | 83.32 | | | | | 69.42 | | | | | | | 76.66 | | |

| Differential Synthetic - WTI Premium/(Discount) | (2.40) | | | (198) | | | 2.46 | | | | | 2.75 | | | | | (7.54) | | | | | | | 2.88 | | |

Synthetic at Edmonton (C$/bbl) | 103.83 | | | — | | | 104.33 | | | | | 114.01 | | | | | 93.65 | | | | | | | 102.98 | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

(1)These benchmark prices are not our realized sales prices and represent approximate values. For our average realized sales prices and realized risk management results, refer to the Netback tables in the Reportable Segments section of this MD&A.

| | | | | |

| Cenovus Energy Inc. – Q2 2024 Management's Discussion and Analysis | 11 |

Selected Benchmark Prices and Exchange Rates – Continued (1)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, | | | | | | | | | | | | | | |

| (Average US$/bbl, unless otherwise indicated) | 2024 | | Percent Change | | 2023 | | | | Q2 2024 | | | | Q1 2024 | | | | | | Q2 2023 |

| Refined Product Prices | | | | | | | | | | | | | | | | | | | |

| Chicago Regular Unleaded Gasoline (“RUL”) | 94.28 | | | (7) | | | 101.07 | | | | | 99.09 | | | | | 89.48 | | | | | | | 102.32 | |

| Chicago Ultra-low Sulphur Diesel (“ULSD”) | 102.04 | | | (6) | | | 108.90 | | | | | 99.80 | | | | | 104.27 | | | | | | | 102.40 | |

Refining Benchmarks | | | | | | | | | | | | | | | | | | | |

Upgrading Differential (2) (C$/bbl) | 18.97 | | | (36) | | | 29.68 | | | | | 22.28 | | | | | 15.65 | | | | | | | 23.59 | |

Chicago 3-2-1 Crack Spread (3) | 18.10 | | | (37) | | | 28.72 | | | | | 18.76 | | | | | 17.45 | | | | | | | 28.57 | |

Group 3 3-2-1 Crack Spread (3) | 17.82 | | | (44) | | | 31.56 | | | | | 18.13 | | | | | 17.50 | | | | | | | 31.78 | |

| Renewable Identification Numbers (“RINs”) | 3.53 | | | (56) | | | 7.98 | | | | | 3.39 | | | | | 3.68 | | | | | | | 7.72 | |

| Natural Gas Prices | | | | | | | | | | | | | | | | | | | |

AECO (4) (C$/Mcf) | 1.84 | | | (35) | | | 2.83 | | | | | 1.18 | | | | | 2.50 | | | | | | | 2.45 | |

NYMEX (5) (US$/Mcf) | 2.07 | | | (25) | | | 2.76 | | | | | 1.89 | | | | | 2.24 | | | | | | | 2.10 | |

| Foreign Exchange Rates | | | | | | | | | | | | | | | | | | | |

| US$ per C$1 - Average | 0.736 | | | (1) | | | 0.742 | | | | | 0.731 | | | | | 0.741 | | | | | | | 0.745 | |

| US$ per C$1 - End of Period | 0.731 | | | (3) | | | 0.755 | | | | | 0.731 | | | | | 0.738 | | | | | | | 0.755 | |

| RMB per C$1 - Average | 5.311 | | | 3 | | | 5.143 | | | | | 5.293 | | | | | 5.330 | | | | | | | 5.228 | |

(1)These benchmark prices are not our realized sales prices and represent approximate values. For our average realized sales prices and realized risk management results, refer to the Netback tables in the Reportable Segments section of this MD&A.

(2)The upgrading differential is the difference between synthetic crude oil at Edmonton and Lloydminster Blend crude oil at Hardisty. The upgrading differential does not precisely mirror the configuration and the product output of our refineries; however, it is used as a general market indicator.

(3)The average 3-2-1 crack spread is an indicator of the refining margin and is valued on a last in, first out accounting basis.

(4)Alberta Energy Company ("AECO") 5A natural gas daily index.

(5)New York Mercantile Exchange (“NYMEX”) natural gas monthly index.

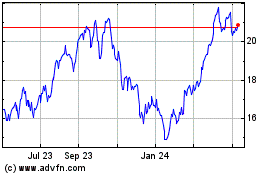

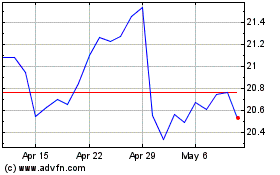

Crude Oil and Condensate Benchmarks

In the second quarter of 2024, crude oil benchmark prices, Brent and WTI, continued to increase compared with the first quarter of 2024. OPEC+ continues to manage global oil markets and support prices with extended production cuts amid robust global demand growth for crude. Geopolitical events related to Russia and Ukraine, Israel and Gaza, Iran, the Red Sea, Venezuela and Guyana continued to add volatility in the second quarter of 2024, but have had a limited impact on global oil markets. Slowing U.S. drilling activity since the beginning of 2023 has further eased some pressure on global crude supply and demand balances.

WTI is an important benchmark for Canadian crude oil since it reflects inland North American crude oil prices, and the Canadian dollar equivalent is the basis for determining royalty rates for a number of our crude oil properties.

The price received for our Atlantic crude oil and Asia Pacific NGLs is primarily driven by the price of Brent. The Brent-WTI differential narrowed in the second quarter of 2024 compared with the first quarter of 2024, in part due to weaker European light crude demand related to refinery turnarounds.

WCS is a blended heavy oil which consists of both conventional heavy oil and unconventional diluted bitumen. The WCS at Hardisty differential to WTI is a function of the quality differential of light and heavy crude, and the cost of transport. In the three and six months ended June 30, 2024, the WTI-WCS differential at Hardisty narrowed compared with 2023, due in part to the start-up of TMX as well as a strengthening of the heavy oil quality differential as outlined below.